Key Rate Duration: Definition, Overview & Formula

Are you just starting to make certain investments and want to learn some strategies to maximize your return? Are you an active investor that has a large portfolio of various types of investments?

No matter where you are in your investment journey, the value of certain investments can change. So what happens when this occurs and is there anything you can do to be prepared? The key rate duration is an effective way to forecast potential changes in the value of your portfolio. Read on to learn what you need to know.

Table of Contents

KEY TAKEAWAYS

- The change in a bond’s price in response to a 100-basis-point (1%) change in yield at a specific maturity is calculated using the key rate length.

- Effective duration can be used to estimate the portfolio of bonds given value changes when a yield curve shifts in a parallel fashion

- While key rate duration must be utilized when the yield curve shifts in a non-parallel fashion.

- When interest rates change, duration measures let you know the price risk associated with holding fixed income products.

- Key rate duration is used to quantify non-parallel shifts, or curve twists, in the yield curve.

What Is Key Rate Duration?

Key rate duration gauges the change in the value of a portfolio of debt securities or debt instruments, usually bonds, at a particular maturity point along the entire yield curve. The key rate duration gauges how sensitive a debt security’s price is to a 1% change in yield for a particular maturity while holding other maturities constant.

The price sensitivity of a fixed income instrument to a non-parallel shift in interest rates is primarily measured by its Key Rate Durations (KRD).

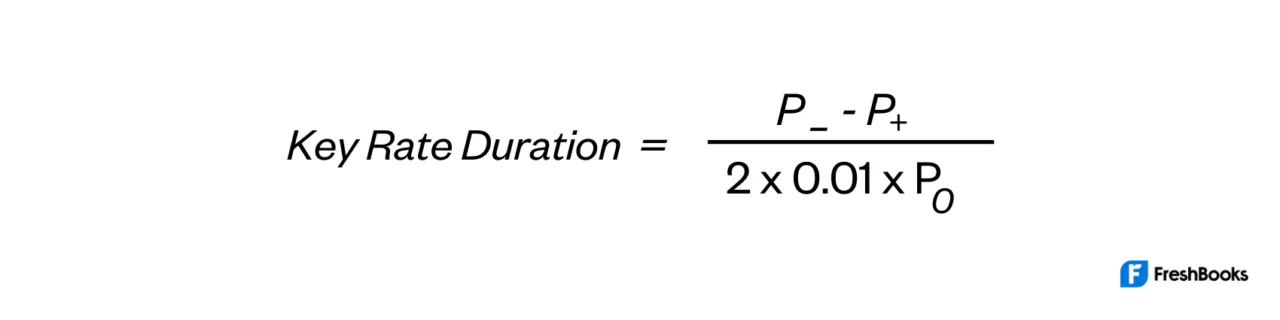

What Is the Key Rate Duration Formula?

The Key Rate formula can be written as follows:

Where:

P_ = the price of the security after a 1% decrease in its yield

P+ = the price of the security after a 1% increase in its yield

P0 = the original price of the security

How to Calculate the Key Rate Duration

Let’s say that Bond X has an original price of $10,000. A 1% increase in Bond X’s yield would price it at $9,700. A 1% decrease in yield would price the bond at $10,400. So if we take the above key rate formula, then the key rate duration for Bond X would be as follows:

KRD = ($10,400 – $9,700) / (2 x 1% x $10,000) = $700 / $200 = 3.5

What Does the Key Rate Duration Determine?

When the yield curve adjusts in a way that is not precisely parallel, which happens frequently, key rate duration is a crucial notion in evaluating the projected changes in value for a bond or portfolio of bonds.

Another crucial bond indicator is effective duration, which analyses projected price changes for a bond or bond portfolio given a 1% change in yield but is only applicable for parallel movements in the yield curve. The key rate duration is a very useful measure because of this.

Example of Key Rate Duration

Let’s go back to our example of Bond X.

Let’s say that Bond X has a one-year key rate duration of 0.5. It also has a five-year key rate duration of 0.9.

Bond Y on the other hand has respective key rate durations of 1.2 and 0.3 for the maturity points.

On the short end of the curve, bond X could be considered to be half as sensitive to interest rate fluctuations as bond Y, while bond Y could be said to be one-third as sensitive.

Summary

The key rate duration depicts the anticipated value change brought on by a change in yield for a bond or bond portfolio with a particular maturity. It is based on the supposition that all other maturities’ yields remain constant.

Financial analysts or investors can forecast the likely profitability of investing in bonds of various maturities by using the statistic.

For U.S. Treasuries, there are more than 10 distinct bond maturities, and the investor can determine the key duration for each maturity level.

FAQS on Key Rate Duration

Effective duration is thought to be inferior to the key rate duration. Because short- or long-term interest rates for all different bond maturities simultaneously increase or drop by the same amount, the effective length metric is only applicable to parallel shifts in interest rates and the yield curve.

A bond portfolio’s key rate exposure can be used to describe the rate risk distribution along the term structure. They provide guidance on how to use highly liquid benchmark bonds to implement the ideal hedge.

When the price of a bond or other debt product swings in the same direction as interest rates. In other words, negative duration happens when interest rates rise along with bond prices and vice versa.

Share: