How To Transfer Money From PayPal to Bank: A Step-by-Step Guide

PayPal offers users a quick, easy, and secure way to send and receive money. It’s popular for all kinds of personal and business transactions, with browser and mobile app options so you can access your money in the way that‘s best for you.

When you receive money through your PayPal account, you can deposit it to your bank account or sign up for a PayPal debit card for additional ways to use your money. We’ll explore different options for transferring money from PayPal to your bank with a step-by-step guide. We’ll also look at PayPal’s withdrawal and currency conversion fees so you’ll have everything you need to start depositing the money sent to you in your bank today.

Key Takeaways

- You can transfer money from PayPal to your bank using a browser or the PayPal app.

- A PayPal debit card allows you to withdraw cash from ATMs.

- You can use a PayPal debit card for online payments, paying by using apps and in person.

- PayPal offers 1 to 3 day free withdrawals or withdrawals in a few minutes for a fee.

- PayPal charges transaction fees and percentage fees for currency conversion transactions.

Table of Contents

- How To Transfer Money From PayPal To Your Bank From Your Browser

- How To Transfer Money From PayPal To Your Bank Account From Your Mobile App

- How To Withdraw Money From PayPal Using Your PayPal Debit Card at an ATM

- Understanding PayPal Withdrawal Fees and Exchange Rates

- Conclusion

How To Transfer Money From PayPal To Bank From Your Browser

Step 1: Link an Eligible Debit Card and/or Bank Account

You don’t need to link your bank account to set up a PayPal account, but you will need to link it to your bank account or an eligible debit card before you can withdraw any money.

Once you open a PayPal account, follow the instructions where you’ll be prompted to link an eligible debit card or bank account. If you don’t receive a prompt, go to the Wallet section and click ‘Link a card or bank.’ This will take you through the steps to connect your PayPal with your bank account.

There are two ways to connect your account: with the drop-down menu or with a manual entry. From the drop-down menu, select your banking institution and log in to your account. For manual entry, you can enter the account and routing number. You’ll then receive 2 small deposits to confirm the account.

To link a debit card, the Quick Add option offers a list of cards to choose from. You’ll then be prompted to log in to your card account and finish the linking process. You also have the option to manually add your card number, expiration date, and other information.

Once you’ve added your banking information and set up a linked bank account or eligible debit card, you can deposit funds directly to your bank account in minutes.

Note: You cannot do electronic funds transfers without a confirmed bank account.

Step 2: Go to Your PayPal Wallet To Begin Your Transfer

To withdraw funds and make a transfer to your bank, go to the Wallet section of PayPal, click on Transfer Money, then click Transfer to Your Bank.

Step 3: Decide How You Want To Transfer

Next, you’ll be prompted to follow the instructions to choose between a Standard Transfer and Instant Transfer. The Standard Transfer is free and takes 1 to 3 days—most transactions deposit in 1 day, others take approximately 48 hours, but for some banks, it may take up to 3 business days to transfer funds. It’s important to note that holidays aren’t business days. Instant PayPal Transfer is subject to a fee and will deposit the money in your bank in just a few minutes.

For the Standard Transfer, select ‘1–3 days.’ For the Instant Transfer, select ‘in minutes.’

Note: For Instant Transfers, you’ll usually receive your transfer in a few minutes, although in some cases it can take up to 30 minutes. If you haven’t received your money after 30 minutes, contact your bank.

Step 4: Enter How Much You Want To Transfer

Once you’ve selected your transfer method, enter the amount you want to transfer to your bank or debit card. There are no additional fees if you’re receiving money from your personal PayPal balance to a domestic bank account in USD. If you’re receiving money from your PayPal in a different currency, PayPal will charge a small fixed fee per transaction which varies according to which currency you’re converting from.

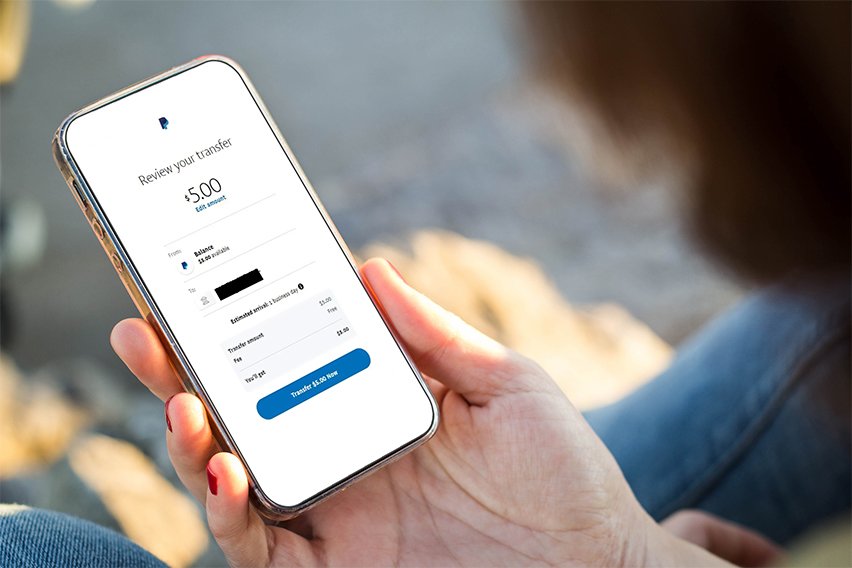

Step 5: Double Check Your Transfer Details

The final screen will show you:

- The amount you are transferring to your account

- Any transfer fees

- The final amount that will be deposited in your account

- Which of your connected banks you are sending the money to

If everything looks good, click “Transfer Now” to begin the process. If not, you still have time to fix any mistakes by clicking “back.”

After you order and confirm the transfer, you will get an email notification and a confirmation link.

How To Transfer Money From PayPal To Bank Account From Your Mobile App

Transferring money from your PayPal balance to your bank is even easier on mobile.

Step 1. Go to Your PayPal App and Tap Your Account Balance

When you open your PayPal app, the first thing that appears on your screen will be your PayPal Home Screen. Tap on Wallet in the lower right corner and then on your PayPal balance to see your action options.

Step 2. Tap “Transfer”

Once you’ve tapped on your balance, you’ll have the option to select Transfer. Tap on this, then tap Transfer to Bank at the bottom of your screen.

Step 3. Select Your Transfer Method

Just like with a browser transfer, you’ll now have the option to tap ‘1–3 days’ for a free Standard Transfer or ‘in minutes’ for an Instant Transfer with a fee.

Step 4. Enter the Amount You Want to Transfer

On the next screen, PayPal will prompt you to enter the amount of money you want to transfer. Click “enter” when you are done.

Step 5. Double Check Your Transfer Details

Just like in the desktop version, you have the chance to verify if the transfer details are correct. When you’re ready, click “transfer now” to start the process.

How To Withdraw Money From PayPal Using Your PayPal Debit Card at an ATM

PayPal isn’t just for online transactions—you can also use a PayPal debit card like any other card from your other banks to make purchases, pay for physical purchases, and withdraw cash from ATMs.

You have 2 options with a PayPal debit card—a physical card or a virtual card that will be added to your smartphone’s mobile wallet. There’s no difference in how they work, so you can have either or both. We’ll take you through the steps to order your PayPal debit card and use it to withdraw money from an ATM.

Order Your PayPal Debit Card

To order a PayPal debit card, go to the PayPal Debit Card page and click ‘Get The Card.’ As long as you have a working PayPal account with some money in your balance, you’re eligible to get a PayPal debit card.

Once you receive your card, you’ll have to activate it before you can make transactions. Go to paypal.com/activatecard, log in to your account, and click Activate Card. You can also activate your card through the app by going to your Wallet, tapping PayPal Debit Card, and tapping Activate Card.

How To Withdraw Money With PayPal Debit Card

You can withdraw money using your PayPal debit card at any participating bank or ATM. Any MoneyPass ATM allows you to withdraw cash at no charge, while withdrawals at non-MoneyPass ATMs come with a fee of $2.50 per transaction. You can withdraw up to $400 USD per day from your PayPal account using a PayPal debit card.

In addition to making cash withdrawals, you can also use your PayPal debit card as a regular debit card for making transactions. You can shop in stores, online, and on apps for any transaction where MasterCard is accepted.

Understanding PayPal Withdrawal Fees and Exchange Rates

Simple transactions like 1 to 3-day withdrawals in your domestic currency are free, but for most other withdrawals or currency conversions, PayPal charges a fee. This fee can include a percentage of the amount you’re exchanging, a flat fee for the service, or both.

Some basic withdrawal fees include:

| Transaction | Fee |

| Standard 1 to 3 day withdrawal | No fee |

| Instant withdrawal | 1.75% of the transfer amount, with minimum and maximum fees depending upon currency |

Currency Conversion Fees

| Transaction | Fee |

| Paying for goods and services in a different currency Sending or receiving money in a different currency | Currency conversion spread of 4%, or another amount which will be disclosed at the time of transaction |

| All other currency conversion transactions | Currency conversion spread of 3%, or another amount which will be disclosed at the time of transaction |

How Does PayPal Set Its Exchange Rate?

Exchange rates fluctuate constantly, so PayPal receives a bank quote twice a day to keep updated with the current exchange rate. Then they add a small fee to determine the retail exchange rate.

You’ll pay this exchange rate any time you send money, withdraw funds, or accept and automatically convert money into another currency. You’ll also pay when you convert some or part of your PayPal balance into a different currency.

To see the exchange rate of the day, go to your PayPal Wallet and click on Currency Calculator, then select the currency you want to convert. The exchange rate will be displayed there.

Maximizing Your Conversion Rate for PayPal Withdrawals

When you receive a personal transaction that requires a currency conversion, you’ll also pay a small fixed fee on top of the percentage fee that PayPal adds to the exchange rate. This fixed fee varies depending on which currency you’re converting.

In general, converting currency through PayPal instead of going through your bank will often mean a slightly higher rate as PayPal adds a percentage charge and a currency conversion fee. However, if you need to use PayPal to send money and receive money in different currencies, it’s better to do larger amounts at once so that you can minimize the amount of per-conversion fees that you have to pay.

Conclusion

PayPal offers several different ways to quickly and easily transfer money to your linked bank account. You can connect a bank account or debit card and withdraw money directly to your bank account, or use your PayPal debit card to take out money at an ATM.

Standard PayPal withdrawals are free and take 1 to 3 days to process, while instant transfers take just a few minutes and cost a small fee. PayPal also offers the option to convert currency at daily exchange rates with an accompanying transaction fee. Users can withdraw from their browser or the PayPal mobile app for easy banking on the go.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

How To Receive Money From Cash App

How To Receive Money From Cash App How to Receive Money on PayPal? Small Business Guide

How to Receive Money on PayPal? Small Business Guide Does PayPal Charge a Fee? Know-How to Reduce Fees on PayPal

Does PayPal Charge a Fee? Know-How to Reduce Fees on PayPal What is Payment Gateway?

What is Payment Gateway? How to Delete a Paypal Account: 5 Simple Steps

How to Delete a Paypal Account: 5 Simple Steps How to Set Up a PayPal Account: A Step By Step Guide

How to Set Up a PayPal Account: A Step By Step Guide