How to Accept Credit Card Payments

Credit cards are an increasingly popular payment method, so it’s essential for small businesses to have an efficient system for accepting credit card payments. As cashless transactions increase, accepting credit cards helps businesses stay competitive, expand sales, save time, and build customer loyalty.

Businesses can accept credit cards in-store, online, and with a mobile device. We’ll explore popular ways to accept credit card payments, as well as the benefits of accepting cards and the associated credit card processing fees. We’ll also look at popular payment processors to help you find the right fit for your small business.

Key Takeaways

- Accepting credit card payments is key to staying competitive.

- In-store, online, and mobile payments are three popular credit card payment methods.

- Accepting credit cards helps you save time, boost sales, and improve security.

- Payment processors charge a small fee for credit card transactions.

- Explore different processors to find competitive rates and strong security.

Table of Contents

- 3 Ways to Accept Credit Card Payments

- Benefits of Accepting Credit Card Payments

- What Are Credit Card Transaction Fees?

- Which Types Of Businesses Can Accept Credit Cards?

- 4 Popular Solutions to Accept Credit Card Payments

- Start Accepting Credit Card Payments with FreshBooks Payments

- Frequently Asked Questions

3 Ways to Accept Credit Card Payments

Learn how to process credit card transactions anywhere with three popular methods for accepting credit card payments.

1. Online Credit Card Payments

Accepting credit cards online offers a fast and easy payment solution that can help boost sales and grow your business. In order to accept online credit card payments, you’ll need a payment service provider like Square to process the transaction and deposit the funds into your merchant account.

There are multiple ways to accept online credit card payments. You may have a payment page on your website, or you can choose to include a custom payment link when you send an invoice to your client. Online credit card payments also help you track client payments so you can keep accurate records of all your financial transactions.

2. In-Store Credit Card Payments

To accept in-person transactions made by card, you’ll need to purchase a point-of-sale (POS) system. A POS system includes hardware (like a card payment terminal) and software to process in-person payments. Customers can insert or swipe their credit or debit card using the card reader and the transaction will quickly either be approved or declined. If a transaction is approved, your merchant account will then receive the funds and transfer them to your business bank account within a matter of days.

3. Mobile Credit Card Payments

Mobile payment processing apps enable you to receive physical credit card payments using your phone. Your phone acts as a point of sale system using an app or a small physical attachment that connects to your device.

Many mobile credit card readers, such as Square, use a portable device that plugs into your smartphone and pairs with a credit card processing app. This enables you to accept credit card payments anywhere, as long as there’s an internet connection.

Mobile credit card payments are ideal for businesses that attend pop-up sales events like trade fairs and farmers’ markets. The flexible system lets you do business anywhere and delivers all the same convenience and security as traditional in-store credit card payment systems.

Benefits of Accepting Credit Card Payments

Accepting credit card payments offers flexibility and convenience to your clients and can also benefit your business. The benefits of accepting contactless payments for small businesses include:

Boosts Sales

Accepting credit card payments can help you attract new clients to your business, improving your sales. If you are a business that sells products, accepting credit card payments can translate into increased sales because customers tend to spend more when they’re using a card. A recent study found that people spend between 12 and 18 percent more when they use credit cards rather than cash.

Improves the Client Experience

Offering flexible payment options that include credit and debit cards gives your clients a better experience and encourages loyalty. Many clients prefer to pay using credit cards because they can quickly and easily process the payment online rather than having to fill out and mail a check.

Increases Cash Flow

Unlike checks, which often take between five and ten business days to clear through your bank, credit cards are processed relatively quickly. Often, card payments are cleared and the money appears in your business bank account within a day or two of the transaction.

Saves Time

Most card processors allow you to accept credit payments with a few simple clicks, saving you time. You won’t have to go to the bank to deposit checks or spend as much time requesting payment for invoices.

Improves Payment Security

Accepting credit cards can mean your business has less cash on hand, which lowers the risk of theft or loss. Although there are security risks with accepting credit cards, in many cases, fraudulent charges can be recovered when you use a merchant service provider.

Provides Useful Sales Metrics

Most credit card processors provide robust sales reports based on your transactions. You’ll be able to gather useful data about the types of payment clients use, how long it takes them to pay, and the average payment amount your business receives. Credit card reports also include sales and revenue information that’s useful when you file your taxes.

What Are Credit Card Transaction Fees?

Whenever you accept a credit card payment, the payment service provider charges a small fee for the transaction. These fees fall into 3 categories:

Transaction Fees

This is a fee charged for every credit card transaction. It may be charged as a percentage, a flat rate, or both. For example, Stripe charges 2.9% of the transaction amount plus a 30-cent flat fee for credit card payments.

Interchange Rate

Some providers may choose to charge an interchange rate instead of a transaction fee. This is more common with larger businesses, where they may pay the interchange and a markup. The interchange rate is set by large credit card companies and is non-negotiable.

Service Fee

Some payment service providers also charge a subscription fee for the use of their software. Others, like PayPal, waive this fee and generate revenue solely through their transaction fees.

Which Types Of Businesses Can Accept Credit Cards?

Almost every type of business can accept credit card payments. Some common examples of businesses that can accept credit cards include:

- Sole proprietors

- Contractors and freelancers

- Fully online businesses

- Businesses with physical store locations

- Mobile businesses that attend pop-up events

- Traditional businesses with employees

Even individuals that aren’t registered as businesses can accept credit card payments. As long as they have a payment processor set up and a merchant services provider, anyone can accept credit cards.

4 Popular Solutions to Accept Credit Card Payments

The advantages of card payments depend upon which payment service providers you use. Browse five of the top-rated providers who accept payments online to find the right fit for your business:

1. FreshBooks Payments

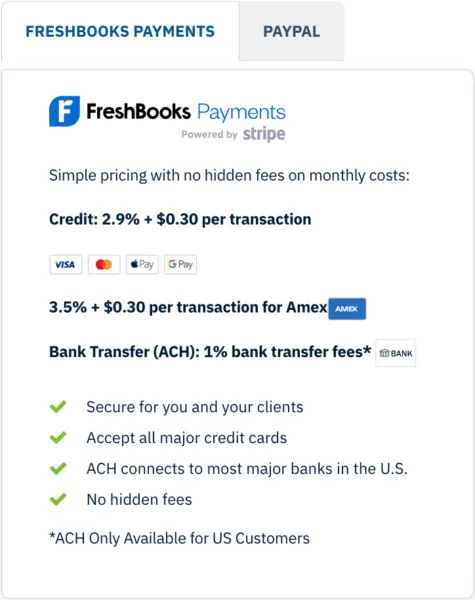

FreshBooks Payments powered by Stripe offers a convenient and transparent system for sending invoices and receiving online payments. Accept a variety of payment methods including credit cards, debit cards, and bank transfers, with competitive rates so you can keep more of your revenue.

FreshBooks Payments also enables you to generate and send custom payment links in your invoices, making it even easier for you and your clients to complete transactions. With more ways to pay, clients can pay instantly when they receive their invoice, improving the customer experience and helping you get paid faster.

2. Square

Square offers affordable payments on a flat rate structure. You can choose from different support plans; however, Square doesn’t work with high-risk merchants.

3. Venmo

While most popular for peer-to-peer payments, businesses can also use Venmo for quick processing and reliable security.

4. PayPal

Popular for domestic and international payments, Paypal offers variable fees and volume discounts and can accept a variety of different credit cards.

Start Accepting Credit Card Payments with FreshBooks Payments

Finding an efficient way to accept credit card payments is essential for keeping your small business competitive. There are a variety of payment processors that can accept credit cards for in-person, online, and mobile sales. When looking for a merchant provider, consider their rates, fraud protection, and customer service options.

In addition to boosting your sales, credit card data can be helpful for analyzing your business. It offers helpful insights into customer spending and can be used as records to simplify taxes and accounting. FreshBooks Payments powered by Stripe is a great solution for accepting credit card payments online. It’s quick, simple, and secure, and integrates effortlessly with accounting software for an all-in-one system. The built-in payment gateway enables you to accept all major credit and debit cards, as well as bank transfers so customers can enjoy even more ways to pay.

In addition to accepting credit card payments online through FreshBooks Payments, FreshBooks offers a host of tools for invoicing, expense tracking, payment processing, and accounting. With FreshBooks, small business owners benefit from an all-in-one system for simplifying financial tasks and enhancing business efficiency.

FAQs on How to Accept Credit Card Payments

How can I accept credit card payments as an individual?

To accept credit payments as an individual, simply set up an account with a payment processing system. This lets you easily accept online or mobile payments, or you can purchase further options like a credit card terminal to accept in-person credit card transactions.

Which platform is best for credit card payment?

Choosing the best credit card payment platform depends on your business needs. Consider whether you need in-person, online, or mobile payment options, as well as provider fees and fraud protection. FreshBooks Payments makes it easy to invoice your clients and accept online credit card payments.

What is the safest way to accept payment?

All payment methods carry some risk, but credit cards are generally considered one of the safest ways to accept payment since they eliminate the need to carry cash. Many payment processors offer robust digital security measures to help protect customers and businesses from credit card fraud.

What types of credit cards can I accept as payment?

The types of credit cards you can accept as payment will depend on the payment processor or service provider you use. However, most payment processors and service providers allow you to accept payments from major credit card networks like Visa, Mastercard, and American Express.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How to Make Your Customers Pay for Credit Card Fees

How to Make Your Customers Pay for Credit Card Fees How Long Do You Have to Pay an Invoice

How Long Do You Have to Pay an Invoice How Much Does It Cost to Send an Invoice?

How Much Does It Cost to Send an Invoice? What Does Payable by Invoice Mean?

What Does Payable by Invoice Mean? How to Get Invoices Paid Faster: 10 Tips To Get Paid Faster

How to Get Invoices Paid Faster: 10 Tips To Get Paid Faster How to Keep Track of Invoices and Payments: A Guide

How to Keep Track of Invoices and Payments: A Guide