Payroll Cost: How to Calculate & Factors that Affect Payroll Cost

Your payroll costs are more than just employee wages; they also encompass taxes, benefits, and administrative fees. Paying employees on time is crucial to running your business, but so is managing expenses.

Small businesses must be especially mindful when it comes to saving money. Optimizing your payroll process with cost-saving methods like using payroll software or outsourcing to online providers can save you money.

In this article, we’ll go over how to calculate payroll services costs, the factors affecting the cost of payroll services, and some practical strategies small business owners can use to reduce expenses.

Key Takeaways

- Payroll costs are more than employee wages and also include employee benefits, taxes, and other forms of compensation.

- To calculate payroll costs, add the employee’s net pay to the total employer costs.

- Businesses can choose between doing their payroll in-house manually or with helpful payroll software, or outsourcing to online payroll providers.

- Factors that influence payroll costs include payroll frequency, the number of employees and where they’re located, employee benefits, direct deposit costs, and more.

- You can reduce payroll service costs by using the right plan, avoiding paying extra for unnecessary services, automating tasks, and implementing an all-in-one software to integrate accounting, invoicing, expense tracking, and payroll together.

Table of Contents

- What are Payroll Costs?

- How Do You Calculate Payroll Costs?

- How Much Does Payroll Cost for a Small Business?

- Factors Influencing Payroll Costs

- 5 Ways to Reduce the Cost of Your Payroll Service

- Cut Payroll Costs With FreshBooks’ All-In-One Solution

- FAQs on Payroll Cost

What Are Payroll Costs?

Payroll costs are all of the costs associated with paying your employees for their work. In the US, payroll expenses include employee gross wages, salaries, employee benefits like health insurance and vacation leave, and other compensatory obligations. It also includes FICA taxes, unemployment insurance contributions, and the employer-paid portion of payroll taxes. Depending on the type of business and the employee contract, bonuses, tips, or commissions may also be included in the cost of payroll per employee.

When you run a business, knowing all costs associated is essential for budgeting, and that includes understanding the full cost of payroll.

How Do You Calculate Payroll Costs?

The simplest way to calculate your payroll costs is to implement payroll software that can do it automatically. If you’d rather do it yourself, use the following steps to calculate the cost of your business’s payroll services manually:

1. Determine the gross wages

If the employee is paid hourly, multiply the number of hours worked by their hourly wage during a period, and if they’re on salary, determine how much they were paid by dividing their annual salary by the number of pay periods in a year.

2. Calculate Deductions and Taxes

Once you know the gross wage amount, you can determine how much money your business has to pay in deductions and taxes. FICA, income tax, FUTA, Social Security, Medicare, and other federal, state, and local taxes must be calculated to ensure compliance with tax regulations and obligations.

3. Calculate Net Pay

Consider factors like overtime pay, bonuses, and commissions, as well as deductions like health or dental insurance, 401K, IRA, cafeteria plans, etc., in your calculations.

4. Add These Amounts Together

To calculate the total payroll costs of an employee, add their net pay with the total employer costs using the following formula:

Employee Net Pay + Employer Costs (Social Security, Medicare Tax, Unemployment Taxes, etc.) = Total Payroll Cost

How Much Does Payroll Cost for Small Business?

In most cases, the true cost of payroll services is between 1.25 and 1.4 times their salary. You can reduce these expenses by finding a payroll service provider or payroll software that is affordable and practical for your business.

In-House Payroll

In-house payroll is when you or an employee processes the payroll for your organization, either manually, or using in-house resources. Some companies prefer to outsource payroll, as they feel they have better control over the process, and it offers better flexibility for teams that need to make changes quickly, as many outsourced payroll provider companies need the payroll submitted up to 5 days before payday.

Payroll management in-house is not always a way to save money, although it may seem like it is. Depending on the amount of work there is to do, you may end up paying more in administrative costs in the long run.

Payroll Software

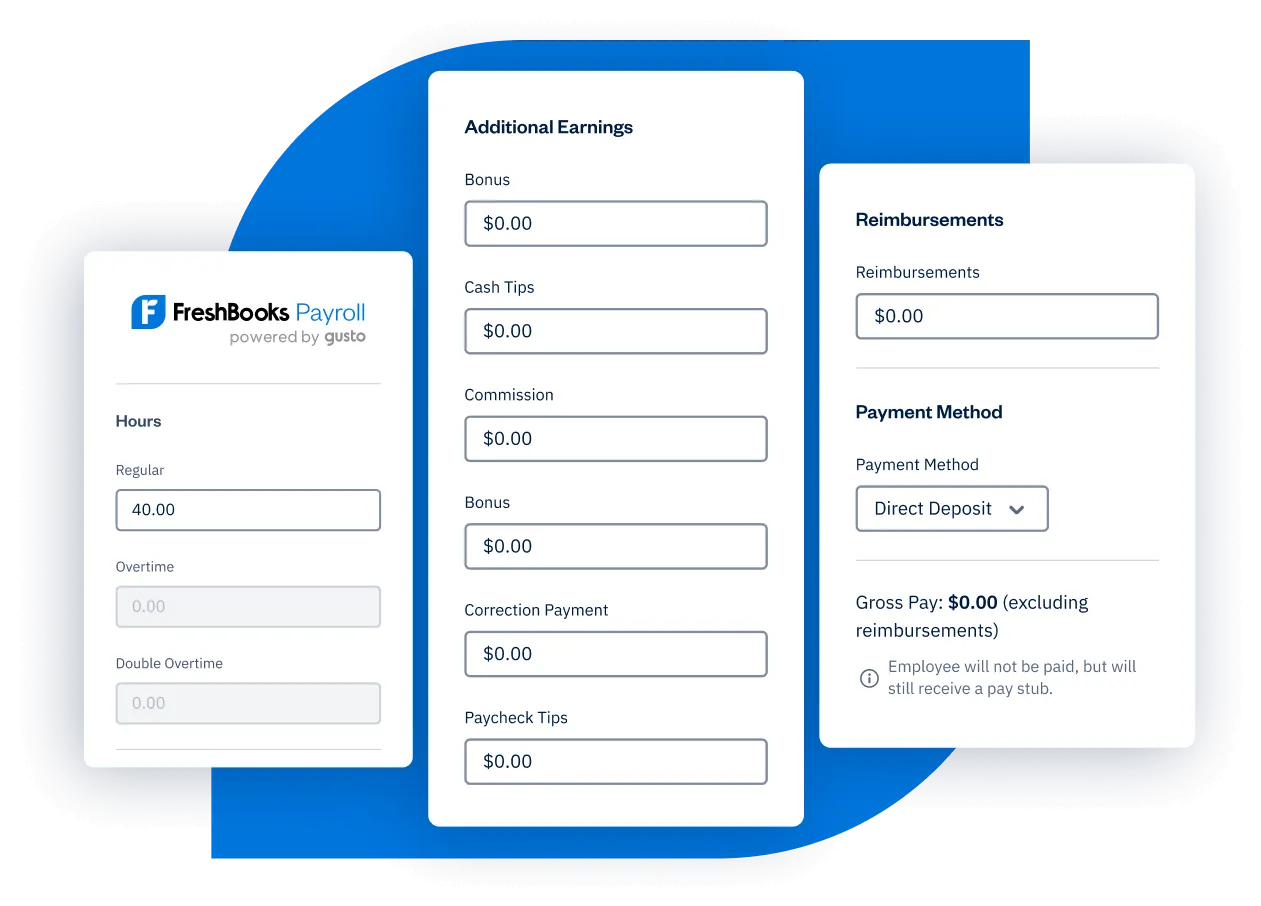

Payroll software is designed to work with your pre-existing business system, managing everything surrounding the process of paying your employees, including calculating wages, printing and delivering checks, and filing employment taxes.

Employers input relevant information like hours worked and wages; the software automatically does the rest. This saves time while keeping things organized, and ensuring your business remains in compliance with updated tax laws and local regulations.

One of the downsides of using it is that payroll software costs money, so it can be a big investment in the growth of your company. Businesses must also consider the security risks of using third-party software when processing and storing employee information and should implement strong passwords, firewalls, and antivirus protection.

Automated Payroll Software

Automated payroll software is easier to use than your standard payroll program, and reduces human intervention and errors. When you use a solution like FreshBooks Payroll powered by Gusto, you can automate everything from payroll tax calculations, to direct deposits, and tax filing, streamlining your workday with reliable accuracy.

Online Payroll Providers

Online payroll providers are web-based companies that handle payroll on behalf of businesses, allowing you to outsource the work to skilled professionals working outside of your company. This is a convenient solution for those who don’t have a dedicated payroll team, providing accurate payroll for as low as $40 per month (with an additional fee per employee), to thousands, depending on the size of your company and the scope of the work they’re doing for you.

Factors Influencing Payroll Costs

You might have difficulty managing payroll because of the number of factors in play. These include the following:

- Payroll Frequency: Some online payroll services charge you for each payroll cycle. Others offer unlimited runs every month and include your off-cycle runs. Be careful if you choose a payroll provider that charges for each payroll run, especially if you offer weekly paychecks. In most cases, the more frequently you pay your employees, the higher the cost of payroll.

- Number of Employees on Payroll: The total number of employees is another major factor in managing payroll, as many payroll service providers charge an additional set dollar amount per employee. This system is more affordable for larger companies since they usually qualify for a volume discount.

- Direct Deposit: In general, a monthly fee for a full-service payroll provider includes direct deposit to your workers’ bank accounts. Setup can cost extra, but your employees will appreciate the convenience this service offers.

- Employees in Multiple States: Payroll pricing can increase if your employees live in different states. The accounting system might be more complicated, which can make calculating payroll taxes harder. You may have to purchase more than a basic payroll service to get the nuanced analysis necessary for residents of various states.

- Tax Filing Services: Businesses need to pay different types of payroll taxes during each cycle. This includes state, local, and federal taxes. You must also pay your share of Medicare and Social Security taxes for each full-time employee, and there could also be state unemployment tax requirements, depending on where your business is located.

- Employee Benefits: If you’re a business owner who offers ample employee benefits, you need to consider them when managing payroll. They can be a significant additional cost. Many payroll providers include these perks, either in higher tiers or basic packages. The provider will do most of the work for you, but you should still pay attention to healthcare and compensation spending. Otherwise, you risk overpaying through additional fees.

- Adding or Dropping Employees: There are many tasks involved in proper payroll management. One of them is adding and terminating employees.

Whenever you change your payroll system, you also alter your tax data. So, payroll processing providers may charge fees when including or removing workers from the system.

5 Ways To Reduce the Cost of Your Payroll Service

The following are 5 actionable strategies you can employ to reduce your payroll services cost every year.

1. Select the Right Plan for Your Business

Browse different payroll services available to you and find one that aligns with your business size and needs. In many cases, several tiers will be available to you. It’s well worth researching each level to find the right plan for your business without overpaying for unnecessary services.

2. Automate Payroll Tasks to Save Time

By automating your payment processes, including tax filing and calculations, you’ll be able to reduce the amount of manual labor taking place in your company. This will increase your business’ efficiency and reduce costs.

3. Regularly Review and Compare Providers

It’s always good business practice to periodically evaluate processes to ensure they’re still working for you, including your payroll provider. Compare your current provider with other services to make sure you’re getting the best deal. By simply looking at other offers, you could save the company thousands a year.

4. Consider Using a Single Provider for Multiple Services

When you consolidate your services, like payroll, accounting, invoicing, etc., under one provider, you’ll likely save money on subscription fees and other costs, while streamlining management.

All-in-one software like FreshBooks integrates comprehensive tools to streamline your workflow, incorporating payroll, accounting tools, invoicing, expense tracking, and more on one reliable platform. This not only makes it easier to track your business finances but also saves you time, as you won’t be juggling multiple platforms and providers.

5. Minimize Errors to Avoid Additional Costs

Payroll errors can be costly, leading to expensive corrections and fines. It’s advisable to focus on accuracy and double-check your work, or use software to reduce errors and avoid unnecessary additional expenses.

Cut Payroll Costs with FreshBooks’ All-in-One Solution

Every business with employees has to deal with some sort of payroll solution to compensate them for their work. Various factors can affect the amount of money your company has to spend on payroll solutions, like the number of employees working with you, and whether you choose to implement software to streamline your business processes.

Using FreshBooks Payroll software can help you save time and money. It’s an all-in-one solution that not only simplifies payroll, but also integrates key functions like accounting, invoicing, and expense tracking. It’s easy to use, keeping your business’ payroll-related services in one place.

Ready to see what FreshBooks can do for you? Sign up for the trial period to try FreshBooks for free today.

FAQs on Payroll Cost

The following are some of the most frequently asked questions about payroll costs.

How much should payroll cost?

Payroll costs differ depending on the size of your company and other factors, but typically it’ll range from 1.25 to 1.4 times an employee’s salary.

What is the total payroll cost?

“Total payroll cost” is a term referring to the employee’s annual pay, along with payroll taxes, and any other expenses that would be paid by the organization on their behalf, like benefits, insurance, retirement contribution match, etc.

Can I do payroll myself?

Yes, it’s possible to do payroll yourself, although it’s much easier to do so using payroll software. FreshBooks Payroll can help you avoid errors while keeping you organized and compliant with updated tax regulations.

What is standard costing payroll?

The term “standard costing payroll” refers to the expected cost of an employee to a company, including taxes, benefits, and other costs. It’s crucial to understand that the cost of an employee is more than just their salary or wage.

What is the fully loaded employee cost?

“Fully loaded employee cost” is a term describing the total cost of hiring an employee, like federal and state taxes, the cost of job posting and training, as well as all the benefits your company provides.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How to Do Payroll Yourself for Small Business

How to Do Payroll Yourself for Small Business Payroll Accounting: Definition, Importance & Setup Process

Payroll Accounting: Definition, Importance & Setup Process What is a Payroll Card & How Do They Work?

What is a Payroll Card & How Do They Work? Back Pay: Definition, Process & Best Practices

Back Pay: Definition, Process & Best Practices Payroll Taxes: What Are They & How to Calculate Them

Payroll Taxes: What Are They & How to Calculate Them How To Pay Independent Contractors In 2025

How To Pay Independent Contractors In 2025