How Can You Convert an Estimate to an Invoice

Once a customer accepts an estimate, you can directly convert the estimate into an invoice. When you are converting estimates into invoices, you are creating a traceable link which ultimately helps help your books be accurate. It also helps reduce bookkeeping time, allowing you to avoid entering the same information twice and saving on labor costs. This article will help you understand how to convert an estimate to an invoice quickly, efficiently, and accurately.

Key Takeaways

- Once a customer accepts an estimate, you can convert the estimate into an invoice.

- Keep track of whether open estimates have an accepted or pending status to avoid making multiple invoice adjustments.

- An accepted estimate can be used to copy over information to an invoice manually or with the use of accounting software.

- If any changes have occurred between the time a customer accepts an estimate and an invoice is ready to be issued, highlight those changes and provide detailed reasoning.

In this article, we’ll cover:

- How You Can Convert An Estimate To An Invoice Using Accounting Software

- How Do You Convert an Estimate into a Tender?

- How to Convert an Estimate to a Purchase Order

- How Do You Turn an Invoice into an Estimate?

- Conclusion

- Frequently Asked Questions

How You Can Convert An Estimate To An Invoice Using Accounting Software

1. Copy Over the Information

Creating an Invoice Using Accounting Software

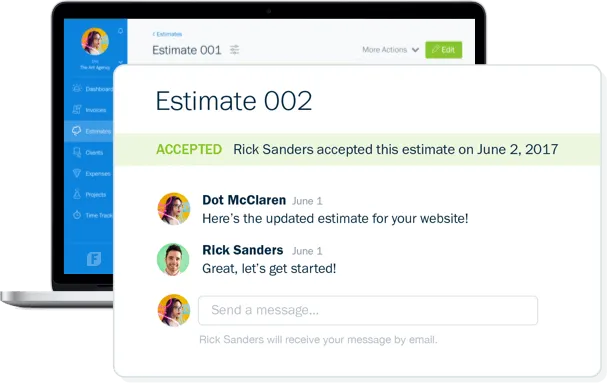

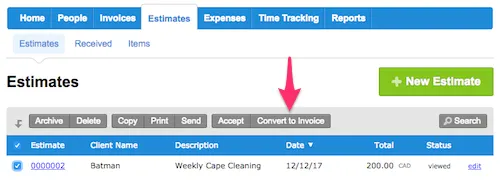

Usually, it’s quite simple to convert estimates to invoices using accounting software. Keep an eye on whether an estimate has an accepted or pending status, and once accepted, you can begin the conversion process to create invoices from your sales menu. FreshBooks offers online accounting software that makes estimate and invoice management simple and efficient. Click here to learn more about our accounting software and to start your free trial.

In FreshBooks, enter the estimates page via the menu, check off the estimate you want to convert, and click “Convert to Invoice.” Edit the new invoice to your company preferences, select save, and send it to the client.

FreshBooks also has features that let you make your desired estimate and invoice using professional templates to save time.

Creating an Invoice Manually

To manually convert an estimate, copy the project information from your estimates to an invoice template (you can download this free invoice template). If you’re using progressive billing, meaning you’re only invoicing for part of a project, copy over only the line items and costs you want to bill for right now.

You can also repurpose your existing estimates into an invoice. Use whatever format you prefer, whether Word, Excel, Google Docs, or PDF, and select create an invoice. In the next step, we’ll discuss what fields you need to change.

2. Customize the Invoice

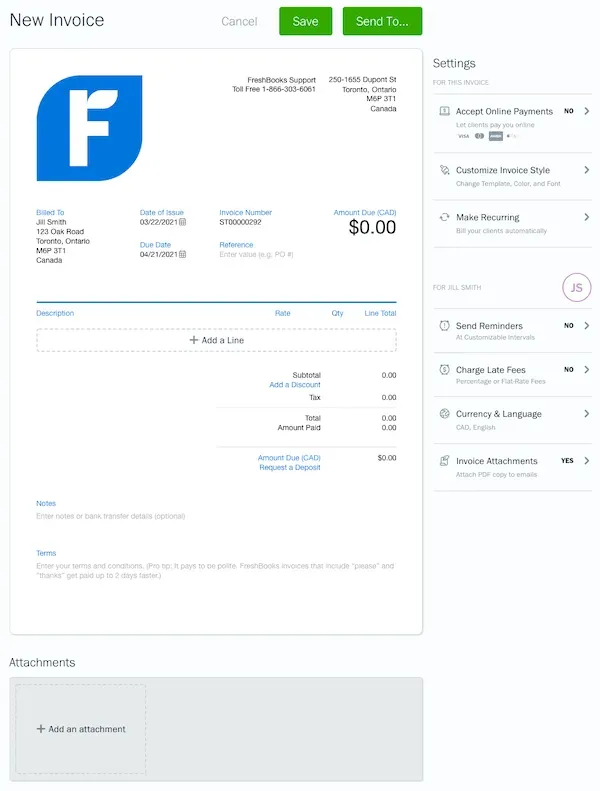

Now it’s time to customize the information from your estimate to make it into an invoice.

Ask yourself first:

- Have any of the line items or prices changed?

- Do you want to invoice for the entire project or only part of it?

The following information will remain the same:

- Contact information for you and your client

- Your logo

- Services and costs from your estimate you want to invoice for

You’ll need to change the following:

- Change the date to today’s date

- Change the estimate number to an invoice number

- Include a payment (or payments) due date

- Remove any timelines or project completion dates

- Double check if you’re including the appropriate services and costs

- Delete any estimate terms, like how long the estimate was valid for

- Delete any notes on what services and costs are excluded from the estimate

- Double-check the sales tax and total amount due

- Include payment terms (including how you want to be paid and any late fees)

Need help completing your invoice? This article tells you exactly how to write an invoice step by step.

Here’s an example of an invoice in FreshBooks that includes all the key elements:

3. Explain Any Changes

Any line items or costs in the invoice that are different from what’s on your estimates must be cleared with the customer in advance. Write an estimate first for the client’s approval. Simply submitting an invoice with unapproved changes will damage your relationship with your customer and make you less likely to get paid.

Once the customer has approved the changes in the project scope, include a note in your invoice referencing the updated estimate number. Include a separate line item with additional charges, if appropriate.

Double-check your work and then send the invoice to your customer. Email or print the invoice and mail it, depending on what your customer prefers. Put a reminder in your calendar on the payment (or payments) due date in case you need to follow up with your client.

Conclusion

Keep your invoicing process efficient and hassle-free by quickly converting your estimates into invoices. This simple step keeps your books accurate, your payment deadlines on track, and lets your customers know what to expect. Once an estimate is accepted, accounting software makes invoice conversion fast and painless, allowing you to focus on marketing, scaling, and customer relations.

You can learn more about the difference between estimates, quotes, and bids in the estimates category.

People also ask:

- How Do You Convert an Estimate into a Tender?

- How to Convert an Estimate to a Purchase Order?

- How Do You Turn an Invoice into an Estimate?

- Can An Estimate Be Used As An Invoice?

- Is An Invoice The Same As An Estimate?

How Do You Convert an Estimate into a Tender?

You can’t convert an estimate into a tender. However, you could convert an estimate into a bid.

That said, the terms “tender” and “bid” are often used interchangeably.

By definition, a tender is a document produced by a company (the buyer). It outlines the project and requests bids from suppliers.

- For example, a government agency sends a tender to three contractors asking for bids to renovate their office. The contractors each write a bid that details how much they’ll charge for completing the project. The agency then chooses one winner from the three bids.

To convert an estimate into a bid, do the following:

- Review the buyer’s tender (also called a request for proposals or “RFP”). You may have prepared a general estimate before looking at the buyer’s specific requirements. According to Info Entrepreneurs, the tender should include how costs should be broken down and written.

- Add a detailed breakdown if the tender asks for one. This information could include staff/management/administration time and costs, estimates of reimbursable expenses, and costs at each stage of the project (weekly or monthly, for example).

- Reevaluate your total project cost. If your bid is accepted, you’ll have to commit to this cost (unlike in an estimate which is just that, an approximation).

- Double check you’ve included sales taxes, mentioned what currency you’re using, and write your total project cost in both words and figures.

- Say how long your prices are valid for.

- Add a disclaimer accounting for potential surprise costs or additional work and detail why you’re including this.

How to Convert an Estimate to a Purchase Order

Let’s say your estimate has switched from pending status to approved. You need to buy materials or supplies listed in the estimate from one of your vendors.

For example, a painter includes in his estimate that he will need to buy two gallons of paint to complete the job. The client approves the estimate. The painter then issues a purchase order to his local hardware store for the two gallons of paint.

Accounting software will often let you automatically create a purchase order from an estimate.

You can also do this manually from a Word, Excel, or PDF document. A purchase order needs to include several critical elements, according to InTouch Manufacturing Services, which are outlined below.

To convert an estimate to a purchase order:

- Change your client’s information to your vendor’s information

- Edit the date of issue to today’s date

- Change the estimate number to a purchase order (PO) number

- Add a shipping address for the products or goods

- Delete any line items except for the items you want to purchase

- Double-check the sales tax and total

- Include payment terms (how and when you’ll pay for the goods)

How Do You Turn an Invoice into an Estimate?

Perhaps you made an invoice instead of an estimate by mistake. You want to turn the invoice into an estimate. This is usually difficult to do automatically in accounting software. You may have to copy and paste the information from your invoice into an estimate template.

FreshBooks makes it easy to quickly produce and send professional estimates with its cloud-based estimate software.

To turn an invoice into an estimate manually, edit your invoice using the following steps:

- Change the title from “invoice” to “estimate”

- Edit the date

- Change the invoice number to an estimated number

- Add any timelines and an expected completion date

- Edit the services, if necessary

- Edit the costs, if necessary

- Mention any exclusions (what the project won’t include)

- Double-check the sales tax and total

- Include any terms and conditions (for example, how additional costs will be priced)

Can An Estimate Be Used As An Invoice?

In short, no. While an estimate and invoice cover similar information, there are key differences. Remember, an estimate is an informed guesstimate of what a project will cost you. Using it as an invoice could lead to a financial loss.

Is An Invoice The Same As An Estimate?

Estimates are not considered an amount owed by your customer, whereas an invoice is a formal statement of a balance due. An invoice covers the true cost of goods, labor, and other project details. To keep accurate and healthy books, you should have an estimate and invoice for each project or purchase.

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

5 Estimate Terms and Conditions for Your Small Business

5 Estimate Terms and Conditions for Your Small Business How to Calculate Total Assets: Definition & Examples

How to Calculate Total Assets: Definition & Examples Balance Sheet vs Income Statement: Differences With Examples

Balance Sheet vs Income Statement: Differences With Examples Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts

Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts How To Price Moving Jobs: A Pricing Guide for Small Businesses

How To Price Moving Jobs: A Pricing Guide for Small Businesses