How to Prepare Financial Statements for Small Businesses

Information is power—as long as you can make sense of that information. As a business owner, you’ll want to track your financial progress to make informed business decisions about your future. And that involves understanding cash flows, operating expenses, and net profit, all found in your financial statements.

Even if you delegate the bookkeeping to a professional, and don’t prepare financial statements yourself, you’ll need to know what your CPA is talking about when they walk you through your balance sheet.

In this article, you’ll learn everything you need to know about preparing financial statements for your business, including examples of income statements, balance sheets, and cash flow statements, as well as tips on creating them, interpreting them, and putting them to use for your business. Let’s take a look.

Key Takeaways

- The process of preparing financial statements is broken down into 5 steps: compiling financial data, categorizing it, entering the data onto preliminary statements, reviewing all data, and finalizing the statements.

- Income statements are the first report you’ll need to prepare—they show the company’s revenue, expenses, and net profit or loss.

- Another important statement is the balance sheet, which shows your assets, liabilities, and total equity.

- The third essential financial report is your cash flow statement, which shows your cash inflow and outflow in the categories of operations, investing, and financing.

- Accounting software is an invaluable tool for saving time and ensuring accuracy when preparing financial reports.

Table of Contents

- 5 Easy Steps to Prepare Financial Statements

- Income Statement (Profit and Loss Statement)

- Balance Sheet

- Cash Flow Statement

- Use FreshBooks for Accurate Small Business Financial Statements

- Frequently Asked Questions

5 Easy Steps to Prepare Financial Statements

To start making the most of your financial statements, you’ll need to learn how to collect and organize your financial data and compile them into useful statements. These finalized reports are used to look at the company’s cash flow, financial health, and overall performance.

Step 1: Compile all Important Financial Data

The first step is to gather all your financial data from various sources, including receipts, sales invoices, bank statements, and expense reports. This is essential, since all this information makes up the foundation of your financial statements, eventually helping you look at the company’s performance overall.

Manually gathering all this information is a tedious, time-consuming process. However, the right accounting software can help you automate tasks like recording invoice payments and totaling expenses from receipts, saving time and ensuring accuracy.

Step 2: Organize Your Accounts

With your data collected, it’s time to organize it into categories like expenses, revenue, assets, liabilities, and so on. With well-organized data, it will be much easier to create future reports, quickly prepare and file your taxes, and ensure your reporting is accurate and useful. Your accounting software should make it easier to categorize each piece of data as you input it, saving you more time and reducing the chance of a mistake.

Step 3: Prepare Preliminary Financial Statements

Now that your data is organized, you’ll begin creating three initial statements: Your income statement, balance sheet, and cash flow statement. Even though these won’t be your final reports, they’re still invaluable for evaluating the company’s financial help and will be a key part of making future business decisions. That’s why it’s essential that you take your time with the first two steps, ensuring accurate data throughout the process. We’ll cover the steps to create each type of statement in detail further down in this article.

Step 4: Review and Adjust

To confirm the information in your preliminary reports, you’ll need to review it against your records and perform reconciliations utilizing bank statements and other third-party documents. This is also the time to confirm your math was correct (if you did it manually instead of automating calculations with accounting software) and double-check that your figures for taxes and debt are right.

Step 5: Finalize and Report

Now, it’s time to finalize the reports. For larger businesses, this might involve having them audited by a third-party accountant to ensure accuracy, or it might just mean others in the company sign off on them. In any case, your reports are now considered finalized and can be used to show your company’s performance to stakeholders, potential investors, and lenders. Keep in mind that having a formal audit of your financial statements provides an unbiased assurance of the accuracy of the information presented.

Now that you’ve learned the general steps to create a financial report, we can focus on the three main kinds of statements in detail, explaining how to create them accurately and efficiently to gain greater insight. Let’s look at how to generate income statements, balance sheets, and cash flow statements.

Income Statement (Profit and Loss Statement)

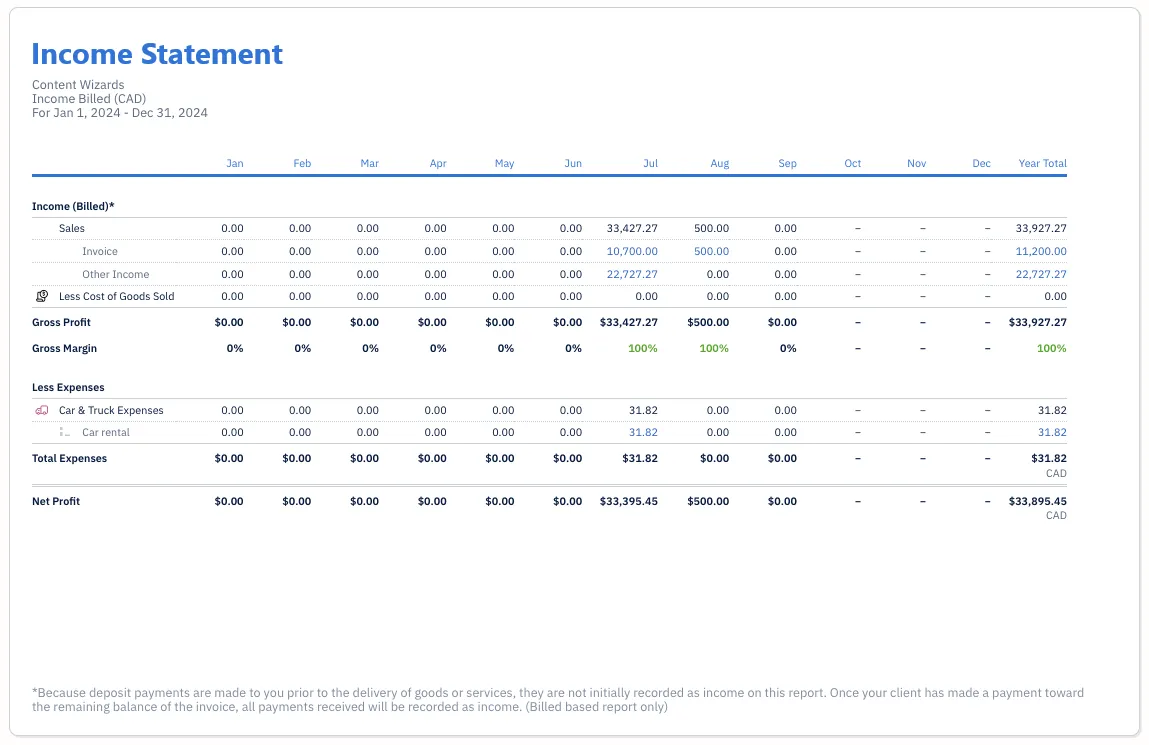

An income statement shows a company’s financial performance by revealing whether it’s made a profit or a loss during a period of time.

Without an income statement, you’d be in the dark about the profitability of your business. An income statement is also known as a profit and loss statement, profit and loss account, or P&L.

The reporting period for an income statement is typically one fiscal year.

What Goes on an Income Statement?

An income statement should show all income earned by the company (revenue), costs incurred while earning that revenue (expenses), and the difference between revenue and expenses (net profit or loss).

In most cases, it will look something like this:

Now, let’s dig into what an income statement covers.

Revenues (or Sales)

This is the top line on your income statement. It’s the total amount for the year of all the things or services you sold. But if you’ve given any discounts, you’ll reduce your sales by the discount amount.

For example, if you sold $100 in t-shirts but offered a 10% discount as a Black Friday incentive, you would record $90 as your net sales amount.

Cost of Goods Sold (or Cost of Sales)

These are the expenses directly related to the sales you’ve made. Suppose you’re selling electronics. The cost of goods sold is the cost of the electronics you sell within a financial year. And this is important. It’s not the cost of the electronics you bought in the year, as this is considered inventory.

In a service-related business, a consultancy, for example, the cost of sales is often termed direct costs. Hence, you’ll include costs directly related to your service.

Gross Profit

Gross profit is the profit that results directly and specifically from the trading activity of buying and selling. You calculate the gross profit by subtracting the cost of goods sold from revenues.

Selling, General, and Administrative Expenses

All other expenses like salaries, rent, or travel merely facilitate the main trading activity of your business and are often categorized under selling, general, or administrative (SG&A) expenses.

You can have as many categories of SG&A expense as is necessary and helpful for running your business. Some of the common ones are:

- Office supplies

- Salaries and wages

- Insurance

- Rent

- Marketing and advertising

- Utilities

Operating Income

Next is operating income. As the name implies, it’s the profit your business has earned from its operations when considering all the revenue and expenses necessary to run your business.

Finance Costs

Finance costs represent the costs of financing arrangements, such as interest on bank loans. You’ll want to strip financing costs away from SG&A expenses because they don’t represent the costs necessary for producing the goods or services you sell.

Net Income

After factoring in finance costs, you’re left with net income (or net loss). This is the much-talked-about bottom line. Your net income is how much your company has earned throughout the year.

If you’re looking for a way to simplify income statement generation, check out the FreshBooks income statement template. This ready-made document guides you through the process effortlessly, making it much simpler to create an accurate income statement.

What About Income Taxes?

You may ask yourself, why didn’t we include taxes? A small business isn’t burdened with income tax unless it’s structured as a C-corporation (which few small businesses are due to their complexity and maintenance costs). Instead, the business profits pass through to the owner and get taxed on the individual Form 1040.

Balance Sheet

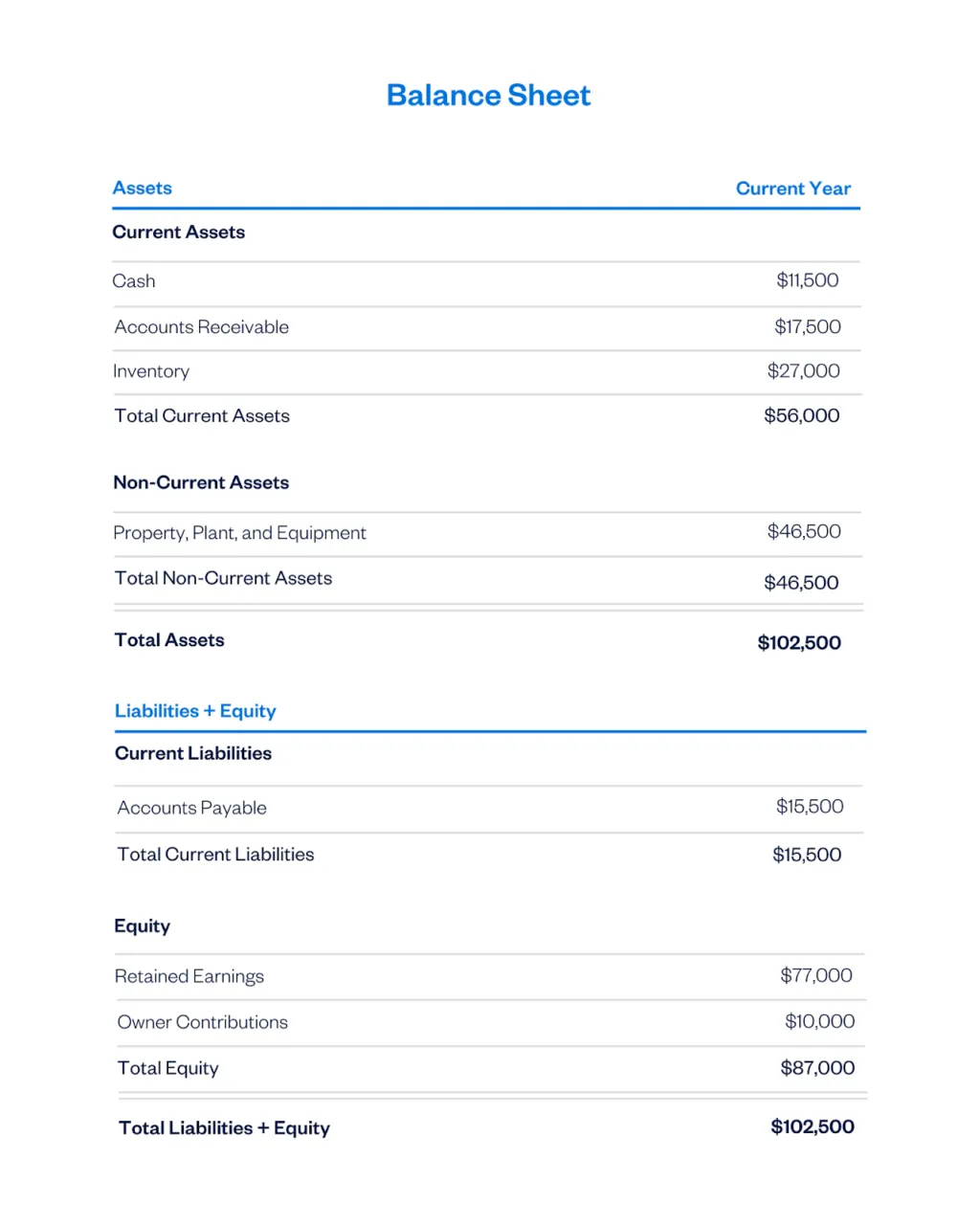

Also known as the statement of financial position, the balance is an organization’s most important financial report because it shows the company’s financial health.

A balance sheet reports data for a specific point in time, often the last day of a fiscal year.

What Goes on a Balance Sheet?

Balance sheets contain 3 sections: assets, liabilities, and equity.

1. Assets

These are the resources your company owns that have a current or future economic value. This may include items such as cash, equipment (e.g., computers), inventory, and vehicles.

Assets can be broken down into:

- Current assets: This is anything you own that can be converted to cash within one year (e.g., accounts receivable and inventory). Also called short-term assets.

- Non-current assets: These are assets that can’t be quickly converted into cash, like computers, equipment, and vehicles, or intangible assets, like trademarks and copyrights. Also called fixed assets or long-term assets.

2. Business Liabilities

These are amounts your business owes other entities such as banks, employees, and suppliers.

- Liabilities can be broken down into:

- Current liabilities: Amounts you owe that are due within one year (e.g., accounts payable and payroll liabilities)

- Non-current (long-term) liabilities: Debts that will be repaid in more than one year

3. Owner Equity or Shareholder Equity

This is the value of the owner’s or shareholders’ investment in the business after liabilities are subtracted from assets. It may also be called owner’s or shareholders’ capital.

Purpose of a Balance Sheet

The balance sheet shows anyone what your business is worth. Lenders, investors, partners, and potential buyers will want to review your balance sheet.

The overall worth of your business can be measured or estimated by the total value of its assets, which are recorded and presented on the balance sheet.

But even more important, your balance sheet shows your business’s net worth, which is the owner’s equity (or shareholder’s equity). This is a business’s residual value after removing its liabilities. It’s what ultimately belongs to the business owner.

Format of a Balance Sheet

Balance sheets are prepared based on the accounting equation, which is:

Traditionally, before accounting software was developed and bookkeeping was done with pencil and paper, assets were put on the left side of the balance sheet, while equity and liabilities went to the right side.

Today, however, a balance sheet will almost always look like this:

Now here’s something to remember.

The net income (your income statement bottom line) is annually transferred to your balance sheet, where it will appear as retained earnings. So retained earnings are a running total of your company’s profitability from day 1.

Ready to simplify the process of making a balance sheet? FreshBooks can help with our ready-made balance sheet template. This document makes it much easier to report, organize, and format your financial data, saving you time and reducing the risk of errors.

Difference Between an Income Statement and a Balance Sheet

If you want to know how your business has performed over a span of time (a year, month, or quarter), you’ll want to refer to your income statement.

On the flip side, if you want to know your business’s financial health, to know its value or worth at a particular point since it was established, the balance sheet is the report you’ll want to refer to.

Cash Flow Statement

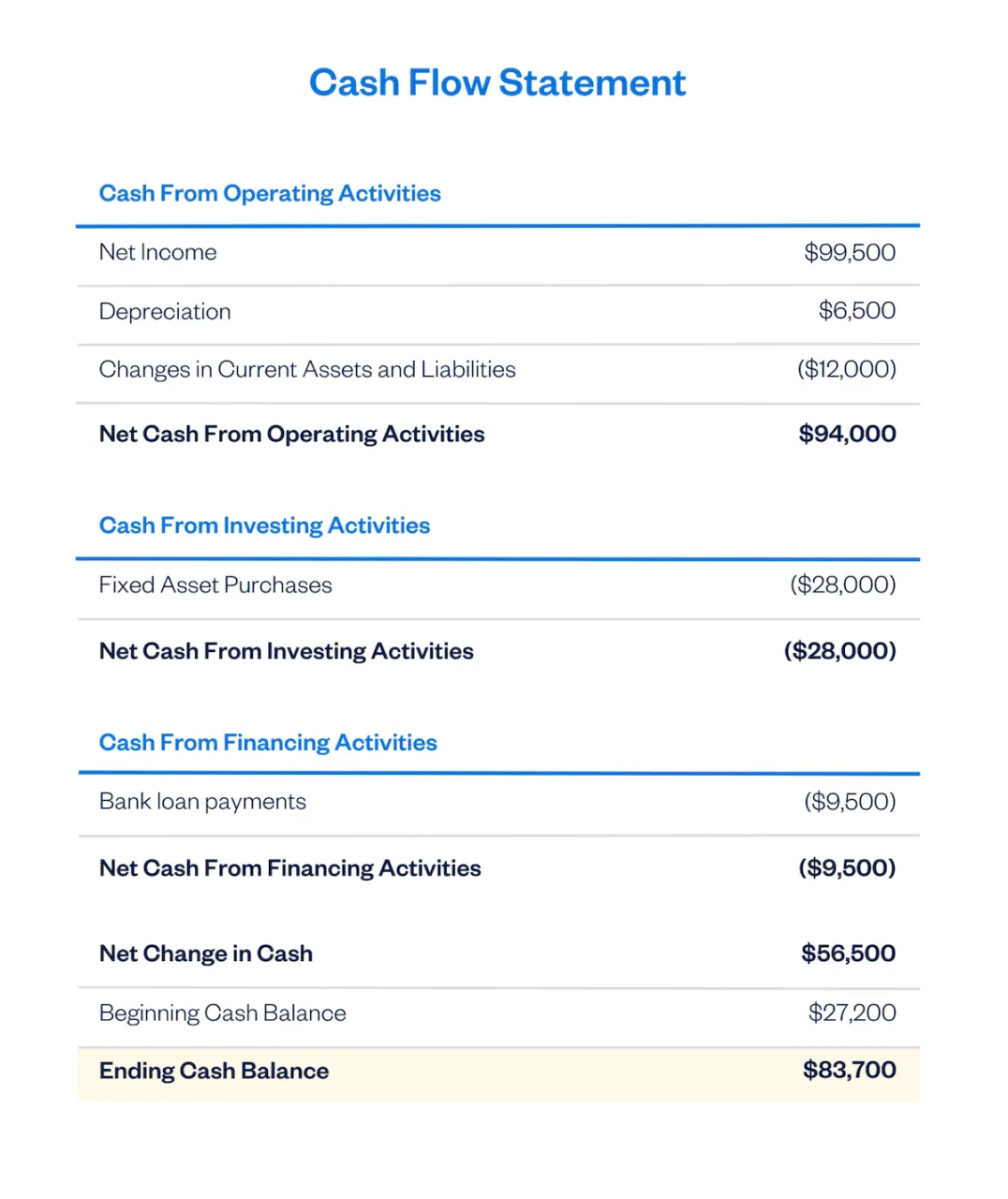

A cash flow statement shows the movement of cash, the cash inflows and outflows within the business, based on 3 cash sources and cash expenditure categories: operations, investing, and financing.

This is an extremely important financial statement because, ultimately, cash is the best indicator of the financial health of an enterprise.

The reporting period for a cash flow statement is often one fiscal year but could be a quarter, month, or any reporting period that makes sense for your business.

Why Do You Need a Cash Flow Statement?

You already have an income statement that shows you the profits you’ve made. Why do you still need a cash flow statement?

An income statement is prepared based on the accrual method of accounting. This means your sales are recorded when you earn them, not when your business receives the actual cash.

This creates a timing difference. A sales amount of $10,000 on your income statement, for example, doesn’t always mean this amount is in your bank account. It may be an invoice you sent to your customer, and you’re still awaiting payment.

The same goes for expenses. In accrual-basis accounting, expenses are recorded when your business incurs them and not when you pay out the cash.

But what about the cash figure on the balance sheet? While the balance sheet captures the cash balance, which can be meaningful, this balance sheet figure doesn’t tell us the source of the cash.

The cash could be from a windfall, like an insurance claim, which is a one-time event and unsustainable. Or it could be from normal day-to-day business operations, which are more sustainable.

Sections of a Cash Flow Statement

A cash flow statement has 3 sections:

- Cash from operations (or from operating activities)

- Cash from investing activities

- Cash from financing activities

And this is what a typical cash flow statement looks like:

Cash From Operating Activities

Cash from operations is the first section of a cash flow statement, revealing its relative importance in the cash flow statement hierarchy. Cash from operating activities is the most meaningful because this is cash from your day-to-day trading activities.

These include cash received from sales, set off against cash expenses like the cost of goods sold, utility expenses, and rent.

It also takes into account non-cash items, like depreciation, that are included in net income but don’t involve any actual cash movement. And it considers any changes in your assets and liabilities during the time period, like an increase in accounts receivable.

Since operating activities are the mainstay of a business, a company with positive cash flow from operating activities will be more sustainable.

Cash From Investing Activities

The main source and use of cash from investing activities are purchasing and selling fixed assets. Common examples of fixed asset items are things like buildings, vehicles, computer equipment, or machinery.

But other investment items can appear in the investing activity section, such as buying stocks and bonds for investment purposes.

Cash From Financing Activities

All cash inflows and outflows from financing activities will be captured in this last section of cash flow statements.

If you’ve taken out a bank loan to purchase equipment, the cash the bank provided you will show up in this section. And when you begin making loan payments, these will be included here. To learn more about this follow our guide on Loan Repayment Entry, which provides you with the right steps.

Use FreshBooks for Accurate Small Business Financial Statements

Accurate financial statements are essential for small businesses. Thin margins mean every dollar counts, which means every dollar must be counted. At the same time, the process of manually making financial statements is so time-consuming that it can prevent small companies from really focusing on their businesses. That’s why so many businesses turn to financial reporting software like FreshBooks to help.

FreshBooks automates large parts of the financial reporting process, saving countless hours and preventing costly errors. With built-in reporting tools, you can generate virtually any financial statement in just a few clicks, and our easy-to-use templates guide you through the process of entering financial data with ease. Overall, this tool is perfect for small businesses looking to improve their financial reporting without needing to pay a professional accountant, saving time, money, and stress in the process. Try FreshBooks for free!

FAQs about Financial Statement Preparation

Still have questions about preparing financial statements? Get the answers you’re looking for with these frequently asked questions.

In what order are the financial statements generally prepared?

The order of financial statement preparation is generally: Income statement, then the balance sheet, and finally, the cash flow statement. Businesses start with the income statement because it shows all revenue and expense information needed for the other reports.

Can a non-CPA prepare financial statements?

Yes, a non-CPA can prepare financial statements using a few financial frameworks, including FRF (Financial Reporting Framework), tax, cash, and generally accepted accounting principles (GAAP) bases of accounting.

Who is required to prepare financial statements?

Corporations, non-profits, and public bodies are often legally required to submit financial statements that have been audited by an external accountant. Additionally, you may need to prepare financial statements for financing partners, investors, insurance companies, tax authorities, and more.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How Long Do IRS Audits Take?

How Long Do IRS Audits Take? Examples of Itemized Deductions

Examples of Itemized Deductions How Long Do You Tax Preparers Have to Keep Records?

How Long Do You Tax Preparers Have to Keep Records? How Long Does It Take To File Taxes

How Long Does It Take To File Taxes What Does Your Accountant Need to Do Your Taxes?

What Does Your Accountant Need to Do Your Taxes? Closing the Books: Basics & 8 Steps Guide

Closing the Books: Basics & 8 Steps Guide