12 Legal Requirements for Starting a Small Business

When starting a new business venture, small business owners and entrepreneurs should comply with all the legal requirements for starting a small business. New businesses and startups have various legal obligations, including financial regulations, tax obligations, and employment laws. Ensure your new company complies with all its legal responsibilities so you can focus on growing your business.

Key Takeaways

- Registration is essential for legally running your business operations.

- Choose a clear and memorable business name and register it through the IRS before you begin operating, so you can separate your business from your personal name.

- Keeping detailed accounts of your registrations and transactions helps you comply with tax laws, keep track of what stage you’re at in registering your business, and enables you to manage any renewals for names and trademarks.

- Research what type of business setup is right for your company, and learn your local business and labor laws to protect yourself from liabilities and keep your employees safe.

Here’s what we’ll cover:

What Are the Legal Requirements for Starting a Business?

Can I Start a Business Without Registering It?

What Are the Legal Requirements for Starting a Business?

You may have a terrific business idea, but to get your startup off the ground, you first have to make sure you comply with all the legal requirements involved as a business owner. Here’s an easy-to-follow guide for starting your business legally:

1. Create an LLC or Corporation

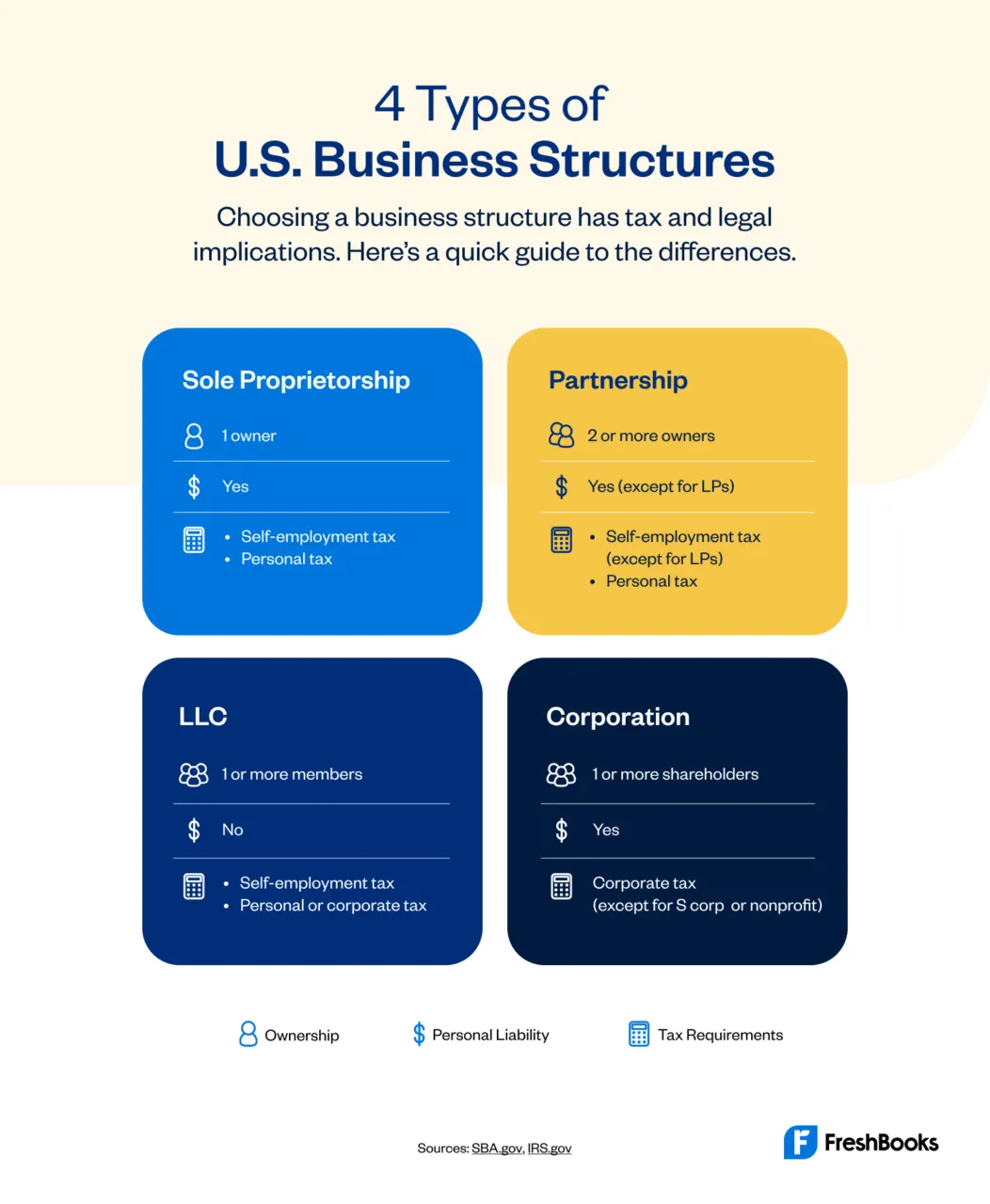

The first legal requirement you’ll need to meet as a new business owner is to choose your company’s business structure. The following four business structures are the most common and will offer different advantages depending on the size and aims of your company:

- Sole Proprietorship: Sole proprietorship is the simplest structure owned by only one person responsible for taxes and liability. This is often the most affordable structure to set up; however, it means that you and your business are one business entity from a legal and taxation perspective. This places greater liability risk on your personal assets.

- Partnership: A partnership structure shares ownership between you and one or more business partners, meaning that liability, workload, and profits are typically shared. Substructures like Limited Liability Partnerships provide additional security against liability for the actions of your business partner.

- LLC: A LLC, or Limited Liability Company, protects you from personal liability under most circumstances. This means that if your business is sued or if it declares bankruptcy, your personal assets, including your home and vehicle, won’t be at risk. With an LLC, you can file your business income as part of your personal income taxes, but you will likely need to pay self-employment tax.

- Corporation: A corporation, or C corp, is legally a separate entity from its owner or owners. Corporations offer the most significant personal protection from liability out of all business structures. However, they’re more expensive and complicated to form. Corporations file separate income taxes on profits.

2. Register Your Business Name

Once you’ve decided on a business structure, you’ll need to register your business name. Choose a name that reflects your brand and make sure it hasn’t already been claimed. You can then choose to register your business. There are four ways to register it, each serving its own purpose:

- An Entity Name: Legally protects your business at a state level

- A Trademark: Legally protects your business at a federal level

- A DBA (Doing Business As): Doesn’t offer legal protection but may be required, depending on your location and business structure

- A Domain Name: Claims your business’s web address

3. Trademark your Slogans and Logos

Create a clear and identifiable brand for your business by trademarking your slogans and logos. This helps to protect your intellectual property against other companies with similar phrases and visual branding. Choose simple, memorable slogans and logos that are easy to understand and effectively represent your business.

4. Apply for a Federal Tax ID Number

Your federal tax identification number is an Employer Identification Number (EIN). It allows hiring employees legally, paying federal taxes, applying for business licenses, and opening a business bank account. You can apply for an EIN through the IRS website. Your business will need an EIN if you plan on doing any of the following:

- Hiring and paying employees

- Filing employer tax returns

- Operating as a corporation

- Using a tax-deferred pension plan

5. Determine If You Need a State Tax ID Number

Do research to determine whether your startup needs a state tax ID number. You’ll only need one if your state collects taxes from businesses. Since tax obligations vary from state to state, it’s best to visit your own state’s website and check the local laws related to your income and employment tax obligations.

6. Obtain Business Permits and Licenses

You will need to apply for business licenses and permits at the federal and state government level, but the specific licenses you need depend on the industry you work in and your business location.

The Small Business Administration lists common federal business licenses required based on industry, which is a good starting point for your research. At the state level, the licenses and permits needed and the fees owed will depend on your location and your primary business activities. Research requirements at the state and local levels based on where you do business.

Below are the three licenses and permits you need to look for depending on your industry:

- Federal Licenses And Permits

- State Licenses And Permits

- Local Licenses And Permits

7. Protect Your Business with Insurance

Professional liability insurance can protect you in cases where the personal liability protections offered by your specific business structure aren’t enough. Business insurance can protect not just your personal assets but your business assets as well. Some types of insurance are required by law, such as unemployment and disability insurance. Purchasing business insurance to protect your startup from other potential risks is also a good idea. Some common business insurance options include:

- General Liability Insurance: Protects your business from various forms of financial loss, including property damage, injury, medical issues, lawsuit settlements, or judgments.

- Product Liability Insurance: If your business sells products, this insurance protects you in the case that one of your products is defective and injures a customer.

- Commercial Property Insurance: Protects your business from loss or damage to company property as a result of natural disasters, accidents, or vandalism.

8. Hire and Classify your Employees Properly

Correctly classifying your employees is key to providing fair compensation and filing your taxes correctly. The employees you hire will typically be classified into four categories:

- Employees: This is the most protected category and includes both part-time and full-time employees. Depending upon your location and industry, the people you hire in this category will need benefits and overtime as well as their salaried or hourly compensation.

- Contractors: Contractors deliver a service for your business but are not classified as employees. They typically manage their own hours, and you are usually not responsible for their insurance or benefits.

- Interns: Interns may be paid, or unpaid depending upon your arrangement but are regulated by special rules regarding their hours and what you can ask of them. Internships allow interns to develop real-world career skills and provide short-term labor for your company.

- Volunteers: Volunteers are often involved with charitable work and are also governed by specific rules. Your business may have to meet certain requirements to qualify for volunteers from volunteer agencies.

Also Read: Business With Less Manpower

9. Comply With Labor Laws

Labor laws are essential to protect the rights and safety of employees in your workplace. These can cover everything from fair wages and hours to healthcare and worksite safety. Some labor laws may be federal, while others are specific to your region and industry. Research your local labor laws to understand how they apply to your small business so that you can operate safely and legally.

10. Open a Business Bank Account

From a legal perspective, separating your personal and business finances is important before you start collecting clients’ payments. Choose a convenient bank that serves your needs by offering lower banking fees for small business clients. When you’ve chosen a banking institution, you’ll need to provide some information about your business to open an account, including:

- Your Employer Identification Number (or Social Security Number, in the case of a sole proprietorship)

- The formation documents for your business

- Your business license

- Ownership agreement documents

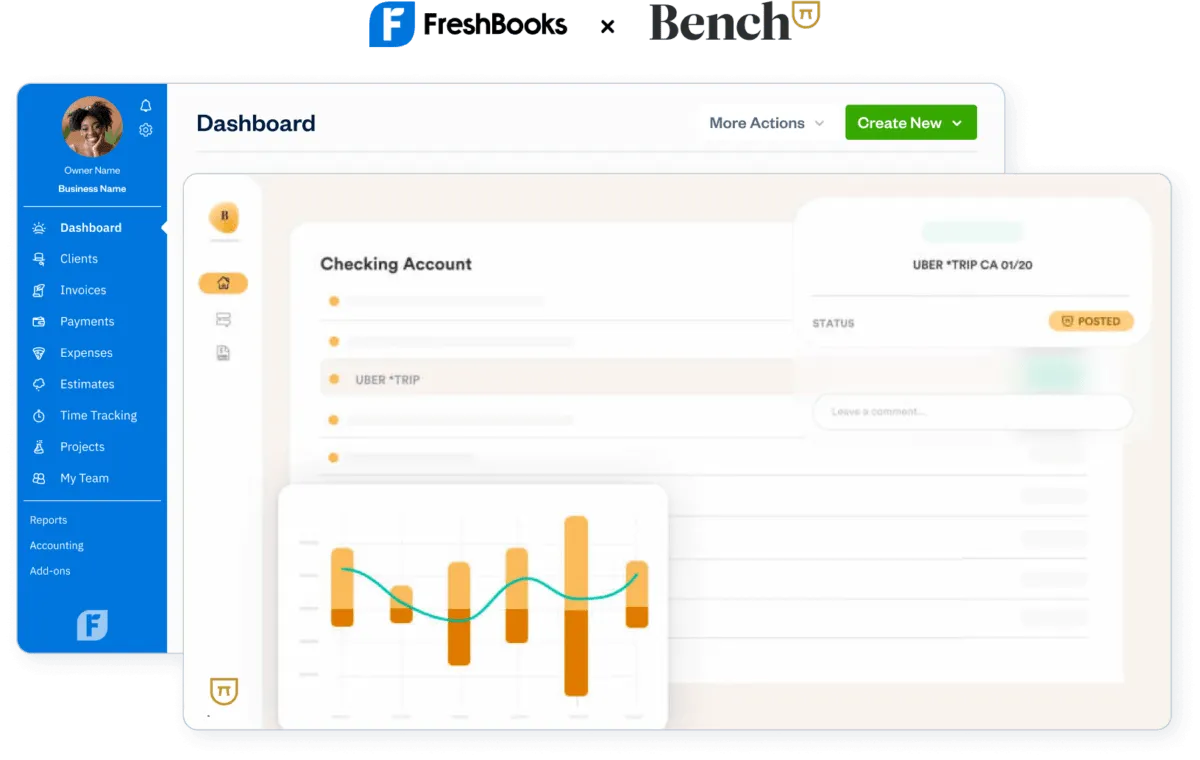

11. Keep Good Records

Documenting your small business transactions is essential for taxation and measuring your growth and progress. Maintaining clear and accurate business records is also important for legality, as good records enable you to demonstrate your business’s compliance. If your business is ever subject to a tax audit, keeping your records organized makes it quick and easy to comply.

Discover a clear and simple way to keep your records with FreshBooks’ bookkeeping services. It helps you organize your sales, invoicing, and payments with free downloadable templates to manage your accounts. Click here to sign up for your free trial and learn more about how FreshBooks can support your small business.

12. Consult the Professionals

To ensure you’ve covered all your legal responsibilities as a business, it’s a good idea to consult professionals for advice. Consider sitting down separately with a lawyer and an accountant to ensure your company is covered legally and financially before opening for business.

Can I Start a Business Without Registering It?

You need to register your business name in order to use that name for your business. If you don’t have a business name registered with the Secretary of State, you can only conduct business under your personal name. Before filing for your business name, ensure it’s not currently used by someone else. Then, register the name online through the IRS.

Conclusion

Starting a small business requires several administrative steps to ensure that you’re legal to operate. Most businesses begin by registering important information like names, logos, and slogans. This helps protect your company’s brand identity and meet IRS requirements.

As you go through the steps to start a small business, remember to keep detailed records of all your information so you’re prepared when the time comes to renew any licensing. Thorough research of your industry is essential for complying with local business laws. Being prepared is the easiest way to protect yourself and your employees when operating a small business.

FAQs on Starting a Small Business Legal Requirements

What documents should a small business have?

When you start your own business, remember to keep document records of your:

- Tax numbers

- Business name registration

- Incorporation number

- Employer identification number

- A partnership agreement, depending upon your business structure

- Unanimous shareholder agreement

Can I run a small business without registering?

While you can run your small business under your personal name, to legally operate it under any other name, you’ll need to register that business name officially.

Does a small business need a permit?

Most small businesses will need at least one type of permit to operate legally. The permits you need will depend on your region and business type.

How do you structure a small business?

Small businesses can be structured in several ways. You can choose to operate as a sole proprietorship, partnership, limited liability company, or corporation.

What are the tax obligations for a small business?

Your small business tax obligations will depend upon where you live, but you’ll typically have to make a minimum level of profits before you’re required to register for GST.

What is a legal compliance checklist?

A legal compliance checklist is a list of items designed to ensure a business meets all regulatory requirements. The items on a compliance checklist will depend on your industry but will typically include required documentation that needs to be submitted, as well as non-compliance items to be avoided.

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

10 Best Home-Based Business Opportunities in 2024

10 Best Home-Based Business Opportunities in 2024 5 Creative Ways to Make Money. Turning Your Imagination into Dollars.

5 Creative Ways to Make Money. Turning Your Imagination into Dollars. 20 Reasons Why Small Businesses Fail And How To Avoid Them

20 Reasons Why Small Businesses Fail And How To Avoid Them One Person Business Ideas: 10 Startups You Can Run Yourself.

One Person Business Ideas: 10 Startups You Can Run Yourself. How to Start Your Own Business With No Money | Cheap Startup Ideas

How to Start Your Own Business With No Money | Cheap Startup Ideas 15 Best Passive Income Ideas To Make Money

15 Best Passive Income Ideas To Make Money