What is Managerial Accounting?

Managerial accounting is the process of identifying, analyzing, interpreting and communicating information to managers to help managers make decisions within a company and to help achieve business goals.

The data collected encompasses all fields of accounting that informs the management of business operations relating to the costs of products or services purchased by the company. Managerial accountants use budgets to quantify the business’ plan of operations.

Performance reports are used to note the deviation of actual results compared what was budgeted.

This article will also discuss:

How Managerial Accounting Helps in Decision Making?

5 Types of Managerial Accounting That Add Value to Your Business

What Are Managerial Accounting Reports?

How Managerial Accounting Helps in Decision Making?

Managerial accounting is very effective in highly competitive and fast-paced business environments where quick decisions need to be made. These decisions might have to do with a sales tactic, budgeting or cash flow management. Managerial accounting will use operational data to make sense of the situation quickly.

The goal is to use the budget to help make short-term operational decisions that will help increase the company’s operational efficiency.

Let’s say an internet company subscribes to cloud computing services. Monthly prices to rent out space in the cloud have been increased. The internet company’s managers can use budgets to see if the price increases are costing too much and decide to reduce cost and increase operational efficiencies.

The company budgets $100 a week for access to the cloud services and the actual expenditure for the week is $200. Managers know there is a 100 percent variance between budgets and actual costs. A managerial accountant would advise to increase their expectations on prices in their budget or move to another provider to meet their budget cost.

5 Types of Managerial Accounting That Add Value to Your Business

Management accounting presents your financial information in a way that will be useful for making operational decisions about your company. Keeping your financial records up to date will help you perform the following managerial accounting tasks that will add value to your company.

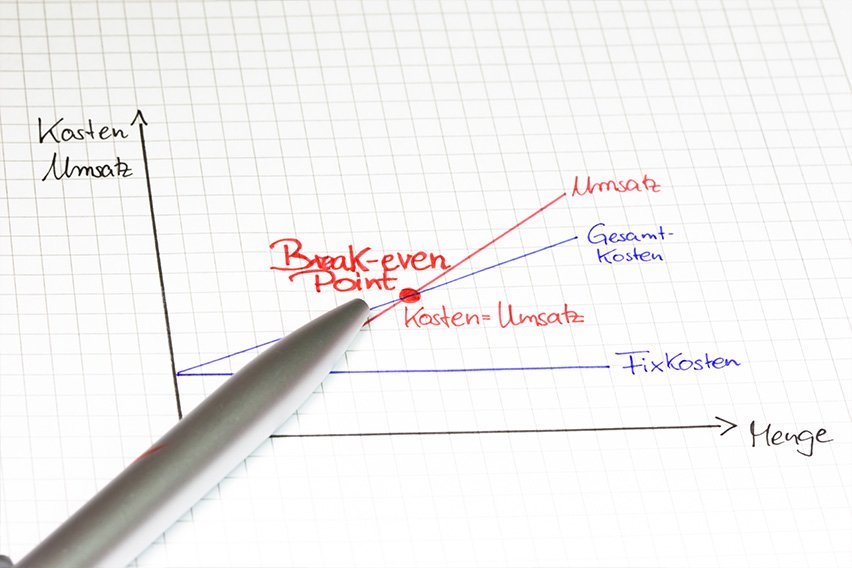

MARGIN ANALYSIS

Managerial accounting analyzes the incremental benefit of increased production – this is called margin analysis. This flows into the breakeven analysis, which involves calculating the contribution margin on the sales mix to determine the unit volume at which the business’ gross sales equal total expenditures. A managerial accountant will use this information to determine the price point for products and services.

2) CONSTRAINT ANALYSIS

Constraint analysis indicates the limitations within a sales process or production line. Managerial accountants find out where the constraints occur and calculate the impact on cash flow, profit and revenue.

3) CAPITAL BUDGETING

Managerial accountants help a business decide when, where and how much money to spend based on financial data. Using standard capital budgeting metrics, such as net present value and internal rate of return, to help decision makers decide whether to embark on costly projects or purchases.

The process involves reviewing proposals, deciding if there is a demand for products or services, and finding the appropriate way to pay for the purchase. It also outlines payback periods, so management is able to anticipate future costs and benefits.

4) TREND ANALYSIS/FORECASTING

Reviewing the trendline for certain costs and investigating unusual variances or deviations is an important part of managerial accounting. Decisions are made by using previous information like historical pricing, sales volumes, geographical location, customer trends and financial data to calculate and project future financial situations.

5) PRODUCT COSTING/VALUATION

Determining the actual costs of products and services is another element of managerial accounting. Overhead charges are calculated and allocated to come up with the actual cost related to the production of a product. These overhead expenses may include the number of goods produced or other drivers related to the production, such as the square foot of the facility. Along with overhead costs, managerial accountants use direct costs to assess the cost of goods sold and inventory that may be in different stages of production.

What Are Managerial Accounting Reports?

Managerial accounting reports use budget reports to help guide managers to offer better employee incentives, cut costs and renegotiate terms with Managerial accounting reports use budget reports to help guide managers to offer better employee incentives, cut costs and renegotiate terms with vendors and suppliers.and suppliers.

Here are a few types of managerial reports.

ACCOUNT RECEIVABLE AGING REPORTS

Does your business rely heavily on extending credit? Then an account receivable aging report is vital to your operations. This report breaks down the remaining balances of your clients into specific time periods allows managers to identify the debtors and identify issues in the company collection process.

If your company has many debtors, you may need to a complete rehaul to tighten up credit policies as cash flow is critical to the operations of any business. A company should always know who owes them what.

PERFORMANCE REPORTS

The performance of a whole company, each department and each employee are considered at the end of each term in performance reports. These reports are used to make important decisions about the company’s future. Under-performers are sometimes let go and individuals who achieve or over-achieve their goals are rewarded for their commitment to the business. Performance reports can show flaws in workflow setups if let’s say for example a whole department is somehow not performing to a certain capacity. A business performance report is an important tool to stay on track a company’s mission.

Cost Managerial Accounting Reports

Managerial accounting determines the costs of articles that are manufactured. All raw material costs, overhead, labor and any added costs are considered, and those totals are divided by the amounts of products produced.

A cost report offers a summary of this information. This report offers showcases the cost prices of items versus their selling prices for managers. Using these reports, profit margins are estimated and monitored.

Better optimization of resources can be achieved by having this understanding of all expenses, including inventory waste, hourly labor costs, and overhead costs.

OTHER MANAGERIAL ACCOUNTING REPORTS

Other managerial reports that are vital to every business include order information reports, project reports, competitor analysis and many other similar reports.

These reports are either created internally or outsourced through professionals depending upon your company’s capability to handle reporting requirements. To make the most informed decision companies and managers must have access to authentic data and credible managerial accounting reports.

RELATED ARTICLES

How to Calculate the Break-Even Point

How to Calculate the Break-Even Point How to Calculate Retained Earnings: Formula and Example

How to Calculate Retained Earnings: Formula and Example What is Indirect Labor Cost?

What is Indirect Labor Cost? What is Journalizing Transactions?

What is Journalizing Transactions? What Does an Accountant Do?

What Does an Accountant Do? Accounting for Loans Receivable: Here’s How It’s Done

Accounting for Loans Receivable: Here’s How It’s Done