What Is a Credit Invoice?

A credit invoice is a professional for a business to account for customer refunds or processing errors in the client’s favor. Often called a credit note or a credit memo, this document is provided to a customer to let them know they have paid more than what was required and money or credit is due to be returned to them.

Key Takeaways

- A credit invoice is a legally binding document provided to a client to let them know that a refund or credit is due to them.

- It is also known as a credit memo or a credit note.

- Common reasons to issue a credit note are invoice errors, customer prepayment receipts, or item returns.

- Creating any type of invoice is easier when you use bookkeeping software

- It is beneficial to businesses as they keep financial records clear

If you have asked yourself, “What is a credit invoice used for?” please read on.

Here’s what we’ll cover:

When and Why Should You Use a Credit Invoice?

What Are the Benefits Of Using a Credit Invoice?

How to Create a Credit Invoice

What Should Be on a Credit Invoice?

Accounting for Credit Invoices in Your Bookkeeping

When and Why Should You Use a Credit Invoice?

Several instances might lead to you preparing a credit memo for a client, including invoicing errors, returns, or perhaps the client paid for a service that is no longer available. Sending out a documented credit will not only keep your accounts in good order with a clear paper trail, but it will demonstrate your business integrity to clients, fostering better business relationships. These instances may include:

The customer asks for a refund

This can be for any number of reasons, such as the product being faulty, receiving the wrong items, or the customer returning goods. When customers return goods to you that they have already purchased, they’re usually entitled to money back. A credit note can be given in this circumstance and is probably the most common use for it.

It helps both the buyer and yourself keep track of what is due to be received/paid. It is also good record-keeping for your accounts as you’ll have a paper trail of your actions in the matter.

Partial credit for a part-refund

Another type of you might also produce one, similar to the above, is for a partial return of what they paid.

If a customer buys several products from you and returns one, you can process an invoice providing credit just for the item that has been returned.

An error with the amount on the original invoice

Mistakes happen. The amount on the original invoice might have been wrong due to not applying a discount, pricing disputes, or adding figures incorrectly.

A credit note can be used to rectify the problem for the customer.

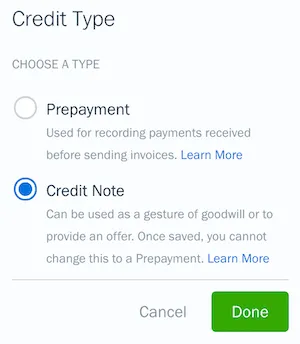

Customer prepayment

Regular customers may already have paid some of their accounts and want to use this as full or partial payment of their bill.

Business owners can therefore use a documented credit as a form of receipt for the customer.

If an outstanding balance is still required, a further credit memo can then be produced, considering what has already been paid.

The invoice was issued by mistake

Again, mistakes are inevitable when running a business. If you’ve invoiced a customer by mistake, you can give them a credit note showing they don’t need to pay.

Keep a record of the initial sale in your accounts

Recording the original sale on the system in case of a refund and return helps you keep your accounts in good order.

It is almost impossible to keep track of every sale for each customer. It can therefore be difficult to determine what happened when a clear paper trail isn’t kept.

It can also leave your books short by not properly accounting for funds coming in and going out.

What Are the Benefits Of Using a Credit Invoice?

A credit note will ensure your financial records are accurate and clear. Simply removing items from your accounting system is not considered good practice. Keeping a credit note on file will instead show that the funds came in from the buyer and were then returned in the form of credit.

This helps to keep your client’s account up to date and allows you to adjust your accounts receivables and sales tax records accordingly. It will also ensure the buyer receives the proper credits they are due.

How to Create a Credit Invoice

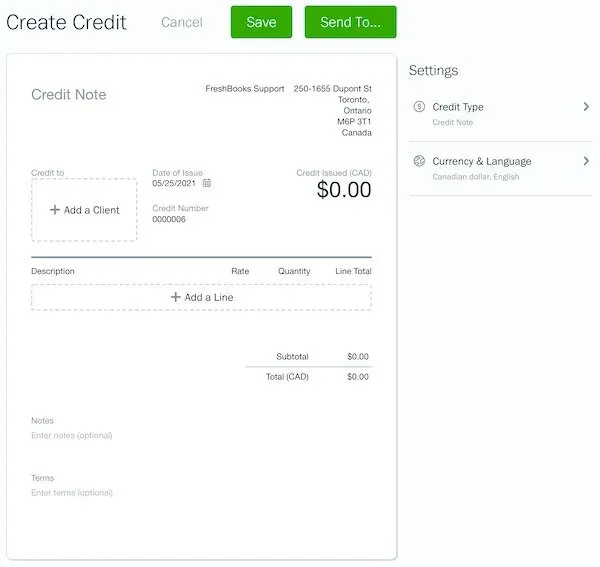

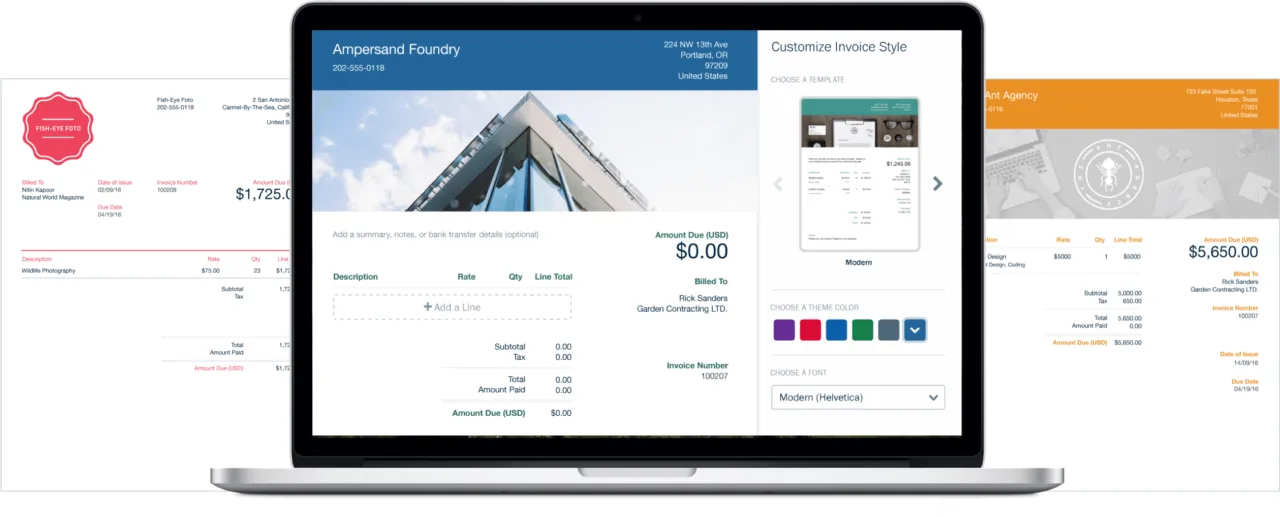

Using financial software will be the easiest way to generate a professional-looking invoice. You can fill in a customizable template and send it off in minutes. You can also create a credit memo manually, but it is important to ensure the document contains all the required information.

Accounting software like FreshBooks will simplify creating a clear and professional credit invoice with personal details like your logo and a personalized thank-you email while automating as much of the process as you wish. Click here to try a free 30-day trial.

If you opt to make your own credit note, it is important to ensure it includes all of the following information provided in a clear and legible format:

- The words “Credit Note” or “Credit Invoice” at the top

- Your company’s information

- Buyer Information

- A unique credit note invoice reference number

- Invoice date issued

- Itemized product or service descriptions, with quantities and prices

- Total amount credited

You can then email the digital version to your client, or if you wish, you can print and mail it to their business address.

What Should Be on a Credit Invoice?

Credit memos have the same structure as a regular invoice, with your company information, the buyer’s information, a unique identifying invoice number, the credit note date issued, an itemized list of products or services (with quantities and prices), and the total amount credited. Put the word “credit” at the top for additional clarity.

The structure is usually the same as a normal invoice, and because it is a legally binding document, every detail is important. The invoicing software should provide a template to generate a credit note from an existing invoice that you have already created.

Invoicing is easy when you choose an easy-to-use template like the FreshBooks invoice template. Just fill in your details and hit send, and voila! You are done. Click here for a free trial.

What Is a Debit Invoice?

If someone purchases something from a seller and has not paid enough, they may be issued a debit memo. This could happen when the seller prepays customs or freight charges or if an applied promotional discount ends and the customer owes additional money.

Accounting for Credit Invoices in Your Bookkeeping

How you process and record the invoice will depend on whether you issued an initial invoice and whether it has been paid. If you need to return some funds to the customer, you should record it under Revenue and Accounts Receivable. This will adjust the amount recorded in your accounts. If the invoice has not yet been paid, you can debit the amount in question under “Revenue” and record a credit in “Accounts Receivable.” That credits the account of that particular customer for future orders.

Conclusion

So what are credit notes and invoices, and what is the difference between a credit memo vs. a refund? Credit memos, credit notes, and credit invoices are useful tools for businesses, providing an easy-to-follow paper trail that keeps track of monies that are due back to the buyer. Not only does a credit memo ensure your accounting records are up-to-date and the books are balanced, but dealing with these types of issues efficiently will also increase customer loyalty.

FAQs on Credit Invoices

What is the difference between an invoice and a credit invoice?

An invoice is an itemized bill sent to customers to request payment for goods and services rendered, whereas a credit invoice is a statement that details a credit to the buyer, acting as a “negative” invoice to correct errors and issue refunds as needed.

How do I make a credit invoice?

You can use invoicing software to generate an easy and professional-looking invoice or create your own credit note. A pre-made template will ensure you don’t miss any important information in this legally binding document.

What is the difference between a credit note and a credit invoice?

There is no real difference between a credit note and a credit memo or an invoice vs. a credit memo. These are different names for the same concept: legal documents detailing an amount owed back to a customer’s account after an overpayment has occurred.

Is a credit invoice a refund?

It is a document that provides a statement that includes all the legal details of a credit or refund owed to a customer. The credit memo/invoice is the paperwork that provides a paper trail, and it is an important piece needed to balance business accounts.

Who issues a credit invoice?

The seller issues a documented credit to a client when there has been a mistake in the invoicing process, when the customer has overpaid, or when the buyer requires a full or partial refund on payments they have already made. The credit invoice is a legal document containing important details, including the credit amount.

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

What Is an Invoice: Purpose, Types, Elements & Example

What Is an Invoice: Purpose, Types, Elements & Example 6 Steps on How to Write a Simple Invoice

6 Steps on How to Write a Simple Invoice How to Invoice as a Freelancer

How to Invoice as a Freelancer How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold

How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold How to Make a PDF Invoice? Steps Explained

How to Make a PDF Invoice? Steps Explained How to Invoice as a Freelance Designer: A Step-By-Step Guide

How to Invoice as a Freelance Designer: A Step-By-Step Guide