Invoice Payment Terms: A Guide to Get Paid Faster

When a business sends out an invoice, it should include clear payment terms that outline how and when the customer needs to pay. Setting expectations for timely payments ensures customers understand their responsibilities for payment, reducing the risk of miscommunication and delayed payments.

Payment terms also help businesses manage their cash flow, follow up on late or unpaid invoices, and find legal recourse in the event of refusal to pay.

We’ll explore common types of payment terms, methods for choosing your payment options and terms, and best practices to help you create your small business invoices.

Key Takeaways

- Payment terms outline payment due dates, payment methods, and late payment fees.

- Every invoice should include clear payment terms.

- Researching your industry can help you determine common invoice payment terms.

- Payment terms specify payment due date and may also include incentives, interest, and fees.

Table of Contents

- What Are Payment Terms on an Invoice?

- 21 Types of Payment Terms

- Invoice Payment Terms Example

- When Are Payment Terms Created and Updated?

- How to Choose Invoice Terms and Conditions

- 14 Best Practices for Invoice Payment Terms

- Use FreshBooks to Ensure Timely Payments

What Are Payment Terms on an Invoice?

Payment terms on an invoice let clients know when they’re expected to pay the invoice and what methods they can use to submit payment. There are a range of payment terms businesses can choose to include on their invoices.

21 Types of Payment Terms

Explore common payment terms and their meanings to discover the right fit for your next invoice.

1. CIA (Cash in Advance)

Cash in Advance requires the client to make a full payment before goods or services are provided. It’s popular for transactions that require delivery of goods but can be used for any business interaction.

2. CBS (Cash Before Shipment)

Cash Before Shipment is similar to CIA in that it requires the client to make a full or partial payment in advance. However, while the CIA can apply to goods or services, CBS is used for business transactions that require a shipment.

3. CND (Cash Next Delivery)

If a customer is receiving multiple deliveries of goods or services, Cash Next Delivery details the amount they have to pay on or before the next delivery date. This term is common for subscription shipment services.

4. COD (Cash on Delivery)

Cash on Delivery, also called Immediate Payment or Payment on Receipt, means that payment is due when the project is delivered to the client. This may allow for same-day payment processing or require immediate payment for work done on-site.

5. CWO (Cash with Order)

Cash with Order requires the customer to pay when they first place the order. Payment must be approved and fully processed before goods or services are produced or delivered to the client.

6. EOM (End of Month)

End of Month means that the customer must pay on or before the end of the month in which the invoice is delivered. This specifies payment in relation to the invoice date rather than the delivery of the product or service.

7. PIA (Payment in Advance)

Payment in Advance is any type of payment made prior to work. This can include a full payment, but may also be partial payments such as down payments or payments to cover the cost of materials and other expenses.

8. PPD (Prompt Payment Discount)

A Prompt Payment Discount confirms that the customer can receive a discount on their order if they pay within a specified time frame. This discount can be added in addition to other payment terms on an invoice.

9. CAD (Cash Against Documents)

Cash Against Documents is used for international shipping transactions between importers and exporters. The importer must provide full payment before the exporter will release the required shipping documents that allow for the importer to receive the goods.

10. MFI (Month Following Invoice)

Month Following Invoice stipulates that the customer must pay their invoice in the month following the invoice delivery. Typically, the payment is due on the 15th or the 30th of the month.

11. Net 7/10/30/60/90

Net Payment terms outline the amount of time a client has to make a payment—for example, 7, 10, 30, 60, or 90 days. Clients are welcome to pay sooner, but the net payment day is the latest allowable payment day.

12. 2/10 Net 30

2/10 Net 30 is a variation on Net 30, where the customer receives a 2% discount if they make the full payment within ten days of receiving the invoice. Payment is still required within 30 days.

13. Interest Invoice

An Interest Invoice is an invoice that contains all of the relevant interest charges for a customer. This is sent in addition to a standard invoice if the customer owes interest on one or more unpaid invoices.

14. Early Payment

Early Payment is a payment term that specifies a discount if the customer pays the invoice before the due date. The exact time and early payment discounts amount vary, and can be included on any type of invoice.

15. Contra Payment

Contra Payments are used when the customer is providing supplies for the good or service they have purchased. The contra payment is offset against the value of the supplies provided.

16. Terms of Sale

Terms of Sale are a part of the business contract that outlines the buyer’s and seller’s responsibilities for a business transaction. This can include things like delivery dates, payment dates, and obligations in case of late payment.

17. Payment Plan Details

Payment plan details outline the payment process for an individual contract. This typically includes a payment schedule, for example weekly, bi-monthly, or monthly payments. Payment plan details may also include payment methods.

18. Payment Method

Payment Method specifies what methods the customer can use to pay their invoice. Common payment methods include e-transfer, cash, credit card, online payment, and check. Businesses may offer one or more payment methods.

19. Shorten Payment Periods

Shorten Payment Periods refers to a business decreasing the length of time that a customer has to pay their invoice. This is often used to provide a warning for changes in payment terms, for example from 90 days to 30 days.

20. Upfront

An Upfront payment is a type of advance payment where the customer pays before work begins. Upfront payments may be a flat rate per job or may be a percentage of the total invoice amount.

21. Overdue Fees

Overdue Fees details the amount that a client must pay if they fail to pay by the due date specified on the invoice. Overdue fees may be charged as a percentage or a flat rate per day, week, or month.

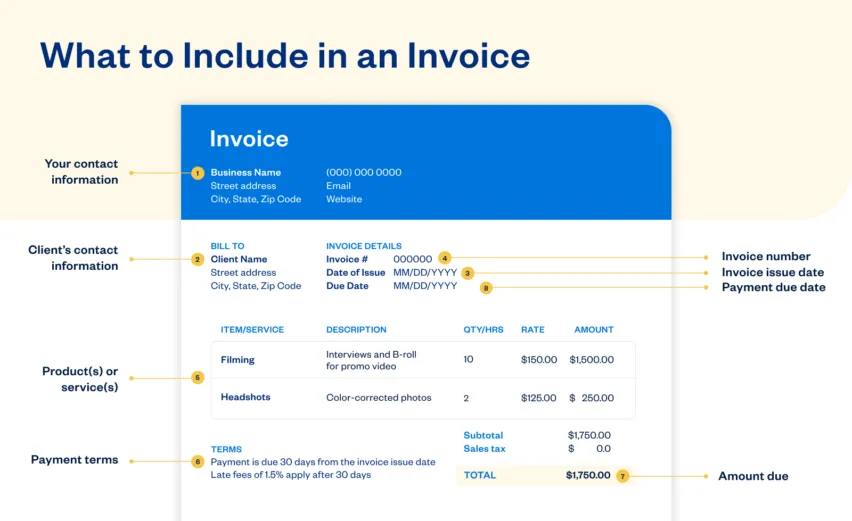

Invoice Payment Terms Example

The example invoice below shows payment terms outlined in the bottom left-hand corner. This invoice includes a Net 30 payment term that specifies payment is due 30 days from the invoice date. It also outlines the fee structure for late payment. Including clear payment terms and specifying consequences for delayed payment can encourage customers to pay on time.

When Are Payment Terms Created and Updated?

Payment terms are created before the invoice is sent and may be updated if a business’s payment structures change. Payment terms cannot usually be changed after an invoice is delivered. It’s generally recommended to maintain consistent payment terms and accepted payment methods so customers know what to expect when they place an order with your business.

How to Choose Invoice Terms and Conditions

Assessing your business needs, customer reliability, and project demands can help you choose the best terms and conditions for a particular invoice.

Monitor Cash Flow

Setting the right payment terms can ensure your business receives cash when you need it. For example, if you’re regularly running short on cash at the end of the month, consider payment terms that specify payment on the 15th to provide smoother cash flow.

Consider Industry Standards

Most industries have payment terms that are commonly accepted. Aligning your terms with the industry standard ensures customers know what to expect from your invoice. Do some research to learn which payment terms are most common in your industry, then decide which of those aligns best with your needs.

Review Client History

While it’s generally recommended to maintain consistent payment terms, you may want to modify terms for certain customers. If a customer is regularly behind on payments, consider including stricter payment terms or late fees. Conversely, you may choose to offer discounts for reliable customers who always pay promptly.

Implement Late Fees and Interest Terms

Late fees and interest terms can motivate clients to pay on time and are also important in case you need to pursue legal recourse for late or unpaid invoices. Make sure to outline all payment terms, including how much interest to charge on overdue invoices, on your contract in addition to on the invoice.

Assess Invoice Size

Some projects incur a larger financial risk for small businesses, especially if the project requires a large amount of time and resources. On major projects with large invoices, you may want to consider payment terms that include a deposit or partial payment to minimize your financial risk.

14 Best Practices for Setting Clear Invoice Terms and Ensuring Timely Payments

Clear invoice wording and well-defined terms are essential for timely payments and smooth cash flow. Here are 14 best practices to help you set clear invoice terms and improve payment speed.

1. Automate Tasks

Automating tasks can streamline your invoicing process, ensuring timely payments and reducing manual errors. FreshBooks invoicing software allows you to automate key tasks that boost efficiency, such as generating professional invoices in minutes and sending automatic payment reminders. You can also take advantage of recurring invoice templates, which enable you to set up invoices for repeat clients once and have them sent automatically on a schedule.

2. Add Late Fees

Late fees are an important motivator to encourage clients to pay on time. Even if you expect the customer to adhere to payment terms, clearly outlining your late fees can provide a valuable legal recourse in the event of an unexpected delay.

3. Incentivize Early Payments

In addition to outlining the consequences of late payment, you can also choose to incentivize early payment with a flat rate or percentage discount for paying by a certain date. Offering a small discount for prompt payments can encourage punctuality and help improve your business’s cash flow.

4. Shorten Payment Periods

If you’re running into cash flow issues or noticing that clients are delaying payments until the last possible date, it may be an indication that you should shorten your payment period. Many businesses choose to switch from Net 60/90 to Net 30 to address this issue.

5. Offer Flexible Payment Methods

Offering multiple ways to pay makes it easier for customers to find a method that works for them. FreshBooks Payments lets customers pay online directly from their invoice with payment links for your business, making it a breeze to pay in minutes. Acceptable payment methods like online payment, credit card, and mobile payments offer extra flexibility.

6. Due Date

Make sure that you set a clear due date so clients know exactly when they have to pay. You may choose to outline an exact date—for example, the 15th or 30th of the month—or you may specify a certain number of days from the invoice date.

7. Set Specific Deadlines

In addition to the invoice due date, you can outline additional payment deadlines that may apply in case of late or non-payment. This can include the date on which interest or late payments apply, and the date after which legal recourse may be pursued.

8. Total Invoice Amount Due

Ensure that customers understand how much they owe by including the total invoice amount due. While it’s also important to include a breakdown of costs, concluding the invoice with a total amount due encourages customers to pay the full amount on time.

9. Be Flexible

Some flexibility is important when creating invoices so that customers feel they have a convenient and reasonable way to pay. One option for including flexibility is to offer multiple payment methods. This enables customers to choose the method that works best for them, reducing the likelihood of delayed payments.

10. Invoice as Early as Possible

Sending prompt invoices ensures that your work remains fresh in the customer’s mind. It also gives them time to review the invoice and address any concerns that may arise. Aim to send out your invoices immediately after work is done, ideally the day of the order, job, or delivery.

11. Make Payment Easy for Customers

Encourage customers to pay on time by making the process as easy as possible. Offer multiple payment methods, clearly state the total amount, and outline the due date and payment process. Make sure your contact information is readily available so customers can reach out with any questions.

12. Politely Word Your Invoice Payment Terms

Maintaining a positive relationship with your customers is essential to getting paid. Make sure all your payment terms are worded in polite and professional language. You may also choose to omit harsher terms like legal recourse dates and simply outline basic incentives and late fees.

13. Use Simple Language

Make payments easier for your customers by using simple, clear language. Be direct and to the point—specify the amount due, when they need to pay, and how they can pay. Avoid abbreviations and technical terms; instead, use complete language and common names for all payment terms.

14. Follow Up

Remember to follow up with customers and gently encourage them to pay. You may employ different follow–up reminders depending on the customer’s payment history. For example, a customer who regularly pays at the last minute may benefit from a reminder the week before the payment due date.

Use FreshBooks to Ensure Timely Payments

Creating effective invoices is essential to creating a positive customer experience and getting paid on time. Choosing the right payment terms and conditions helps improve cash flow, build strong customer relationships, and reduce the risk of late payment.

FreshBooks invoicing software offers an efficient way to create professional invoices for your small business. Browse invoice templates, customize your payment terms, send automated reminders, and let customers pay directly from their invoices. Try FreshBooks for free to discover how the right invoicing software can help you get paid and grow your business today.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Payment Approval Process: Everything About Invoice Approvals

Payment Approval Process: Everything About Invoice Approvals How to Accept International Payments: International Payment Methods

How to Accept International Payments: International Payment Methods Suing for Non-Payment of Services: How to Take Legal Action and Get Paid

Suing for Non-Payment of Services: How to Take Legal Action and Get Paid How Does Invoice Payment Work?

How Does Invoice Payment Work? Do You Send an Invoice Before or After Payment? Invoice Timing Explained

Do You Send an Invoice Before or After Payment? Invoice Timing Explained Invoice Payment Methods For Small Business: How to Get Paid Faster

Invoice Payment Methods For Small Business: How to Get Paid Faster