Small Business Financial Reporting Free Trial

FreshBooks makes it easy to know exactly how your business is performing. With our straightforward dashboard and reports, your success will never be a mystery. Plus, they’re detailed enough that your accountant will love you.

Instantly See How Well Your Business is Performing

Staying in the black? Charging enough? Sometimes it can be a mystery where your business stands. Skip the stress and use FreshBooks’ insightful dashboards and reports. They’re full of valuable information to show you exactly what you need, at‑a‑glance.

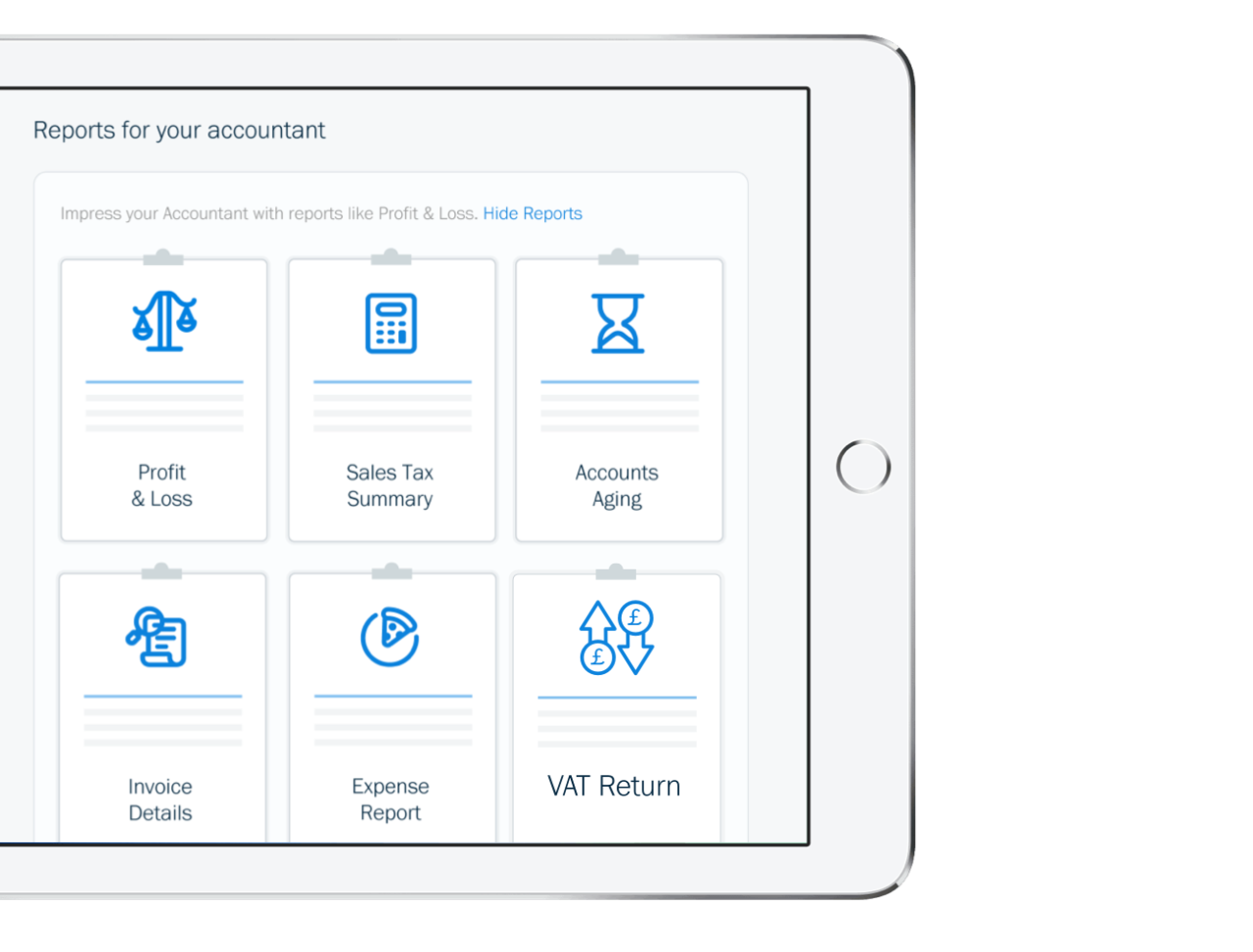

Ready-made Financial Reports When You Need Them

Let FreshBooks crunch the numbers for you. From your Dashboard, you can conveniently access important reports (like profit and loss) and skip the math headaches. You’ll save time and make tax season stress-free.

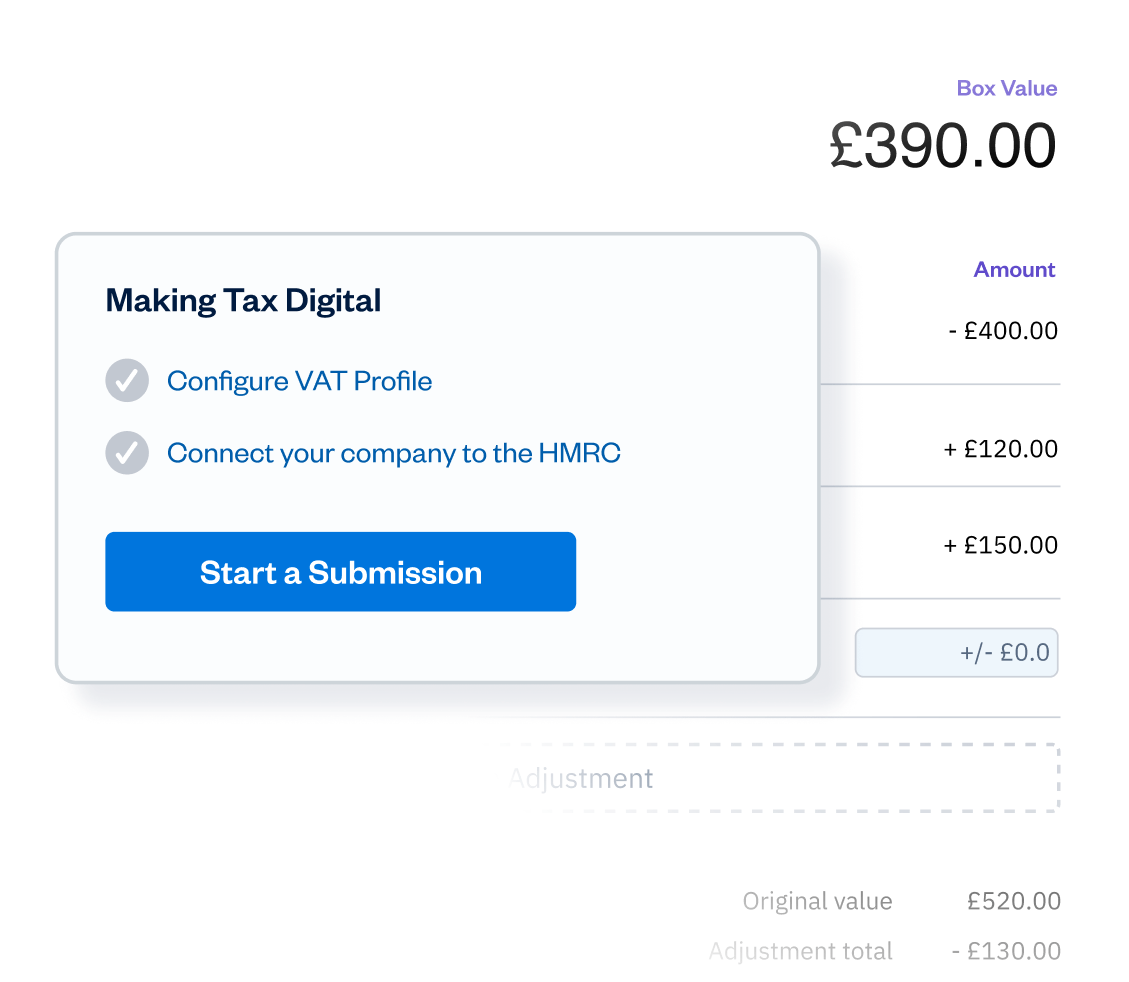

FreshBooks Is a Fast, Easy-to-Use, MTD Software

FreshBooks connects to HMRC for easy VAT Return filing (or export via CSV). Plus, with invoicing, online payments, and expense tracking – you can keep your records accurate and HMRC Recognised all year ‘round.

Even More Dashboard + Reports to Keep You On Track

- Color-coded breakdown of spending

- Summary of most recent activity

- VAT Return Report

- Profit and Loss Report

- Sales Tax Summary Report

- Accounts Aging Report

- Payments Collected Report

- Accounting Reports (General Ledger, Trial Balance, Chart of Accounts)

- Expense Report

- Invoice Details Report

- Report filtering by client, team member, or date

- Save, export or print financial reports for your accountant

- Time Tracking and Project Profitability reports

See the other ways FreshBooks delivers powerful business insights >

Did You Know…

Frequently Asked Questions

The Reports on your dashboard will give you easy access to all of the business reports available in FreshBooks.

From Profit & Loss to the Sales Tax Summary, FreshBooks gives you standard business reports to help you understand your business’ health. Better yet, you can even easily download the reports to share with your accountant.

FreshBooks is 100% MTD compliant and helps you get all the information you need for HMRC tax time. You can generate and file your VAT returns to HMRC directly from FreshBooks with just a few clicks.

Absolutely. FreshBooks makes it easy to keep a close eye on the bottom line with Profit & Loss Reports you can whip up in mere seconds. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.

Project Profitability allows you to track your Projects’ performance to see how profitable they are. Project Profitability also helps you better manage team members and see how time and expenses are being tracked to help you make better business decisions.

Check out how ridiculously easy to use FreshBooks invoicing is, or learn more about FreshBooks.