General Ledger: Definition, Importance, and How It Works

When starting a small business, you may not know all of the important ins and outs of record keeping. While a simple petty cash book or journaling system may work for you at first, a general ledger, or GL, is a record-keeping system that you should implement sooner rather than later, to track your company’s transactions, generate financial statements, and other accounting reports.

Using a general ledger to keep clear records of your company’s financial data will give you a competitive edge, and make sure the information is ready when you need to prepare financial statements or find important data quickly. As your company grows, you can use the GL to track where your money is going and where it is coming from, using this data to make future business decisions.

In the following article, we will explore more about general ledger accounting, and how you can use FreshBooks software to simplify your bookkeeping as you track your company’s finances.

Key Takeaways

- A general ledger is a system used to document all of a company’s financial transactions over a specific period.

- The most common types of general ledger accounts are asset, liability, equity, and operating and non-operating revenue and expense accounts.

- GLs can help you spot accounting errors, unusual activity, and revenue and expense trends while giving you the information you need for financial reporting.

- Using bookkeeping software or spreadsheets can keep double-entry accounting simple.

Table of Contents

- What Is a General Ledger?

- Types of General Ledger Accounts

- How To Create a General Ledger

- General Ledgers and Double-Entry Bookkeeping

- General Ledger Reconciliation Process

- Importance of General Ledger Accounts

- General Ledger Example

- Leverage General Ledger Capabilities through FreshBooks Accounting Software

- Frequently Asked Questions

What Is a General Ledger?

A general ledger is an accounting system you can implement to track your company’s debit and credit transactions, along with detailed information about each transaction, like the date, amount, and a short description of the transaction. It is also known as “GL” or “Principal Book of Accounting System.”

This system acts as a master document detailing the business’s transactions over some time. These transactions are organized by accounts together with their dates, descriptions, and account balances—enough information to give you a bird’s-eye view of your business’s financial health. You may include individual assets and accounts like accounts payable and receivable, liabilities, inventory, and investments. This information is used to prepare financial reports, monitor finances, track cash flow, and prevent accounting errors or fraud.

Types of General Ledger Accounts

A business will use a general ledger to track and organize types of financial transactions. Some of the most common types of general ledger accounts are:

- Asset Accounts: They record all assets owned by a company, like capital expenditures, cash in the bank, inventory, and accounts receivable.

- Liability Accounts: They track all legally binding debts a company owes to someone else, like accounts payable, employee’s wages and taxes payable, or loans.

- Equity Accounts: They represent the owner’s or member’s capital, common stock, dividends, and retained earnings.

- Operating Revenue Accounts: They show the earnings generated by a business’s primary activities, like sales and service fees.

- Operating Expense Accounts: They represent the costs of production and business operations, like wages and rent expenses.

- Non-Operating Revenue Accounts: They record all gains or losses that you cannot attribute to normal business activities, like sales of assets or investment income.

- Non-Operating Expense Accounts: They show costs not incurred from everyday business expenses, like one-time legal expenses or interest expenses.

How To Create a General Ledger

The following is a step-by-step guide to creating a GL for your business.

1. Determine Which Features You Want To Include

Options to include on your GL chart of accounts are assets, liabilities, revenues, equities, and expenses, along with other income and expenses, if relevant. Your ledger will reflect the numbers that are important to your small business.

2. Create A Ledger Table In Columns

Make your table double-entry style, with columns that have two sides – one for debits and one for credits.

3. Fill In Essential Information

Include the account names and numbers, the date of each financial transaction, a reference number, a debit column, a credit column, and a balance column. You may also include a space for a short description of each transaction, for better clarity on your cash flow.

4. Record All Financial Transactions

Once your GL has been created, diligently fill in the spaces, documenting all financial transactions that take place. This is the place where you consolidate all cash inflow and outflow, purchases, sales information, and other journal entries.

5. Maintain Your Ledger:

Adapt the ledger to suit your working style, while keeping it up-to-date and accurate. Double-check record accuracy routinely to prevent accounting errors so you can use the information within to more-precisely track your company’s growth.

Balancing the books used to be a demanding task, but with the helpful general ledger templates and accounting software, it is easy to automate the process, so you can focus on growing your business.

General Ledgers and Double-Entry Bookkeeping

General ledgers use the double-entry bookkeeping method to record transactions, meaning every transaction will be posted to two (or more) GL accounts. One side of the entry will be a debit, and one side will be a credit. Debits should always equal credits. Each ledger item will have four main sections. These are:

- A journal entry with a description of the transaction

- A journal entry transaction number

- A debit and credit entry to record the transaction

- Posting the transaction from the journal to GL accounts

In double-entry bookkeeping, each transaction will affect at least 2 accounts. One is debited, and the other is credited.

The accounting equation used to balance the debit column with the credit transaction is as follows:

Assets – Liabilities = Owners’ Equity

or

Assets = Liabilities + Owners’ Equity

General Ledger Reconciliation Process

To reconcile your GL at the end of each fiscal period, you must generate a trial balance by totaling all of the debit and credit accounts and then checking to verify that the debits are equal to the credits. If these are not equal, then the accountant will check for errors in the journals and accounts.

The following are the steps to a proper general ledger accounts reconciliation in detail.

- Gather Information: The first step is to gather all of the end-of-period data, getting all the details regarding the credits and debits made to each account.

- Compare Beginning And Ending Account Balances: Verify that all asset, liability, and equity accounts are balanced to the cent. Accounting software like FreshBooks makes this a quick and easy process.

- Reconcile All Transactions Posted To The General Ledger Accounts: Check that all transactions were posted from the journal to correct GL accounts.

- Adjusting Journal Entries: These are journal entries made at the end of the fiscal period to ensure all revenues are recognized when services are performed and expenses when incurred, regardless of when the cash is received.

- Review Any Adjustments And Reversals Made: This is an important step to ensure no errors have been made. Creating a trial balance will give you insight into whether your calculations and adjustments were correct.

- Review The Adjusted Trial Balance: Look everything over one last time to be certain your account reconciliation is complete.

The Importance of General Ledger Accounts

Using general ledger accounting is important for businesses of all sizes because it is helpful for:

1. Financial Transaction Accuracy

Having an accurate record of all transactions that have taken place within a single point in time will ensure your financial reporting is done correctly. It is organized in such a way that you can quickly view, and verify information. The precise, accurate details in a GL leave little room for error.

2. Collecting Information for Financial Reports

The GL serves as the basis for a company’s income statements, balance sheets, and cash flow statements. By keeping your general ledger up-to-date, stakeholders, investors and analysts can accurately assess the company’s performance.

3. Balancing the Books

When going over all transactions in the GL and completing your trial balance, you will be able to see all of the accounts’ closing balances and track down any errors, missed payments, or unusual activity. This gives you the chance to reconcile these errors before closing your books at the end of an accounting period.

4. Doing Taxes

The GL is a big part of your company’s overall financial picture, acting as an important repository of all your accounting data. It is the place where accountants can easily access a streamlined picture of the business income and expenses.

5. Spotting Errors

Having an easy-to-read general overview of your company’s finances and creating trial balances can help you spot unusual activity, or fraud quickly, so you can take action before a serious problem develops. You can also use the information on a GL to verify the accuracy of financial statements during internal reviews and audits.

6. Seeing Real-Time Business Insights

Using a GL will keep you up-to-date on your cash flow, debts, and spending, so you can watch for trends and make adjustments to your business operations to maximize profits over time.

7. Compliance With Laws

All financial transactions are recorded in the GL, making it easier to ensure your business is in full legal compliance. Following generally accepted accounting principles (GAAP) and keeping financial statements accurate will make certain that your company’s financial statements are consistent, complete, and comparable.

Also Read: What Is Ledger

General Ledger Example

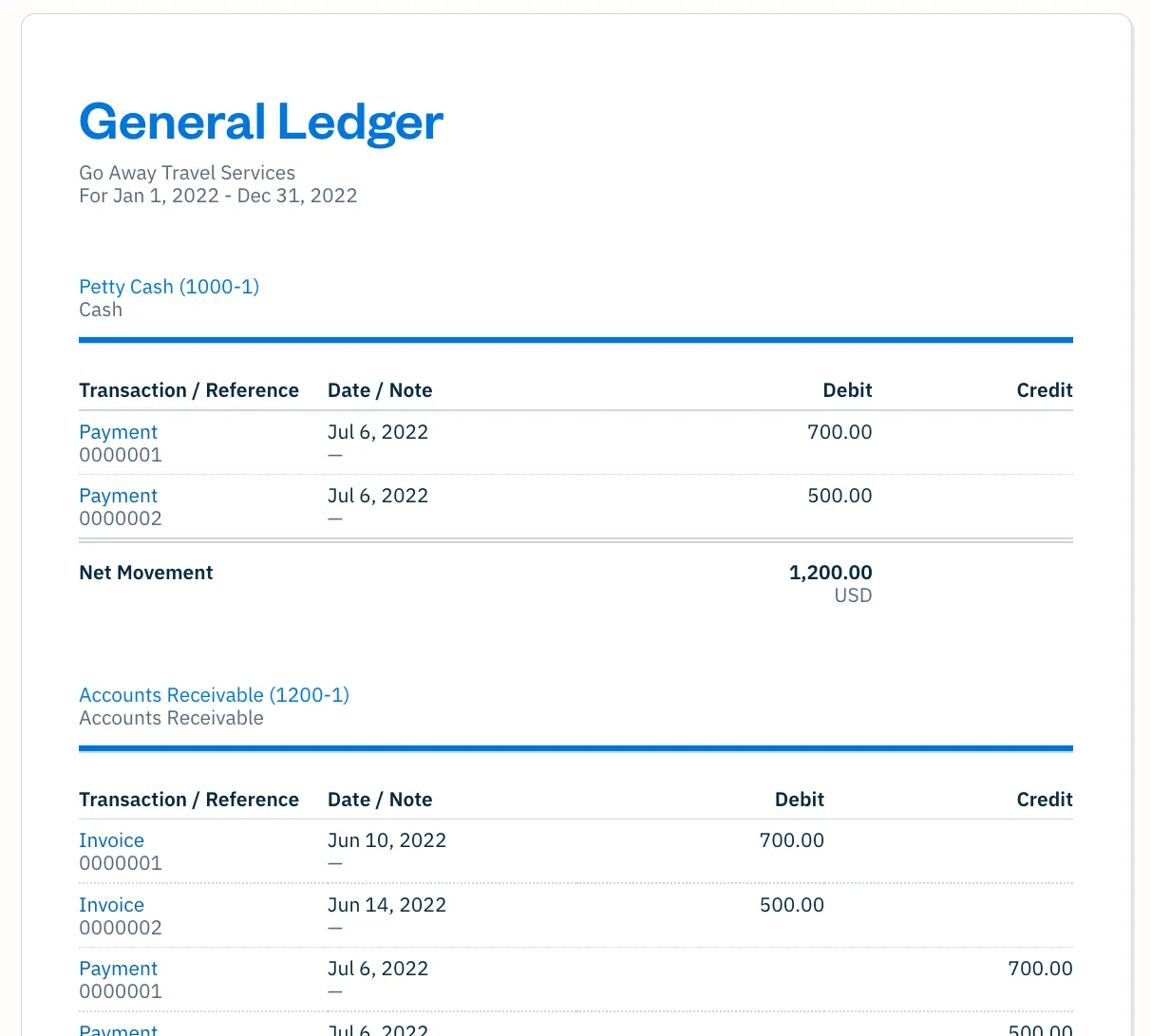

While every small business is unique, the following general ledger example shows the proper format of a general ledger, along with the type of information you may wish to include when incorporating this type of system into your organization’s financial record-keeping practice.

Don’t have time to create and format a general ledger? Try the customizable FreshBooks general ledger template for free. It’s available to download in Google Docs, Google Sheets, XLS, DOC, and PDF, making it easier to see your business finances at a glance.

Leverage General Ledger Capabilities Through FreshBooks Accounting Software

Now that you’ve learned more about what a general ledger is in accounting, you’ll be better able to provide your accountant with the information they need to keep your books balanced.

Make it easier to keep track of your transactions, account debits and credits, tax deadlines, and more by incorporating FreshBooks accounting software into your business’s bookkeeping and accounting processes. FreshBooks has everything you need, including journal entries, accounts payable, balance sheets, and more, freeing you up to work on growing your company and increasing profits. Try FreshBooks free to see how easy it is to get started.

FAQs About General Ledger

Are you still wondering what a general ledger is or looking for the general ledger definition? The following questions help you better understand what a GL is and how to use it.

Is a general ledger the same as a balance sheet?

No, a general ledger is not the same as a balance sheet. GL is a set of ledger accounts where transactions recorded in journals are posted. A balance sheet is a statement that presents the company’s financial position at a point in time.

What’s the difference between GL and P&L?

The GL is a detailed record-keeping tool, while the P&L (profit and loss) or the income statement reports a company’s profit during a period.

What’s the difference between a journal entry and a general ledger?

The difference between a journal entry and a GL is their use. A journal entry is a sequential list of accounting entries recording transactions while a GL is a formalized account system where recorded transactions in a journal are posted.

How do I know if my general ledger is correct?

The best way to know if your general ledger is correct is to reconcile all entries then generate a trial balance to verify the completeness and ensure that debit balances equal credit balances. You can then investigate discrepancies and make corrections if necessary.

What are the disadvantages of a general ledger?

Some disadvantages of a general ledger include the cost and amount of time it takes to set up. Additionally, if you make errors in updating or recording transactions, the GL account balances will be incorrect.

Should I use a GL for my small business?

You should incorporate a GL into your business practices if you want up-to-date financial reports to secure small business loans, balance your books effectively, prepare for an audit, or accurately file your taxes.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What Is Inventory Carrying Cost & How to Calculate It?

What Is Inventory Carrying Cost & How to Calculate It? What is a Comparative Balance Sheet? – Definition & Examples

What is a Comparative Balance Sheet? – Definition & Examples Cycle Time Formula: How to Calculate Cycle Time

Cycle Time Formula: How to Calculate Cycle Time How Cash App Works? A Guide on Sending & Receiving Money

How Cash App Works? A Guide on Sending & Receiving Money Accountability vs Responsibility: What’s the Difference?

Accountability vs Responsibility: What’s the Difference? 10 Best Financial Software (Personal and Business) for 2025

10 Best Financial Software (Personal and Business) for 2025