7 Best Business Expense Tracker of 2025

Expense tracking is essential for any small business: it helps you manage your budget, accurately reimburse employees, and saves you time and money when it’s time to file your taxes. Good expense tracking software streamlines this entire process so you can enjoy efficient and accurate expense and receipt tracking.

The right business expense tracker should be easy to use, affordable, and compatible with your accounting software. Features like expense categorization, integration, and mobile options make expense tracking easier for your business.

We’ll explore the top 7 expense trackers for small businesses, and the features to look for so you can choose the best business expense tracker app for your needs.

Table of Contents

- FreshBooks

- Zoho

- Certify

- Expensify

- QuickBooks

- SAP Concur Expense

- Everlance

- How to Choose Business Expense Tracker

- Best Business Expense Tracker App at a Glance

- Simplify Your Expense Tracking with FreshBooks

- Frequently Asked Questions

1. FreshBooks (Best Overall)

Designed for small business owners, FreshBooks expense tracking software offers a convenient and versatile way to manage all your business expenses. The cloud-based system makes it easy to sync all your expense data while the automatic expense importing offers a quick and easy way to track your receipts.

You can use FreshBooks expense and receipt tracking on your desktop, browser, or with the mobile app. The app also includes mileage tracking so you can manage your vehicle expenses on the go.

Features

- Cloud-based system for quick integration and collaboration

- Automatically import your expenses from your bank account and credit card

- Organize expenses by category

- Desktop, browser, and mobile app options

- Mobile app includes mileage tracking

Pricing

- FreshBooks offers a free 30-day trial so you can find the right plan for your small business

- Lite: $19/month

- Plus: $33/month

- Premium: $60/month

- Custom plans also available by consultation

2. Zoho

Affordable and versatile, Zoho offers a good option for small and medium-sized businesses. Its per-user pricing plan is competitive compared to other per-user systems, and it offers a solid range of integrations and reporting insights.

The downside of Zoho is that it requires all expenses to be submitted with a report in order to be claimed. This can slow down the reimbursement and reporting process, making it less popular with some businesses and employees.

Advantages

- Versatile integration options with Zoho and other software

- Offers automatic ACH payments

- Integrates with corporate credit cards

- Includes real-time reporting insights

Drawbacks

- Expenses need to be submitted with a report

- No option to auto-categorize expenses

Pricing

- Basic free trial

- Standard: $4/month per user

- Premium: $7/month per user

- Custom plans for businesses with more than 100 users

3. Certify

Robust and versatile, Certify offers a flexible expense tracking option for small businesses. Its auto-fill and receipt scanning features make it easy to rapidly upload your team’s expenses together, while the mobile app simplifies expense tracking on the go.

Certify is an affordable option for small businesses that only need 1 or 2 users to access the expense tracking system. However, its per-user pricing model can quickly add up for businesses with multiple employees.

Advantages

- Allows you to scan receipts for quick upload

- Rapid auto-fill for expenses and receipts

- Includes mobile app option

- Creates automatic expense reports

Drawbacks

- ACH reimbursements cost extra

- Limited integration options—aside from QuickBooks, users must contact Certify if they wish to integrate other software

Pricing

- Certify Now: $12/month per user

- Certify Professional: custom pricing system

4. Expensify

Expensify is a good fit for medium to large companies with more complex receipt and expense tracking needs. It offers a wide array of comprehensive expense management and tracking tools, including GPS mileage capture for instant mileage tracking and sophisticated corporate features like foreign currency reimbursement and corporate card integration.

Expensify is designed for larger companies, and the added features can make the user interface complicated for a small business owner. While it’s a good fit for businesses with complex demands, it can be less helpful for small businesses and new users.

Advantages

- Offers integration with corporate credit cards

- Includes foreign currency reimbursement processing

- Includes GPS mileage capture for easy mileage tracking

- Allows users to analyze spending trends

Drawbacks

- Extensive features present a steep learning curve

Pricing

- Collect: $5/month per user

- Control: $9/month per user

5. QuickBooks

QuickBooks is a versatile accounting software that also includes options for expense and receipt tracking. Since it’s geared towards users who also manage their bookkeeping and tax filing with QuickBooks, it’s easy to organize receipt and expense information for tax season.

QuickBooks is a more expensive option compared to FreshBooks in terms of comprehensive software. Its Simple Start plan only allows for 1 user, while the Essentials plan offers 3 users and the Plus plan offers 5. For small businesses that want to allow employees to access and submit expenses, this can get expensive.

Advantages

- Integrates with PayPal, Square, bank accounts, and credit cards

- Easy to organize receipts

- Includes mileage tracking features

- Automatically pulls vendor info for easy tax management

Drawbacks

- Glitches reported with the mobile app

- User interface can present a learning curve

Pricing

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

6. SAP Concur Expense

SAP Concur is a robust expense tracker that’s well-suited to larger businesses. It offers a range of features like automatic expense categorization for quick and easy organization, as well as foreign currency reimbursement for travel and out-of-town employees.

Concur’s pricing plan is less transparent than many competitors: final pricing depends on optional services and add-ons, and users must contact Concur sales representatives to receive a quote.

Advantages

- Users can automatically categorize expenses

- Offers automatic ACH payments

- Enables corporate card integration

- Allows for reimbursements in foreign currencies

Drawbacks

- Difficult to predict pricing

Pricing

- Per quote

7. Everlance

Everlance makes it easy to keep track of your tax deductions in real time. One of its strongest features is the automatic deduction finder, which allows users to automatically scan their expenses for potential tax deductions and organize their deductions for tax time.

Its free plan offers unlimited receipt uploads, but only a limited number of trips with mileage tracking. Users who plan to drive lots will need to upgrade to a paid plan.

Advantages

- Free plan includes unlimited receipt uploads

- Allows unlimited users

- Comprehensive mileage tracking system

- Generates downloadable reports

- Automatic tax deduction finder

Drawbacks

- Only supports USD

- Limited mileage tracking on free plan

Pricing

- Basic free plan

- Premium for individuals: $5/month

- Premium Plus for individuals: $10/month

- CPM for companies: $10/month per user

- FAVR for companies: $33/month per user

How To Choose Business Expense Tracker

There are several factors to consider when looking for the best expense tracker. We’ll explore how user interface, integrations, mobile access, and analytics can help your business.

User Interface

Expense trackers vary widely in user interface—some are approachable and well-suited to new users. Others have a wide array of additional features that present a steep learning curve.

There are two main factors to consider when thinking about user interface: your experience level and your business needs. If you’re new to expense tracking software, a tracker with an intuitive interface can save you time.

For small businesses with relatively straightforward expense tracking, look for expense tracking software that delivers a clear and easy system for managing basic expense tracking. If you need more complex tracking for foreign currency or corporate card integration, you may want a tracker with more comprehensive features.

Integrations

How well will this expense tracker integrate with your existing systems? If you already have accounting software that you use, look for a tracker that can integrate with your preferred software.

It’s also important to choose an expense tracker that integrates with your banking needs. In some cases, this may be a simple bank account link for quick reimbursements, in other cases you may want corporate card integration and automatic ACH transfer options. Check whether these integrations are simple or if you’ll need to contact a representative to manage integrations.

Mobile Access

The ability to track your expenses on the go is key to quick and easy tracking and reimbursement. Especially if you need to track travel expenses, mobile tracking saves you the hassle of organizing piles of paper receipts when you travel.

Mobile tracking is also important for vehicle and mileage expenses. If you use a vehicle for work, a mobile app with mileage tracking makes it easier to accurately record and submit your vehicle-related work expenses.

Analytics

Expense tracking isn’t just about quick and easy reimbursements—it’s also an important tool for analyzing how and where your business spends money. Good analytics tools should help you track where your money is going so you can assess efficient spending practices, evaluate your operating expenses, and create a strong budget.

Look for trackers that offer easy expense organization. Auto-categorization helps you organize expenses quickly so you can instantly track spending patterns.

FreshBooks expense tracking software offers an accessible interface that works well for new and experienced users. It integrates with popular software like Gusto for easy payments, includes a mobile app for on-the-go tracking, and lets you organize expenses to track your financial habits.

Best Business Expense Tracker App at a Glance

Explore some of the most popular expense tracker apps to see their best features, compare pricing options, and find the best fit for your small business.

| Company | Best For | Starting Price |

| FreshBooks | Best overall | Free Trial – Sign Up Now! |

| Zoho | Best for small to medium-sized businesses | $4/month per user |

| Certify | Best for quick uploads | $12/month per user |

| Expensify | Best for large companies | $5/month per user |

| QuickBooks | Best for one user | $30/month |

| SAP Concur Expense | Best for add-on options | Custom quotes only |

| Everlance | Best for tracking tax deductions | Basic free plan |

Simplify Your Expense Tracking With FreshBooks

Expense tracking is key to promptly reimbursing employees, tracking your spending, and organizing your receipts for tax time. The right expense tracking software is one of the most essential small business tools and streamlines this process to boost efficiency, optimize spending, and help you capture the best tax deductions.

FreshBooks expense tracking simplifies your business finances with easy expense and receipt tracking. Upload and organize your expenses, track your mileage with the mobile app, and integrate everything you need for effortless tax filing. Try FreshBooks free to start tracking your expenses for accurate and efficient financial management.

FAQs About Business Expense Trackers

Learn more about how small businesses track expenses, using bank statements for your taxes, and easy expense tracking methods with frequently asked questions about expense trackers.

How do small businesses keep track of receipts?

The best way for small businesses to keep track of receipts is to use expense-tracking software. This allows you to scan and upload receipts so you don’t have to worry about losing them. Expense tracking also helps you organize your receipts for easier tax filing.

What do I need to keep track of for my small business?

It’s important to keep track of all expenses and profits for your small business. Hang on to any receipts, invoices, deposit slips, and other transaction records. Expense tracking software can help you upload and organize your receipts for easy management.

Can I use bank statements instead of receipts for taxes?

Bank statements are usually not enough to provide the full documentation needed to file taxes. It’s best to keep your receipts so that you can provide proof of purchase for all your business expenses and deductions. The IRS may ask to see details like payee and amount paid that are on your receipts.

Can I use Excel to track business expenses?

Yes, you can use Excel to track business expenses, but it’s not the most efficient system. Dedicated expense tracking software offers more features like receipt scanning and mileage tracking to help you track business expenses quickly and accurately.

What is the easiest way to keep track of expenses?

The easiest way to keep track of your expenses is with expense and receipt tracking software. This lets you upload receipts, organize your expenses, and track your spending patterns so you can manage your budget effectively. It’s also helpful for finding deductions and filing your business taxes.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Can You Claim Volunteer Work on Taxes? No, but Some Expenses Can Be.

Can You Claim Volunteer Work on Taxes? No, but Some Expenses Can Be. Tax Deductions for Start-up Businesses

Tax Deductions for Start-up Businesses Tax Deductible Donations: Can You Write Off Charitable Donations?

Tax Deductible Donations: Can You Write Off Charitable Donations? Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business?

Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business? Business Deductions: New Tax Plan Explained

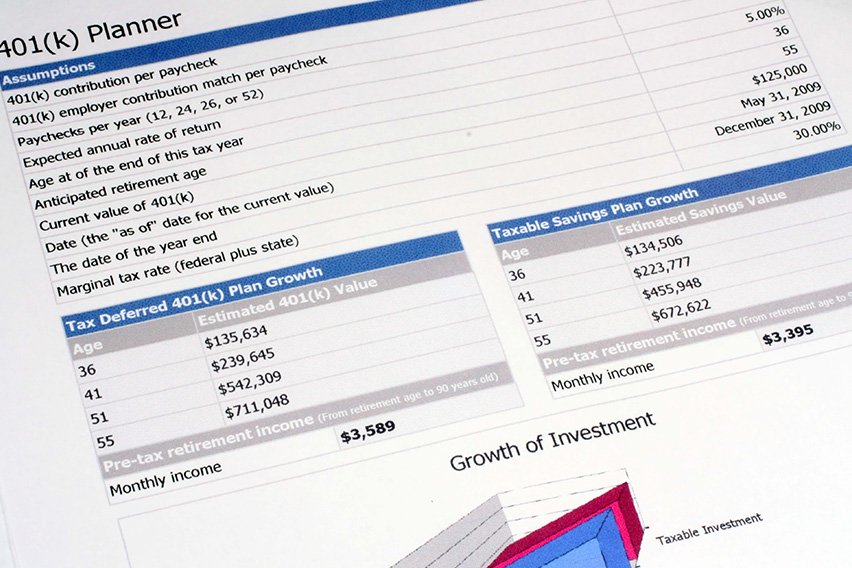

Business Deductions: New Tax Plan Explained How to Set Up a 401(k) in 4 Easy Steps (For Small Business)

How to Set Up a 401(k) in 4 Easy Steps (For Small Business)