8 Tips for Filing Taxes

While tax season can be stressful, it can also be rewarding once you’re done. If you’re organized, you can get to your reward with more ease and less stress. Here are a few things to know to make your life a bit easier during tax season.

1) Use E-File

Save trees, time, and money by e-filing. If you’re wondering how to file taxes efficiently, tax software with built-in forms can expedite the process, and you’ll get your refund back faster if you’re owed one.

There may be a few instances in which you will have to file a paper return. If you need to file a paper return, check out the IRS website to see the forms you will need for your specific tax situation.

Then, read instructions on how to file.

2) Get Your Filing Status Right

Your filing status is important because it determines how much you pay or save on your taxes. Also, there is a chance that if you get it wrong you could be stuck with an audit.

A filing status basically expresses how the IRS should treat you as a taxpayer and can determine which deductions and credits are applicable to you, which forms you should fill out and more.

3) Figure Out Your Adjusted Gross Income

While you’re filing your taxes, you’ll see a lot of instructions referring to your AGI like, “if your AGI is less than $100,000” or “up to 10% of your AGI.”

Your AGI is your adjusted gross income. After the government receives your income report, it subtracts certain expenses such as education, tuition, or IRA contributions to determine your adjusted gross income or AGI. So, AGI determines what deductions and credits a taxpayer is eligible for.

Your 1040 tax form will walk you through calculating your AGI.

4) Credit Equals Savings

Tax credits directly reduce the amount of taxes you’re owed. If you owe $3,000 in taxes, a credit will be subtracted from that. In other words, if you receive a $1,000 credit that means you will pay $1,000 less in taxes. It is that simple but it is a rarity in the tax code.

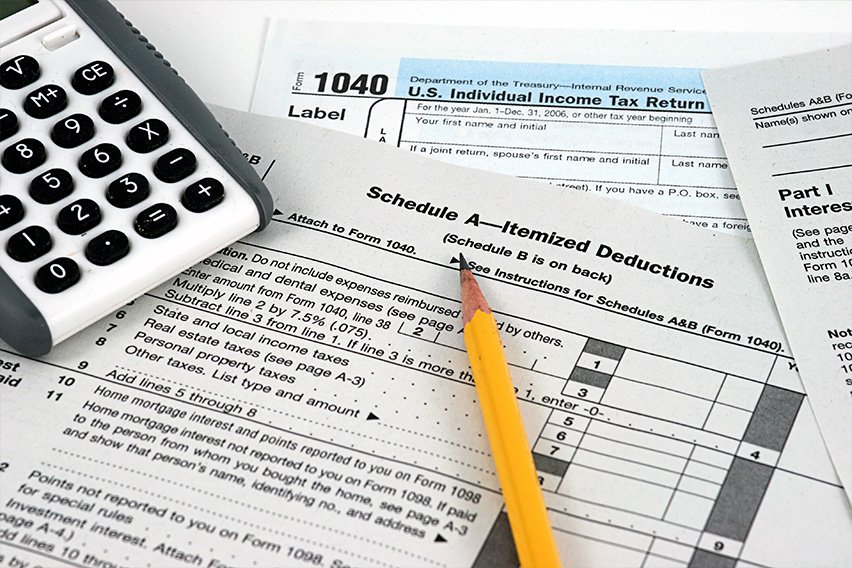

5) Consider Itemizing Your Deductions

An important decision you have to make on your tax return is whether you itemize your deductions or not. Here are your two choices:

a) Take the standard deduction. You can avoid a complicated process if your taxes are simple. The standard deduction reduces the amount of income you will be taxed on.

Most taxpayers take the standard deduction which is $12,950 for single filers in the 2022 tax year and $13,850 for 2023.

b) Itemize your deductions. When taxpayers deductions are greater than the standard amount, they might opt to itemize their deductions. This is basically listing out each of the deductions they qualify for. This can include things like medical expenses, large charitable donations and mortgage interest payments.

The decision between standard and itemized deductions is really a question of time and money. Some taxpayers could save hundreds or thousands of dollars in taxes by itemizing their deductions. However, if you don’t need to itemize your deductions, doing so would take up your time without a financial benefit.

6) There are Extension for Paperwork but Not Payment

Can’t file your taxes on time? Don’t worry! The IRS allows you to file paperwork that gives you an extension and a bit more time to file your taxes.

However, if you are granted an extension you can’t put off paying the taxes you owe. If you don’t have the cash to pay your tax bill, there are payment plans that can help you out.

7) Know When You Need an Accountant

It is entirely possible to file your taxes by yourself but there are just some cases where it pays to have a professional help you sort through the tax code.

Some situations where a taxpayer might want to consider using an accountant include:

- Complex deductions

- Non-cash contributions to charity

- Self-employed or small business owners

- Big life changes like buying a house or having a baby

- Frequent trading in investments

8) Don’t Take A Rapid Refund

If you filed your taxes through a tax preparer, you may be offered a rapid or instant refund – you should not take it.

It may seem like you’re getting your tax refund faster but this is essentially a short-term loan called the “refund anticipation loan”. This loan has a large interest rate and will take a chunk of $50 or more out of your tax refund.

This article will also include details on:

How to Estimate Tax Return

There have been many tax reforms in recent years. That’s made estimating your tax refund trickier than it has been in previous years. You can use this Tax Reform Calculator to estimate your return due in 2023. When you provide the relevant details it will give you an estimate of your tax refund and taxes owed on your return.

More Useful Resources

- How Long Does It Take To File Taxes

- How to File an Amended Tax Return

- What Does Your Accountant Need to Do Your Taxes?

- What Happens If You Don’t File Taxes?

- How to File Taxes

- Best Tax Software

- Estimated Tax Payments

RELATED ARTICLES

What Is Tax Evasion? It’s a Crime

What Is Tax Evasion? It’s a Crime Are Product Samples Tax Deductible? Understanding Tax Deductions

Are Product Samples Tax Deductible? Understanding Tax Deductions Unreimbursed Employee Expenses: What Can Be Deducted?

Unreimbursed Employee Expenses: What Can Be Deducted? How to Get a Business Tax ID

How to Get a Business Tax ID How Long Do IRS Audits Take?

How Long Do IRS Audits Take? Examples of Itemized Deductions

Examples of Itemized Deductions