Branch Accounting Definition, Types & Examples

When you’re running a business, one of the decisions that you have to make is which method of accounting you’ll keep your books according to.

There are many different methods of bookkeeping. Some are more popular than others. But what they all have in common is the aim of keeping a business’s books in order.

One type of bookkeeping system is branch accounting. But what exactly is branch accounting? And why should it be considered as a strong bookkeeping system?

We’ll take a closer look at the definition, the different types, and give you an example of branch accounting in action.

Table of Contents

KEY TAKEAWAYS

- Branch accounting is a bookkeeping system.

- It separates accounts into different branches, each of which is maintained separately.

- It is a system that is typically found in corporations that are geographically dispersed, as well as chain operators.

- The two types of branches are independent and dependent.

What Is Branch Accounting?

Branch accounting is a bookkeeping system. It separates accounts into different branches, each of which is maintained separately. This is a system that is typically found in corporations that are geographically dispersed, as well as chain operators. It allows for greater transparency when it comes to transactions and calculating cash flow, as well as helping accountants track the overall performance and financial position of each branch.

Branch accounts also refer to individually produced records. These records show the performance of the different locations. These accounting records are maintained at the corporate headquarters. But in most cases, each branch keeps its own books. They will then send them to their respective corporate headquarters at the end of each accounting period, where they will be combined with reports from all other branches.

How Does Branch Accounting Work?

Branch accounting works by each branch within an operating unit being treated as an individual profit center. Each branch will have its own account where items such as accounts receivable, inventory, and wages are kept.

They are essentially separate branches of the same tree.

The Two Types of Branches

A business that deploys a branch accounting method will split its branches into one of two categories:

- A dependent branch

- An independent branch

Let’s take a closer look at each of these categories.

1. Dependent Branch

In a dependent branch, each branch does not maintain separate accounts. The head office at the corporate headquarters will manage the individual profit and loss statements as well as the balance sheets. Only information such as cash accounting or debtors accounting is supported by separate branches as well as inventory.

2. Independent Branch

Independent branches keep a separate book of accounts. This means that their profit and loss statements and their balance sheets are separate from their corporate headquarters. So both the head office and the branches are treated as separate entities.

Examples of Branch Accounting Journal Entries

The journal entries under the branch accounting method are relatively straightforward. Here are some examples of how to record entries for your financial transactions.

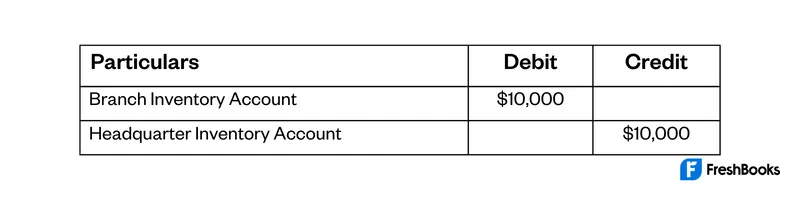

Inventory

Let’s say that the corporate headquarters transferred inventory with a value of $10,000 to its branch office. In this case, the journal entry that would be passed into the headquarters books would look like this:

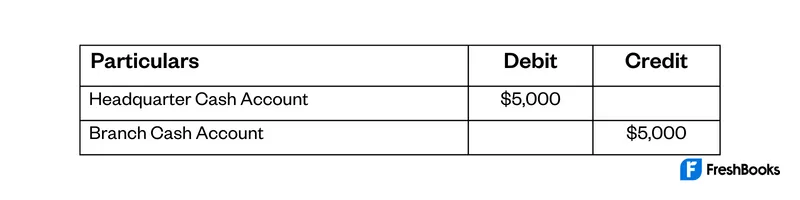

Cash Remitted to Head Office by the Branch

Now, if the corporate headquarters of a company receives a cash remit of $5,000 from the branch office, the journal entry would look like this:

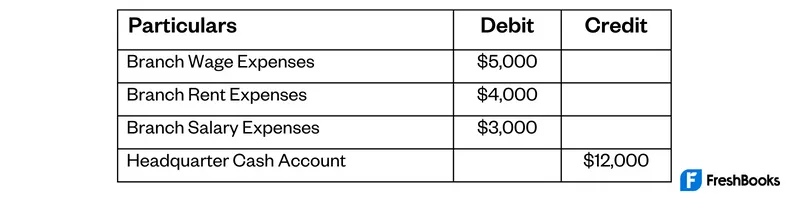

Expenses of Branch Paid By Head Office

If the corporate headquarters paid wages of $5,000, rent of $4,000, and salary of $3,000 on behalf of the branch office, the journal entry would be as follows:

Methods of Branch Accounting

There are a number of different methods that can be used for keeping branch accounts. Which one you may use would depend both on the complexity and the nature of the business. As well as how independent the operations of the branch are. Here are some of the most common branch accounting methods:

- Debtor system

- Stock and debtor system

- Final accounts system

- Wholesale branches system

Let’s take a quick look at each of these methods.

Debtor System

In the debtor system, a branch account is debited in the head office’s books with the goods supplied by the head office. The branch account will then be credited with all of the returns and remittances. This can be used to find out the profit or loss of each branch.

Stock and Debtors System

This system is ideal for smaller branches. It is where goods are shipped to the branch at the sale price. The branch doesn’t have the authorization to vary that selling price.

Final Accounts System

In this method, trading and profit and loss accounts are prepared. This is for calculating the gross profit or gross loss, alongside the net loss or net profit. Opening goods and stock that are sent to the branch are debited in the trading account. Any closing stock, goods, and sales that are returned by the branch are credited to the trading account.

Wholesale Branches System

For this system, the invoicing of goods is done at the wholesale price. This is to a retail branch. The opening and closing stock of the branch in question is shown at the wholesale price. Plus any unrealized profits in the closing stock are debited as a stock reserve. This is to the profit and loss account of the corporate headquarters. A stock reserve of opening stock is also then credited to the same account.

What Are the Advantages and Disadvantages of Branch Accounting?

Let’s look at some of the advantages and disadvantages of branch accounting.

Advantages of Branch Accounting

Some of the advantages of branch accounting include:

- It helps to figure out the profit and loss of each of the corporation’s branches.

- It helps to know the debtors inventory as well as the cash position of each branch.

- It helps to figure out the wages, rent, salary, and expenses of each separate branch.

- It helps to better control the operations of the overall branch.

- By utilizing separate branch accounting, you can easily track the performance and progress of each branch.

- It helps to make informed decisions according to the requirements of each branch.

Disadvantages of Branch Accounting

Some of the disadvantages of branch accounting include:

- Branch accounting requires a larger workforce. This is because each branch has a separate account, which takes more time.

- You have to have an individual manager for each of the branches.

- You need to have infrastructure at each of the branch locations.

- The accounting system is prone to mismanagement. This is because it is a decentralized operation, so there is less control to be had from head office.

- There are multiple authorities at play. This can make decision-making difficult.

- There is a different setup at each branch’s location. This, therefore, increases company expenses.

Summary

Branch accounting is a useful method of bookkeeping for organizations that are widespread. This is because it helps to keep track of each department and branch. It also gives you a deeper understanding of the overall performance of each unit. However, it can be a costly operation that requires a much larger workforce. This inevitably affects the overall profitability of the company.

FAQs About Branch Accounting

Head office is the main headquarters of the business that owns each branch.

Branch accounting shows the results of trade of each individual branch within an overall structure. Whereas departmental accounting shows the results of trading for each separate department within a business.

The synthetic method in branch accounting is when goods that are sent at cost price or invoice price are debited to the branch account.

The branch account is a nominal or temporary ledger account.

Loading is the difference between the invoice price of goods and the cost price of goods. It is also known as the higher price over the cost.

Branch accounting allows businesses to maintain separate books of accounts for different branches under the same umbrella.

Share: