Tax Classifications for LLC: Everything You Need to Know

The way you structure your business has legal and tax consequences. This short article will give a detailed overview of how a Limited Liability Company (LLC) fits into different tax classifications.

While sole proprietorship, partnership, and corporation are recognized by the Internal Revenue Code (IRC) and state code as established business structures, certain states have also authorized the limited liability company as an alternative way to run a business.

Since the IRC has made no provision for taxing LLC, the company can choose to be taxed as any of the recognized business structures, including a C-Corporation and an S-Corporation. This means that the owners of an LLC can choose to structure their business in different ways depending on their tax purposes.

Key Takeaways

- Deciding how to structure your business has implications for how your business will pay taxes.

- With regard to LLCs, it’s possible for business owners to structure their business as either a C-Corporation or an S-Corporation.

- One of the main differences between an LLC and a C- or S-Corporation is that a C- or S-Corporation will be taxed as a separate entity.

What this article covers:

- What is the LLC Default Tax Classification?

- What Taxes Does an LLC Pay?

- Benefits of Default Tax Classification

- Factors that Influence Tax Classification Selection

- Conclusion

- Frequently Asked Questions

What is the LLC Default Tax Classification?

By default, a single-member LLC is taxed as an entity disregarded as separate from its owner (a sole proprietorship), while multiple-owner companies are taxed as a partnership by default.

The LLC pays income tax differently based on the ownership structure and the type. The owner of an LLC is referred to as a member. If an LLC has one member, it’s known as a single-member LLC. Apart from individual members, the LLC can be owned by a corporation, an S-Corporation, a trust, and another LLC.

LLCs are classified as “pass-through” entities for tax reasons, meaning the business profits and losses will flow through to the personal tax return of each member.

An LLC can also elect to be taxed as an S-Corporation or a C-Corporation. To be taxed as an S-Corporation, the LLC must file IRS form 2553. To be taxed as C-Corporation, the LLC must complete IRS form 8832.

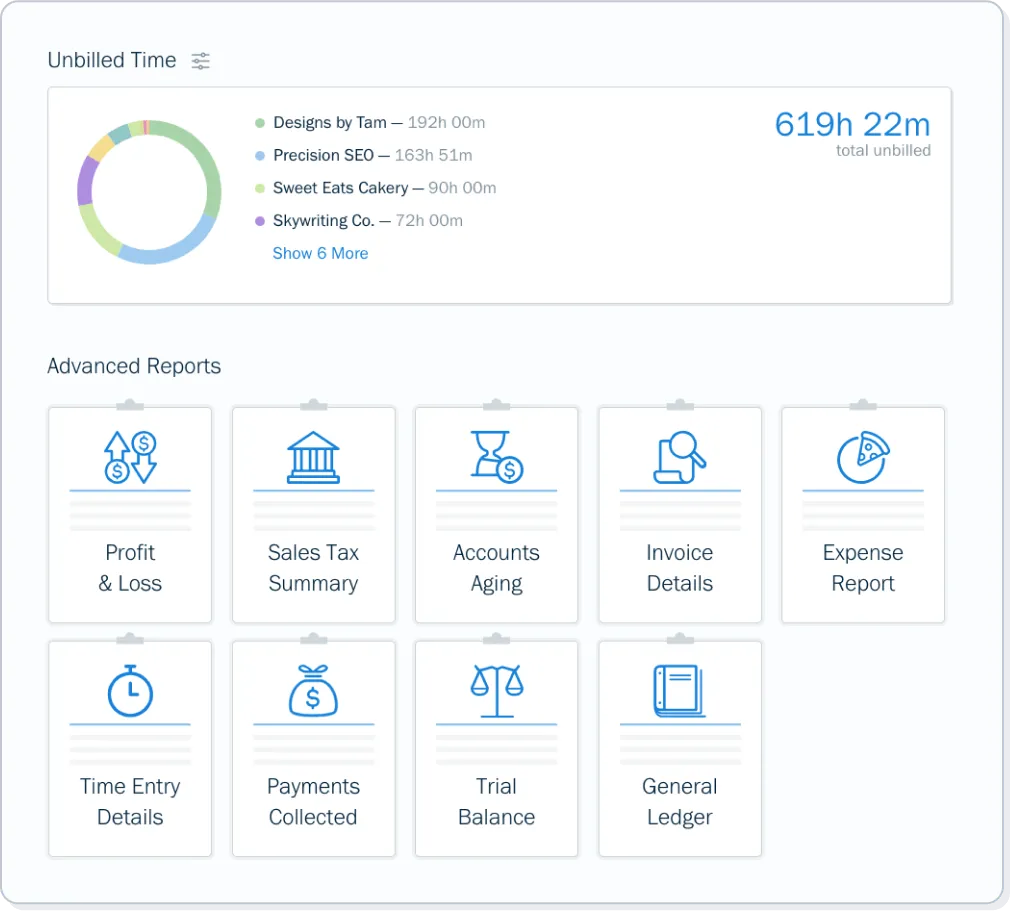

FreshBooks’ accounting software helps small business owners, freelancers, and independent professionals classify taxes for an LLC by automatically tracking and categorizing business expenses & streamlining the financial management process.

Sign up for FreshBooks for free by clicking here.

What Taxes Does an LLC Pay?

There are 4 different Taxation types for LLC depending on their corporate structure.

Disregarded Entity

If the LLC is structured as a sole proprietorship for taxation, it’s treated as a disregarded entity by the IRS. A disregarded entity is a type of business that exists separately for the business and its owner for liability and legal purposes but not for taxation.

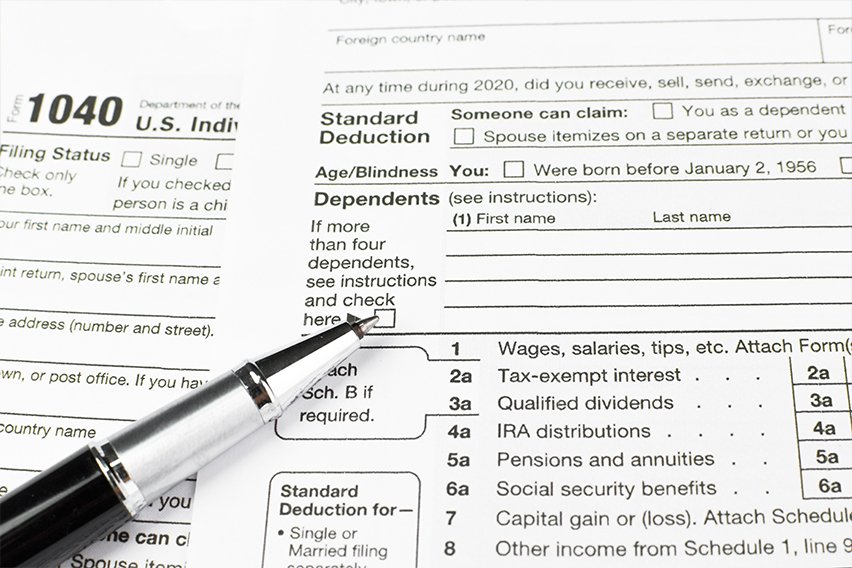

This means that the LLC’s taxes are passed on to the owner’s personal tax requirements. This means that the LLC is taxed however its owner is taxed. The owner reports the LLC activities on Schedule C of their personal tax return.

Partnership

If the LLC has more than one member, it’s taxed as a partnership by default. Similar to taxation as a sole proprietorship, the taxes incurred by a multi-member LLC would also pass directly through to those partners in the business. This means all owners would handle their business-related taxes on their personal returns and taxed on the LLC’s profits and losses.

The members file an information return on Form 1065 indicating the total profits and losses from the partnership. In addition, the members receive a Schedule K-1 tax form to report their portions of the profit or loss. This form is included with the member’s personal tax return.

S Corporation

For tax purposes, businesses can choose to be classified as corporations. If the members have elected to structure an LLC to be taxed as an S Corporation, all taxes resulting from business activities are passed through to the personal tax obligations of an LLC’s owners.

The S Corporation does not have to pay federal taxes on profits. This means that the S corporation owners can report the profits and losses of the LLC on their personal tax returns and not incur double taxation. The tax returns are filed on Form 1120-S and the owners file a Schedule K-1.

C-Corporation

While it’s complex to structure your LLC as a C-Corporation, it can have some advantages. When the LLC is taxed as a C-Corporation, it means that the LLC is taxed directly as a separate business entity. Unlike taxation as a partnership or sole proprietorship, the taxes incurred by the business are not passed through to the owner’s personal taxes.

This structure separates the owner’s personal and business assets and also allows businesses to take advantage of deductions.

However, double taxation is the biggest disadvantage of an LLC taxed as a C-Corporation. Unlike a pass-through entity, an LLC with a C-Corp tax classification is taxed at the corporate and personal levels. The LLC must file an income tax return with the IRS for the business, while the owners must also file personal income taxes.

The owners of the LLC should make the appropriate decision for the tax classification of the LLC based on the tax benefits and savings that the business may be able to enjoy. While filing changes for LLC tax status to a C- or an S-corporation, it’s best to consult a tax professional for assistance and advice.

Benefits of Default Tax Classification

As mentioned above, when you structure your business as an LLC you’re automatically enrolled in the default tax classification. The major benefit to this classification is that your company’s taxes and your personal income tax return are not separate. This means you don’t have to worry about double taxation: Being taxed at both the corporate and personal levels in one calendar year.

For a small business owner looking to minimize self-employment taxes, this default classification can end up saving you both time and money. If, for example, you decide to be taxed as a corporation, you might end up having to pay extra taxes. In addition, you might also find yourself wading through additional paperwork.

These are some of the potential benefits of the default tax classification that’s granted to newly minted LLCs. Be sure to consult with a certified tax specialist to ensure that you make the best decision for your company and to help minimize your self-employment tax.

FreshBooks can help streamline and organize complex paperwork and give everything your accountant needs for taxes. Check out our easy-to-use accounting software today. Click here to sign up for your free trial.

Factors that Influence Tax Classification Selection

3 factors influence tax classification selection and they are:

- Business Structure and Ownership: The way a business is structured and owned, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC), can impact its tax classification selection.

- Liability Protection: The level of liability protection a business desires, such as protection of personal assets from business debts and lawsuits, can influence its tax classification selection.

- Tax Benefits and Implications: The tax benefits and implications associated with each tax classification, such as the ability to deduct business expenses or pay lower tax rates, can also play a role in determining the best tax classification for a business.

Conclusion

Now that you understand the differences between LLCs, C-Corporations, and S-Corporations, you can more effectively decide how to structure your own business. Remember that one of the great benefits of the laws around LLCs is that you can elect to structure your business as a C- or S-Corporation. For many small business owners, however, it may be best to remain an LLC to achieve the best tax outcomes.

FAQs on LLC Tax Classifications

What is the best tax classification for an LLC?

The best LLC tax classification will be the one that best fits the specific requirements of the company. Other factors, such as personal income outside of the company, also play a major role in determining which tax structure will be the most effective.

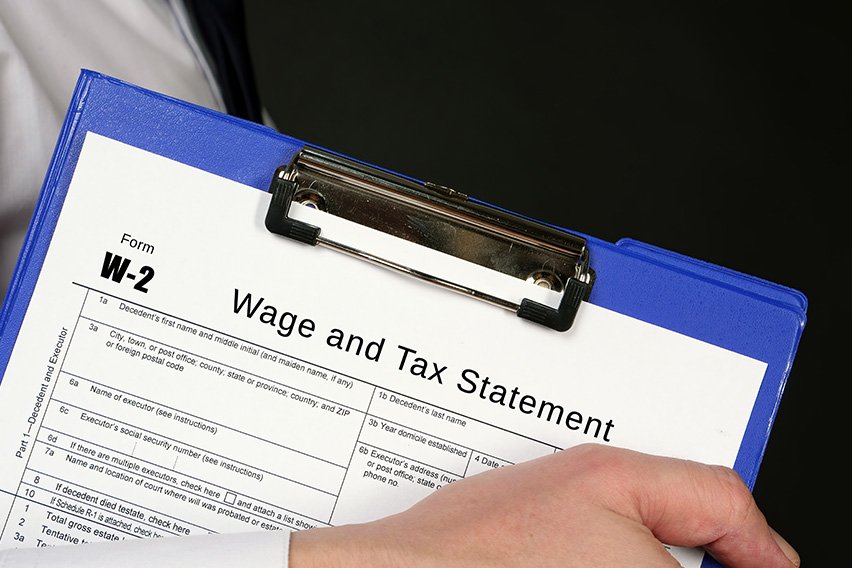

What is LLC tax classification on W9?

The W-9 is an Internal Revenue Service (IRS) form that LLCs must prepare for contracting parties at their request. Within that form, the LLC owner must specify its company’s tax classification for legal purposes. For detailed instructions on completing the W-9 form for an LLC, please consult our guide, ‘How to Fill Out a W-9 for LLC.

How do I know what classification my LLC is?

Unless you have elected to pursue an alternative classification, your LLC will either default to a Disregarded Entity (Sole Proprietorship) or a Partnership depending on the number of owners in your business.

How do I maximize my LLC tax deductions?

Maximizing tax deductions for LLC involves determining which tax classification best suits your company’s needs and business income. Depending on personal income, business income, and other factors, you have opted to remain in the default classification (Disregarded Entity, Partnership) or potentially elect to become an S- or C-Corporation.

How do LLC owners avoid taxes?

There is no way to avoid paying taxes except through various dedications that may be available depending on your specific business activity.

What type of LLC pays the least taxes?

The way to pay the least amount of tax as a business owner will depend on a number of factors, such as the revenue generated, the number of partners, and your own personal income outside of the business. Using these different metrics, one can be the business entity that will result in the best tax outcomes for your business.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How to Calculate Withholding Tax (4 Easy Steps)

How to Calculate Withholding Tax (4 Easy Steps) Pre-Tax Deductions: Definition, Types, and Examples

Pre-Tax Deductions: Definition, Types, and Examples How to File an Amended Tax Return with the IRS in 5 Simple Steps

How to File an Amended Tax Return with the IRS in 5 Simple Steps What Is A W-2 Form? Tips for Employers on Completing Employee Tax Documents

What Is A W-2 Form? Tips for Employers on Completing Employee Tax Documents What Is an I-9 Form? Tips for Employers About the Employment Eligibility Verification Form

What Is an I-9 Form? Tips for Employers About the Employment Eligibility Verification Form Form 2553: Everything You Need To Know

Form 2553: Everything You Need To Know