How To Refund On PayPal in 6 Easy Steps

If your business takes online payments, you’re probably already aware of the industry giant PayPal. Being the most common online payment platform, it’s important to understand how every part of PayPal works if you want smooth business transactions. This means knowing how to take payment, send money, and issue refunds. You might need to give a refund for several reasons, such as if a client made an accidental or unwanted purchase or received an incorrect or damaged item. In this guide, we’ll review the steps to process a PayPal refund to minimize client disputes and create a smooth experience for everyone involved.

Key Takeaways

- PayPal has a simple 6-step process for issuing refunds.

- You can issue a full or partial refund for transactions (except for those made with coupon or gift certificate) within 180 days of the initial purchase.

- PayPal buyers can choose to initiate a dispute with a seller to receive a refund.

- If the dispute is unresolved or the seller is nonresponsive, the buyer can escalate the dispute to a claim, where PayPal decides the outcome.

- Understanding the PayPal refund process helps to satisfy your customers and boost your company’s reputation.

Table of Contents

- How To Refund on PayPal

- PayPal Refund Policy

- How Do I Issue a Refund in a Dispute?

- How To Get a Refund on PayPal

- Alternative Solution for Online Payments with FreshBooks

- Frequently Asked Questions

How To Refund on PayPal

If you’ve received a refund request, you must be familiar with the PayPal refund process. Here are the 6 steps to issuing a refund on PayPal.

- Log into your existing PayPal business account (where the original transaction took place)

- Select the ‘Activity’ header at the top of the page

- Find the transaction that needs to be refunded and click ‘Issue a refund’

- Here, you can provide either a full or partial refund, depending on the agreement you’ve come to with the customer—enter the amount you want to refund and click ‘Continue’

- Double-check all information for any errors

- Click ‘Issue refund’ to complete the process and send the refund to your customer

Once these steps are complete you’ve successfully issued a refund. Fortunately, there are no transaction fees on this process, so you won’t incur any additional costs besides the refund itself. Make sure to double-check everything before hitting the final ‘issue refund’ button, as you can’t cancel a refund once it’s been sent.

PayPal Refund Policy

According to the PayPal refund policy, you can only issue full or partial refunds within 180 days of the original payment date.

Provided you were originally paid through a regular business transaction, you can issue either a full or partial refund. However, you can only issue a full refund for personal payments or payments made with a coupon or gift certificate. You won’t be charged transaction fees for issuing the refund, but any fees you paid to receive the original payment will not be returned to you.

When you sign up for PayPal as a seller, you agree to refund dissatisfied customers and agree that they can initiate a dispute if you’re unresponsive.

How Do I Issue a Refund in a Dispute?

If a dissatisfied buyer opens a dispute against you, you can either issue a full refund to automatically close it, or make an offer for a partial refund that the buyer can choose to accept or decline. Here’s how to issue a refund in a PayPal dispute:

- Log in to the PayPal account used to make the disputed transaction

- Go to the ‘Resolution Center’

- Select ‘Open Cases’ and click on the relevant disputed transaction

- Under the ‘Case’ column, click on the Case ID for the relevant transaction

- Click ‘Issue refund’

- Enter either the partial or full refund amount to resolve the dispute—if needed, add a note for the buyer.

- Click ‘Issue refund’ again

If you issue a refund for the full amount, the PayPal dispute will close automatically. Otherwise, you’ll need to wait for the buyer’s response to find out whether they’ve accepted or denied your partial refund offer.

Generally speaking, PayPal recommends you use good faith when dealing with a dispute with a buyer. These disputes usually occur because an item wasn’t received or wasn’t as described. Being constructive and working with the buyer to find a resolution that you can both be satisfied with is recommended.

How To Get a Refund on PayPal

Dissatisfied buyers have a few escalating methods to request a refund. Here are the 10 steps to go through to get a refund quickly and easily:

- Log in to the PayPal account you made the purchase with

- Go to your ‘Activity’ tab

- Select the payment you want to be refunded

- Use the contact information on this page to email the seller and request a refund

- If you don’t receive a response or the seller refuses the refund, you can open a dispute by going to the ‘Resolution Center’

- Click ‘Report a Problem’

- Select the payment you want to be refunded and click ‘Continue’

- Select the reason for your dispute from the provided options and click ‘Continue’

- You can now exchange messages with the seller through the Resolution Center to try to solve the dispute

- If the dispute is unresolved after 7 days, you can escalate it to a claim, which means PayPal will investigate and decide the outcome. There is an option to attach documentation supporting your claim, such as copies of purchase orders or invoices, or your communication attempts with the seller.

Alternative Solution for Online Payments with FreshBooks

As a seller taking payments on PayPal, it’s important to understand how to process refunds. No one likes sending refunds, but you must make the process swift and simple to keep a good reputation among your customers. With quick responses and good faith in your customers, providing a good experience will far outweigh the downsides of issuing a refund.

If you’re looking for an alternative solution for receiving online payments, FreshBooks offers outstanding invoicing software that makes sending invoices and receiving payments simple for you and your customers. And in case you ever do need to refund a payment, it’s quick and efficient to track refunds and resolve disputes with FreshBooks. Try FreshBooks for free today and see how it can work for your business.

FAQs About How To Refund on Paypal

Still wondering about how to get a refund or refund payment on PayPal? Here are a few frequently asked questions:

Why can’t I refund on PayPal?

If you’re unable to refund a payment through PayPal, it’s likely because more than 180 days have passed since the transaction date. According to PayPal’s refund policy, buyers are only eligible for refunds within this period.

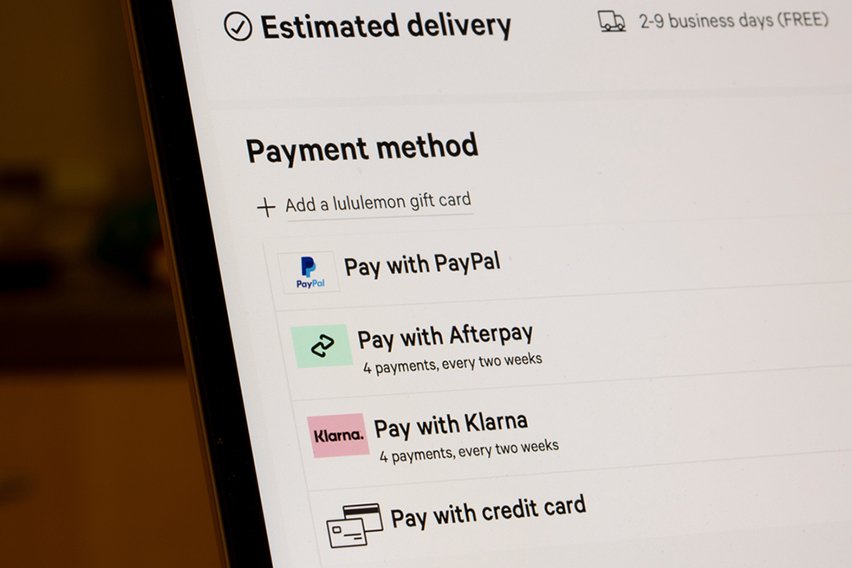

What is the PayPal refund method?

Refunded PayPal payments will be made to the buyer using the original payment method. This means payments might be refunded via the buyer’s bank account, credit card, debit card, or through their PayPal account payments.

How long does it take PayPal to refund a dispute?

After a dispute has been opened, the buyer and seller usually have 20 days to resolve the dispute. If it’s still unresolved after 20 days, the buyer can escalate the dispute to a claim, and PayPal will determine the outcome. This process usually takes about 30 days.

Why is the refund button not showing up on PayPal?

If you don’t see the ‘refund’ button on a PayPal transaction as a seller, it’s either because the transaction occurred more than 180 days ago, a refund was already issued, or because the user doesn’t have the appropriate role permissions to issue a refund.

How does PayPal decide who wins a dispute?

When PayPal has to evaluate a dispute, it becomes a claim. PayPal looks at the buyer’s complaint and reviews any evidence provided by the seller to determine the outcome of the claim, though the process frequently favors the buyer over the seller.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

How Does Stripe Work? A Beginner’s Guide

How Does Stripe Work? A Beginner’s Guide What Is a Payroll Schedule? Pros & Cons of a Payroll Schedule

What Is a Payroll Schedule? Pros & Cons of a Payroll Schedule How to Set Up PayPal Payment Gateway

How to Set Up PayPal Payment Gateway How to Cancel Automatic Payments on PayPal

How to Cancel Automatic Payments on PayPal A Guide to Stripe Payment Methods

A Guide to Stripe Payment Methods Payroll Ledger: What It Is and How to Create One

Payroll Ledger: What It Is and How to Create One