How to Fill out an Invoice | Professional Invoicing Checklist

To fill out an invoice properly, small businesses must ensure they include all the information a client will need to pay for their services. This information includes:

- The name and contact details of your business

- The client’s contact information

- A unique invoice number

- An itemized summary of the services provided

- Specific payment terms

- The invoice due date

- The total amount owing on the invoice.

To get paid as soon as possible and to ensure the information filled out on the invoice is as accurate as possible, businesses should fill out invoice details as soon as they complete work on a project, when the information is still top of mind.

Here are some tips to teach you how to fill out an invoice:

How to Fill out an Invoice: Small Business Checklist

How to Include Discounts on an Invoice

How to Fill out an Invoice: Small Business Checklist

1. Create a Consistent Look

Business invoices should have a uniform template that you follow every time you fill out an invoice, to create a consistent look and feel for your invoices. That way, your clients will be able to tell at a glance that an invoice is from your business. It will also make your business appear polished and professional to clients. To create an invoice template, you can download these free FreshBooks business invoice templates in Word, PDF and Excel format. Or, you can create your own invoice design by following these invoice design guidelines.

2. Build Your Brand

Don’t think of an invoice as a boring accounting document. Instead, think of it as an opportunity to impress clients and build your brand. Make sure your invoice reflects the personality of your business. If you have a business website already, you can use FreshBooks free invoice generator to design your customised invoice including logos, colors and fonts. Make the most of your invoice and let it be another marketing tool to help build your business.

3. Fill Out Invoice Basics

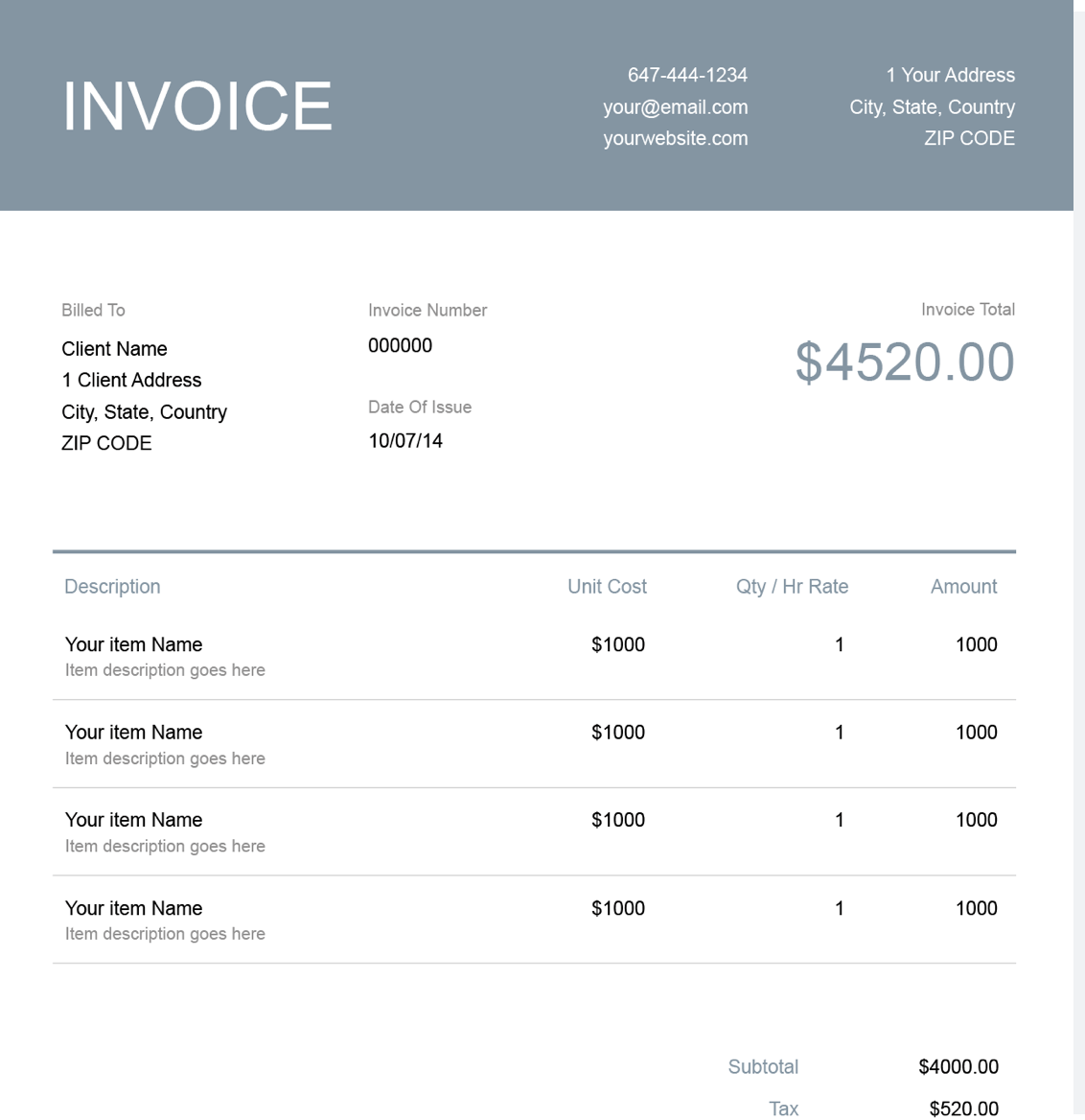

To fill out an invoice, start with the basic details you’ll need to include so your clients can pay you the correct amount, on time. Here’s what you’ll need to include when filling out an invoice:

- Your business’s contact information, including its name, address, phone number and email address.

- Your client’s contact details; make sure you include the correct point of contact for invoicing at your client’s company. It might not be the same person you deal with on a daily basis for business matters.

- A unique invoice number so you can easily refer to specific invoices when communicating with clients or when you’re doing recordkeeping for your business.

- An itemized list of services provided, including all relevant details such as the number of hours worked, the hourly rate charged and a subtotal for each item. It can help to display this information in a grid or table.

- Your payment terms, including the payment methods your business accepts and any late fees clients will incur for missed payments, are an important part of your invoice. We have a guide on Invoice Payment Terms Examples that will help you determine the appropriate payment terms to include on your invoices.

- An invoice due date that’s clearly displayed and stands out on the page.

- The total amount owing in bold font that stands out on the page.

- A brief thank you at the bottom isn’t necessary, but it’s a nice addition that can help you maintain good relationships with clients.

4. Create an Invoice Numbering System

Create an invoice numbering system that works for you when filling out your invoices. The simplest method is just to number your invoices sequentially, i.e. Invoice # 001, Invoice #002, Invoice #003. If you prefer, you can also number them by invoice date or by client ID, if you assign a unique number to each of your clients. If you use a cloud-based invoicing software, the program will automatically assign unique invoice numbers for each new invoice you fill out, based on the numbering system you choose. If you want to learn more about invoice numbering and how it works follow our guide on What Is an Invoice Number.

5. Set Clear Timelines

When filling out an invoice for your business, be sure to set clear, specific deadlines. Instead of using vague language to describe the invoice due date, like “Payment due upon receipt” or even “Payment due in 30 days” you should list a specific due date, i.e. “Payment due on October 1, 2018.” Listing specific invoice due dates when filling out invoices can help eliminate confusion for your clients and can even help you get paid faster, according to a FreshBooks invoicing study.

6. Offer Flexible Payment Options

When considering what invoice payment methods to offer your clients, try to provide as many options as possible. Not only will clients appreciate the flexibility of paying in the way that works best for them, being flexible with payment options can also help you get paid faster. Fill out your invoice with clear instructions for how clients can pay you, whether that’s by check, credit card, direct bank deposit, online payments or cash.

Here’s an example of how to fill out a professional invoice from the FreshBooks invoice template:

How to Include Discounts on an Invoice

If you’re looking to include a discount when filling out a business invoice, first determine what kind of discount you’re offering, whether it’s a percentage discount on your services or a set dollar amount that you’re discounting from the invoice subtotal.

Include the discount at the bottom of your invoice, under the invoice subtotal. List the discount name and the amount being discounted, and then include the final invoice total on the following line.

Did you find this article helpful? If so, check out our article on How to Invoice a Client. In that article, we provide detailed guidance on creating professional invoices, ensuring timely payments, and maintaining a positive client relationship.

RELATED ARTICLES

Invoice Wording: How to Word an Invoice For Your Business

Invoice Wording: How to Word an Invoice For Your Business What Does an Invoice Look Like: Everything You Need to Know

What Does an Invoice Look Like: Everything You Need to Know How to Write an Invoice For Services Rendered

How to Write an Invoice For Services Rendered How to Send an Invoice: An Overview

How to Send an Invoice: An Overview How to Create an Invoice in Excel (Template Included)

How to Create an Invoice in Excel (Template Included) Invoice vs Receipt: What’s the Difference

Invoice vs Receipt: What’s the Difference