How to Fill Out a W-4 Form: A Step-By-Step Guide (2024)

A W-4 form, also known as an Employee’s Withholding Certificate 1 , is an IRS tax document you fill out when you start a new job or make life changes like getting married or starting a side hustle. This form helps your employer calculate how much state and federal tax to withhold from your paycheck. Accurate completion of the W-4 is important for your future financial planning, as well as for tax compliance.

In the following article, we’ll explain more about what a W4 tax form is and how to fill out a W-4 step-by-step so you can maintain an accurate federal income tax filing status.

Key Takeaways

- W-4s are Internal Revenue Service documents that determine how much money should be withheld from your paycheck for income tax purposes.

- Your income taxes will be adjusted based on how much your employer withholds from your pay.

- Depending on how you fill out your form, you may receive a tax refund or owe taxes when you file your tax return.

- You can manually adjust the amount deducted from your paycheck using line 4 of Form W-4.

- There are no major changes to the 2024 W-4 form, but new language options have been added along with new deduction amounts and a helpful withholding estimator tool.

- You can re-submit a new W-4 form to your employer as your situation changes.

Table of Contents

- What Is a W-4?

- How To Fill Out Form W-4

- How To Adjust Your W-4 Form

- How and When To Update a W-4

- Recent W-4 Form Updates To Know

- Conclusion

- Frequently Asked Questions

What Is a W-4?

Form W-4 is an important document that you will fill out when you start working at a new job. It is also known as an employee’s withholding certificate.

The information requested on this document includes personal information, any other jobs you have, information about your dependents and spousal income (if filing jointly), and optional additional information.

Your employer uses this document to determine how much tax to withhold from your pay. The amount withheld is noted by the IRS to determine your tax liability and your tax due or tax refund will then be calculated accordingly during tax time.

If not enough tax is withheld from your paychecks, you may owe taxes to the government. Alternatively, if more money is withheld from your paycheck than what you owe in income taxes, you may receive a tax refund.

How To Fill Out Form W-4

Filling out a W-4 form is not complicated, but accuracy matters, because the IRS will use this information to determine how much income tax you owe at the end of the year. The following steps will show you how to correctly fill out a W-4:

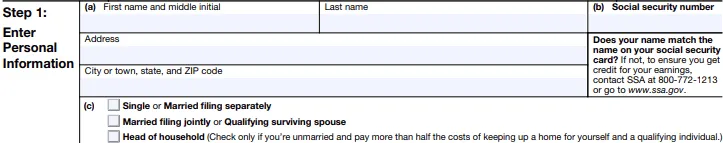

Step 1: Enter Your Personal Information

Fill in the sections for your name, address, and Social Security number. You will also want to determine your filing status and accurately fill this in. Your filing status options are:

- Single (or married but filing separately from your spouse)

- Married, filing jointly with combined income, or a qualifying widow(er)

- Head of household

The filing status that you select will dictate the amount of income tax you are responsible for paying annually, based on your family situation.

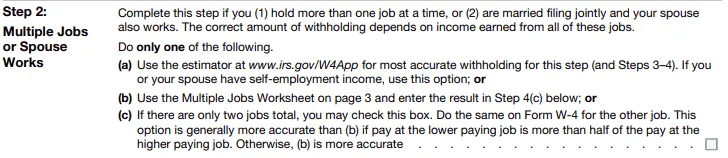

Step 2: Account for Multiple Jobs or Spouse Works

This section will tell your employer what they need to know about your overall tax liability, either as a single filer, in conjunction with your spouse, or as a head of household.

Entering all information if you have 2 or more jobs or if your spouse also works will make your tax withholding amount more accurate at filing time.

To calculate tax form W-4 employee’s withholding, use the two-earners/multiple jobs worksheet, which is on page 3 of the W-4 instructions, or use the IRS Tax Withholding Estimator. 2

Make sure to complete Steps 3–4(B) on the W-4 of your highest-paying job only if you are submitting for multiple jobs. Leave these steps blank on the other job forms to ensure accuracy.

For more information on how to fill out a W4 married filing jointly, you can see the IRS website, but in general, all you have to do if you and your spouse each have one job is check the box. Your spouse should do the same on their form.

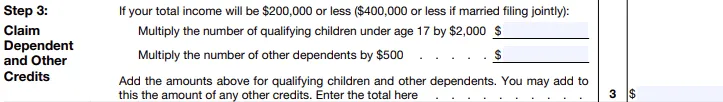

Step 3: Claim Dependents and Children

If you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your W-4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents.

Add these 2 numbers together to find your total dependent credit amount. Showing that you plan to claim dependents on your tax return will lower the monthly income tax withholding. You can also leave the section empty. More money will be withheld from each of your paychecks, however, you might later receive a tax refund.

To find out more about how to fill out a W-4 with dependents or to learn who qualifies as a dependent, see the frequently asked questions on the IRS website. 3

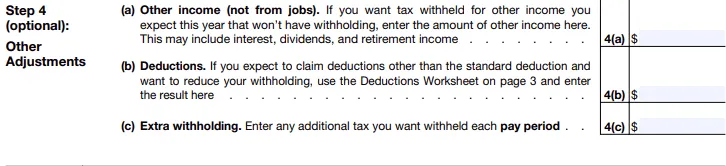

Step 4: Make Any Other Adjustments Necessary

Once you have completed the other steps, you can tweak your deductions for extra withholding 4 You may wish to have your primary place of employment hold back more taxes if you have other income from a non-traditional job or investments, or if you have other income or deductions you want to account for where no tax is deducted.

If you are claiming the standard deduction, you likely won’t need to enter anything in section 4(b), but if you plan to itemize, you can note the higher deduction in this section.

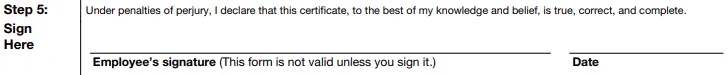

Step 5: Sign and Date Your W-4 Form

Once you have completed the form, verify that all information is correct, particularly your Social Security number, then sign and date the form to make it official and give it to your employer. You may wish to keep a copy for your records, as well.

Your employer will add additional information to the form as well as enter their Employer Identification Number (EIN) for the IRS. The company’s HR or payroll department will file the form appropriately.

Now that you know how to properly fill out a W-4, you can do it confidently when you start your new job or when you need to make changes, like altering your filing status after getting married or receiving self-employment income.

If you’re an employer running a US-based business, FreshBooks Payroll software can help you onboard new employees, automatically run payroll, and make sure you stay compliant with tax and labor laws.

How To Adjust Your W-4 Form

Everybody’s financial situation is unique, and you may wish to adjust the tax withholding amount on your W-4. The following are some common scenarios in which people may want to adjust their form.

1. You Want Less Tax Taken Off Your Paycheck

You may want less tax withheld from your biweekly or monthly pay period because you prefer to receive more take-home pay rather than getting it back later in a tax refund. You may also want to decrease withholding if you have many tax credits to use or if you are exempt from withholding based on your household income.

Whatever your reasoning, you can reduce the amount of income tax withheld by reducing the number on line 4(a) or 4(c) or increasing the number on 4(b).

You may also be able to increase the number of dependents you claim (but make sure you’re being truthful).

2. You Want More Tax Taken Off Your Paycheck

If you want to get a tax refund sent to you after you file your taxes, if you work more than one job as a freelancer or independent contractor, or to simply lower your big tax bill at the end of the year, you can reduce the number of dependents you claim. You can also add a higher withholding amount to line 4(c) for extra withholding each pay period.

3. You Want To Make Sure You Owe Nothing on Your Tax Return

You may be able to manipulate your paycheck so that your tax bill comes out to $0 by using the correct and updated filing status and number of dependents and by accurately estimating your other sources of income as well as your deductions. Adding more withheld money online 4(c) will also help reduce your tax bill.

How and When To Update a W-4

Updating your W-4 tax forms is not difficult. All you have to do is request a new W-4 form from your employer (or download one from the IRS website for free), complete the form with accurate information, and resubmit it to your payroll or HR department.

Your HR or payroll department can show you how to fill out a federal W-4 or a state W-4 and ensure your payroll information is updated immediately. You can do this any time, but remember, if you alter your W-4 later in the later months of the year, the changes might not affect your tax situation significantly for that year.

Some common reasons to update your information include significant life changes such as:

- Change of employer(s)

- Addition or loss of extra income, including receiving self-employment income, stock dividends, money made by selling stocks, mining or trading cryptocurrency, or any additional income

- A change in marital status (getting married or getting divorced)

- Making a major purchase like a new home

- Updating the number of qualifying dependents in your household (birth or adoption of a child, a death in the family, etc.)

- Updating the additional dollar amount you’d like your employer to withhold from your pay

Recent W-4 Form Updates To Know

The Internal Revenue Service makes annual updates to the W-4, so when you fill out a new form, make sure you have the most recent version.

There have been no major changes to the document in 2024, but the IRS has made a few small adjustments to make filling it out accurately even easier than it was before.

The updated form has a new “Step 2” section that prompts you to use the Internal Revenue Service Tax Withholding Estimator Tool. This tool will help you adjust your withholding amount to maximize benefits to your household (and your wallet). This is especially helpful to those with multiple jobs and those filing jointly with their spouses.

The IRS has also recently released Form W-4 in several languages including Chinese, Spanish, Vietnamese, Korean, and Russian, helping immigrants or those whose first language is not English, to better understand tax compliance and income withholding.

Conclusion

Now that you have learned all about what a W-4 tax form is and how to fill out a W-4 for a single person or a married person, you can feel more confident in manipulating your paycheck to benefit you during tax season.

FAQs About How To Fill Out a W-4

The following are answers to some frequently asked questions to help you better understand the W-4 form and how it’s used to determine your paycheck withholding amount.

Do I claim 0 or 1 on my W-4?

It no longer matters whether you claim 0 or 1 on your W-4 because as of 2020, allowances are no longer on the form.

In the past, choosing 0 allowances meant your employer would withhold the maximum amount from your paycheck while choosing 1 allowance meant reducing the withholding amount.

What is the difference between W-9 and a W-4?

The difference between a W-9 and a W-4 tax form is determined by the employment type.

A regular employee fills out a W-4 for their employer, while an independent contractor will fill out a W-9 form and is responsible for paying their income taxes.

How many W-4 allowances shoud I claim?

The 2024 Internal Revenue Service W-4 form does not have withholding allowances on it. This means that employees can no longer claim withholding allowances on this form.

Who fills out a W-4?

Anybody in the USA who is a regular employee at a company or business will fill out a W-4. The employee will provide certain information to inform their employer how much pay to withhold from their paychecks for tax purposes.

How to fill out a W-4 for dummies

Completing a W-4 is easy, simply fill in your personal information, your filing status, and information regarding your dependents and employment, along with any adjustments you’d like to make.

The IRS has attached a helpful and accurate withholding estimator tool to their digital W-4 form to simplify the process further.

How to get the most out of your paycheck without owing taxes?

By doing the math and adjusting your tax withholding appropriately, you can avoid owing taxes without paying too much extra out of your paychecks all year. Try using the IRS Tax Withholding Estimator online calculator tool to determine how much to withhold.

Article Sources

- IRS. “2024 Form W-4” Accessed Feb 21, 2024.

- IRS. “Tax Withholding Estimator” Accessed Feb 21, 2024.

- IRS. “Frequently Asked Questions” Accessed Feb 21, 2024.

- USA.GOV. “How to Check and Change Your Tax Withholding” Accessed Feb 21, 2024.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

W2 vs W4: The Difference Between W2 and W4 IRS Forms

W2 vs W4: The Difference Between W2 and W4 IRS Forms Top 8 Tax Deductions for Photographers (2025)

Top 8 Tax Deductions for Photographers (2025) Real Estate Tax Deductions Every Business Should Know

Real Estate Tax Deductions Every Business Should Know Tax Deductions for Cleaning Businesses

Tax Deductions for Cleaning Businesses Construction Tax Deductions for Builders and Contracting Businesses

Construction Tax Deductions for Builders and Contracting Businesses Nonprofit Tax Deductions for 501(c)(3) Organizations

Nonprofit Tax Deductions for 501(c)(3) Organizations