Billing System: What It Is, How to Set Up, and Top Software

Having a functional billing process in place is essential for running your business and managing your financial transactions because your company’s billing procedures include all the steps you follow to create and send invoices to your clients and process their payments. Billing systems help with expense tracking, getting paid, compliance with regulations, and limiting billing errors.

In this article, we’ll look at the different types of billing and their standout features, the benefits of using a billing system, and the most popular billing system software and invoicing software options.

Key Takeaways

- A billing system is a procedure used by a company to charge and invoice clients.

- Common billing systems include hourly rate, flat rate, recurring, and milestone billing.

- The top features to look for in a billing system include automation, integration with software, and a simple user interface.

Table of Contents

- What Is a Billing System?

- Types of Billing

- Key Features to Look for in a Billing System

- How to Set Up a Billing System

- Best Billing and Invoicing Software

- Benefits of Using a Billing System

- How FreshBooks Enhances Your Billing System

- Frequently Asked Questions

What Is a Billing System?

A billing system is a procedure used by a company to charge and invoice clients. It’s sometimes done manually but usually involves a billing software that automates the process of sending invoices and taking payments, as well as tracking expenses and revenue.

Using software makes it easier for your clients to pay for your products and services. It is suitable for entrepreneurs, small startups, medium-sized companies, and large enterprises. Such software is generally scalable, and can streamline your processes, saving you or your accounting team time and money.

Types of Billing

Every business has unique needs when it comes to invoicing and billing. The following are some of the most common types of billing, and their key features.

Hourly Rate Billing

When using hourly rate billing, the business will set a dollar amount to charge per hour, multiplying that number by the actual number of hours worked to calculate the total amount due on the invoice. This is an ideal method for businesses that offer services that take varying amounts of time, like legal firms, tutors, or fitness trainers.

Flat Rate Billing

Flat rate billing terms of payment are determined in advance, with the business charging an agreed-upon amount for a deliverable or service. This is an unchanging fixed price, regardless of how much time or resources it takes to complete the job. Some businesses that may send invoices with flat rates include auto repair businesses, graphic design jobs, or an all-you-can-eat buffet.

Recurring Billing

Recurring billing is an easily automated billing process that takes payment at regular intervals for ongoing services like online or software subscription services, gym memberships, or utilities. These services may be paid in weekly, monthly, or annual installments, and may go on in perpetuity, or have a set, limited time.

Milestone-Based Billing

Milestone-based billing is often used in large-scale, long-term projects, like construction, web development, and other businesses with project-driven revenues. Payments are linked to the achievement of set goals or project milestones, spacing out the billing while keeping the project on track.

Key Features to Look for in a Billing System

There are several features to look for when exploring different billing solutions, but the most important consideration is what you want to get out of it. Are you going to need a general billing solution or one that is a bit more specialized? Another thing to keep in mind is the level of customer support that’s available to you.

The following are some considerations to take into account before you configure your billing system.

Easy-to-Use Interface

Automated systems range from simple to complex, but usability is key. If you’re not very tech-savvy, investing in a platform with a steep learning curve can end up costing you time and money. This could mean you look towards a choice that’s more intuitive and offers basic functions for what you need most.

The best invoice software should be easy for you to understand, integrate into your system without issue, and make it easy to send invoices, create reports, and more. Teaching your employees and other organization members to use the software should also be easy.

Easy Integration

If you’re already using other software systems, it can be worth exploring options that allow for easy integration. These can range from payment gateways to invoice templates, and even dedicated customer relationship management (CRM) software.

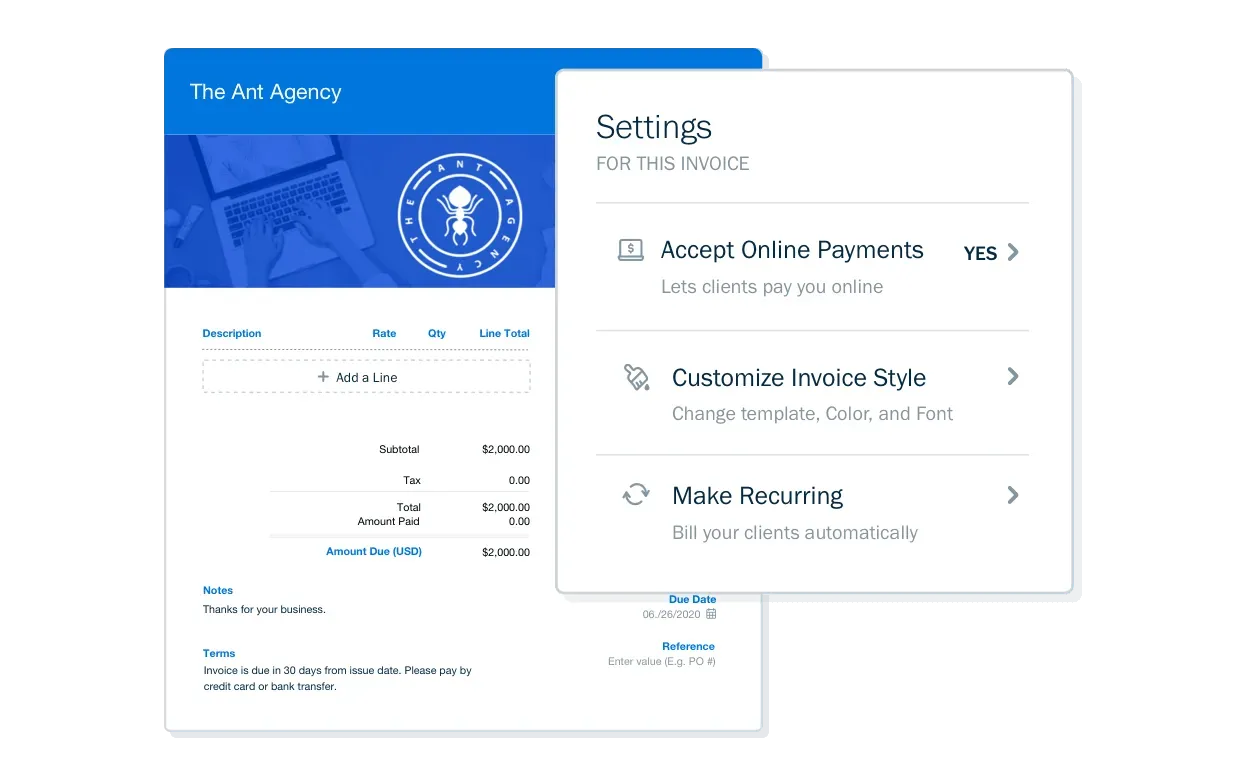

Accepts Online Payments

A billing system that incorporates online payment collection will improve customer satisfaction, and make your life easier. Choosing accounting software like FreshBooks will let your clients conveniently pay directly on their invoice using their credit card, debit, Apple Pay, Google Pay, and bank transfer.

Automated invoicing

Using an automatic billing system that sends out timely, professional invoices on a pre-determined schedule will streamline operations, while reducing late payments, for better financial success. Billing automation removes human error issues that can come up during manual processes.

How to Set Up a Billing System?

Setting your billing system up is as easy as following 5 steps.

1. Add Important Data

You’ll have to add your client info, including their name, billing address, and payment terms, all of which are essential for invoicing. You should also input your product and service information if applicable, like the amount of product in stock, pricing, product descriptions, discounts offered, etc. This will ensure the system can record incoming funds, track inventory, and monitor cash flow.

2. Create Billing Codes

It is recommended that you use billing codes to categorize your products, track your money, identify services, and track business finances. You can use business codes in reporting to monitor how your business spends resources and time and ensure ongoing profitability.

3. Add Your Payment Processor

Finding the right payment processor that can integrate into your system is important. It’s best to accept as many payment methods as you can, for customer convenience. In today’s fast-moving world, businesses that accept credit cards and online payment systems like PayPal and Stripe are preferred by most customers.

Having an easy-to-use payment process, like clickable payment links in your invoice, can also streamline your B2B operations with suppliers and vendors.

FreshBooks Payments, powered by Stripe, is a popular option for small businesses online payment processing, as it allows businesses to accept payments seamlessly, directly through their invoices. Customers can use Visa, Mastercard, Discover Card, AMEX, Apple Pay, and more to make convenient payments, with everything automatically deposited and recorded.

4. Set Up Payment Tracking

You’ll never forget to follow up on a late invoice again if you choose a system that offers payment reminders for clients. Integrated billing systems can help your clients avoid late payments, and can help you set realistic payment terms delinquent clients can meet.

5. Ensure Your System is Secure

Choosing a secure, safe billing system is key. The last thing you need is an external party accessing your financial records or creating fraudulent invoices. Choose a system that uses a secure network that can only be accessed by authorized users.

Best Billing and Invoicing Software

Choosing a new billing software for your company means choosing the system that will work best for your business operations. The following are the top programs available. We’ve emphasized their benefits and drawbacks to make it easier for you to select which option is best for your business.

1. FreshBooks

FreshBooks invoicing software is the top choice for many businesses over other systems because of its simple interface, professional-looking invoice templates, and easy automation. The program automatically calculates taxes, makes it easy to offer discounts, and helps businesses manage timelines and stop scope creep, letting you schedule work and a payment schedule at a pace that works for you.

With FreshBooks you can create custom branded invoices, establish due dates, impose late fines, and monitor your cash flow from anywhere using the mobile-friendly app, perfect for busy on-the-go business owners. Accept payments online, streamline your invoicing process, generate reports, and send recurring invoices with ease using this flexible and intuitive software. Try FreshBooks free to find out if this powerful software meets your business needs.

Pros

- Integrated financial management that allows you to handle invoices and collect payments with FreshBooks on the same platform.

- High end customer support services

- A simple, clear, and user-friendly interface with a contemporary look.

- The whole suite is included, so you can set due dates for invoices, monitor client invoicing, apply late fees, and collect money while making sure all tax obligations are met.

- You may easily monitor spending and record expenses

- FreshBooks processes data, creates balance sheets and spending reports, and summarizes taxes.

- Fees are based on the number of team members that are actively using the system each month, for more reasonable pricing than other options.

- Integrations with numerous third-party applications and top payment card issuers.

- Full-featured mobile applications that give access to documents on Android and iOS devices, letting FreshBooks help take finances outside of the office.

2. Xero

Xero allows businesses to choose from a wide range of integrations with business and financial systems. It’s a combined automated billing system and accounting solution with complete payment options like automated billing reminders that will significantly reduce administrative burden.

Pros

- You can fully integrate payment methods like Stripe and PayPal.

- The mobile app allows access to all your data and information no matter where you are.

- The platform provides decent live chat support.

Cons

- The basic plan is limited, so if you want to access all of Xero’s features, you’ll have to purchase an expensive higher-tier plan.

- The system’s reports sometimes fail to combine manual data with automatically generated data.

- There have been issues when using Xero to generate 1099 forms for freelancers and independent contractors.

3. Zoho Invoice

Zoho Invoice performs a variety of tasks that assist small and midsize enterprises with invoicing and expenditure management. The platform’s templates are configurable, allowing users to add logos and company colors to the design for professional-looking quotes and invoices that can be sent using the client interface, SMS, and email, with automatic payment reminders and status tracking options. It tracks unbilled hours, work hours, and their associated financial worth, and interacts with several payment gateways, like PayPal, Stripe, and Forte.

Pros

- Zoho Invoice features adaptable, customizable templates.

- It supports multiple currencies when processing payments..

- It offers intuitive projections, accounting for your prices, discounts, and any applicable terms and conditions.

- The comprehensive client portal allows customers to complete all of their transactions like sending payments through clickable links on their invoice.

- More than 10 integrated payment gateways can be integrated with Zoho Invoice.

- Recurring payments can be charged automatically and notifications can be fully automated.

Cons

- The platform doesn’t offer chat assistance, so any issues with utilizing it won’t be remedied right away.

- The system’s reports occasionally fail to combine manual data with automatically generated data, resulting in irregular custom reports.

Benefits of Using a Billing System

Using an integrated billing system is more efficient and accurate than manual billing, and helps determine the workflows you’re going to end up using for creating and organizing invoices, contributing to everything from accepting payments to project management.

The benefits of using a billing system are:

- Accurate, automated billing

- An efficient process for creating and sending invoices

- Easier auditing

- Convenient online payments

- Easier access to all your billing information

- Accurate analytics and reporting

- Better clients relationships with more satisfied clients

How FreshBooks Enhances Your Billing System

Invoicing and payment processing have never been simpler for small businesses. FreshBooks is a well-organized program designed to handle all your billing and payment needs, as businesses can accept the most popular online payment methods for seamless transactions your clients will appreciate.

Keep your books balanced, make tax time easier, and enjoy online access to your business finances 24/7 with our easy-to-use mobile app and our simple, clean interface. You can even set up automatic recurring billing and payment reminders, further freeing you to focus on developing your company and expanding your reach. Grow your business while gaining more creative time when you use FreshBooks to handle payments, invoices, and your other accounting needs.

FAQs About Billing Systems

How do I choose a billing system?

You should choose a billing system that suits your business needs. There are options out there that are more complex and offer additional functionality. But there are also basic choices that provide simpler services for less complicated business needs.

What are typical billing processes?

Some of the most typical billing processes include creating and printing invoices. They also include recording journal entries and accumulating various costs.

Why do we need a billing system?

A billing system lets you easily control costs, accept payments, and track your finances. You can also benefit from the range of automation it can include, like payment reminders and follow-up emails.

Is Excel used for billing?

You can use Excel for billing and creating your own invoices. However, it can be incredibly time-consuming to do, and investing in software like FreshBooks will make your life easier. You can send professional invoices and accept payments online.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Short Pay: Definition & How It Could Impact Your Business

Short Pay: Definition & How It Could Impact Your Business E-Invoicing: Definition, Benefits & How To Create Them

E-Invoicing: Definition, Benefits & How To Create Them How to Pay Bills on Time: 7 Tips to Keep in Mind

How to Pay Bills on Time: 7 Tips to Keep in Mind Prepayment Invoice: Definition & How To Create One

Prepayment Invoice: Definition & How To Create One Paperless Invoicing: Is It Better Than Paper Invoice?

Paperless Invoicing: Is It Better Than Paper Invoice? Consolidated Invoicing: Definition & How to Create One

Consolidated Invoicing: Definition & How to Create One