Accumulated Earnings Tax: Definition & Overview

When a business pays tax, that money goes to the government for various reasons.

In fact, taxes are a government’s main source of income. This can be spent on public services, infrastructure, and general government spending.

However, if a business holds onto its earnings, then the government will suffer. That’s where the accumulated earnings tax comes into play.

Read on as we take a closer look into this federal government tax.

Table of Contents

KEY TAKEAWAYS

- Accumulated earnings tax is a federal government tax.

- It is used to tax businesses that have held onto earnings that are considered unreasonable.

- The threshold for accumulated earnings is set at $250,000 for most businesses.

- Companies can avoid this tax by making a dividend payable to their shareholders. This dividend payable will then be taxed through capital gains tax.

What Is Accumulated Earnings Tax?

An accumulated earnings tax is a tax imposed by the federal government. It’s put on companies that have retained earnings that are deemed to be unreasonable and beyond what is considered normal.

To put it simply, it encourages companies to hand out dividends rather than hold onto their earnings. The Internal Revenue Service (IRS) allows for certain exemptions to this tax rule.

Why Are Accumulated Earnings Important?

Companies that retain earnings will typically experience a higher stock price appreciation. This is beneficial to shareholders as their capital gains taxes have a lower rate than dividend taxes. However, this is detrimental to the government because their tax income will decrease alongside this.

By adding an extra 20% tax on a company’s retained earnings, one of two things will happen. The government will either collect more taxes from the company, or the tax increase will persuade the company to issue dividends—allowing the government to collect the tax from the various forms of shareholder capital.

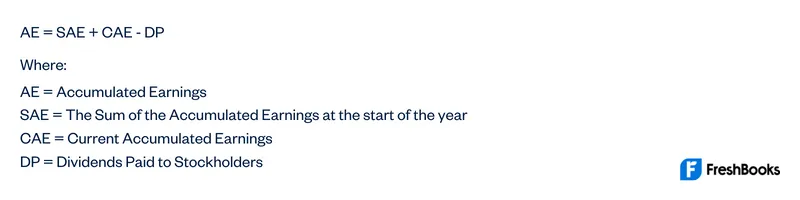

How To Calculate Accumulated Earnings

In order to calculate accumulated earnings, you can follow the following formula:

Reason for An Accumulated Earnings Tax

When companies accumulate and hold onto their profits or earnings, they’re subjected to the accumulated earnings tax when the amount of retained earnings rises above a certain threshold. The companies would be holding onto these earnings instead of handing them out in the form of dividends to shareholders.

The threshold of accumulated earnings is anything up to $250,000. Once it hits this number it will be deemed unreasonable, and the 20% tax rate will be added.

Accumulated Earnings Tax Exemptions

Any company will have an exemption amount of $250,000. This means that they can accumulate their earnings up to $250,000 before the accumulated earnings tax is imposed. Once the earnings accumulated go past $250,000, a 20% tax will be levied against future earnings.

There are further exemptions for certain companies. For any company whose principal function is performing services in the following, the exemption amount is at $150,000:

- Accounting

- Actuarial science

- Consulting

- Architecture

- Health

- Law

- Engineering

- Performing arts

Additionally, there are certain types of companies that are exempt from the Accumulated Earnings Tax altogether:

- Personal holding companies

- Tax-exempt corporations

- Passive foreign investment companies

If a business can show that any earnings over the threshold are for the reasonable needs of the business, then it may also have an exemption. The IRS defines these reasonable needs as:

- Specific, definite, and feasible plans for the use of the earnings accumulation

- Product liability loss where the accumulated amount is needed for the payment of reasonably anticipated product liability losses

- Various redemption needs

Summary

The accumulated earnings tax stops companies from holding onto their earnings past a certain limit. By levying a tax against holding onto profits, it stops businesses from being able to avoid paying certain taxes that are necessary for government funding.

Taxes on dividends paid out to shareholders by a company stop this tax from taking place. The government can then raise these funds from shareholders through the capital gains tax on their income dividends.

FAQS About Accumulated Earnings Tax

The accumulated earnings tax applies to any company that has accumulated earnings over $250,000. The following corporations are excluded: Personal holding companies, tax-exempt corporations, and passive foreign investment companies.

You can avoid the tax by paying out dividends to your shareholders. The shareholders will then have to pay income tax on their capital gains.

No, as earnings are taxed to S corporation shareholders even if they are not distributed to them.

Retained earnings represent the company’s surplus or profits after they have paid out dividends to shareholders. So they are not the same thing as accumulated earnings.

Share: