How To Calculate Gross Profit: Formula and Example

Gross profit measures the revenue a business earns after deducting the cost of goods sold. It’s an important metric for assessing how efficiently a business covers its production costs in relation to its total income from sales.

Gross profit is the difference between the amount of sales made during a period and the cost of those sales.

Gross profit is calculated by subtracting the cost of goods sold from the business’s revenues for a given period. Cost of goods sold includes the cost of inventory sold to customers or the cost of services provided, like materials, tools, freight, and labor, incurred while generating revenues.

Understanding gross profit is key to tracking business growth, assessing overall financial health, and developing strategies to increase profitability. We’ll explore the formula for calculating gross profit and how gross profit compares to profit margin. We’ll also look at why gross profit is important to help you develop this essential business metric.

Key Takeaways

- Gross profit is the amount of profit a company generates after subtracting the cost of goods sold from sales during a period.

- To calculate gross profit, subtract the cost of goods sold from revenue for a given period.

- Gross profit is an important metric for assessing business profitability and efficiency.

- Gross profit margin is gross profit expressed as a percentage (for example 25% of sales).

Table of Contents

- What Is Gross Profit?

- Gross Profit Formula

- How To Calculate Gross Profit

- Gross Profit vs. Gross Profit Margin

- Why Is Gross Profit Important?

- What’s the Difference Between Net Profit and Gross Profit?

- Final Thoughts: Evaluating Gross Profit

- Frequently Asked Questions

What Is Gross Profit?

Gross profit is the amount of profit a company generates after deducting the cost of goods sold from the company’s total revenue. Cost of goods sold refers to the costs directly associated with selling goods and services —the labor and materials needed to produce merchandise or render services. Gross profit is also called cost of sales or cost of merchandise.

Gross profit is calculated before other indirect operating expenses are deducted from sales for the period (such as salaries of salespeople and officers, rent expenses, insurance expenses, etc.)

Gross profit is an important metric for assessing a company’s efficiency and productivity. A negative gross profit means the costs of doing business exceed the revenue brought in from sales. Positive gross profit means that a business is successfully covering its basic production costs. The higher the gross profit, the more efficient the business’s production.

There are several different profit measures commonly used in business, so it’s important to note that gross profit only accounts for the cost of goods sold. It does not include any costs for labor associated with sales and distribution or any additional deductions like taxes, dividends, and interest.

Gross Profit Formula

As the name suggests, the gross profit formula is the formula for calculating a company’s gross profit.

The gross profit formula is:

Let’s break down each element of the gross profit formula.

Revenue

Revenue is the amount of money generated from sales of a company’s products and/or services during a specific time period (for example, a month or a quarter).

Revenue measures income generated before any deductions.

Cost of Goods Sold

Cost of goods sold (or COGS) are the direct costs associated with production of a product and/or service (also known as production costs).

These costs include labor directly related to the product or service and any materials required to produce it. They do not include overhead—fixed or variable costs like advertising, sales labor costs, software, administration, and other expenses associated with running your business.

How To Calculate Gross Profit

Now that we know the gross profit formula, let’s look in-depth at an example.

1. Determine revenue for the given period

The first step in calculating gross profit is determining the company’s revenue. This is the total amount that your company generated from sales before any costs or deductions are included.

Garry’s Glasses is a sunglasses manufacturer and retailer. At the end of the year, Garry determines the company’s annual revenue for the year is $850,000.

2. Determine the cost of goods sold for the given period

COGS (cost of goods sold) includes all of the costs Garry incurred in manufacturing and selling his sunglasses—including production and direct labor costs and material costs. After reviewing his expenses for the year, Garry determined his COGS is $650,000.

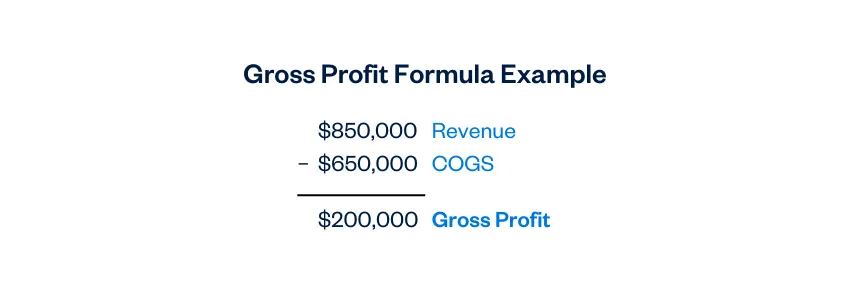

3. Use the gross profit formula to calculate gross profit

Using the gross profit formula, Garry can calculate his gross profit as follows:

When Garry subtracts the company’s COGs from its revenue, he ends up with a gross profit of $200,000 for the year.

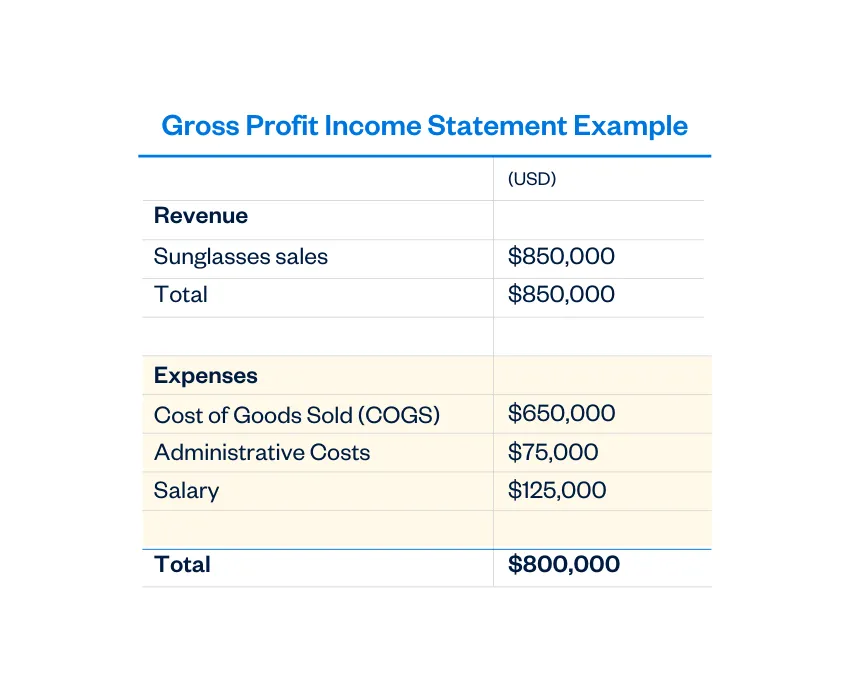

Let’s see what this might look like if Garry was using his company’s income statement to calculate gross profit

To determine gross profit, Garry would subtract COGS ($650,000) from his total revenue ($850,000). For gross profit, he would ignore the administrative costs and salary costs on his company’s income statement. These are fixed costs and, as such, aren’t included in the gross profit formula.

What is Included in Gross Profit?

Gross profit calculations only include revenue and Cost of Goods Sold, so you can ignore the Administrative Costs and Salary that are also included on your income statement. These are fixed costs and can be used as part of net profit calculations, but aren’t needed for gross profit.

Net profit calculations include revenue and Cost of Goods Sold, as well as fixed costs like Administrative Costs and Salary. Net profit also includes all other expenses involved in running a business, such as advertising costs and taxes. While it’s important to record the other elements of your income statement like Administrative Costs and Salary so you can include these in your net profit calculations, you’ll also need other expenses and taxation costs before you can calculate net profit.

Gross Profit vs. Gross Profit Margin

Gross profit and gross profit margin measure similar things, but they’re expressed differently. Gross profit is expressed as a whole number in dollar value, while gross profit margin is expressed as a percentage.

In both cases, the cost of goods sold is subtracted from revenue. To calculate the gross profit margin, we then divide by revenue and multiply by 100 to get a percentage.

Gross profit and gross profit margin will both tell you how successful a company is at covering its production costs. Gross profit helps understand the dollar value of the income that a company brought in. Gross profit margin is useful for tracking changes over time, so businesses can assess how current profits compare to previous quarters.

Learn more about how to calculate gross profit margin and its relevance to your business.

Why Is Gross Profit Important?

Gross profit is an important indicator of a business’s efficiency and overall financial health. It measures how well a company is covering its basic production costs and generating a profit.

High gross profits indicate that a company is doing well in balancing sales revenue and manufacturing costs (or cost of sales). Low or negative gross profits mean that costs exceed income and that a company may need to reassess its strategy.

The 2 components of gross profit—revenue and cost of goods sold—each offer an opportunity to examine business strategy. Companies can choose to focus on revenue by developing strategies to boost sales or reassessing their pricing policies or they can focus on the cost of goods sold and try to cut down on labor and raw materials expenses.

Understanding gross profit helps businesses track their growth and assess their profitability. Business owners can use this information to make strategic decisions about how to improve their revenue-to-cost ratio and grow their company’s profits.

What’s the Difference Between Net Profit and Gross Profit?

Gross profit and net profit both measure a company’s efficiency and profitability, but they include different costs in their calculations. Your gross profit calculation is the income that your business earns after deducting the costs directly associated with producing a product or service. Net profit is the net income amount that remains after all expenses and revenues are deducted. This includes production costs and operating expenses (selling and administrative), as well as income taxes, and other income like dividend and interest income.

So essentially, gross profit measures the profitability of a company’s production and manufacturing processes, while net profit measures the company’s profitability as a whole. The 2 metrics are different, but both are valuable in assessing a company’s ability to generate profit.

Final Thoughts: Evaluating Gross Profit

Gross profit measures the amount of profit that a business generates after subtracting the costs of production or rendering services. Understanding gross profit is important for assessing a company’s production efficiency and tracking its growth and profitability.

The right expense-tracking software can help you catch costly production components that may impact your gross profit. Expense tracking software makes it easy to record and organize all your business expenses so you can reduce costs and improve your gross profits. Try FreshBooks free to get started tracking expenses and grow your small business today.

FAQs About How To Calculate Gross Profit

Learn more about what’s included in gross profit and when to calculate gross profit with frequently asked questions about calculating gross profit.

What is included in gross profit?

Gross profit has two components: revenue and cost of goods sold. Revenue is the income a business generates from the sale of goods or services. The cost of goods sold is the costs directly associated with producing that good or service. These may include materials and production labor.

When should you calculate gross profit?

Most businesses choose to calculate gross profit as part of their quarterly accounting. This helps track changes in profit so companies can adjust accordingly. Smaller businesses may choose to calculate gross profit monthly so they can adapt more quickly.

How do you calculate net profit from gross profit?

To calculate net profit from gross profit, add other non-operating income (like dividend and interest income) and deduct operating and nonoperating expenses (like selling and administrative expenses).

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

How to Calculate Total Assets: Definition & Examples

How to Calculate Total Assets: Definition & Examples Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts

Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts What Is an Intangible Asset? A Simple Definition for Small Business (With Examples)

What Is an Intangible Asset? A Simple Definition for Small Business (With Examples) What Is Straight Line Depreciation?

What Is Straight Line Depreciation? Auditing: Definition, Types, and Importance

Auditing: Definition, Types, and Importance What Is Depreciation: Definition, Types, and Calculation

What Is Depreciation: Definition, Types, and Calculation