Why Are Financial Statements Important?

Your financial statements are the equivalent of an annual medical checkup. They are vital in assessing your company’s financial health.

The 3 primary financial statements you’ll want to study closely are the:

- Income statement, also known as a profit and loss statement

- Balance sheet, also known as a statement of financial position

- Cash flow statement, or statement of cash flows

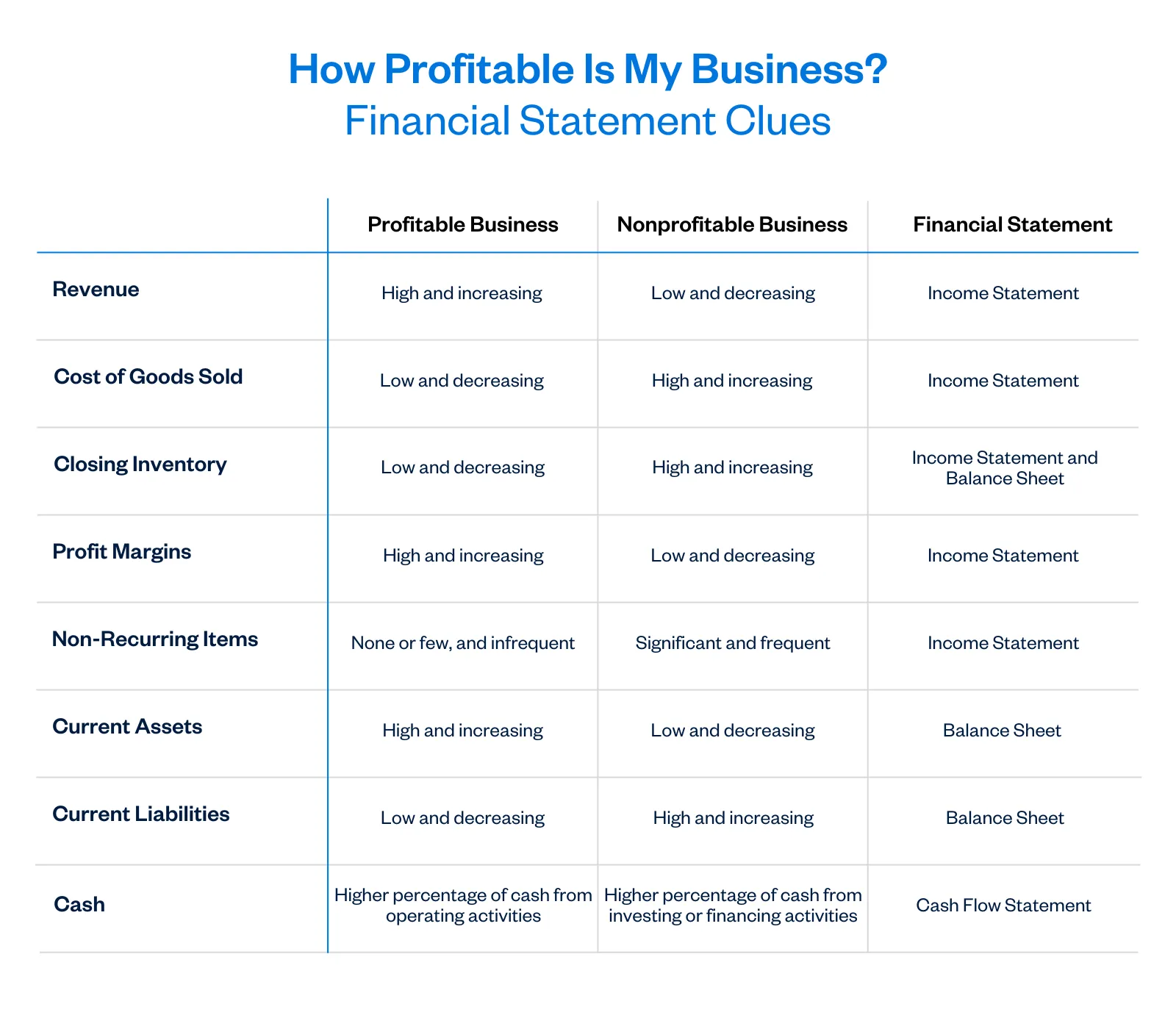

In this article, we’ll show you certain green lights ✅ and red flags ❌ you can easily tease out from each of your company’s financial statements.

These indicators will separate a profitable company from a non-profitable one and help you make more informed decisions for your business.

Here’s What We’ll Cover:

What to Look for in Your Company’s Income Statement

What to Look for in Your Company’s Balance Sheet

What to Look for in Your Company’s Cash Flow Statement

What to Look for in Your Company’s Income Statement

An income statement reveals how your business has performed in a given period. That reporting period could be a month, a quarter, or a year.

By a company’s performance, we mean detailed information about the revenue it generated, the expenses it incurred, and ultimately, the net income—the net profit your business has made.

You should look for the following results in your income statement. Some of these may be the critical red flags or the reassuring green lights.

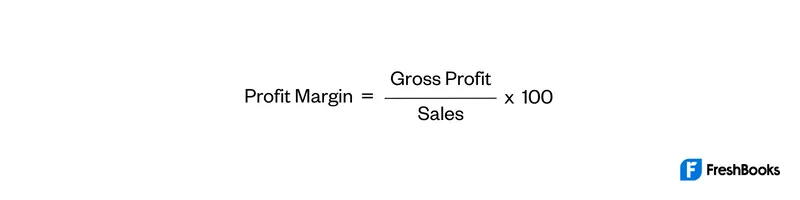

Declining Profit Margins

A good income statement shouldn’t show declining profit margins. If your profit margins are falling, you should be concerned with the sustainability of your business.

This may point to shrinking revenues or ballooning expenses. Either way, just ensure your finger is on the actual cause.

Non-Recurring Transactions

A good income statement should not have significant or frequent non-recurring transactions.

These are the “blue-moon” items—things that don’t arise from the ordinary course of business or day-to-day business operations.

Say, for instance, you run a gym and fitness center, and on your income statement, you spot something like “other income” or “other expenses” and remember that you had a broken water pipe that flooded the locker rooms. Your insurer gave you money to make necessary repairs.

This is an example of a non-recurring transaction. If you see these rare financial events showing up regularly on your income statement, you need to do some research into why these unexpected costs keep cropping up.

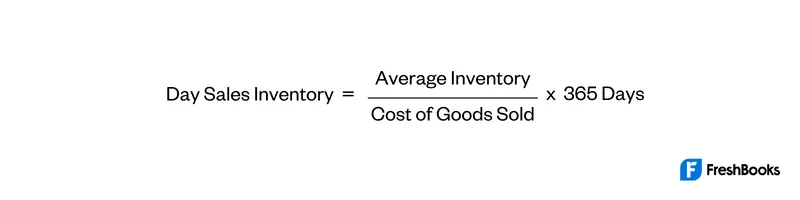

Closing Inventory Metrics

High or increasing closing inventory levels might show that you’re struggling to sell your products. A good measure here is day sales inventory:

This shows the number of days it takes before you sell your products. Calculate this for three years and see the trend.

If you see an increase in the time to sell your products, you’ll want to find out why. Do you need updated styles or colors? Has the product quality decreased? Are you overproducing and holding on to too much inventory?

Get clarity so you can improve your profit margins.

What to Look for in Your Company’s Balance Sheet

Also known as the statement of financial position, the balance sheet shows your company’s net worth: What it owns (company’s assets) less what it owes (company’s debts) at a particular date.

These are the metrics you should keep your eye on in your balance sheet:

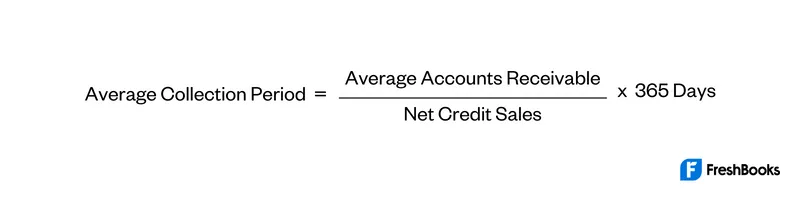

Receivable Metrics

As a rule, a good balance sheet shouldn’t show increasing receivables. If your receivables are on the rise, all factors constant, you’re failing to collect your business debts, which is a bad sign.

To monitor your company’s revenue collection trends, you’ll want to observe what’s known as the average collection period:

Declining Profit Margins

You can do this for at least 3 years. If you spot an increasing trend, you should urgently recalibrate your debt collection strategy.

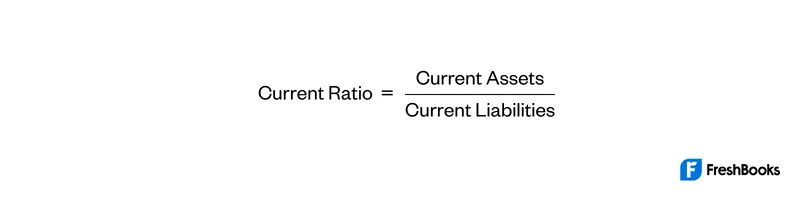

Liquidity Metrics

As a rule of thumb, a good balance sheet should have

- More current assets, which is the stuff your company owns and can convert into cash within a year, and

- Low current liabilities, which are the financial obligations your business owes and which you should pay within a year.

The current ratio is the most indicative of this.

The current ratio shouldn’t dip below 1.5, which means you have $1.50 in current assets for every $1.00 in current liabilities.

What to Look for in Your Company’s Cash Flow Statement

A cash flow statement shows your cash outflow and inflow for an accounting period, indicating whether you have enough cash to cover your expenses. The cash flow statement breaks down cash flow into 3 categories:

- Cash flows from operations (or from operating activities)

- Cash flows from investing activities

- Cash flows from financing activities

A good cash flow statement will have cash mainly coming from operating activities. This is because other cash streams are not sustainable.

Here’s a summary of financial clues to look for on your company’s financial statements.

FAQs on Financial Statements

Are Financial Statements Important for a Company’s Health?

Financial statements are like regular health screenings. If you don’t review them frequently, your business may end up with a serious and even irreversible (financial) health problem.

Should My Business Have Financial Statements?

Absolutely. Without financial statements, you wouldn’t know your company’s financial position or financial health. You also wouldn’t figure out the value of your business.

How Can I Make Financial Statements?

While there are accounting software programs you can use, such as FreshBooks, for accurate records, you’ll need someone with accounting knowledge to input your company’s financial information into it accurately. If you want to lear to prepare a financial statement follow our guide on How to Make a Financial Statement for Small Business.

How Is a Financial Statement Different from a Financial Report?

Financial statements usually refer to the “Big 3”: the income statement, the balance sheet, and the cash flow statement.

Financial reports can refer to financial statements or other reports you may need from time to time. An example is an aged receivables report that shows each customer with an outstanding balance.

RELATED ARTICLES

What Is a Tax Transcript, and How Do You Request It?

What Is a Tax Transcript, and How Do You Request It? How Long Does It Take To Get a Tax Refund? The Complete Guide

How Long Does It Take To Get a Tax Refund? The Complete Guide Capital Gains Tax on Real Estate: What You Need to Know

Capital Gains Tax on Real Estate: What You Need to Know What Is a Tax Break: Definition, Types, and How to Obtain One

What Is a Tax Break: Definition, Types, and How to Obtain One What Is a W-9 Form? Everything You Need to Know

What Is a W-9 Form? Everything You Need to Know What Is a Tax Rebate? Everything You Need to Know

What Is a Tax Rebate? Everything You Need to Know