All About Dishonoured Cheques

You have a dishonoured cheque when you pay someone but your financial institution doesn’t honour your funds. When this happens, they say that your cheque bounced. Learn more about why cheques bounce and how you can prevent it from happening to you.

Here’s What We’ll Cover:

Reasons for a Dishonoured Cheque

Preventing a Dishonoured Cheque

Reasons for a Dishonoured Cheque

If you have a dishonoured cheque on your account, you may want to know why. Below are six common reasons for dishonour.

Account Concerns

If you have insufficient funds in your account to pay someone, don’t write a cheque. You may think that other funds have the chance to deposit into your account before the payee cashes the cheque, but this may not happen. Bouncing a cheque costs you even more in fees that you have to pay because of a bounced cheque.

Your account could also be frozen. If the government or a court issues a request for your account funds to be placed on hold, no cheques process on your account. Any outstanding payments decline and may result in dishonoured cheques.

Your Signature Doesn’t Match

The digital age of banking means that you may not need to use your signature as often – but it’s still important. Your bank has a signature on file for your account. If you sign a check with an irregular signature, your bank may decline the payment thinking it is fraudulent. You can avoid confusion by signing the same way each time for your cheque payments.

Check Date

Your bank only honours a check for a certain length of reasonable time. You may have dishonour of cheque if you write the date incorrectly, forget the date, or write the date so it cannot be read. You can avoid this by writing the date clearly on the dateline of your cheque.

Unclear Value

If you write one payment amount using digits and another payment amount using words, the bank may decline your cheque. Double-check to make sure the dollars and cents match up correctly for each amount. When both values match, you can avoid having a dishonoured cheque.

Damage

You may spill a drink on a cheque, rip the paper, or allow it to wear out before using it. If this happens, avoid using the cheque for a payment. Doing so may result in a dishonoured check because the bank teller cannot read information on your cheque.

Excess Writing

Limit the words on a cheque to what is necessary. Do not add notes and other irrelevant information. Too much writing makes it difficult for a bank teller to read your cheque, and may lead to a dishonoured cheque.

Fix a Dishonoured Cheque

If you have a dishonoured cheque, correct the situation immediately, preferably within a business day. If you don’t have sufficient funds, this can be a problem. Lack of funds may lead to legal actions. Contact your bank to find out the reason for a dishonoured cheque. Make corrections to how you manage cheques to avoid the same situation again in the future.

Preventing a Dishonoured Cheque

Tips for preventing a dishonoured check include:

- Using digital banking tools instead of printed cheques.

- Writing legibly on cheques

- Balancing your account so you know how much you have to spend before writing a cheque

- Double-checking information so that everything is accurate

A bad check may leave your financial record tarnished and cost you fees. Too many dishonoured cheques can affect your ability to use financial services in the future. Use these tips to maintain a good financial standing and avoid bounced cheques with your bank.

If you’re looking for more articles like this, check out our resource hub!

Frequently Asked Questions

- Are dishonoured cheque fraudulent?

Not always. Sometimes it’s easy to make a simple error that results in a bounced check. However, if you purposely use a cheque knowing it isn’t good, that may be considered fraud. Getting caught with fraudulent dishonoured checks may have legal repercussions if you get caught.

- Do cheques have safety features?

The MICR line across the bottom of a cheque shows bank account number(s). MICR lines are printed using a special type of ink. Truly fraudulent checks that are falsified do not have magnetic ink for that line.

- What is a dishonoured cheque is a mistake?

If the banks mark a cheque as being dishonoured by mistake, they will take steps to correct the error. This may include waiving fees, expediting payment to the payee, and putting measures in place to ensure it doesn’t happen again.

RELATED ARTICLES

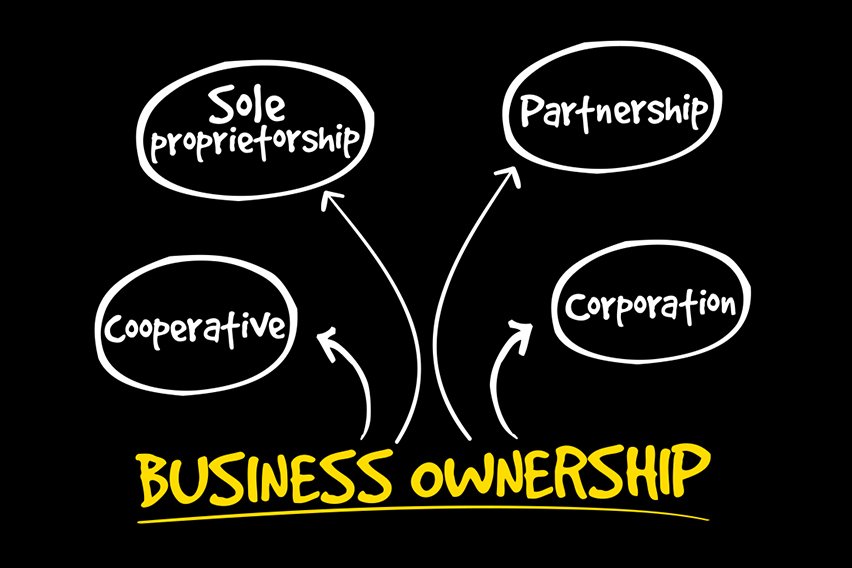

Types of Business Structures

Types of Business Structures 4 Best Free Inventory Software for Small Businesses & Freelancers

4 Best Free Inventory Software for Small Businesses & Freelancers What Is Opportunity Cost? Definition & Examples

What Is Opportunity Cost? Definition & Examples What Is an EBITDA Margin? Definition, Formula & Examples

What Is an EBITDA Margin? Definition, Formula & Examples Market Risk Premium: Definition, Formula & Calculation

Market Risk Premium: Definition, Formula & Calculation What Are Debt Securities & How They Work? Overview & Types

What Are Debt Securities & How They Work? Overview & Types