Book Value Per Share: Definition, Formula & Example

The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares. To put it simply, this calculates a company’s per-share total assets less total liabilities.

But what exactly is book value per share? And how can you use it to help your business? Read on as we learn more about this ratio’s calculation, its meaning, and how investors use it to inform their choices.

Table of Contents

KEY TAKEAWAYS

- Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated.

- To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding.

- The book value per share metric can be useful in identifying undervalued stock prices, but it has its limitations.

- There are limitations to the book value per share measurement. It doesn’t take into account intangible assets and it focuses on historical costs rather than current stock price values (fair market value).

What is Book Value Per Share?

Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities.

Preferred stock is usually excluded from the calculation because preferred stockholders have a higher claim on assets in case of liquidation.

To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1.

Let’s talk more about this metric. We’ll discuss its importance and how you can use it and the drawbacks and how best to use book value per share.

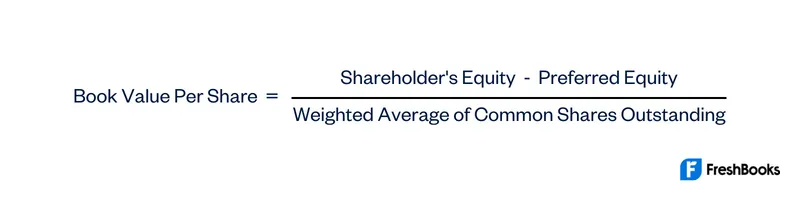

Book Value Per Share Formula

The book value per share formula is very simple. All you need to do is divide a company’s total equity by the number of shares outstanding. The exact formula is as follows:

Book value per share can vary widely from one company to the next. For example, let’s say that ABC Corporation has total equity of $1,000,000 and 1,000,000 shares outstanding. This means that each share of stock would be worth $1 if the company got liquidated.

Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding. In this case, each share of stock would be worth $0.50 if the company got liquidated.

What does the Book Value Per Share Indicate?

The book value per share metric can be useful in identifying undervalued stocks. If a stock is trading below its book value per share, it means that the market is valuing the company at less than its liquidation value.

Of course, this doesn’t necessarily mean that the stock is a good buy. There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments.

Methods to Increase the Book Value Per Share

There are a few different ways that companies can increase their book value per share:

- Increase the total equity of the company through share repurchases, which reduce the number of shares outstanding, or by issuing new shares of stock.

- Decrease the liabilities of the company through debt reduction or by selling off assets.

- Increase the value of the asset balance sheet by investing in new equipment or property, or by increasing the efficiency of the company’s operations.

Drawbacks of Book Value Per Share

There are some limitations to the book value per share metric that you should be aware of:

- It doesn’t take into account intangible assets. These are assets that don’t have a physical form , such as patents or trademarks.

- It focuses on historical costs rather than current market values. This means that it can sometimes be misleading.

In the example from a moment ago, a company has $1,000,000 in equity and 1,000,000 shares outstanding. Thus, the book value per share would be $1. Now, let’s say that the company invests in a new piece of equipment that costs $500,000. The book value per share would still be $1 even though the company’s assets have increased in value.

So the book value per share ratio has its limitations. Even though book value per share isn’t perfect, it’s still a useful metric to keep in mind when you’re analyzing potential investments.

Book Value Per Share Example

Let’s say that Company A has $12 million in stockholders’ equity, $2 million of preferred stock, and an average of 2,500,000 shares outstanding. You can use the book value per share formula to help calculate the book value per share of the company.

The calculations would look like this:

$12 million in Stockholders’ Equity – $2 million of Preferred Stock ÷ 2,500,000 Shares Outstanding = $4.00 Book Value Per Share

Now, let’s say that Company B has $8 million in stockholders’ equity and 1,000,000 outstanding shares. Using the same share basis formula, we can calculate the book value per share of Company B.

The calculations would look like this:

$8 million in Stockholders’ Equity – $0 million of Preferred Stock ÷ 1,000,000 Shares Outstanding = $8.00 Book Value Per Share

This means that each share of the company would be worth $8 if the company got liquidated. Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company. However, you would need to do some more research before making a final decision.

The book value per share is just one metric that you should look at when considering an investment. It’s important to remember that the book value per share is not the only metric that you should consider when making an investment decision.

There are a number of other factors that you need to take into account when considering an investment. For example, the company’s financial statements, competitive landscape, and management team. You also need to make sure that you have a clear understanding of the risks involved with any potential investment.

Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment.

Summary

In closing, it’s easy to see why the book value per share is such an important metric. It’s a simple way to compare the value of a company’s net assets to the number of shares that are outstanding. But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision.

FAQs About Book Value Per Share

The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated. The market value of a company is based on the current stock market price and how many shares are outstanding.

It depends on a number of factors, such as the company’s financial statements, competitive landscape, and management team. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do a lot of research before making any investment decisions.

If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors.

Book value per share relates to shareholders’ equity divided by the number of common shares. Earnings per share would be the net income that common shareholders would receive per share (company’s net profits divided by outstanding common shares).

The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding.

Share: