What Is Accounting? Definition, Importance, Types, & Solutions

Accounting is the recording of financial transactions of an individual or enterprise to summarize, analyze, and report on these transactions. But accounting does so much more for you and your business. Accounting helps guide you to financial health. By hiring an accountant, using a software solution, or a combination of both, you can improve profitability and the financial health of your personal life and business.

Key Takeaways

- Accounting is a system of tracking, analyzing, and presenting financial data.

- The data accountants compile drives decision-making in an enterprise.

- Financial, managerial, cost, and tax are the 4 main types of accounting.

- The accounting cycle is a series of checks and balances that ensure accuracy and compliance.

- Bookkeeping is administrative financial data entry: Accounting analyzes and presents data.

- Accounting software helps support the accounting aspects of your business.

Table of Contents

- What Is Accounting?

- Why Is Accounting Important?

- Types of Accounting

- The Accounting Cycle

- Bookkeeping vs. Accounting

- Accounting for Your Business

- Accounting Solutions for Business of All Sizes

- The Accounting Profession

- Streamline Your Accounting With FreshBooks

- Frequently Asked Questions

What Is Accounting?

Accounting is the system of recording and analyzing financial statements and ensuring the accuracy and compliance of financial records with generally accepted accounting principles (GAAP) and Canadian accounting standards 1.

Accountants deal with business and financial transactions, including reconciling bank statements, filing tax returns, and maintaining the accounting systems for a business or organization. They report their findings in financial reports and submit them to internal and external readers of financial information.

These reports guide business stakeholders in their decisions, including hiring and firing, purchasing and selling, and other financially-based decisions that influence success and profitability.

Why Is Accounting Important?

Accounting is a critical cog in the workings of any business or organization. It has implications for tax law, financial health, and stakeholder confidence.

Tax and Legal Implications: Accounting can optimize taxes to improve a business’s financial liability come tax time and mitigate fraud and other risks associated with misrepresented financial documents.

Financial Health: The resulting reports generated through accounting procedures offer data-driven financial information. That information influences the development of pricing and business strategies and forms the valuation of a company.

Stakeholder Confidence: Banks, investors, and other stakeholders use the financial reports to determine loan rates and investment levels. Lack of stakeholder confidence often leads to a withdrawal of interest in the business.

Types Of Accounting

There are many different types of accounting, including financial, managerial, cost, and tax accounting. Let’s take a closer look at each.

Financial Accounting

Financial accounting records financial transactions and summarizes them into reports to demonstrate the business’s financial position. It focuses on past performance rather than projections and overall data rather than individual departmental data.

Financial accounting reports include income statements, balance sheets, and cash flow statements. Financial accounting documents for public companies must comply with the International Financial Reporting Standards 2, as they are called upon by the Canadian Revenue Agency (CRA) during an audit.

There are 2 common approaches to this type of accounting—historical cost accounting for assets based on their original cost and current cost accounting for assets based on their current market value.

Financial accounting statements provide businesses with an overview of a company’s performance.

Managerial Accounting

Managerial accounting is a more relaxed type of accounting that provides detailed information on the company’s operations for internal use, including budgeting, cost, and financial analysis. It doesn’t need to adhere to the same GAAP guidelines as financial accounting.

Rather than the overview presentation seen in financial accounting, managerial accounting breaks down data into categories and relevant segments to identify problem areas and successes. For example, a company can have overall profits, but a detailed breakdown illustrates that one product operates at a loss while another accounts for most of the profits. In this way, managerial accounting can help with strategic planning and resource allotment within the company.

Managerial accounting uses techniques like capital budgeting and trend and margin analysis, examining the information through a strategic, performance, and risk management lens to improve profits and minimize loss.

Cost Accounting

Considered a part of managerial accounting, cost accounting focuses on the cost structure of a business. Like managerial accounting, it is for internal purposes only. Cost accounting aims to streamline overall operations, reduce costs, and increase profit margins and is particularly useful for manufacturing businesses.

Cost accounting tracks and analyzes production costs by examining various expenditures like labour and materials to ensure the cost-to-benefit is worthwhile for a company. Techniques include:

- Standard cost accounting weighs the actual production costs against theoretical costs

- Marginal cost accounting to calculate cost fluctuations

- Lean cost accounting to eliminate waste

- Activity-based cost accounting measures all production activity

Businesses use reports from cost accounting to determine how to lower costs and other pricing strategies.

Tax Accounting

Tax accounting focuses solely on taxes. Tax accountants apply the specific tax rules that businesses, individuals, and organizations must use and then work within those rules to develop strategies to minimize tax liabilities. Mistakes in tax accounting can have serious financial and legal consequences.

In business, tax accounting may differ from other accounting standards. For example, the rate of depreciation the CRA allows for an item differs from that used in financial accounting. In this way, it is common for businesses to hold separate financial statements for tax, financial, and managerial reporting.

There are 3 different tax filing methods: using free or paid tax software, through Netfile, or authorizing a chartered professional accountant to file them on your behalf.

The Accounting Cycle

The accounting cycle ensures the accuracy of the financial statements. There are 8 core stages:

- Transactions: These include any transaction, including client invoices, purchases, bill payments, and so on.

- Recording: The next step in the cycle is to enter each transaction into a journal entry in chronological order and sorted into credits and debits.

- Posting Transactions. Transactions are transferred into the company’s general ledger to reconcile all recorded information and confirm accuracy.

- Preparing the Unadjusted Trial Balance: Following the accounting period, the accountant prepares a balance of totals for the company’s accounts.

- Analyzing the Worksheet: If the accounts don’t balance, the accountant must find and reconcile the debits and credits and track and record the adjustments on a worksheet.

- Adjusting Journal Entry Discrepancies: With the debits and credits balanced, the accountant adds adjusting entries for accruals and deferments for certain accounts.

- Summarizing: Using adjusted balances, the accountant prepares the financial statements, such as audit reports and cash flow statements.

- Reporting and Closing the Books: After each period, the expense and revenue accounts are closed out, but the balance sheets stay open.

Bookkeeping Vs. Accounting

Bookkeeping and accounting are different aspects of the financial cycle of your business. Bookkeeping tends towards the administrative aspects such as invoicing, billing, and payroll. It primarily records and organizes with some reconciliation.

Accounting records and reconciles financial data but also analyzes and interprets that data before creating reports and presentations for the relevant internal and external parties, such as shareholders, owners, and investors. Accountants also handle tax returns and audits, and their presentations offer strategic insights into a business’s finances.

| Bookkeeping | Accounting | |

| Overall function | Oversee the administrative aspect related to the financial data of a business or organization. | Interpret and compile the financial data of a business or organization. |

| Purpose | Ensure all financial data is maintained in a chronological and systematic record. | To use the information provided by a bookkeeper to interpret and analyze the data so businesses can make informed decisions. |

| Result | The main result is to make available accurate financial information for the accountant. | To compile the data into relevant reports and presentations so the business can make important financial decisions. |

| Key skills | Attention to detail, strong organizational skills, critical thinking skills, and a proficient knowledge of bookkeeping. | Critical thinking skills, the ability to understand complex financial information and the implications they have on a business. |

| Typical tasks | Data entry, double journal entry, invoicing, reconciling accounts, and managing payroll. | Perform audits, prepare cost information, prepare and file tax returns, advise business owners, prepare adjusting entries, and prepare financial reports. |

Accounting For Your Business

Accounting for your business makes a complementary addition to your financial team and your overall success. Whether you are starting small or scaling up, consider using an accountant or accounting software in your business.

Outsource To Professionals

Using the services of a Chartered Professional Accountant (CPA) or accounting firm can ensure a high degree of financial accountability. They have expertise in multiple areas of accounting and provide full services that can benefit all aspects of your business. They can also ensure you remain compliant with ever-changing tax laws while providing cost, managerial, and auditing accounting needs.

Most CPAs and accounting firms represent many clients and varying interests. This can mean their attention is divided and they may need more time to return your calls. They also tend to carry a higher initial investment but offer long-term financial benefits. Outsourcing to a professional accountant or firm is a top consideration, if not a need, for large enterprises.

Hiring An In-House Accountant

Employing an in-house accountant offers significant benefits for large and growing medium-sized businesses, including availability and real-time access. With real-time access, business owners can get answers to queries that will guide the financial decisions of the business. Having an on-staff and on-site accountant to provide guidance and support can help an enterprise grow.

Large enterprises with big growth aspirations should consider a dedicated accounting staff to support the scaling of their business. While a single accountant can manage a medium-sized business, diversified and larger enterprises require a staff with focused specialization. For example, rather than using a general accountant or CPA, a large enterprise should have managerial, tax, and cost accountants.

Doing It Yourself

DIY accounting is a viable option for small businesses that are comfortable with bookkeeping and have the appropriate software. A cursory knowledge of bookkeeping provides a familiarity with basic accounting processes. The right software can help with the rest.

Good accounting software will provide many of the services that an accountant can. It can offer double-entry accounting tools, help you prepare financial reports, and help you stay compliant with CRA regulations.

Added benefits could include robust business support features, like direct payment options and email configurations. Accounting software does all that and more, taking care of almost everything except preparing your tax return.

Accounting Solutions For Businesses Of All Sizes

Businesses of all sizes can take advantage of tech and cloud-driven accounting solutions.

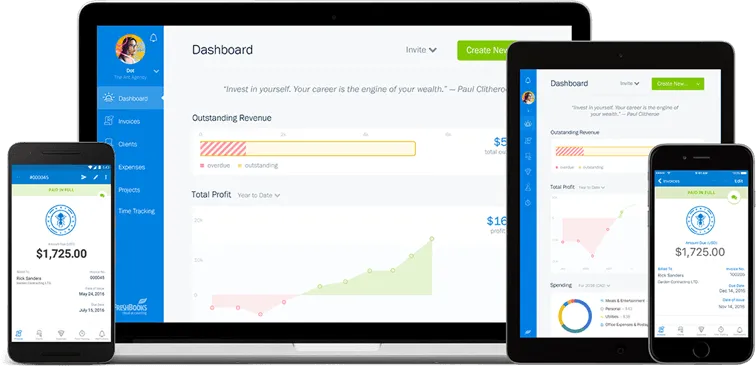

FreshBooks

FreshBooks accounting software offers a full suite of solutions for businesses of any size, streamlining your business processes from expense tracking to the billing cycle. Automated business reports help you make data-driven decisions about financial moves that impact your profitability and make it easy to know the financial health of your business with just a few clicks.

Invoice, receive payments, and collaborate with clients from one application. FreshBooks software also features integration options that bring all your apps into one place. Sync Slack to keep team conversations organized. Connect Acuity to make scheduling appointments easy for your team and your clients.

Price: Plans begin at $19 a month for the Lite Tier. This tier includes the client’s self-portal, billing features, client payment options, the performance dashboard, and robust reports.

QuickBooks

QuickBooks offers an easy-reading dashboard that displays your business overview at a glance. It allows you to track expenses, manage inventory, and simplify your bookkeeping to make tax time easier. With customizable reports, you can view your financial data and make informed decisions about your business.

QuickBooks also has automation features like auto payroll that help streamline the administrative aspects of your business.

Price: Plans begin at $24 a month for the Easy Start. This light version allows you to track and manage expenses, run reports, and produce invoices.

Xero

Xero software has robust payroll features that allow you to keep all your employee information securely stored in-house. You can generate and email payslips, manually enter employee leave, and generate payroll reports or connect with your payroll software to enjoy enhanced functionality.

Xero is also more than a payroll solution. It also offers invoicing and bill and receipt capturing through the Hubdoc integration.

Price: Plans begin at $20 a month for the Starter tier. You can reconcile banking transactions, enter bills, and send invoices.

The Accounting Profession

Accountants are skilled professionals who provide a necessary function in the financial cycle of individuals, businesses, and organizations. Accounting can be a rewarding and lucrative career for people with the aligning skills and a desire to help individuals, businesses, and organizations.

Roles And Responsibilities Of Accountants

The roles and responsibilities of accountants vary, depending on their area of focus and training.

- Auditors ensure a company’s records are accurate and compliant within the legal framework. They can be internal or public auditors and work for government agencies, corporations, non-profit organizations, and individual businesses.

- Forensic accountants perform investigative work on a company’s finances and present the results as witnesses in a court of law. They detect any errors of commission, omission, or fraud.

- Cost accountants review your expenses, including all administrative, transportation, and production costs, and provide a cost analysis. The data and recommendations they provide can help maximize profits.

- Tax accountants specialize in taxation, staying up-to-date with all relevant tax laws. They inspect and analyze all books of accounts, devise the payable tax amount, prepare returns, and ensure prompt payment to avoid penalties.

- Staff accountants work within a company as paid employees and provide various in-house accounting functions. These duties can include all steps in the financial cycle, cash management duties, and internal control estimations.

- Public accountants navigate all aspects of accounting, from tax issues to financial advice and planning. They also carry out forensic, auditing, and litigation services.

Skills Required For A Successful Accounting Career

Professional accountants in Canada must have a bachelor’s degree in accounting. To earn the CPA designation, you must complete additional work experience, pass your CPA Professional Education Program, and pass the Common Final Exam 3 For a successful accounting career, you’ll also need the following skills and qualities:

- Analytical skills

- Business acumen

- Communication, including written, oral, and listening skills

- Creativity and problem-solving skills

- Deductive reasoning

- Ethical decision making

- Leadership qualities

- Mathematical prowess

- Organization and attention to detail

- Technology expertise

- Time management

Streamline Your Accounting With FreshBooks

Accounting services ensure tax compliance and provide valuable financial insight for individuals, businesses, and organizations. With reconciled, error-free records and reports, enterprises and individuals can make informed decisions and develop strategies to benefit financial positions.

FreshBooks accounting software is convenient and efficient with robust features that can simplify accounting processes, help maximize profitability, and improve overall financial health. Try FreshBooks for free and start enjoying the benefits of accounting software today.

FAQs About What Is Accounting

We’ve compiled a list of frequently asked questions about accounting and summarized the answers for your convenience.

How can I learn basic accounting for my small business?

You can learn the basics of accounting for small businesses by enrolling in a bookkeeping or beginner accounting course. If you already have some experience with bookkeeping, you can enhance your knowledge by using the FreshBooks resource hub to get answers to many common accounting questions.

What are the golden rules of accounting?

The golden rules of accounting guide accountants in the recording of financial transactions in a dual entry system of debits and credits. There are 3 primary rules:

1) Debit the receiver, credit the giver

2) Debit what comes in, credit what goes out

3) Credit all incomes, debit all expenses

What is the difference between cash and accrual accounting?

Cash-basis accounting focuses on cash flow, tracking revenue and expenses. Accrual-basis accounting focuses on actions that lead to earnings or expense accrual. They are the 2 most common tracking methods, and each has specific applications.

Article Sources

- CRA. Impact of the IFRS on taxable income. Accessed May 17, 2024

- CRA. International Financial Reporting Standards. Accessed May 17, 2024

- CPA. CPA PEP Admission Requirements. Accessed May 17, 2024

About the author

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

What Is Accrual Accounting? Definition & Guide to Its Revenue

What Is Accrual Accounting? Definition & Guide to Its Revenue What is NOPAT?

What is NOPAT? Accounts Payable Turnover Ratio: Definition, Formula & Example

Accounts Payable Turnover Ratio: Definition, Formula & Example A Guide to Break-Even Analysis & How to Calculate It

A Guide to Break-Even Analysis & How to Calculate It What Are the Different Types of Liabilities in Accounting?

What Are the Different Types of Liabilities in Accounting? GAAP Vs IFRS: What’s the Difference?

GAAP Vs IFRS: What’s the Difference?