Bookkeeping For Freelancers: A Beginner’s Guide

As a freelancer, getting paid and being ready for tax season are crucial parts of your business. That’s why understanding the basics of bookkeeping for freelancers is so important.

It can be hard to keep track of your clients and when and how much they should pay you. Understanding how to manage your accounting and the tools you can use will help you stay on top of outstanding invoices and collect payments from clients who owe you money.

When you’re keeping a consistent and accurate log of your business activities you can understand your business better and have an accessible view of your cash flow. Plus, you’ll be prepared for tax season and the potential for an audit.

If you’re finding it hard to keep up with your accounting tasks, hiring an accountant or using bookkeeping software can give you more time to focus on what you love about your business.

Key Takeaways

- It’s important to stay on top of your accounting all year long so you’re prepared when tax season comes around.

- Keep track of all your expenses and set cash aside to avoid surprises during tax season.

- Accounting software is a major help to freelancers.

- Bookkeeping helps you stay on top of your freelance income and ensures you’ll be ready in the event of an audit.

Table of Contents

- 12 Tips for Bookkeeping for Your Freelance Business

- Why Freelancers Should Care About Bookkeeping

- Streamline Your Finances with FreshBooks

- Frequently Asked Questions

12 Tips for Bookkeeping for Your Freelance Business

Stay on Top of Your Accounting

Knowing what’s going on with your money can help you succeed as a freelancer.

Whether you use an accountant for tax season or not, it is important to have a handle on your finances all year long. This helps you anticipate future problems and grow your business. Set your freelance career up for success by allocating time daily or weekly, depending on transaction volume, to organize your bookkeeping and ensure you enter in every invoice or expense receipt.

Establish a System That Works for You

Bookkeeping can be daunting for freelancers and self-employed individuals, so finding a system that works for you is so important.

Luckily, there are many tools in the marketplace that will help you easily input your financial data anywhere and at any time. Accounting software will help you organize your finances by tracking outstanding invoices, managing your cash flow, invoicing clients, and ensuring you have accurate and timely financial records.

Bookkeeping services are another great way to help manage your business finances. They provide efficient support bookkeeping, tracking expenses, and making the most of your tax deductions, helping you save money and reduce the likelihood of a tax audit. Hiring a bookkeeping service also frees up your time so you can focus on other aspects of your business, such as connecting with clients and reaching new markets.

Track Everything

As a freelancer, keeping track of your bookkeeping is so important when it’s time to file your taxes. Here are a few write-offs and data to track for the end of the year.

- Hours you worked on a project

- Jobs you have completed for clients

- Fees charged per hour for every client

- Common business expenses

- Office supplies

- Home office deduction

- Travel expenses

- Power and utility bills

- Phone and internet bills

- Bills for technology purchases like a computer, printer, or phone

- Software

- Advisory services

- Website design and hosting

- Career-related classes, books, and seminars

- Payments you made

- Bank transfers and online payments

- Client payments

Seeing your financial numbers in an easy-to-read table can make tracking your business cash flow even more effortless. The FreshBooks free accounting template is an excellent place to start, displaying everything you need to see at a glance. Click here to get started.

Set Aside Cash

Setting aside cash for your annual tax bill is always a good idea.

Newer freelancers might be used to having an employer automatically deduct a portion of their earnings from each paycheck to cover their income taxes. As a freelancer, you’ll have to be prepared for the possibility of a higher tax bill that will be calculated differently than what you might be used to.

The general rule is to save about 30 percent of your income. Using an accounting software can also help you create reports that can help you estimate your tax bill and give you a clear picture of:

- All your invoices

- Your cash flow

- The financial health of your business

- Who owes you what, and when

- How much you owe others

- Clients who are paying on time

Use Accounting Software

There are many benefits to using bookkeeping software that can benefit you as a freelancer.

Major benefits include getting paid faster, having clear financial records to submit when you’re applying for a loan and being prepared for a potential audit.

An online accounting software program, like FreshBooks online accounting software, will have advanced features to help you:

- Quickly create and send custom invoices

- Set invoice alerts for you and your clients

- Upload receipts and keep them organized

- Identify and follow up with late payers

Separate Personal and Professional Assets

As a freelancer, separating your personal and business finances can be tricky. You should open a separate bank account for business transactions to ensure everything is clear. This differentiation in your finances can make your life much easier and allows you to accept cash, checks, and electronic payments (bank transfers, online web-based payments like PayPal, etc.) without the waters becoming muddied.

Having separate accounts gives a more straightforward visual of how much money you have linked to your business at any time. This will help with bank reconciliation, make it easier to budget, and provide costs for your services.

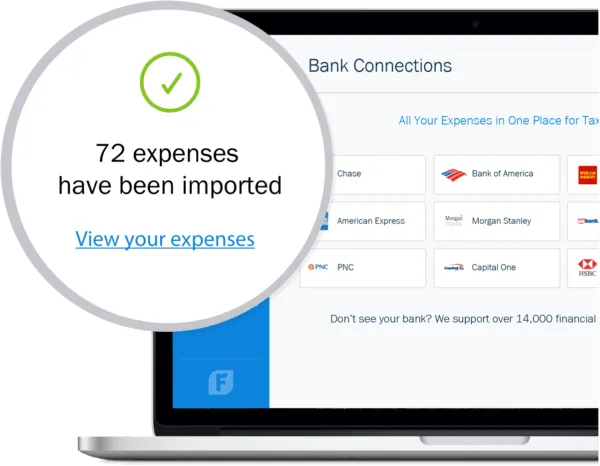

The right expense tracking system also makes it easier to separate your personal and business finances. FreshBooks expense tracking software links to your business bank account or credit card to automatically import and track your business expenses. It makes it easy to record your business expenses and claim your deductions without mixing up your personal and professional expenses.

A clearer view of your freelance finances will help you avoid financial problems in the future and help you see clearly which expenses are crucial for your work.

Be Transparent About Your Income and Expenses

If you don’t separate your business account and personal accounts, you can get paid straight to your personal bank account, which can make it tempting to brush things under the rug.

The immediate benefits will not be worth it in the long run.

If you’re caught during an audit, you could face penalties like fines or even jail time.

Transparency also helps your business by clearly showing where your money is going and coming from. This can be helpful when planning business strategies for growth, too. Make sure that you’re generating accurate monthly financial statements including balance sheets and cash flow statements. This financial reporting practice can demonstrate the strength of your business’s financial health to potential investors as well as providing important records for tax season.

Set and Follow a Budget

Setting and sticking to a budget will help you manage your cash flow and ensure you have organized tax records.

There is accounting software that can help you track and monitor your spending habits and help you set up savings and growth goals for your business.

A strict budget plan will help you develop healthy financial habits as a freelancer. This smart money management will help your business grow in the long run.

Evaluate Your Financial Records

Your independence as a freelancer puts a lot of responsibility on your shoulders when making business decisions.

You can better visualize your business’s landscape by analyzing insightful business reports. These business reports can give you the necessary information to improve your business.

Comparing different periods can give you a true picture of your business cycle and assist with budgeting through ebbs and flows during the year. Make sure you close off your books of accounting at the end of each reporting period, often monthly or quarterly, to ensure reporting is relevant to a certain period, making it easier to compare.

Here are just a few reports that you can use to analyze your data:

- Aged Payable

- Aged Receivable

- Balance Sheet

- Income Statement

- General Ledger

- Trial Balance

- Journal Report

Reconcile Bank Transactions

Having your books organized and matching your bank accounts is crucial to the success of your freelance finances.

This can be quite a difficult task but using bookkeeping software can help you reconcile your bank account in no time. To sync up your accounts, you can import data from your bank accounts, credit cards, and Stripe and PayPal transactions to make sure your bookkeeping is up-to-date.

You can reconcile all your transactions within minutes when you get a live bank feed. Plus, you’ll get a good sense of your cash flow.

Reconciling your bank account can make the day-to-day business of freelancing easier and prepare you for tax season.

Send Invoices and Payment Reminders

Making sure you get paid is a surprisingly tough task for freelancers.

When you’re waiting to get paid, it can be difficult to stay on top of your income. To protect your cash flow and achieve your projected income, it is important to ensure you are getting paid on time by clients.

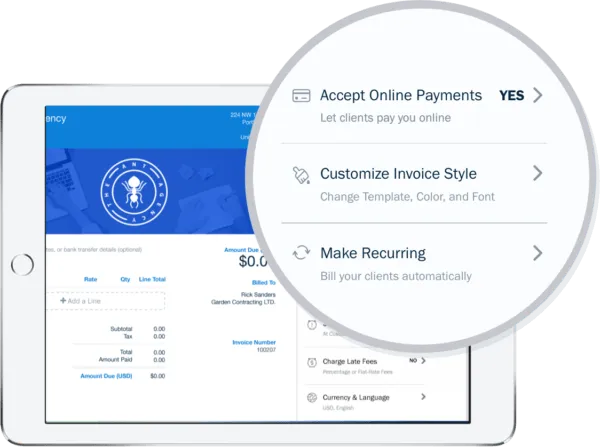

Sending out invoices with clear due dates and setting up late payment reminders will help you get paid faster. Too often, freelancers don’t get paid on time because their clients focus on other things and forget upcoming bill due dates. Recurring invoices and planned reminders will get you your money with minimal effort.

FreshBooks Payments enhances freelancers’ payment process by automating their invoicing and payment process. Save time and energy by sharing invoices online and sending automatic payment reminders to clients. You can also send custom payment links and accept credit, debit, and bank transfer payments online, making payments easier for your clients and helping you get paid faster.

Also Read: How to Make an Invoice as a Freelancer

Create Quotes and Estimates

Landing clients and negotiating contracts can be hard for a freelancer.

Providing potential customers with quotes or estimates of the work you will do upfront will help set the expectations and might significantly improve the rate of deals you’re closing. In these documents, you can provide an estimate of the time it will take you to finish their project, the rate, estimated taxes, and the scope of work. If prospective customers are still unsure about the deal, you can always send them a more detailed quote to further break down the charges they are unclear about.

If this detailed quote is logged in your accounting system, it serves as a contract once the customers agree on the terms. It can easily be turned into an invoice once the service or goods are delivered. And because your customer is already aware of the estimated costs, it’s easier for them to pay you faster.

Why Freelancers Should Care About Bookkeeping

Bookkeeping isn’t always at the top of a freelancer’s mind. You start your business because of an idea you are passionate about, and often that doesn’t include accounting. However, there are many reasons freelancers should care about keeping on top of their bookkeeping, and here are just a few.

Easier Trips to Your Accountant

You might be using an accountant to help you file your taxes. Those accountants likely charge a pretty expensive hourly rate. If you come with a shoebox of unorganized and sloppy records, your accountant will charge you for the hours spent organizing and locating the appropriate documents to create your financial records.

If you bring your information organized and ready to go, they can focus their billable time on making sure that all of your tax forms are filled out properly before filing your taxes for you.

You’ll Be Ready for an Audit

The best way to painlessly get through the audit process is to always have your financial records organized and store the related financial records properly. The IRS usually selects freelancers for audits randomly and often focuses on deductions claimed like home office expenses, travel expenses, mileage, etc.

If the tax audit finds errors in your filing, resulting in additional taxes owed, you will be more likely to be selected for audits in the following years. If your bookkeeping is organized, you will be less likely to have mistakes on your next tax returns and filings and will be less likely to be red-flagged by the IRS.

Keeping up with Your Daily Business Tasks

Doing a little accounting daily will make your overall operations easier to handle. Organizing your receipts and invoices as they come in will save you from a huge amount of work during tax season.

As you make project management and bookkeeping a part of your daily routine, you’ll be able to spend less time on it. This task management will give you more time to focus on your day-to-day work and even help you plan future growth and long-term financial health.

Protecting Your Assets When Things Go South

It’s not fun to think about things that unexpectedly go wrong in your life that could impact your business. Good bookkeeping can prepare you for anything from a legal proceeding with an angry client to a difficult divorce.

While going through a legal proceeding, your financial records will likely play a critical role. Clean records will help your lawyer prove what assets and funds are truly yours.

Avoiding Legal Problems

There may be legal requirements in terms of your financial record keeping, depending on where you’re doing business. Failing to keep proper records could result in significant penalties and fines, so be aware of state and federal requirements.

Recognizing Potential Issues

When you’re on top of your accounting and bookkeeping, just by looking at profit and loss statements, you can anticipate future problems that your business might face.

You can identify serious financial irregularities by consistently analyzing your books before they become a problem. Maybe you will catch an upcoming cash flow problem and realize you’re losing money on daily expenses or other serious issues impacting your bottom line.

Streamline Your Finances with FreshBooks

A good bookkeeping system is essential for every freelancer. It helps ensure your finances remain tax-compliant, empowers you to make the most of your tax deductions, and enables you to create effective financial strategies for your business.

FreshBooks accounting software helps you stay on top of your small business bookkeeping. The easy-to-use invoicing system streamlines your invoicing process with professional templates, automated due date reminders, and a versatile online payment system. It also makes it easy to keep track of your business spending and revenue so you’re ready for tax season.

FAQs on Bookkeeping For Freelancers

How do freelancers record income?

Keeping track of all income for small businesses can be difficult, so utilizing freelance accounting software to record income and tax dollar amounts may be the best accounting solution around. The best accounting software for you is the one that’s the simplest to use, reducing your stress level as you track your finances.

How often should I review my bookkeeping as a freelancer?

Freelancers should do bookkeeping at least once a month but you can go over accounts more frequently if you wish. Some will do it at the end of every week, while others go over their bookkeeping daily, depending on your transaction volume. Just a few hours a month will keep your books balanced.

What bookkeeping software is best for freelancers?

FreshBooks is the best free accounting software and the best bookkeeping software for freelancers because it is simple to use and provides powerful tools like invoicing software, automatic mileage tracking, and payment tools that will improve the efficiency and profitability of your small business.

How much should I pay a freelance bookkeeper?

Small businesses can expect to pay a freelance bookkeeper around $50 to $100 USD an hour. The price depends on the complexity of your needs and the bookkeeper’s experience and qualifications.

What are the benefits of bookkeeping for freelancers?

As a freelancer, bookkeeping will help you keep track of all expenses, tax payments, and income. It will also make tracking late payments from clients easier and provide a clear view of your business’s health by allowing you to track customer payments and business transactions.

What expenses can freelancers claim on their taxes?

Some big expenses that you can write off at tax time include business memberships, education expenses, professional fees, marketing and advertising expenses, home office expenses, car costs, insurance costs, legal fees, professional fees, and retirement contributions. However, it can be challenging to keep track of and record these expenses. For a smarter solution to these problems, you can use expense tracking software. Our guide, Expense Tracking for Freelancers, will provide you with more insight into this.

What are the differences between bookkeeping and accounting for freelancers?

A bookkeeper only needs a basic understanding and certification in the field of accounting to help record transactions and financial data while keeping daily responsibilities organized. Accountants are experts in the field, with in-depth insight into accounting and taxes, allowing them to provide financial business advice.

What are the bookkeeping mistakes that I should avoid as a freelancer?

Some common issues freelancers have regarding bookkeeping include mixing business and personal transactions, failing to do bookkeeping regularly (at least monthly), and losing or failing to properly organize purchase receipts.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How to Manage Loan Repayment Account Entry

How to Manage Loan Repayment Account Entry How to Audit Accounts Payable in Your Small Business

How to Audit Accounts Payable in Your Small Business Accounting Forecasting Techniques and Tips for Small Businesses

Accounting Forecasting Techniques and Tips for Small Businesses What Is Work Order Accounting? Why It’s Important to Your Business.

What Is Work Order Accounting? Why It’s Important to Your Business. How to Calculate Equity Income in 4 Easy Steps

How to Calculate Equity Income in 4 Easy Steps How to Create a Single-Step Income Statement and Simplify Your Small Business Accounting

How to Create a Single-Step Income Statement and Simplify Your Small Business Accounting