What Is Burden Cost in Manufacturing and Why You Should Calculate It

A Burden Cost refers to the hidden labor and inventory charges companies pay in their manufacturing processes. It is helpful for small businesses to calculate these numbers as burden costs can affect a company’s profitability.

Here’s What We’ll Cover

What Does Burden Rate Include?

How Do I Calculate Burden Rate?

Is Burden and Overhead the Same?

When Do I Use Burden Rate?

Businesses should calculate a burden rate when they want to get a clearer picture of what it will cost them to actually manufacture their products. The results of a burden rate analysis are sometimes why companies prefer to open manufacturing plants outside their home country, because the burden rate for labor or machinery operation proves to be too high to allow their business to be profitable in the area in which they reside. This is part of the reason why you will sometimes hear of specific industries getting tax breaks, to keep some larger companies going.

Some companies fail because they have not conducted a proper burden rate analysis in advance of commencing business operations. At the very least, understanding a company’s burden costs can provide a guideline on what burden costs are affordable and which are not, at least to start.

What Does Burden Rate Include?

The Burden Rate involves two separate areas of business:

Labour Burden

These are expenses a company incurs above and beyond the payout of regular salaries to its staff. They include:

- Payroll Taxes

- Workers’ Compensation

- Health Insurance (Including Sick Leave)

- Vacation/Statutory holidays

- Education

- Travel

- Pension Contributions or Annual Bonuses

- Other Benefits (That May Be Unique to a Particular Company and Not Standard).

Burden costs are added up and then converted into a burden rate. This rate will be higher for senior employees and executives because they will have increased benefits and higher salaries.

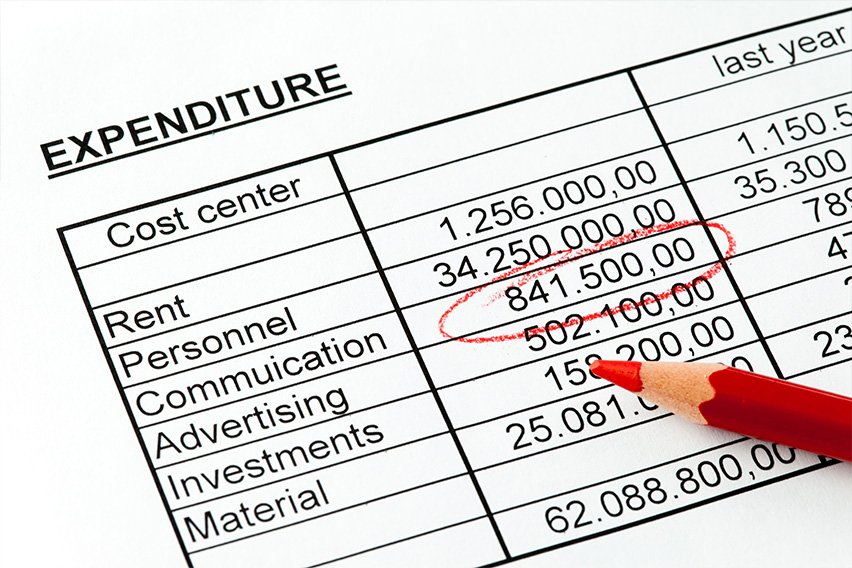

Inventory Burden

Inventory burden is calculated separately and converted into an hourly cost rate based on machine hours. For instance, you’ve opened a plant and purchased all the equipment, but how much does it cost you to keep running those machines every day in relation to product output? This figure needs to be added to the total cost of producing your product.

How Do I Calculate Burden Rate?

The calculations for Labor and Inventory Burden rate are different:

Labor Burden Rate Equation

Labor Burden Cost ÷ Payroll Cost

Example: Let’s say the accounting department of a large communication company does an analysis and determines that Paul, an employee in their call centre, receives 15K in benefits annually. His wages are 60K. That means his burden rate is $0.25 for every $1.00 of wages the company pays him.

The company executives consider this data carefully. They decide this burden rate is too high as a standard, and consider ways to reduce benefits for new hires so that the company remains profitable. Alternatively, the company may feel this rate is within a good range based on their existing profitability, the industry and their competitor’s offerings.

Inventory Burden Rate Equation

Manufacturing Overhead Cost ÷ Activity Measure

Example: Let’s say a 1000 hours of machine time are used to create a batch of a company’s product. Perhaps the company considers the value of this machine’s operation during this time to be worth $25,000. That means the inventory burden rate is $25.00 per machine hour used.

Is Burden and Overhead the Same?

Burden costs are the hidden costs (either labor or inventory) that can drive up the cost of manufacturing a product. Overhead costs are not directly related to the manufacturing of a product. For instance, if a company pays rent, utilities and insurance on a factory, they are paying those costs every month regardless of whether the business becomes a success or not.

RELATED ARTICLES

Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting

Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting What Is Accumulated Depreciation?

What Is Accumulated Depreciation? A Simple Guide to Small Business Write Offs

A Simple Guide to Small Business Write Offs How to Become a Small Business Owner in 7 Steps

How to Become a Small Business Owner in 7 Steps How to Choose the Best Accounting Software for Your Small Business?

How to Choose the Best Accounting Software for Your Small Business? Specific Identification Accounting 101

Specific Identification Accounting 101