What Is a PayPal Invoice? And How Does It Work?

PayPal is a payment processor but it also has invoicing software! In this guide, learn how to use PayPal invoicing for your business.

PayPal is a powerful payment processor. It accepts international payments in a flash. It’s a worldwide household name. It supports many businesses large and small.

In today’s guide, we’re going to talk about their invoicing software. How does it work? Is it right for you? How can you start creating invoices on PayPal?

For the ultimate guide on PayPal invoicing, you’re in the right place!

Key Takeaways

- Along with being a powerful payment processor, PayPal is an effective invoicing tool you can use

- PayPal invoices are sent directly through the platform to your client’s email address using your computer or the mobile app

- With PayPal, you can create customized invoices and add notes, attachments, or conditions to your PayPal invoice to provide your client with all the info they need to know

- Easily save professional invoices as templates in your PayPal account for quick return-client billing

- Clients can pay you using a credit card, bank account, or PayPal balance, and in some countries, they can use PayPal credit

- PayPal accepts international payments, calculates exchange rates, and adds taxes and shipping for you

Here’s What We’ll Cover:

How Does a PayPal Invoice Work?

Benefits of Using PayPal Invoicing

Drawbacks of Using PayPal Invoices

How to Send an Invoice on PayPal Step-by-Step

What Is a PayPal Invoice?

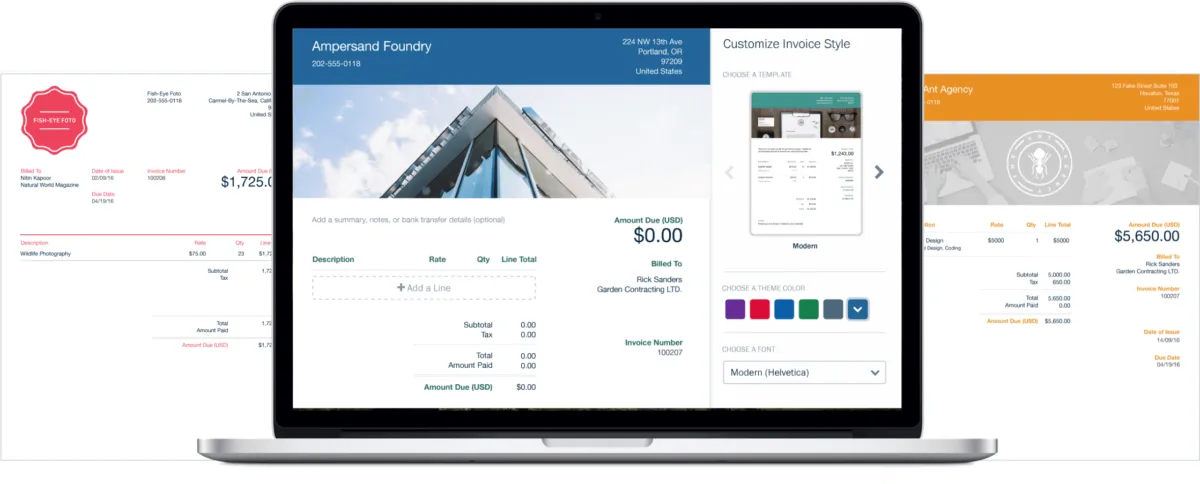

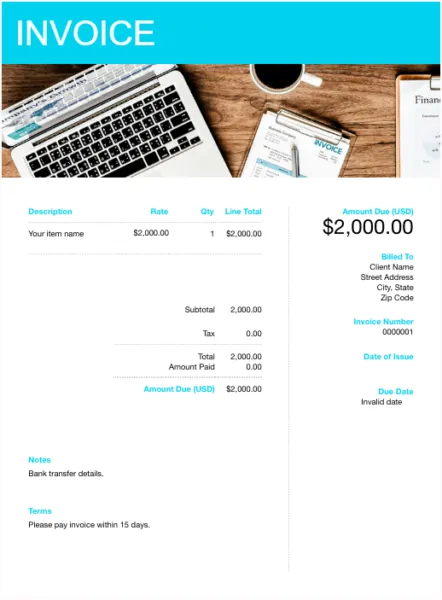

Paypal invoices are invoices sent via the PayPal platform. There are invoice templates on PayPal that you can use to start sending business invoices. The recipient will receive your invoice via email and can pay using PayPal.

If you receive payments primarily from PayPal, it’s not a bad option. If you receive payments from multiple sources like Stripe and bank transfers, PayPal won’t work well. You may be better off with broader accounting software that covers all bases.

Have questions about where to start when it comes to invoicing for your work? See the FreshBooks invoicing software product page to get started with invoice software that will keep you organized and get you paid on time, every time. Streamline your workflow with FreshBooks.

How does a PayPal Invoice Work?

After you have completed a job for a customer, the next step is to create an invoice so you can get paid. With PayPal, all you need to do is enter the customer’s email address and then add an item, the quantity, and the amount owed.

Paypal also allows you to add attachments, notes, and conditions where you may wish to add due dates or any other information your client needs to know.

To send the invoice in PayPal, click the Send button, and the invoice will arrive safely in your customer’s email inbox. From there, they will be able to pay you directly online from their bank account or credit card.

Need help creating a customized invoice template now but don’t know where to start? Try FreshBooks’ free invoice templates to save time and get paid faster. From Google Docs to PDF templates, we have just what you need to get started now. You can also check out our step-by-step guide on how to create an invoice in Google Docs so you can easily design your own template.

Benefits of Using PayPal Invoicing

- It’s quick and easy to send professional invoices.

- You can receive payments directly to your PayPal account.

- You can save invoices as templates. This is particularly useful if you frequently bill the same client. You can save an invoice template with their billing details. It will automatically populate every time you use the template.

- It calculates taxes and shipping reliably so you don’t have to.

- It’s much, much easier to use than an Excel spreadsheet.

- Your customer can use any payment method to pay you. They can use their bank account, credit card, or PayPal balance. In some countries, they can also use PayPal Credit.

- You can send invoices via the mobile app.

- You can create highly customized invoices.

Drawbacks of Using PayPal Invoices

- PayPal fees can be quite high. (However, you don’t get charged PayPal fees if you receive the money via another channel).

- It can be confusing to recipients who don’t habitually use PayPal.

- It isn’t a complete accounting software with tax projections and expense management. You will have to use other third-party apps for that. With FreshBooks, you can integrate your invoicing with the rest of your accounting! You can even accept payments through PayPal.

How to Send an Invoice on PayPal Step-by-Step

Step 1: Log into your PayPal business account.

Step 2: On your dashboard, your quick links may have an “invoicing” icon. Click that.

If you can’t see the “invoicing” icon on your quick links dashboard, you can find it on the top dropdown menu.

Step 3: Hover your mouse over “Pay & Get Paid”. Go to “Invoicing”. Click “Create & Manage invoices.”

Step 4: Click the blue button in the top right corner that says “Create Invoice”.

Step 5: Decide whether you want to use a template. As standard, PayPal has three different invoice templates available:

- Amounts Only – Work for invoicing products with no tax or quantity measurements. This is a very flexible template to use

- Quantity – Works well for products with sales tax and quantities

- Hours – Best for services that are billed per hour

You can customize any of the templates to suit whatever you’re invoicing for.

Step 6: Enter the customer’s email address. You can save their details for later if you want.

Step 7: Add your customer’s address using the link underneath the email address field. The link says “Add address”. This will take you to a mini window where you can enter the customer’s billing address, shipping address, telephone number, and tax IDs.

Step 8: If you are shipping a physical product, check “ship order”. Checking this box will allow you to add your shipping fees or rate. If you are not, you can uncheck this box.

Step 9: Enter the item details. This includes the item name, quantity, tax rate, and description. You can add as many details as you want.

Step 10: Enter a message to your customer. This could be billing information and payment terms. You could include your bank details if you don’t want them to pay you using PayPal. Or it could be a simple “Thank you”.

Step 11: Enter optional details if needed. PayPal allows you to attach pictures and PDF documents to your invoices. You can also add a “memo to self” which is an internal note that the customer can’t see.

Step 12: Now draw your attention to the right side of the screen where your invoice’s final details lie. This contains the calculations from your shipping rates and tax. You can insert a discount amount if you want to. You can also change the due date for the invoice. The default is “on receipt” but you can change this to any of the options on the dropdown menu.

Step 13: Check the final amount and invoice details. Underneath the full amount, there is the option to allow tipping or partial payments. Partial payments work well for deposits.

Step 14: Preview your invoice and send it. If you send via email, your customer will get an email notification. Alternatively, you can send invoice links in any way you choose.

Conclusion

The benefits of using PayPal for invoicing include having a variety of methods for accepting payments, easy-to-use, professional invoice template options, and secure online transactions that get you paid faster.

PayPal is a trusted online platform you can use to send customized invoices directly to your client’s email inbox, giving them the option to make a payment using their bank account, credit card, or PayPal balance. Whether your clients are locals or international, you can get paid instantly while keeping an easy digital record of all transactions to help you with your bookkeeping later.

For more guides on PayPal and invoicing, head to our payments section.

FAQs On What Is A Paypal Invoice

Is there a fee for using PayPal invoices?

Yes, PayPal charges a fee for using its invoicing service. The fee varies depending on the country and currency used for the transaction, but it is typically a percentage of the total transaction amount plus a fixed fee per transaction.

Is PayPal invoicing safe for the buyer?

Yes, all data sent through PayPal is encrypted with updated cyber security measures, meaning nobody will have access to the buyer’s information. As long as you use a secure internet connection, once the transaction has taken place, your credit card and bank account information is safe.

How do I get money from a PayPal invoice?

Your invoice will arrive in the buyer’s email, and they will make a secure digital payment that goes directly into your PayPal account. To receive the money into your bank account, simply go to the Wallet, and follow the withdrawal instructions. The funds will arrive safely in your linked bank account.

Does the PayPal invoicing service hold money?

Yes, sometimes PayPal holds money for up to 21 days. This can happen if the account has been inactive for a long time, if it’s a new account, or if there have been complaints or chargebacks. Holds may also be used if you are selling riskier items like tickets, computer components, or experiences.

Will PayPal refund me if I get scammed?

PayPal is not liable for issues caused by phishing scams or if your password or identity is stolen, but there are steps you can take to help you avoid losing money, like canceling pending payments, requesting a credit card chargeback, or filing a dispute with the seller within 180 days.

Did you find this article helpful? If so, you might be interested in our guide on How to Transfer Money from Bank Account to Paypal Instantly, where we explain the step-by-step process of transferring money.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How to Set Up a PayPal Business Account: 8 Steps

How to Set Up a PayPal Business Account: 8 Steps What Is eBank (Electronic banking)?

What Is eBank (Electronic banking)? IMPS Vs NEFT: What’s the Difference?

IMPS Vs NEFT: What’s the Difference? How to Confirm Bank Account on PayPal

How to Confirm Bank Account on PayPal The Best Way to Pay Off Mortgage Early: 5 Methods

The Best Way to Pay Off Mortgage Early: 5 Methods How FICA Tips Credit Works & Help Business

How FICA Tips Credit Works & Help Business