What Is the Accounting Cycle? Definition, Steps, and Example Guide

The accounting cycle is a crucial part of any business. Accounting is made up of all of the ways that a business’s money moves. It documents every transaction, making sure that things are accurate and kept track of. Without accounting, most businesses would be in poor financial health.

As such, as a small business owner, it’s important to understand the accounting cycle. All business transactions should be recorded using accounting. No business model should be without the financial accounting process. To gain a better understanding of the accounting of business activities, keep reading!

Here’s What We’ll Cover:

The 8 Steps of the Accounting Cycle

What Is the Accounting Cycle?

The accounting cycle involves all of the financial transactions for a business. It refers to recording these transactions, as well as processing them. This includes when a financial transaction occurs, all the way to the creation of financial statements. If it has anything to do with bookkeeping tasks, it’s part of the accounting cycle. From time to time, you may hear it referred to as the bookkeeping cycle.

How Timing Relates to the Accounting Cycle

Accounting happens over a specific period of time. This period of time is often referred to as the accounting period. An accounting period is the time period that financial statements refer to. As such, the passage of time is important to accounting. You have to make sure that all transactions are recorded in a timely manner so that they can be reported.

There are several different amounts of time that a company may choose to report on. Some have a monthly accounting period, while others only report on an annual basis. The accounting cycle periods a business chooses tend to reflect the size of the company. Larger companies can report more frequently. Additionally, many companies have to report on their financial statements due to regulations.

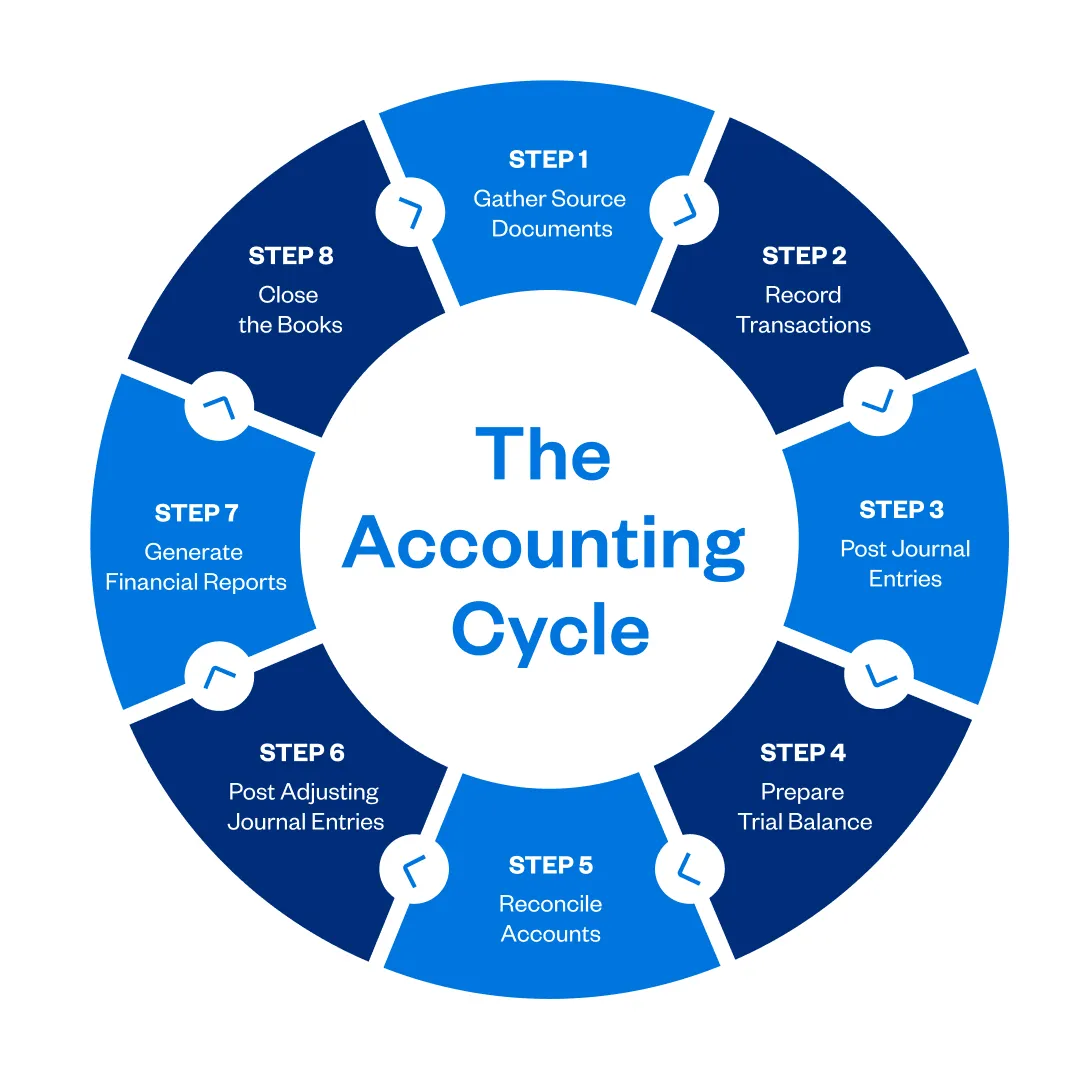

The 8 Steps of the Accounting Cycle

There are 8 major steps involved in the accounting cycle. Each one of them relates to an accounting transaction that has taken place. We’re going to go over all of the steps and provide examples of what each step would look like.

Step 1: Identify Transactions

The first step in the cycle is to identify transactions. Most businesses are going to have numerous transactions each accounting period. It is important that these transactions are identified as they occur. While this used to be done manually, accounting software now makes this task easy. What was once difficult to stay on top of is now easy for anyone to manage.

The identification of transactions is, arguably, the most important step in the process. If transactions aren’t identified, then accounts cannot be made. This can impact a business’s financial statements and financial position. If financial activity goes unidentified, it cannot be reviewed or monitored by the business.

An example of identifying transactions would start with point-of-sale software. Many of these software options automatically identify a transaction. They then communicate it to accounting software.

Step 2: Record Transactions

After transactions have been identified, they have to be recorded. If a transaction is identified but it isn’t recorded, then it’s like it never happened at all. Transactions are recorded in a journal. Each transaction gets its own journal entry.

This is the point in the cycle where the method of accounting has to be chosen. There are a few decisions to be made here. First, you have to choose between cash-basis accounting and accrual accounting. Cash-basis accounting is limited, and transactions are only recorded when cash changes hands. Accrual accounting is more flexible, and it allows you to match revenue and expenses. It does not rely on cash to change hands.

Then, the next choice to make has to do with bookkeeping. There are two options; single-entry accounting and double-entry accounting. Single-entry accounting is simple and goes hand-in-hand with cash-basis accounting. It only records a single entry for each transaction, like a chequebook. Double-entry accounting is more transparent. It records where cash is going, as well as where it’s coming from. It’s the standard for modern accounting.

For example, when a transaction is recorded using accrual accounting, it happens at the time of the sale. This happens regardless of whether or not cash has moved in or out of business. Then, the double-entry method comes into play. It creates a debit for where the money is going, and a credit for where it is ending up.

Step 3: Post to the General Ledger

When a transaction is recorded, it has to be posted to an account on the general ledger. Accounts have to do with business operations, as well as where money is moving. The general ledger allows bookkeepers to monitor a company’s financial position. General ledger accounts are often referenced on financial statements. One of the most common to be referenced is the cash account, which tells a business how much cash is available at any time.

Step 4: Prepare Unadjusted Trial Balance

At the end of any accounting period, a trial balance is calculated for all accounts on the general ledger. This trial balance tells the company the amount of cash each unadjusted account is worth. Calculating these balances is crucial, as they are used for testing and analysis.

Step 5: Analyze a Worksheet / Reconcile Accounts

After the unadjusted trial balance has been calculated, the worksheet can be analyzed. Worksheets allow bookkeepers to identify adjusting entries so that the accounts are balanced. This step is also where bookkeepers will ensure that debits and credits are equal. When discrepancies are found, adjusting entries are created. This step also allows businesses that use accrual accounting to adjust for revenue and expenses. This is only used in accrual accounting.

Step 6: Post Adjusting Journal Entries

When a bookkeeper identifies adjustments that need to be made, they have to create new journal entries. These journal entries have to be made in reference to the original transactions. They shouldn’t be done in bulk, and any adjusting entry needs an original transaction for reference.

To gain a better understanding of this, consider an error in the general ledger. A transaction may have been recorded for an incorrect amount. That entry cannot be erased. Instead, a new journal entry must be placed on the ledger. This entry needs to reference where the error exists so that anyone reviewing it can verify it for accuracy.

Step 7: Create Financial Statements

In many cases, the creation of financial statements is imperative. Financial statements are often regulated, and they have to be created for any public company. Generally speaking, there are three major financial statements that all companies create. These three statements are explained in detail below:

- The Income Statement: The statement that shows a company’s revenue and expenses. Sometimes referred to as a profit and losses statement. This tells a company, or an investor, how revenues are turned into net income or net profit.

- The Balance Sheet: The statement that shows all of a company’s financial balances. On this sheet you’ll find a company’s total assets and liabilities.

- The Cash Flow Statement: The statement that shows how a company’s money moves. It may also be called a statement of cash flows. It tells how a company is making its money, as well as how it’s spending it.

These are not the only financial statements that can be generated, but they are the most important. When a company moves through all of the steps of the accounting cycle, these statements are the results. If they are viewed together, they can paint a picture of the company’s financial health.

Step 8: Close the Books

The accounting cycle ends when a company closes its books. Closing the books takes place at the end of business operations on the last day of the accounting period. Then, the next day, a new accounting period begins, and new books are opened. The accounting cycle is a circular process, and as long as a company is in business it will be active.

Key Takeaways

Understanding the accounting cycle is important for anyone in the world of business. Through accounting, financial responsibility can be taken by a company. It allows them to look at the bigger picture, and see how they’re doing business. Without accounting, the financial position of a business cannot be analyzed. As such, business decisions cannot be made. Nowadays, most accounting is done through accounting software, making the process much easier.

RELATED ARTICLES

What Is Quick Ratio & How to Calculate It? Formula & Example

What Is Quick Ratio & How to Calculate It? Formula & Example 4 Types of Depreciation Methods & Its Formula

4 Types of Depreciation Methods & Its Formula The Definitive Guide to Variance Analysis for Businesses

The Definitive Guide to Variance Analysis for Businesses 5 Best Asset Management Software

5 Best Asset Management Software General Journal: Definition, Examples & Format

General Journal: Definition, Examples & Format What Is Leverage Ratio & How to Calculate It?

What Is Leverage Ratio & How to Calculate It?