EDI Invoice: Definition and How It Works Explained

You may wish to move away from the traditional paper invoice. If that’s the case, you need electronic data interchange (EDI) invoices. These invoices enable prompt payment and create a record of each business transaction.

This need leads us to an obvious question:

What is an EDI invoice?

This article provides the answer and information that helps you create EDI invoices for your services.

Table of Contents

Essential Components of EDI Invoice

How Do I Create an Invoice With EDI?

What Is EDI 810 Invoice?

An EDI 810 invoice is a business document that a seller sends to a buyer. The invoice indicates the charges due and requests payment from the buyer based on pre-agreed terms.

You can use an EDI invoice instead of sending paper documents. They can also replace other forms of electronic invoices, such as PDFs or documents sent via email.

There are several types of EDI invoices beyond the EDI 810. Examples include EDI 210, EDI 880, and EDI 894 invoices. However, these EDI documents apply to specific transactions. An EDI 810 is often preferred because you can use it across various order types.

How Does EDI Invoice Work?

EDI 810 invoices follow the X12 standard developed by the American National Standards Institute (ANSI). This organization regulates all other EDI documents in the United States.

Sending EDI invoices requires a computer-to-computer exchange. You’ll accomplish this exchange using special software or an outsourced EDI service provider. In many cases, you can automate sending these business documents, saving time and money.

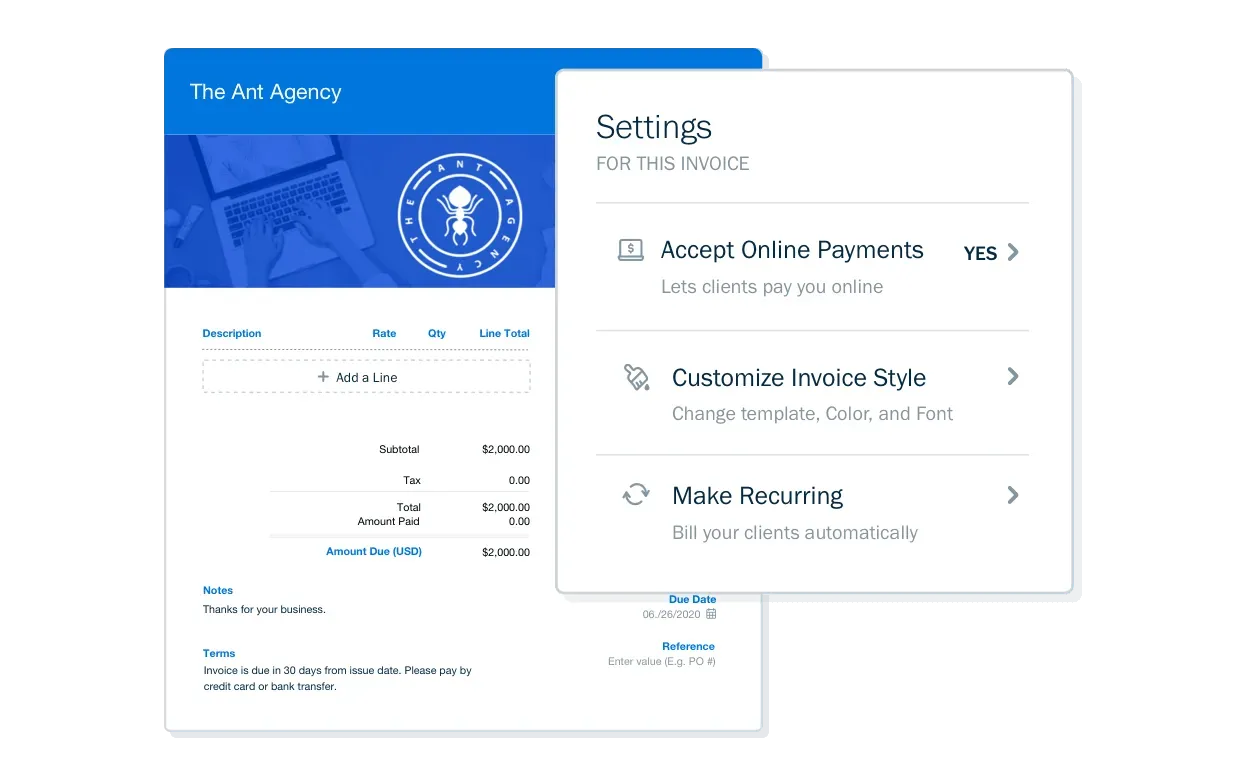

Assuming you wish to create your documents in-house, you’ll need software to create electronic invoices. For example, FreshBooks offers invoicing software that includes electronic invoice templates and tracking options.

These software packages often provide a standard format you can follow when creating invoices. With FreshBooks, you also get access to other documents and tracking features that help you to confirm receipt.

However, having your own software is only one part of the equation.

Your recipient must also have the ability to receive the electronic invoices you send. Additionally, you may have to work with a business intermediary to facilitate the transaction.

Essential Components of EDI Invoice

Your EDI document must have the following components:

- An invoice transaction set, along with a unique three-digit number called a transaction set ID

- Identification details related to the buyer, seller, and remittance

- An invoice date

- Full details of the order, such as product prices and quantities

- The total amount due

- Any additional charges or discounts applied to the order

- Payment terms and details about payment methods

- Tax information, whenever applicable

It’s worth exploring the concept of an invoice transaction set.

These data elements are equivalent to similar info found on paper documents. Think of it as the electronic version of a traditional paper invoice.

The unique code assigned to this transaction set allows a computer to determine the purpose of your EDI document.

Benefits of Using EDI Invoice

Why use EDI to generate invoices, purchase orders, and other business documents? There are several benefits EDI offers that you don’t receive with other forms of invoicing.

Lower Costs

Research demonstrates that EDI costs just one-third of the paper-based equivalent. According to EDI Basics, one American company reduced its cost to $1.35 per order from a previous cost of $38.

Higher Speed

Paper-based invoicing takes a lot of time. Beyond generating the invoice, you must send it, confirm receipt, and await payment. The process can easily take five business days or more.

EDI allows you to send invoices and receive an acknowledgment within the hour. Some estimates state that using EDI across the entire supply chain leads to 30% quicker delivery times.

Improved Accuracy

EDI incorporates three components that lead to higher accuracy:

- Automation

- Confirmation

- Standardization

An EDI 810 invoice is less prone to human error than a regular invoice. Automation means less human intervention. Plus, ASCI’s standardization means there are fewer format issues.

Finally, EDI provides a confirmation of receipt. This confirmation serves as a functional acknowledgment that the buyer received the document.

Real-Time Visibility

EDI allows businesses to view transaction statuses in real time. A real-time view leads to faster decision-making.

A business can also streamline its processes thanks to this visibility. You can see issues as they occur, allowing you to create and implement timely solutions.

Promote Sustainability

America alone throws away over one billion trees’ worth of paper per year. By sticking to a paper-based model, your business contributes to this waste.

Making the switch to EDI invoicing allows you to promote sustainability. Your company becomes more environmentally friendly, which you can use in your marketing materials.

Furthermore, you’ll have less paper floating around the office. That means less time spent searching for invoices because you have an electronic tracking system. You can find an EDI invoice instantly.

Standardizing Business Language

EDI standards apply to any company that uses this invoicing.

These standards make it easier for your business to enter new territories. The companies you work with all speak the same electronic “language” when using EDI. As a result, business partner onboarding is much simpler.

How Do I Create an Invoice With EDI?

Every EDI 810 Invoice contains data elements and segments. You arrange this data in accordance with ASCI’s EDI 810 specifications. This specification saves time and ensures uniformity across all EDI 810 invoices.

Specifically, you’ll use the EDI 810 X12 transaction set. Your business sends this set in response to an EDI 850 Purchase Order. The purchase order is the buyer’s request for goods or services. Your invoice acts as a request for payment after you’ve delivered your goods or services.

Note that you can’t use any electronic invoicing software to create EDI documents. Instead, you need specific EDI software. These software packages understand the standardization used for EDI documents. They also contain templates that ensure you include all of the components required for your invoice.

The software creates the data exchange necessary to transmit EDI documents. It also translates common file formats into EDI standards.

Finally, you may receive one or more of the following EDI documents after sending an EDI 810 invoice:

- Functional Acknowledgement EDI 997

- Remittance Advice EDI 820

- Text Message EDI 864

EDI 997 confirms receipt of EDI 810. EDI 820 provides details about payment from the buyer, along with remittance advice. An EDI 864 reports violations within your EDI 810.

Key Takeaways

There are many reasons to consider using EDI invoices. They speed up transaction times, reduce errors, and ensure rapid payment.

However, distinguish EDI invoices from regular electronic invoicing. EDI requires the use of special standards and software. The need to stick to specific formats means all parties involved in a transaction must use EDI software.

These standards also mean you must understand the components of an EDI 810. Your invoice may get rejected if it includes only some of the necessary components.

FAQs on EDI Invoices

What are the EDI transactions?

An EDI transaction is an inter-company communication of business documents. These transactions use ASCI’s EDI standards.

What is an EDI invoice number?

EDI invoice numbers are the electronic equivalent of the number you’d use for a paper-based invoice.

What is the difference between EDI and e-Invoicing?

EDI can send more types of messages and business documents than e-Invoicing. It allows you to send multiple invoices along with other data from the procurement chain.

RELATED ARTICLES

What is a Commercial Invoice? Definition & Format

What is a Commercial Invoice? Definition & Format 6 Best Invoice Apps For Small Businesses

6 Best Invoice Apps For Small Businesses Invoice Factoring: Definition & How It Works

Invoice Factoring: Definition & How It Works How to Write a Rent Receipt?

How to Write a Rent Receipt? Online Invoicing Portal: A Small Business Guide

Online Invoicing Portal: A Small Business Guide What is a Disputed Invoice? – How to Resolve Them

What is a Disputed Invoice? – How to Resolve Them