Incremental Cost of Capital: Definition, Overview & Example

As a business begins earning more profits and is able to see revenues rise, there are going to be more opportunities for growth. Depending on the type of business, you could purchase more inventory or fund a new expansion. But sometimes the business needs to raise new financing options.

One of the most effective ways to do this is by injecting new capital into the business. There can be a lot to know and understand, which is why we created this article about the incremental cost of capital. Read on to learn more.

Table of Contents

KEY TAKEAWAYS

- The incremental cost of capital is the opportunity cost of investing in an additional unit of capital.

- The ICC includes the cost of both equity and debt financing.

- Businesses can use incremental cost of capital to determine how debt will affect their balance sheets.

- The ICC is used to evaluate whether a company should invest in a project by comparing the project’s required return to the ICC.

- Companies can reduce their financing costs with proper ICC calculations.

What is the Incremental Cost of Capital?

Incremental cost of capital is additional money that a company must spend to raise new financing. This could be for a new project, additional inventory, or other needs. At its core, incremental cost of capital refers to a single unit that a company must raise.

A company raises additional increments according to its needs. To finance a new project, for example, it may need to take on debt or sell more equity. The cost of each additional unit will be different, and the company must weigh the pros and cons of each option to decide which is best.

There are several factors that go into calculating the incremental cost of capital. These include the type of financing (debt or equity), the current market conditions, the company’s financial history, and more.

In the sections below, you’ll find out what you need for proper ICC calculation. We also provide an example of incremental cost of capital. Be sure to read until the end for answers to frequently asked questions.

How to Calculate Incremental Cost

Before calculating ICC, you need to determine the fixed costs and the variable costs. Fixed costs are those that do not change with production or sales, such as rent and insurance. Variable costs are those that change with production or sales, such as raw materials and labor.

To calculate ICC, you only want to use variable costs. This is because fixed costs are not relevant to the decision of whether or not to pursue a new project or venture. Once you have determined the variable costs, you can calculate ICC by adding up all of the variable costs.

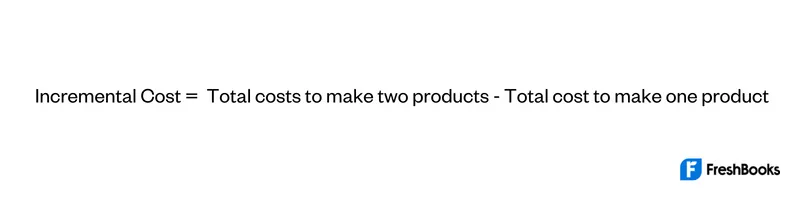

Next, you subtract the variable costs to make two products from the variable cost to make one product. Thus, the increment cost formula is:

For example, let’s say it costs $10 of raw material to make one widget. You pay an employee $20 an hour, but it only takes them 30 minutes to complete the product. The calculation to make one product looks like this:

(20/2) + 10

10 + 10

20

Your variable cost to make one product is $20.

When you increase to two widgets, the employee works more efficiently due to repetition. So instead of taking one hour to make two products, your employee can do it in 45 minutes.

(20 x 0.75) + 20

15 + 20

35

Now you’re ready to put your variable cost differences to work to get the incremental cost.

35 – 20 = 15

Your incremental cost to make the second product is $15.

Benefits of Incremental Cost Analysis

There are several benefits of using incremental cost analysis when making investment decisions. Including:

- It helps companies make more informed investment decisions.

- It takes into account all relevant variable costs and benefits when making investment decisions.

- It ensures that companies only invest in projects that are expected to generate sufficient returns.

- There are also some risks associated with using incremental cost analysis, which include:

- It can be difficult to accurately estimate all relevant fixed costs and benefits.

- It can lead to suboptimal decision-making if not used correctly.

- Projects with high upfront costs but low marginal costs may be wrongly rejected.

- Incremental cost analysis is a powerful tool that can help companies make more informed financial decisions.

Example of Incremental Cost

Imagine that you are the owner of a small business that manufactures and sells widgets. You are considering expanding your business by opening a second factory.

You have done some market research and believe that there is demand for your product in the new location. However, you are not sure if the expansion is worth the cost. To help you make a decision, you calculate the ICC of the expansion project.

You determine that the fixed costs of the expansion would be $1 million. The variable costs would be $0.50 per widget. You estimate that you would sell 2 million widgets in the first year after expanding.

To calculate ICC, you add up all of the variable costs. In this case, that would be $1 million (2 million x $0.50). You then subtract the variable costs of making one widget from the variable cost of making two widgets.

$1 million – $0.50 = $0.50

This means that the ICC of expanding your business is $0.50 per widget.

You decide to go ahead with the expansion because you believe that the potential revenue from selling widgets in the new location justifies the cost.

Summary

Incremental cost is the difference in total cost when output changes by one unit. It is a useful tool for making decisions about which projects or ventures to pursue. ICC can help you optimize your resources and make the most of your investment opportunities.

It is also a useful tool for evaluating risk. Projects with higher ICCs are typically more risky than those with lower ICCs.

When making a decision, you should compare the ICC of the options to see which one is most cost-effective. Generally speaking, the option with the lower ICC is preferable. However, you should also consider other factors such as revenue potential and risk when making your decision.

FAQs About Incremental Cost of Capital

The marginal cost of capital is the additional cost a company incurs when it finances an additional project. This can be for any number of projects.

Incremental cost analysis is used when making investment decisions. It takes into account all relevant costs and benefits when making investment decisions.

No, depreciation is not an incremental cost. Depreciation is a non-cash expense that is used to allocate the cost of a long-term asset over its useful life.

Incremental cost is the additional cost a company incurs when it expands its operations. Marginal cost is the additional cost a company incurs when it produces one additional unit of output.

A sunk cost is a cost that has already been incurred and cannot be recovered. An incremental cost is a cost that will incur as a result of a decision.

Share: