FreshBooks VS Xero

Looking for an alternative to Xero in Australia? You’ve come to the right place. FreshBooks is ranked the Best Accounting Software for Sole Traders and Small Businesses by PCMag. And we do more than just invoicing and payments – we have award-winning support, are twice as easy to use, and cost half the price.

Offer exclusive to this page: Get 90% Off for 4 Months

Offer terms:

Monthly Plans

Get 90% off a Lite, Plus or Premium Plan for 4 months. After the 4-month promotional period, you will be billed at full price for the plan you have selected.

Yearly Plans

The total price for a Yearly plan is billed at the time of purchase. It includes both the monthly discount outlined above, as well as an additional 10% discount for selecting a yearly plan.

Promotional offers for both monthly and yearly plans are for a limited period. New customers only. Cannot be combined with other offers. No free trial period is included when availing this promotional discount. FreshBooks reserves the right to change this offer at any time.

FRESHBOOKS VS XERO COMPARISON

It’s a No-Brainer

✔ FreshBooks vs ✘ Xero

Choose the accounting software that scales with your business, not the one that treats you like just a number. FreshBooks Australia actually saves you up to 500 hours a year. Check it out ⬇️

|

Product Comparison

|

|

Xero

|

|---|---|---|

|

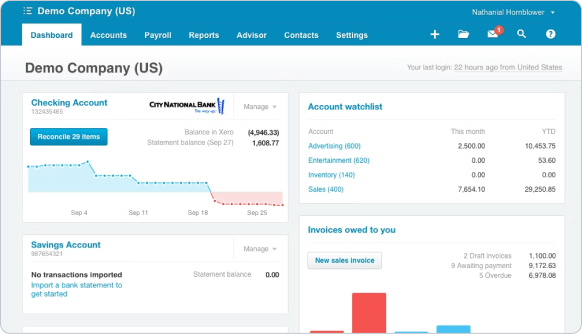

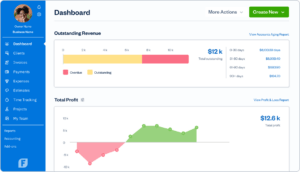

Product Screenshot

|

||

|

Pricing (monthly)

|

Starting at $20.00 AUD

|

Starting at $29.00 AUD

|

|

Free Trial

|

30-day trial included

|

30-day trial included

|

|

Live human customer support

|

Stevie Award Winner for Excellent Customer Service

|

|

|

Easy-to-use interface

|

9.2 Ease of use score on G2

|

8.7 Ease of use score on G2

|

|

Unlimited invoices & quotes

|

|

Available on higher-tiered plans,

starting at $59 AUD/mo

|

|

Late Fees

|

|

|

|

Project Management

|

|

Add-ons available from $10 AUD/user

|

|

Proposals & Estimates

|

|

Add-ons available from $10 AUD/user

|

|

Time Tracking

|

|

Add-ons available from $10 AUD/user

|

|

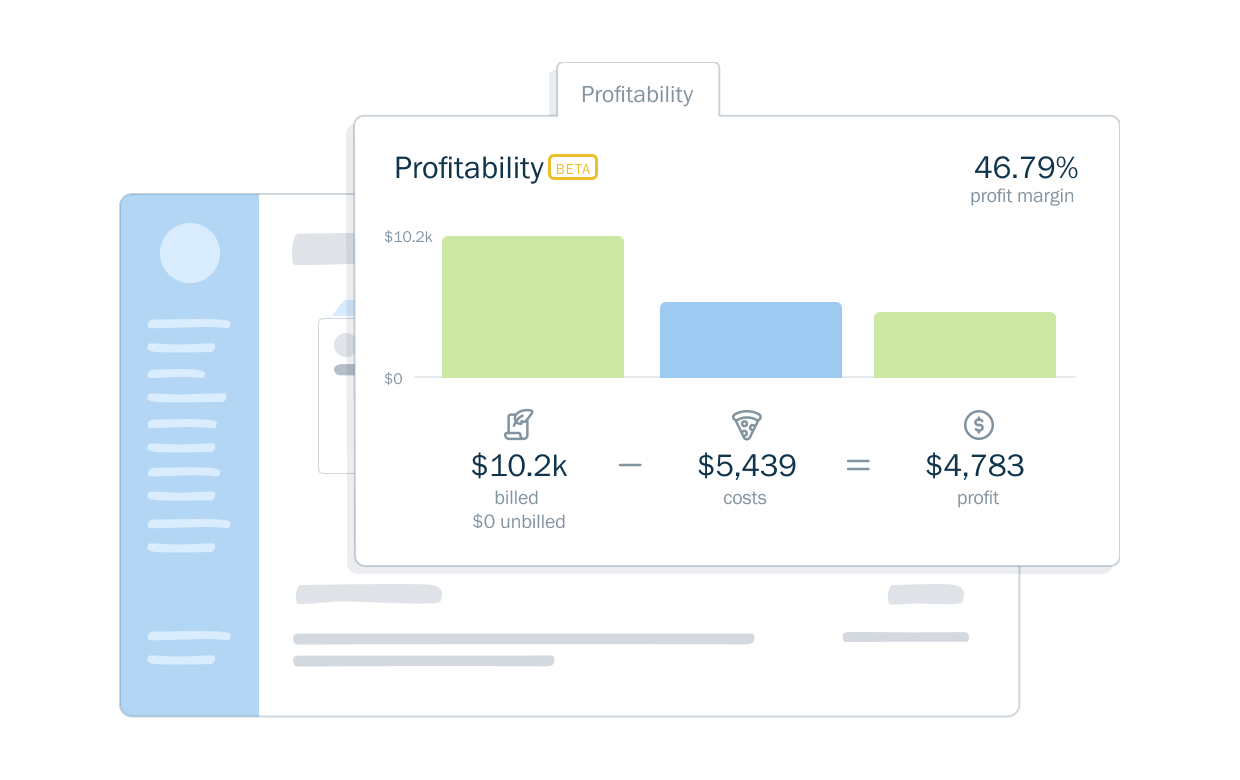

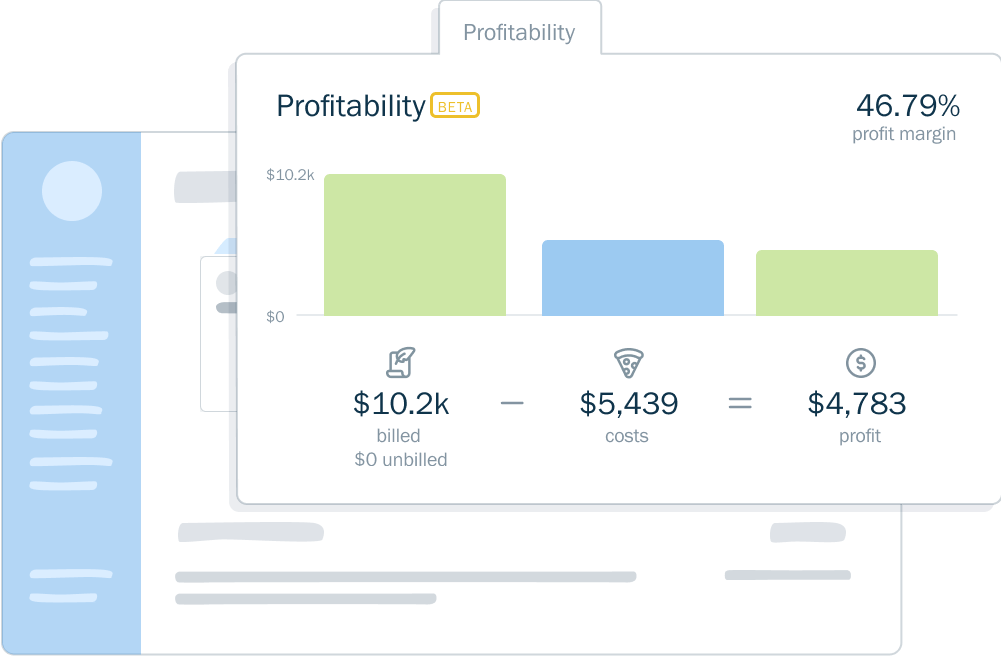

Project Profitability

|

|

Add-ons available from $10 AUD/user

|

|

Client communication

|

|

|

|

Double-Entry Accounting

|

|

|

|

Payroll

|

Partnered With KeyPay

|

|

|

Customized Chart of Accounts

|

|

|

|

Expense Tracking

|

|

|

|

Invite Your Accountant

|

|

|

|

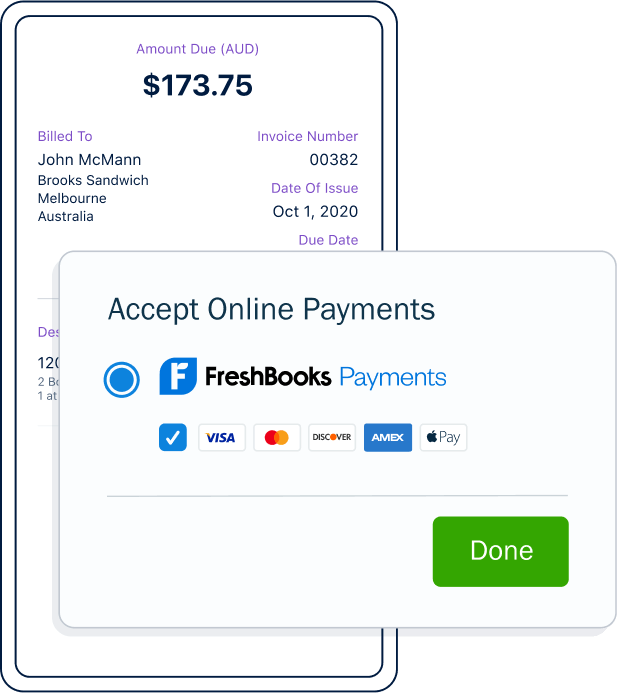

Online Payments (Credit Cards)

|

|

|

|

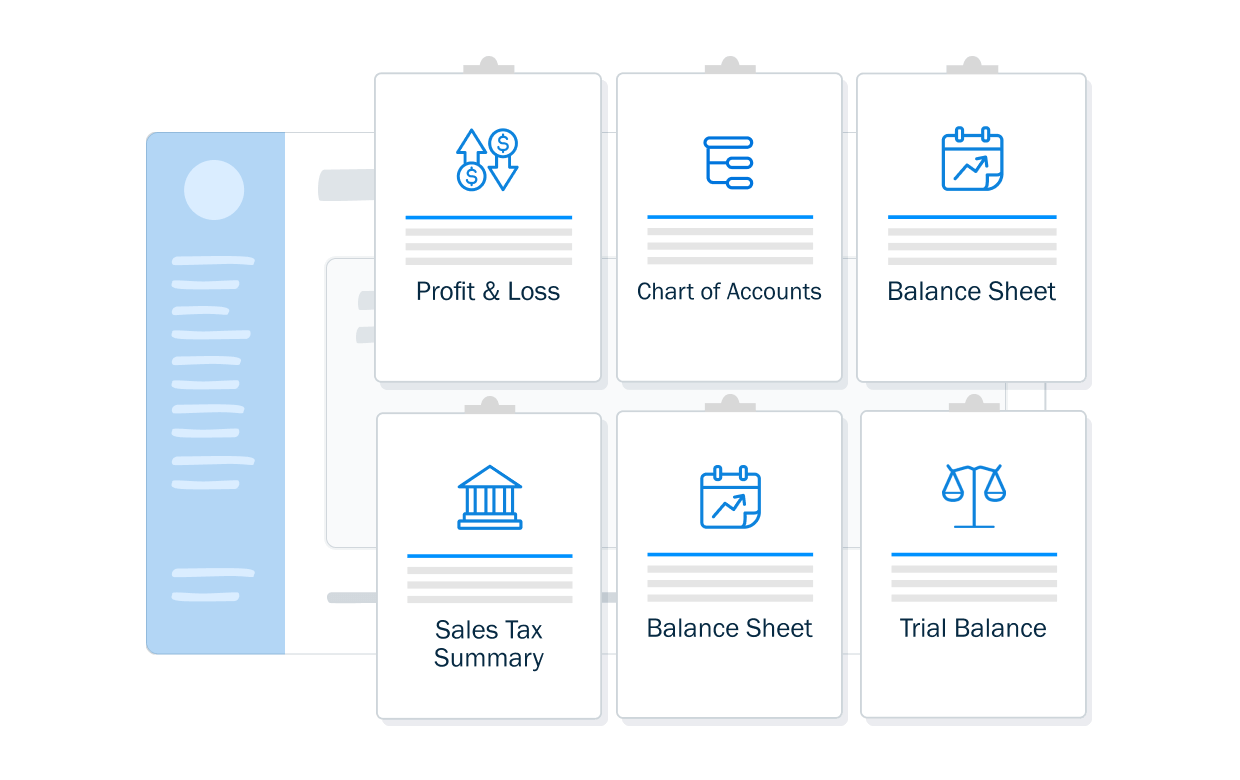

Business Health Reports

|

|

|

Only available to new subscribers via this page. See offer details

FRESHBOOKS VS XERO COMPARISON

From Xero to Hero: 95% Of Small Businesses Say FreshBooks Is Easier to Use

Essential features are available in all FreshBooks plans, like invoicing, time tracking, expense tracking, online payments, and reporting.

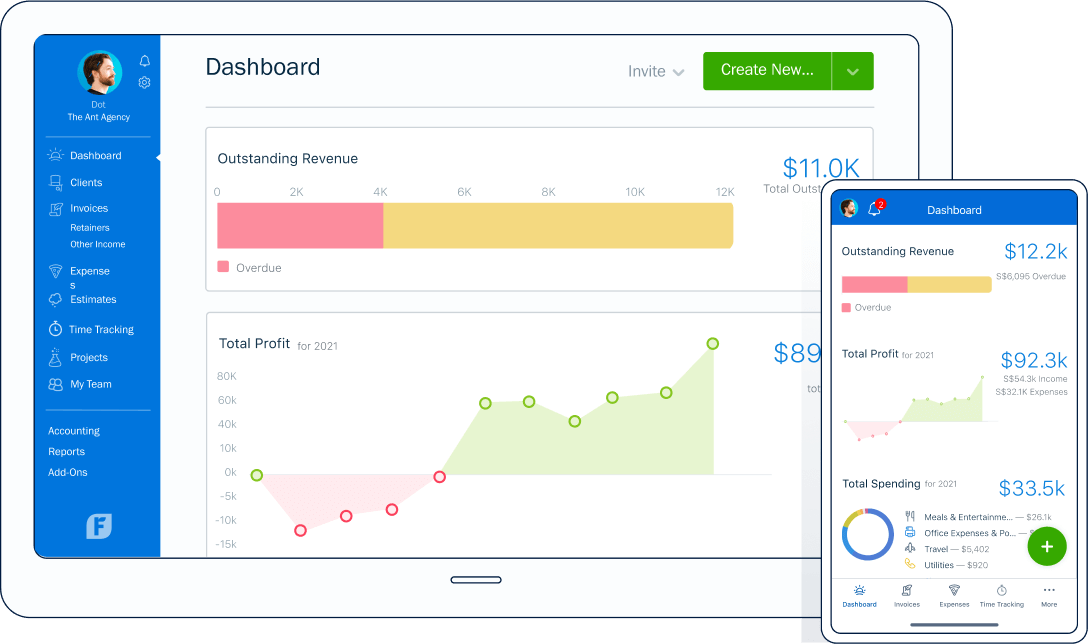

All-In-One Business Software

Easy-to-use invoicing, payments, project management, accounting features, and so much more, is why over 30 million businesses in 160+ countries have used FreshBooks.

Easy to Setup, Easy to Use

FreshBooks makes it easy to transfer all of your financial data over from another platform so you can get up and running. Then, jump right in with our simple yet powerful interface.

Friendly Customer Service

You know who picks up and never transfers you when you call FreshBooks? A real live person! FreshBooks has the best rating for customer support among all competitors at 91%.

Transparent Pricing and Plans

Tired of random price increases? FreshBooks has simple, transparent pricing that fits your budget. No pricey add-ons, no hidden costs, no confusion.

Easy-to-Use Accounting & Bookkeeping Features

Why Are People Switching From Xero to FreshBooks?

Xero is expensive and hard to wrap your head around. And if you ever need help? It’s clear you’re just a number to them as you wait endlessly on hold. But don’t just take our word for it…

“I would not recommend XERO. As it turns out, they have a cancelation fee. You are charged an additional month beyond your cancelation date. So either you have to plan to cancel 2 months in advance or you have to plan to pay an additional month of service after you actually cancel.”

“One thing about this accounting software – when you have a question their first response is to tell you to have your accountant look at it. I was using this software as a replacement for an accountant, in order to save money, so that advice didn’t help much. When you do a google for help, you run into a problem: Xero seems to be doing accounting software for all the english speaking countries,e.g. new zealand, australia, UK, USA and canada. each of these countries has different business formations/corporations, different taxation rules, etc, as well as meaningfully different accounting vernacular. I would end up mnost of the time getting somewhere only to realize I’d pulled up the UK instructions to solve a problem.”

“Price. Their business model is to get people ‘hooked’ and slowly up the price. Sometimes even charging for things that were already part of the product and calling it an add on feature. e.g. Expenses. As a heavily VC backed company, the model was win lost of clients and then up the price because people do not swap accounting systems readily.”

“Xero has some of the worst customer service we have ever experienced, particularly for a company of their size. Combine this with terrible user experience in some parts of the app, unintuitive subscription models, and bad resources online, and it takes about 20x longer than it should to get anything done. The entire premise of Xero is cloud-based accounting, but it feels like traveling back in time 25 years when trying to get anything done with them.”

Award-Winning Customer Support

- Help From Start to Finish: Our Support team is highly knowledgable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Frequently Asked Questions

It’s expected that accountants have recommendations when choosing your cloud accounting tool. Accountants feel comfortable with Xero because it’s built for them. Business owners, on the other hand, might not have the in-depth accounting knowledge needed to make Xero work for them. When choosing software vendors you need to prioritize the one that fits your business needs.

FreshBooks cloud based accounting software is built for non-accountants running small and medium sized businesses – making it easy to create invoices and get paid. And you can always give your accountant immediate access to FreshBooks to get support during tax season and key financial decisions.

95% of users agree that FreshBooks makes it easy to work with your accountant.

The short answer is YES!

The long answer is:

When setting up a FreshBooks account, you can start fresh, or transfer over existing data from any previous accounting software solutions like Xero, QuickBooks Online, Zoho Books, or Invoice2Go. If you’re not a fan of manual entry, Clients, Expenses, and Items can be imported by you with the steps below. For Taxes, you can email our excellent customer support the details below and we’ll take care of it for you.

NOTE: If you choose a Select Plan, your information will be migrated for you by one of our account specialists.

Below are the types of data FreshBooks can import:

Clients: Clients can be imported using the steps here yourself.

Expenses: You can now import Expenses yourself with the steps here.

Items: Import Items using the steps outlined here.

VAT: For VAT, you can put together a CSV file for each type of data with the required columns below first. Then send this from your account with written permission for us to upload.

Required Fields

– Tax Name – i.e. ‘VAT’

– Percentage – i.e. ’13’ for a 13% VAT

Optional Fields

– VAT Number – Government-registered tax number

Vendors: Import Vendors using the steps outlined here.

There are 2 main differences between FreshBooks and Xero pricing.

Unlimited customized invoices and project features:

Included with FreshBooks Lite ($20/mo AUD) vs Xero Standard ($59/mo AUD).

Add-ons:

We don’t charge extra for basic features. FreshBooks offers essential features on all plans.

- Late Fees – Included with FreshBooks Lite (charged as an add-on with Xero, at $13/mo AUD)

- Unlimited Time Tracking – Included with FreshBooks Lite (charged as an add-on with Xero, at $10/mo AUD per user)

- Unlimited Estimates and Proposals – Included with FreshBooks Lite (charged as an add-on with Xero, at $10/mo AUD per user)

- Project Management – Included with FreshBooks Lite (charged as an add-on with Xero, at $10/mo AUD per user)

Absolutely. It’s built so you can add your clients, connect your bank account, launch new projects and get started with expense management, without having to read documentation or get help from a lawyer. And if you need a hand, our phone support with a live rep extends to both you and your accountant, with no additional fees.

Absolutely – as FreshBooks is a cloud based accounting solution.

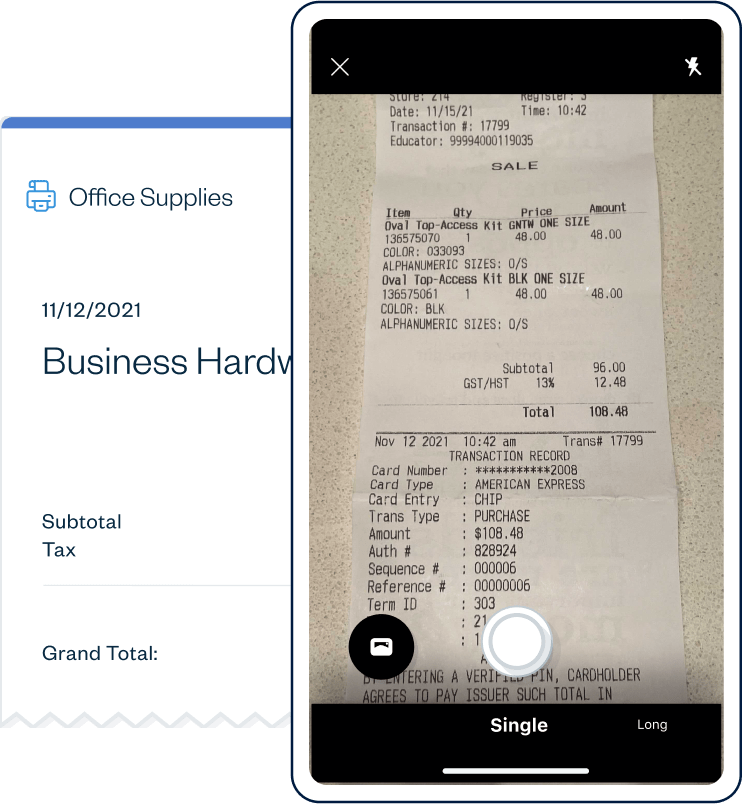

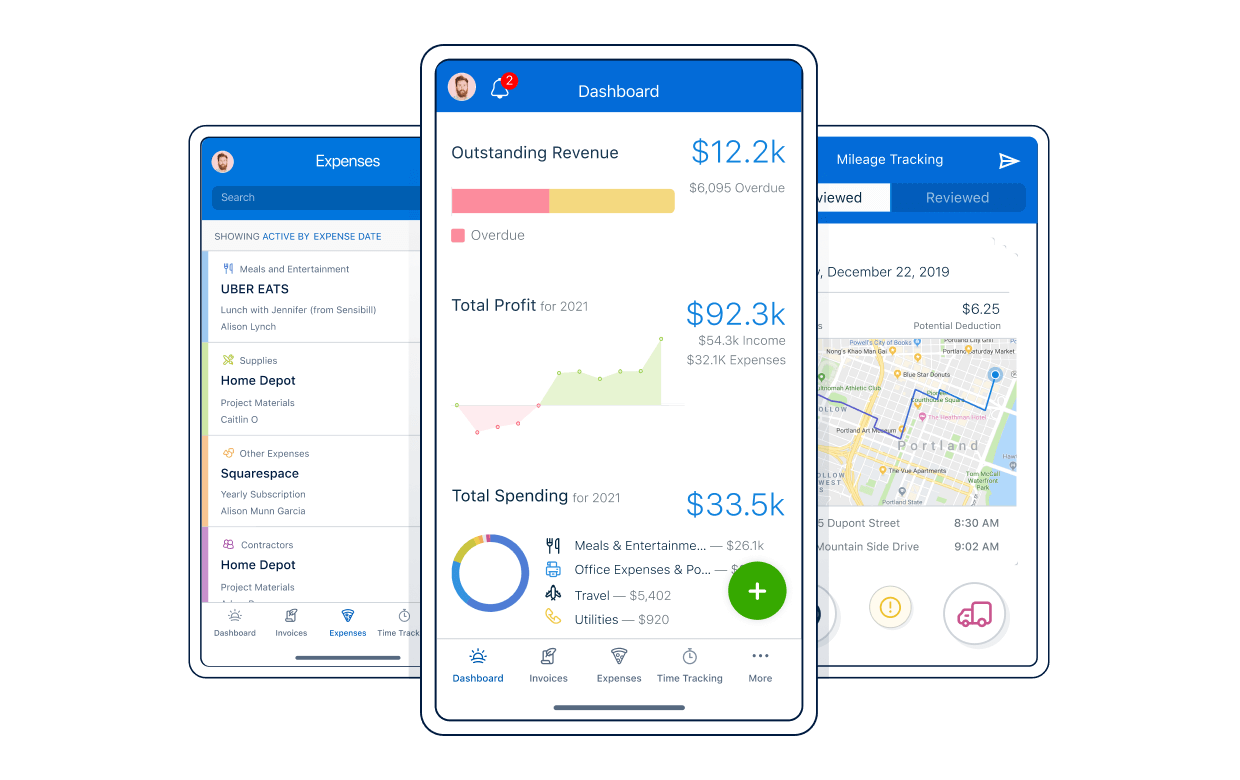

Many FreshBooks customers have service-based businesses that have them constantly on the go. And FreshBooks is a unique accounting software program in that it allows you to bring your software along with you while serving billable clients.

FreshBooks offers mobile access with iOS (iPhone Mobile) and Android Mobile apps that let you painlessly invoice your clients and track expenses wherever and whenever you need to. FreshBooks also has mileage tracking on iOS (coming soon to Android).

Now you can bring your account everywhere. It can be easily accessed from any device, from your PC (Windows desktop) or Mac desktop to your mobile phone.

Being able to create and send invoices on the go means no delays and no accounting headaches waiting for you. You can use the FreshBooks automated bookkeeping software wherever you have access to the internet, so let FreshBooks take care of your invoicing worries while you sit back and relax.

With automated bookkeeping software like FreshBooks, you can take it easy as you travel and rely on real-time notifications to keep you updated on billing and invoicing. From business trips to business lunches, keeping track of your payments will be a piece of cake. This mobile access is all part of your free trial too!

There are a number of payment processors and payment options you can choose through FreshBooks. FreshBooks integrates with a number of payment processors so that you can choose the payment method that works best for you and your business (and can deal with multiple currencies). Whether you want to accept online credit card payments, set up bank transfers, or get paid through FreshBooks Payments, you can easily set up the method you prefer. You can also set up different payment methods for different clients, depending on what suits them best.

The payment providers we utilize are Barclaycard, Stripe, and PayPal in order to provide the following payment methods:

- Major Credit Cards

- Apple Pay

- Google Pay

- PayPal

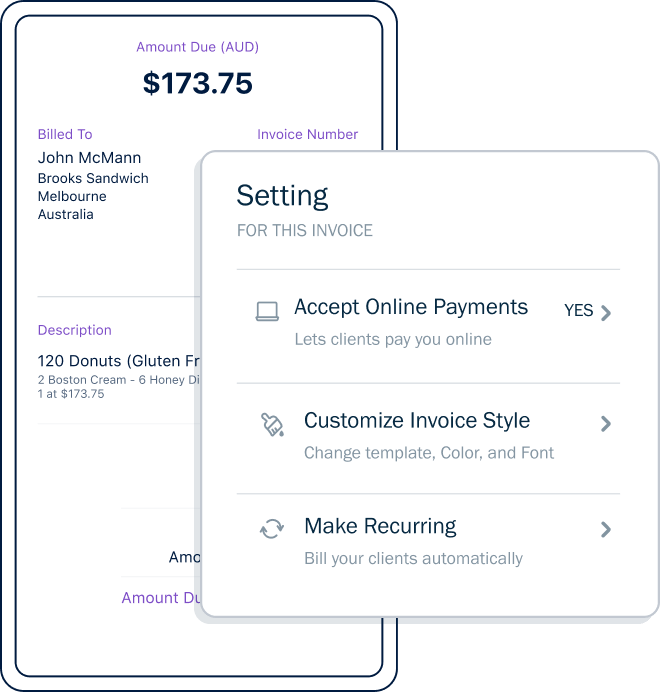

- Stripe

As a client, receiving a FreshBooks invoice with line items for subscription-based products or services, it’s easy to pay. All you have to do is save your credit card, banking or other payment details online in the FreshBooks application so you’re automatically billed each time an invoice comes due. Imagine doing this without invoicing software—dealing with paper invoices and receipts and having to keep track of phone and address records separately.

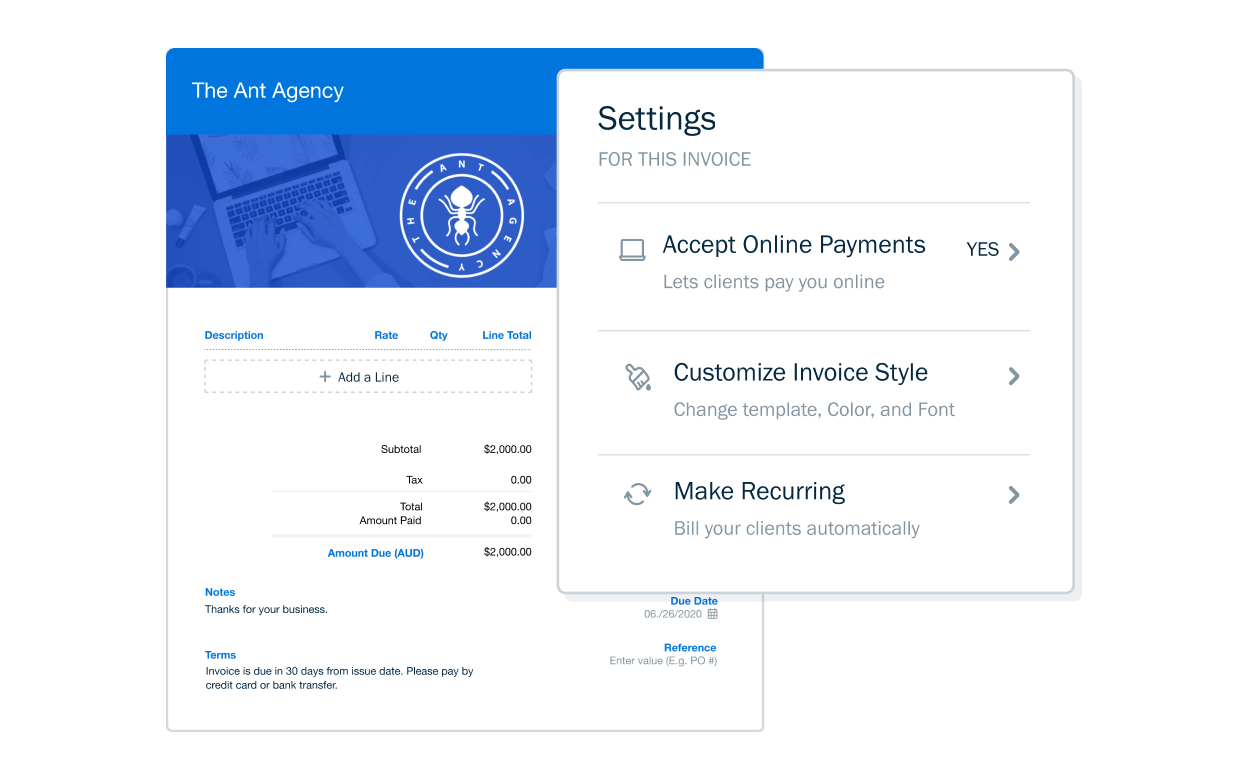

Automatic Recurring Invoices in FreshBooks combined with Recurring Payments makes it simple for clients to pay and for you to accept payments for products or services rendered—hands-free. Recurring Payments works together with Recurring Templates to automatically bill clients every time an invoice is generated and sent.

Saved payment information can always be removed if you want to opt-out of Recurring Payments at any time.

Customizable invoices packed with billable hours and expenses, using advanced features like recurring subscription billing and online payments make it easy for self-employed professionals to get paid faster.

When it comes to making payments easy for you and your clients and comparing FreshBooks vs Xero it’s easy to see why people choose FreshBooks.

You can import expenses from our expense tracker by uploading a CSV file as well as having FreshBooks automatically track them by connecting your bank accounts or credit cards.

If you want to import your expenses in bulk with a CSV file, you just need to ensure your file is populated with the necessary fields, and then select “Import Expenses from a File” from the “More Actions” button in the Expenses section of your FreshBooks account.

You can also connect your bank account and credit cards to your FreshBooks account to automatically track your expenses. Plus, use bank reconciliation to ensure your accounts are accurate and up to date.

You can easily test out expense tracking, team expense claims, and expense importing during your 30-day free trial.

Related articles:

4 Reasons You Should Track Your Business Expenses Daily

Capture Expenses and Invoices on Project Pages in FreshBooks

The safety of your private data is our top priority, that’s why it’s protected by 256-bit SSL encryption—the gold standard in internet security. You can even connect your bank accounts for automatic bank reconciliation trusting your data will always be private and secure. FreshBooks is a cloud accounting solution that uses industry-leading secure servers.

FreshBooks is a super-easy-to-use accounting software built specifically for small business owners, letting you easily do everything yourself. However, when it comes to using all the tools available to you as a small business owner, your accountant should definitely be part of your toolbox.

Sending customizable invoices and managing billing and invoicing for several businesses in FreshBooks might be right up your alley, but leveraging insights from accounting reports and accounting features might be something you want a second set of eyes on.

Not only does FreshBooks allow small businesses to add their accountant to their account, but FreshBooks also has an Accountant Partner Program that pairs small business owners with accountants. This ensures that businesses are matched with accountants that suit their specific needs, and gives them access to the financial and accounting reports they need.

Talk to your accountant and start a free trial to see how easy it is to work together. And if you need a hand our phone support with a live rep extends to both you and your accountant with no additional fees.

One thing we recommend while comparing Xero vs FreshBooks is to learn all about the FreshBooks Accountant Partner Program. It’s a unique part of FreshBooks that you won’t get from other cloud based accounting solutions.

Want to hear what it’s like to be part of the Accountant Partner Program? Here’s a great article: How FreshBooks’ Accounting Partner Program Helps CMA Lindsay Support Clients

Enlarge

Enlarge

Enlarge

Enlarge