Deferred Tax Liability: Definition & Examples

When you invest in a business, you are essentially giving them money so they can grow. The trouble is that when you invest money in a company, it doesn’t change your personal cash flow right away. So, how can you recoup your investment? With a stock option plan.

If your company gives you shares in your employment package, they are likely to give you restricted stock options. Restricted stock is the kind of stock that has some strings attached to it.

In most cases, employees can only sell the shares after a certain amount of time has passed and only if their company meets certain criteria as well.

To find out more about restricted stock and other types of employment compensation, keep reading. This guide will cover everything you need to know about deferred tax liability, including the formula. We will also show you how to properly calculate deferred tax liability

Table of Contents

KEY TAKEAWAYS

- Deferred tax liability is a type of long-term liability. Companies incur it when they postpone paying taxes on certain types of accounting income.

- The amount of the liability is the difference between a company’s taxable income and its accounting or book income.

- Deferred tax liabilities can have a significant impact on a company’s financial statements and cash flow.

What is a Deferred Tax Liability?

A deferred tax liability is an amount of money that a company owes to the government in taxes, but has not yet paid. The liability exists because the tax laws allow companies to defer, or delay, paying taxes on certain types of accounting income.

This method of accounting allows companies to shift the timing of their tax payments. In some cases, your company may have made a profit in a given year but due to the rules, the tax on the income will be paid in a future year.

A deferred tax liability is created when the profit on the income statement is bigger than in the tax return. It is a temporary difference because of the timing for when the taxes will have to be paid.

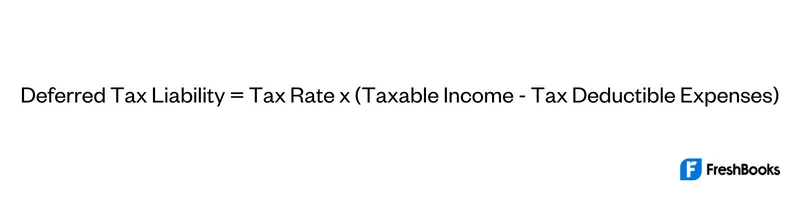

Formula For Deferred Tax Liability

The formula for calculating a deferred tax liability is:

What Causes A Deferred Tax Liability?

A deferred tax liability is caused when the tax income is lower than the book income on the company financial statements. This happens when the timing of expenses that are taken for book purposes is different than for tax purposes. For example, a company has reported taxable income that is lower than its book income. This happens when expenses get deducted for tax purposes but not for accounting principles. For example, a company might be able to deduct a higher amount in depreciation for tax purposes than on its its financial statements

How Does Deferred Tax Liability Work?

Deferred tax liability (DTL) is caused by postponing the payment of taxes on certain types of income. The tax is eventually paid, but the company gets to use the money in the meantime to invest in income producing activities.

The amount of the deferred liability is the difference between the tax amount that needs to be paid on the company’s taxable income versus its book income. Once the amount is calculated, it will be posted on the balance sheet in the liability section.

How Is Deferred Tax Liability Calculated?

Deferred tax liability is calculated by looking at the difference between taxable income and earnings before taxes. This is then multiplied by the tax rate.

Example Of Deferred Tax Liability

A company has reported taxable income of $100,000 and book income of $90,000. The company’s tax rate is 21%. The company’s deferred tax liability would be $2,100 ((21% x $100,000) – (21% x $90,000)).

The example shows a calculation based on the total difference in income. The difference in income might have resulted from:

- Property Depreciation – the different amount of depreciation deducted for book vs tax purposes – the expense on your tax return will be larger than on your income statement.

- Installment Sales – you recognized more income from prepaid subscription sales on your tax return than on your income statement.

- Credit Sales – you sell a product on credit, so you will pay taxes on the customers’ payments at a later time.

Why Does Deferred Tax Liability Matter?

Deferred Tax Liability matters because it lets you keep more money right now by postponing the payment to a later time. By not spending the money on your tax payment now, you can use it to invest in income producing assets, which will generate more income in the long run.

Summary

A deferred tax liability is an important tool for accounting for income taxes. It allows businesses to postpone their tax payments to a later time. Additionally, it allows businesses to manage their tax liability in case of future changes in tax rates.

FAQs on Deferred Tax Liability

No, deferred tax liability is not a current liability. It is a long-term liability that is typically reported on the balance sheet.

No, deferred tax liability is not a long-term debt.

Yes, companies can have both deferred liabilities and tax assets on their balance sheets.

Deferred tax liability is considered to be a long-term liability, because it will be payable in more than one year.

Share: