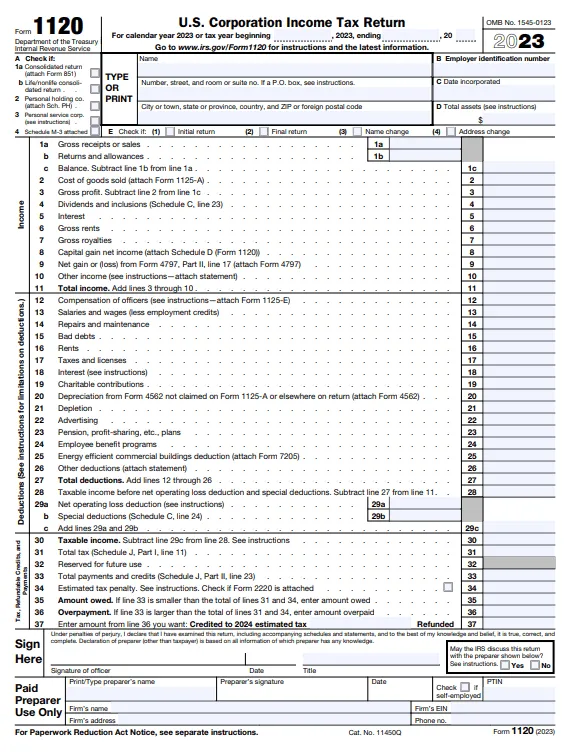

What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses

Form 1120 is the U.S. corporation income tax return. It is an Internal Revenue Service (IRS) document that American corporations use to report their credits, deductions, losses, gains and income. It also helps corporations find out how much income tax they need to pay, according to the IRS.

In this article, we’ll cover:

- What Is a 1120 Tax Form?

- Who Files Tax Form 1120?

- When Do I File a 1120 Tax Form?

- Where Do I File a 1120 Tax Form?

What Is a 1120 Tax Form?

A 1120 tax form is an Internal Revenue Service (IRS) form that corporations use to find out their tax liability, or how much business tax they owe.

It is also called the U.S. Corporation Income Tax Return. American corporations use this form to report to the IRS their income, gains, losses deductions and credits.

There are special forms for specific types of organizations. They include:

- 1120-C: cooperative associations, such as farmers’ cooperatives

- 1120-F: foreign corporations

- 1120-H: condominium management, residential real estate management, timeshare association that elects to be treated as a homeowners association

- 1120-L: life insurance companies

- 1120-POL: political organizations

- 1120-S: S corporations

Download Form 1120 and the Form 1120 instructions.

Who Files Tax Form 1120?

All domestic corporations must file tax form 1120, even if they don’t have taxable income. Corporations exempt under section 501 (see below) do not need to file tax Form 1120. Corporations in bankruptcy must also file Form 1120.

The following entities must file tax Form 1120:

- Businesses that have chosen to be taxed as corporations. These businesses must also file Form 8832 and attach a copy of it to form 1120.

- Limited liability companies (LLCs). LLCs only file Form 1120 if they’ve elected to be taxed as a corporation. Partnership LLCs file Form 1065 instead and single-member LLCs usually file their taxes via the owner’s personal federal tax return. For more information on LLC taxes, follow our post on Tax Classification for LLC.

- Farming corporations. They must file Form 1120 to report their income or losses.

- Corporations with ownership interest in a FASIT. A FASIT is a Financial Asset Securitization Investment Trust.

- Foreign-owned domestic disregarded entities. If a foreign person or corporation owns 100 percent a domestic disregarded entity (DE), then the domestic DE is treated as separate from its foreign owner. A DE is a business the IRS doesn’t consider separate from its owner. Yes, these two things contradict each other but this is how it works. The foreign person or corporation must file Form 1120 and attach Form 5472.

There are also additional documents, or schedules, some types of corporations have to fill out as well. They include Form 1120 (Schedule N) for foreign operations of U.S. corporations and Form 1120 (Schedule D) for capital gains and losses.

Small corporations probably won’t have to worry about these additional forms. You can find them by searching for “Form 1120” via the IRS’ Forms and Publications tool.

When Do I File a 1120 Tax Form?

Corporations must file their income tax return, including Form 1120, by the fifteenth day of the fourth month after the end of their tax year.

If a corporation’s new, it must file by the fifteenth day of the fourth month after their tax year ends, no matter how short it was.

Corporations with a fiscal tax year that end on June 30 must file by the fifteenth day of the third month after the end of their tax year.

Due dates that fall on Saturdays, Sundays or legal holidays are extended to the next business day.

Need an extension for your 2024 tax return? You need to fill out tax extension form 7004. You must file Form 7004 by your regular due date.

Where Do I File a 1120 Tax Form?

Corporations can electronically file (e-file) Form 1120 and any other forms, schedules and attachments such as Form 7004 (automatic extension of time to file) and Forms 940, 941 and 944 (employment tax returns). Sign up for (or log into) Modernized e-File here and submit your return online.

If you owe the IRS taxes, you can authorize that tax payment be withdrawn electronically from your account. Or you can authorize the direct deposit of a refund.

If you choose to mail your return, you should use private delivery services (PDS) that give written proof of the mailing date. A list of IRS-approved PDS is here.

People also ask:

Who Uses Form 1120?

Generally, U.S. corporations use Form 1120, unless they fall under any of the exceptions listed above.

For example, S corporations do not need to file Form 1120. S corporations are classified by the IRS as corporations that pass their corporate income through to shareholders (for tax purposes). The shareholders then report this income or loss on their personal tax returns. S corporations must use Form 2553 instead.

Do I Have to File Form 1120?

Yes, you have to file Form 1120 if you are a U.S. corporation and meet the criteria listed above.

That said, the IRS considers certain organizations tax exempt. These include:

- Charitable organizations

- Social welfare organizations

- Social clubs

- Trade associations

- Labor organizations

- Veterans’ organizations

- Political organizations

The IRS has a full list of tax-exempt organizations here. These types of organizations must file an information return that should include Form 990, Form 990-EZ and Form 990-PF. Download these tax forms and their instructions on the IRS website.

RELATED ARTICLES

What Is Form 720? It’s a Hidden Tax

What Is Form 720? It’s a Hidden Tax Indirect Business Taxes: A Definition and Examples for Small Businesses

Indirect Business Taxes: A Definition and Examples for Small Businesses How Much Does a Small Business Pay in Taxes?

How Much Does a Small Business Pay in Taxes? How Much Do You Have to Make to File Taxes in 2024?

How Much Do You Have to Make to File Taxes in 2024? How Much Cash Can You Deposit?

How Much Cash Can You Deposit? Can I Sue My Tax Preparer For Not Filing My Taxes?

Can I Sue My Tax Preparer For Not Filing My Taxes?