Total Expense Ratio (TER): Definition, Formula & Limitations

Operating a business means there are all sorts of expenses incurred. These include common expenses and fees as well as some other expenses depending on the type of business. For example, these can include management fees, legal fees, and even taxes.

When it comes to investing, you will see various expenses, such as trading fees and auditor fees. Knowing these details can help you put a strategy in place to lower costs. One of the ways to determine total costs is the Total Expense Ratio (TER). It works differently than other financial ratios, like the net expense ratio or the reimbursement expense ratio.

Read on to learn all about TER, how it works, and other helpful details.

Table of Contents

What Is the Total Expense Ratio (TER)?

How the Total Expense Ratio Works

How is Total Expense Ratio Calculated?

Limitations of the Total Expense Ratio

Total Expense Ratio (TER) vs. Gross Expense Ratio (GER)

What Is the Total Expense Ratio (TER)?

The Total Expense Ratio (TER) measures the total amount of management fees paid to an asset management company (AMC). This happens when you invest your money and an AMC manages your investments. However, you don’t actively pay these fees. They get deducted directly from the net asset value.

AMCs charge their clients maintenance and operating expense fees for their mutual fund scheme. The total costs of these fees are reflected in the TER. It covers costs incurred from distribution commissions, advertisements, administrative, and other operational expenses.

The TER assesses the total costs or expenses that come with running an investment scheme. You can use the ratio to compare the costs related to the scheme to the costs of others. You can also assess the possible or available returns from that investment scheme.

The TER is a critical element you have to be aware of when making investment decisions. Funds that consistently have a high TER might not provide the best returns. This is because high costs can affect the returns generated.

In general, the lower the expense ratio, the better it is for you as an investor. Funds that are actively managed tend to come with expense ratios that are higher. The number of expenses also varies depending on your fund’s strategy or the class focus of your asset. Passively managed funds usually come with very low expense ratios.

Fund managers generally reduplicate a given index. You have to compare interchangeable funds ratios to determine what satisfies you as an investor. The Total Expense Ratio is also called the net expense ratio or the after-reimbursement expense ratio.

How the Total Expense Ratio Works

The size of your TER is going to play a very important role in your investments. The costs associated with your investments are deducted from the fund. Ultimately, this affects the returns on your investment.

The more actively you manage the fund, the higher the associated TER. This is due to an increment in personnel costs and increased operational-based fees. Your fund manager has to pay a brokerage fee whenever a trade that concerns buying and selling is performed.

Although the TER is expressed as annual data, it gets calculated daily.

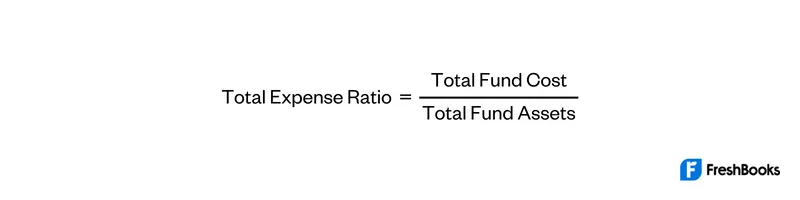

Total Expense Ratio Formula

The TER formula is very easy and straightforward to use. Simply divide the total cost of a particular fund by the fund’s total assets to get a percentage.

How Is Total Expense Ratio Calculated?

To calculate your TER, you can follow these three steps:

- You first have to find the total assets of the fund. In financial disclosures, you can find mutual funds to report to investors and financial analysts via a prospectus. A prospectus is a formal written offer to sell securities.

- You also have to obtain the total costs from the prospectus. This can be difficult to get since the TER analyses all costs associated with operating the investment fund, including trading costs, management costs, overhead, and administration costs.

- You then divide the total cost of the fund by the total assets invested.

Limitations of the Total Expense Ratio

The TER includes the entire cost you expect from an investment fund’s ownership. However, some charges may not be included in your TER, especially those that are only made once or are made from investment capital. These charges include:

- Commission

- Securities transfer tax

- Stockbroker fees

- Annual financial advisor fees

Total Expense Ratio (TER) vs. Gross Expense Ratio (GER)

Your Gross Expense Ratio (GER) is the total percentage of a mutual fund’s assets that come with running an investment fund. Sometimes, a fund may be arranged to include a waiver, reimbursement, or recoupment for some of the fund’s fees. This is often the situation when you invest in new funds. In some investment companies, the fund managers may not include certain fees associated with the launch of a new fund. This is to keep the expense ratio lower for investors.

The TER is simply those fees charged to the fund you invested in after any waivers, reimbursements, and recoupments have been made. These reductions are typically for a particular period, after which the fund may incur all costs.

Key Takeaways

The fees that an asset management company (AMC) charges you for managing and investing your money are known as the Total Expense Ratio (TER). It takes into account all expenses related to maintaining the mutual fund, and AMCs charge a TER regardless of whether a profit or loss is made.

However, you don’t actively pay these fees. Instead, they get subtracted from the value of the net assets. Your mutual fund returns may be negatively impacted by a high TER.

FAQs on Total Expense Ratio (TER)

Why Is Total Expense Ratio Important?

These costs are usually drawn from returns rather than paid directly. So, you only have to be aware of how the TER is calculated and taken off. The TER helps you to determine if you’re getting the best value from an AMC.

What Is a Good Total Expense Ratio?

A good TER for you as an investor should be between 0.5% to 0.75%. Any Total Expense Ratio greater than 1.5% is considered high. You must keep your ratio at or below 0.75% to have a good return.

Is Expense Ratio Deducted Daily?

No. It is deducted annually, but the deductions are calculated on a daily basis.

RELATED ARTICLES

Accounting Records: Definition, Types & Examples

Accounting Records: Definition, Types & Examples Departmental Accounting: Definition, Types & Methods

Departmental Accounting: Definition, Types & Methods Accounting Income: Definition, Types & Calculation

Accounting Income: Definition, Types & Calculation Accounting Standards: Definition & History

Accounting Standards: Definition & History Property, Plant, and Equipment (PP&E): A Complete Overview

Property, Plant, and Equipment (PP&E): A Complete Overview What is Turnover in Business? Importance & Calculation

What is Turnover in Business? Importance & Calculation