8 Best Payroll Software for Restaurants in 2024

The restaurant industry is a unique field, with many moving parts. Choosing the right restaurant payroll software for your business means finding an option that’ll effectively help you pay your employees accurately and on time, handle tips, and ensure you’re in compliance with your local tax and labor laws.

In this article, we’ll review 8 of the most popular payroll software options on the market today, highlighting their pros and cons, with guidance on how to choose the right payroll software for your needs.

Table of Contents

- FreshBooks Payroll

- QuickBooks Payroll

- Paychex Flex

- SurePayroll

- OnPay

- Patriot Payroll Software

- ADP RUN

- How to Choose Payroll for Restaurants

- Effortless Restaurant Payroll Management With FreshBooks Payroll

- Frequently Asked Questions

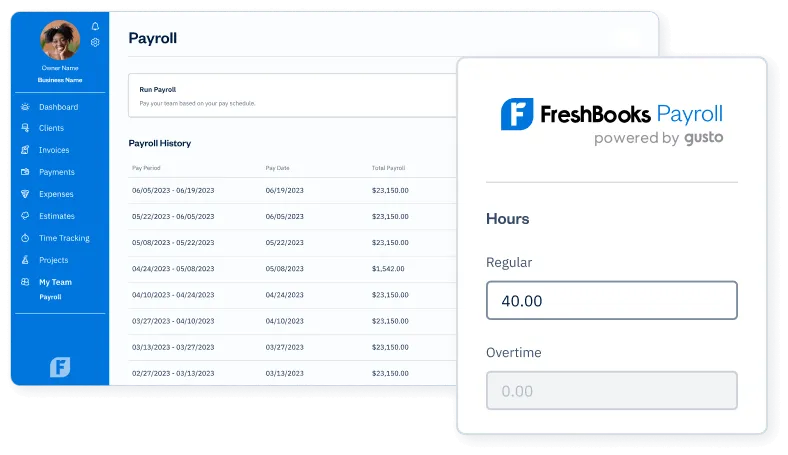

FreshBooks Payroll

FreshBooks Payroll powered by Gusto, offers automatic federal government tax filings and payments, HR tools, a payroll schedule, and much more.

It is designed to pay W-2 employees and 1099 contractors, run regular payroll on a weekly, bi-weekly, or monthly basis, and process payroll, including a 4-day ACH direct deposit speed. It also integrates with Square Payroll and other top restaurant accounting software programs, including SurePayroll, for accurate books and easy automated payroll processing during a set pay period.

FreshBooks is a cloud-based accounting program with the best overall payroll software, offered as an easy add-on feature to small business owners with a FreshBooks account. It delivers powerful invoicing and project management features, making it simple to integrate payroll into your workflow.

Along with streamlining financial processes, this easy-to-use software will file and pay all payroll taxes automatically, and ensure you’re maintaining labor compliance.

With FreshBooks, you’ll have the option to create and send unlimited invoices, accept online payments, and manage your restaurant employees and clients. Other robust features include double-entry accounting, mobile payroll, and more.

FreshBooks is the most popular payroll software because it’s relatively easy to set up and takes only a few minutes to start. Additionally, its award-winning customer support comprises a team of highly knowledgeable staff dedicated to resolving your queries.

Pros

- Robust payroll services including direct deposit and automatic filing for payroll taxes

- Includes unlimited invoicing

- Includes a mobile app and accounting

- A free trial is available for approved clients

- Offers better customer service than most payroll providers offer

- Provides smooth integration with several top accounting software programs

- Seamlessly integrates with FreshBooks’ own accounting software, offering an all-in-one solution in a single plan

QuickBooks Payroll

QuickBooks Payroll delivers full-service payroll, next-day direct deposit, automatic tax filing, and several HR functions. This software is ideal if you’re considering moving to a reliable accounting solution with payroll integration. It’s generally user-friendly, but you’ll need basic knowledge of running payroll. The payroll pricing is suitable for small businesses as you can process unlimited payroll runs, including tips, without paying extra.

QuickBooks has several plan options, all delivering full-service processing for paying your taxes and tipped employees. It offers many other helpful features, including the option to add time tracking and access to HR specialists if and when required—all for a cost-effective rate compared to other payroll system providers.

QuickBooks is relatively inexpensive for its offerings. However, it might not be a good fit if you need more straightforward and cheaper payroll software.

Pros

- Seamless integration with other QuickBooks Intuit products including QuickBooks accounting software

- Same and next-day deposits

- Robust tax penalty protection

- How-to guides and videos

Cons

- Only basic HR features

- Inconsistent customer support quality

Paychex Flex

Paychex Flex is cloud-based automated payroll processing software that grows as your business does. It’s designed to help small enterprises manage payroll and HR processes, employee benefits, and more. It’s ideal if your business is in a rapid growth phase, as it offers easy, scalable, and flexible plans to accommodate your growing payroll processing requirements.

Paychex is one of the best restaurant industry payroll software platforms for restaurants of all sizes. It is robust enough to manage their specific needs, including tip reporting and multiple pay rates. The time and attendance add-on tracks the time of your hourly employees for accurate payments.

Paychex also supports payroll and tax processing, plus compliance in several States, which is ideal if you need to pay employees in different regions.

Pros

- Multiple employee payment options

- 24/7 dedicated payroll specialist support

- Reasonably priced starter tier

- Easy setup with online wizard guidance

Cons

- It can get expensive due to add-ons

- Customer support can be hit-or-miss

SurePayroll

SurePayroll offers inexpensive online payroll management software, including year-end reporting, automatic tax filing, and payments, and the option to handle tax filings yourself. It provides restaurant owners access to employee subsidies, HR forms, and an HR advisor.

SurePayroll is easy to set up, learn, and use. It has flexible tools to manage the wage-processing requirements of small businesses, including restaurants. It helps restaurant business owners resourcefully manage the particulars of handling multiple pay schedules, minimum wage, tip credit, and employee tips.

SurePayroll pricing is relatively affordable; however, if your restaurant is located in Ohio or Pennsylvania, SurePayroll will charge extra for local payroll tax filings due to having more complex tax jurisdictions.

The monthly fees for add-ons may become pricey depending on the add-ons you choose.

Pros

- Affordability

- Intuitive dashboard

- Tax calculation and penalty tax filing guarantees

- Free setup assistance

Cons

- Lengthy customer support waiting times

OnPay

OnPay offers a suite of user-friendly HR payroll processing and benefits solutions for small to midsize businesses in several industries, including restaurants.

It is cloud-based and allows you to finalize payroll for salaried employees, tipped employees, and contractors. Its essential tools include managing paid time off, minimum wage, and employee information.

OnPay is excellent for human resource payroll with HR-focused tools, including tools for employee offer letters, Social Security and Medicare, and benefits administration.

Overall, it’s considered a flexible and comprehensive payroll software program that’s affordable and easy to use. However, it doesn’t cater to varying business needs with multiple plan tiers.

Pros

- Efficient payroll management for businesses with fewer than 50 employees

- Filing of tax forms at no extra cost

- Budget-friendly fees

- Intuitive and feature-rich

Cons

- Doesn’t offer different-tier plans

Patriot Payroll Software

Patriot Payroll software is one of the top online payroll systems if you’re looking for an inexpensive way to process payroll quickly. It offers automated payroll, contractor payments, expert support, payroll setup, and more. Its basic and full-service payroll options make it a reasonably priced restaurant payroll software solution.

Patriot has affordable plans, including an economical option for DIY payroll tax filings if you prefer. The full-service plan is where the software submits reports and payroll tax deposits for you. Patriot’s paid add-ons include HR tools, time tracking, and an accounting solution.

Setting up Patriot is simple, with a setup wizard and Patriot representatives to walk you through the process. If you start using Patriot Payroll software in the middle of the month or quarter, you’ll receive help recording your employees’ payroll history, whether they are tipped employees or management staff.

Pros

- Economical pricing with multiple payroll packages

- U.S.-based expert customer support

- User-friendly platform

- Easy payroll runs

- Mobile-responsive

Cons

- Limited third-party software integrations

- No basic HR tools

ADP RUN

ADP RUN is a cloud-based restaurant payroll software and HR system to support restaurant managers in processing payroll, taxes, basic hiring and onboarding, job postings, and more. It provides expert HR support for professional services to help you better manage your staff and navigate complicated HR issues. In addition, it offers access to basic employee training programs and many other features that other payroll systems don’t provide.

Running your payroll with ADP RUN can take several steps, but overall, the software is straightforward to use. You should be able to set up your business in less than 20 minutes. If you have a lot of data to migrate into ADP, the system will assist you.

ADP RUN payroll software is not the cheapest option and would better suit a restaurant with up to 49 employees and a relaxed budget.

Pros

- Simplified payroll processes

- State-specific HR help desk support

- Integration with several popular accounting solutions

- Built-in compliance tools to flag potential errors

- Employee payments with pay card, direct deposit, or checks

Cons

- A setup fee is required, although it may be waived

- Prices may go up in the second year

How To Choose Payroll For Restaurants

There are several factors to look at when choosing payroll software for your restaurant business, like:

- Cost: Your payroll software should be affordable. Be sure to look into both the monthly subscription fees, whether the software charges per employee, or if there are other fees to consider.

- Software flexibility: Software that allows you and your team to make changes to better suit your processes will give you more control as you run your business.

- Tax payment options: A software that stays up to date on tax regulations and automatically pays your federal and state taxes will keep you compliant and worry-free. This feature is especially useful if you have employees across the country, or working internationally.

- User experience: A mobile app, unlimited payroll processing, accurate reporting, and employee self-service portals are all convenient features that make running your business easier. The more user-friendly the system is, the quicker you can get started.

- Customer support: Connecting with a customer service representative quickly is essential when you have a question or need help.

- Ease of integration: Choosing payroll software that works seamlessly with your pre-existing accounting software will keep things simple.

Effortless Restaurant Payroll Management with FreshBooks Payroll

Your restaurant business needs payroll software that can provide consistent, accurate payroll for tipped employees with hourly employee wages and 1099 contractors, with accurate tax calculations and unlimited payroll runs.

FreshBooks remains a top choice for restaurant payroll management because it offers robust online payroll services while integrating with other accounting solutions. It’s the best payroll system for small business owners searching for a comprehensive financial management solution.

Try FreshBooks Payroll software today for streamlined payroll and accounting, or sign up to try FreshBooks for free to see what else FreshBooks can offer you.

FAQs on Restaurant Payroll Software

To learn more about the best restaurant payroll software features and more, please see the following frequently asked questions.

What should payroll be for a restaurant?

Restaurant labor costs range from 25% to 35% of the average restaurant’s overall costs. A restaurant must pay the state minimum wage 1 , with some states enforcing a much lower hourly rate for tipped employees than for general employees. Check your local laws when doing payroll calculations to ensure compliance.

How do you calculate restaurant payroll?

Restaurant payroll is easier to calculate when dealing with an hourly calculation. The formula is hours worked multiplied by the rate for that position.

35 hours in a week X $10/hour = $350

Article Sources:

- U.S. Department of Labor. “Minimum Wages for Tipped Employees” Accessed Aug 23, 2024.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Payroll for Churches: Top 7 Payroll Software for Churches

Payroll for Churches: Top 7 Payroll Software for Churches Section 125 (Or Cafeteria) Plan: Types and Benefits

Section 125 (Or Cafeteria) Plan: Types and Benefits Top 8 Payroll Software for Accountants

Top 8 Payroll Software for Accountants Wage Garnishment: What It Is & How It Works?

Wage Garnishment: What It Is & How It Works? What Is COBRA Insurance? Process, Pros & Cons

What Is COBRA Insurance? Process, Pros & Cons Bonus Pay: Definition, Types & Tips for Earning Bonus

Bonus Pay: Definition, Types & Tips for Earning Bonus