How to Calculate Bad Debt Expense

Any business that offers sales on credit runs the risk of being unable to collect on some of its debts. These uncollectable debts are known as bad debt expenses. When this does happen, it’s essential that you understand the steps to record a bad debt expense in an accounting entry.

In this article, we’ll define a bad debt expense, explain how to identify them, go over the formula to calculate bad debt expenses (with examples), cover the methods of estimating your business’ bad debt, and describe the method of recording it in your books.

Key Takeaways

- Bad debts are an unfortunate reality of doing business on credit—bad debt expense is an estimated amount of receivables that are highly unlikely to get collected. This estimate is recorded and adjusted every accounting period.

- There are 2 methods of calculating bad debt expense: the Direct Write-Off Method (not GAAP), and the Allowance Method (permitted by GAAP).

- Bad debts must be listed as an expense for your business if you use the accrual accounting method.

- There are 2 methods of estimating bad debt: the percentage of sales approach and the percentage of accounts receivable method.

- Accounting software can make the process of recording bad debt expenses much easier for business owners.

Table of Contents

- What is Bad Debt Expense?

- How to Find Bad Debt Expense

- How to Calculate Bad Debt Expense

- Bad Debt Expense Example

- What Methods Are Used for Estimating Bad Debt?

- How Do You Record Bad Debt Expense?

- Simplify Financial Management with FreshBooks

- Frequently Asked Questions

What Is Bad Debt Expense?

Allowance for bad debts is a contra-asset account, where a business records an estimated amount of receivables that they don’t expect to collect from customers. On the balance sheet, the allowance offsets the number of outstanding accounts receivable (which is then presented at their net realizable value).

The journal entry to record an estimate for bad debts is to debit a bad debt expense account and credit allowance for uncollectible accounts.

You’re only required to record bad debt expenses if you use the accrual accounting method since this method recognizes credit sales as income when earned. If you use the cash accounting method, you record income and expenses when cash is received or spent.

How to Find Bad Debt Expense

When a business offers goods and services on credit, there’s always a risk of customers failing to pay their bills. The term bad debt refers to these outstanding bills that the business considers to be non-collectible after making multiple attempts at collection.

It’s your decision to write off customer invoices that remain unpaid. However, if the customer is avoiding your calls, making no effort to negotiate payment terms and there are invoices that have gone unpaid for more than 90 days, you might consider writing off the invoices as bad debts.

A review of accounts receivable aging schedule, and experience from prior periods will give you a good idea about the bad debt you may incur.

Recording a bad debt expense gives a more accurate picture of your financial position. Writing off these debts helps you avoid overstating your revenue, assets, and any earnings from those assets.

How to Calculate Bad Debt Expense

There are two ways to calculate bad debt expense: the direct write-off method, in which the invoice amount is charged directly to bad debt expense and removed from the accounts receivable (this method is used for federal income tax purposes only), or the allowance method, in which the bad debts are anticipated even before they occur and an allowance is set. This is the approved method in accrual accounting.

Direct Write-Off Method

The direct write off method involves a direct write-off to the receivables account. When it’s clear that a customer invoice will remain unpaid, the invoice amount is charged directly to bad debt expense and removed from the account accounts receivable. The bad debt expense account is debited, and the accounts receivable account is credited.

Under this method, there is no allowance account.

There is a downside of using this method. While the direct write-off method records the exact amount of uncollectible debts and can be used to write off small amounts, it fails to uphold the GAAP principles and the matching principle used in accrual accounting.

The rule is that an expense must be recognized at the time a transaction occurs rather than when payment is made. The direct write-off method is therefore not the most theoretically correct way of recognizing bad debts.

Additionally, the accounts receivable are overstated on the balance sheet.

Allowance Method

Under this method, the bad debts are estimated even before they occur. An allowance for doubtful accounts is established based on an estimate made by the company. This is the amount of money that the business anticipates losing every year.

This contra-asset account reduces the accounts receivable account when both balances are listed in the balance sheet.

An allowance for bad debts is adjusted at year-end, as necessary.

This is recorded as a debit to the bad debt expense account and a credit to the allowance for doubtful accounts. The unpaid accounts receivable that are written off are credited with a corresponding debit to the allowance account.

If a written-off account is later collected, the transaction is reversed.

Bad Debt Expense Example

Let’s use a more real-world scenario to illustrate a bad debt expense. Let’s assume that a company called Larry’s Lumber sells a shipment of wood to a company called Terri’s Toys, which uses the materials to create its products.

Larry’s Lumber sends the shipment of wood to Terri’s Toys, as well as an invoice for $5,000. Due to unforeseen financial circumstances, however, Terri’s Toys cannot pay the invoice on time. Despite Larry’s Lumber attempting to collect the $5,000 several times, they decide that they are very unlikely to be successful.

Because of this, Larry’s Lumber makes an accounting entry for this $5,000, classifying it as a bad debt expense. This uncollectible amount is recorded as a loss in their records, and they decide to be more careful before offering credit to Terri’s Toys again in the future.

What Methods Are Used for Estimating Bad Debt?

According to the GAAP principles, there are two ways businesses can estimate bad debt – the percentage of sales approach, which uses a percentage of the total sales of a business for the period, or the percentage of accounts receivable method.

Percentage of Accounts Receivable Method

Under this approach, businesses find the estimated value of bad debts by calculating bad debts as a percentage of the accounts receivable ending balance.

For example, at the end of the accounting period, your business has $50,000 in accounts receivable.

The historical records indicate that an average of 5% of total accounts receivable becomes uncollectible. Businesses also prepare an aging schedule to estimate bad debts.

You need to set aside an allowance for bad debts account to have a credit balance of $2,500 (5% of $50,000).

Percentage of Sales Method

The percentage of sales of estimating bad debts involves determining the percentage of total credit sales that is uncollectible. The past experience with the customer and the anticipated credit policy plays a role in determining the percentage.

Once the percentage is determined, it is multiplied by the total credit sales of the business to determine bad debt expense.

For example, for an accounting period, a business reported net credit sales of $50,000. Using the percentage of sales method, they estimated that 5% of their credit sales would be uncollectible.

In this case, the business estimates that it would incur an amount of $2,500 ($50,000 x 5%) as bad debt expense.

How Do You Record Bad Debt Expense?

Under the allowance method of calculating bad debts, there are two general ledger accounts – bad debts, an expense account, and allowance for doubtful accounts, a contra-asset account used to offset the accounts receivable balance.

To record the bad debt expenses, you must debit bad debt expenses and a credit allowance for doubtful accounts.

| Date | Accounts | Reference | Debit | Credit |

| 31-Jun-24 | Bad Debt Expense | $170 | ||

| Allowance for Doubtful Accounts | $170 | |||

| 02-Jul-24 | Allowance for Doubtful Accounts | $170 | ||

| Accounts Receivables | $170 |

With the write-off method, there is no contra-asset account to record bad debt expenses. Therefore, the entire balance in accounts receivable will be reported as a current asset on the balance sheet. This entails a credit to the Accounts Receivable for the amount that is written off and a debit to the bad debts expense account.

| Date | Accounts | Reference | Debit | Credit |

| 31-Jun-24 | Bad Debt Expense | $170 | ||

| Accounts Receivable | $170 |

Each time the business prepares its financial statements, bad debt expenses must be recorded and accounted for. Failing to do so means that the assets and net income may be overstated.

Identifying and calculating bad debt expense also helps identify customers that default on payments more often than others. Businesses can use this to identify customers that are creditworthy and offer them discounts for their timely payments.

Simplify Financial Management with FreshBooks

Having a good grasp of bad debt expenses will make for more accurate, transparent, and useful financial records. While it’s not ideal to need to record bad debt expenses, understanding the process will make it much easier to note the loss and move on with your business.

If you’re looking for a solution to manage your finances more simply and efficiently, FreshBooks is here to help. Our expense tracking software makes it easier to record bad debts and factor them into your other financial reports, letting you focus on running your business instead of keeping your books. Try FreshBooks for free today and experience seamless financial management!

FAQs About How To Calculate Bad Debt Expense

Are you still curious about how to calculate and record bad debt expenses for your business? Here are some frequently asked questions to help expand your knowledge.

How do you find bad debts on a balance sheet?

Bad debts are categorized as an expense under your Sales, General, and Administrative (SG&A) expenses on a balance sheet. The bad debt provision, on the other hand, is recorded as a contra-asset account offsetting accounts receivable on your balance sheet.

What is the journal entry for bad debts expense?

Record the journal entry for a bad debt expense by debiting your bad debt expense account and crediting allowance for doubtful accounts. When you decide to write off the account, debit allowance for doubtful accounts, then credit the relevant receivables account.

How to treat bad debts in final accounts?

Your bad debts should be listed on the debit (Dr.) side of your profit & loss statement since they’re a loss for the business. You would also reduce your receivables by the amount of allowance on the balance sheet.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What is Managerial Accounting?

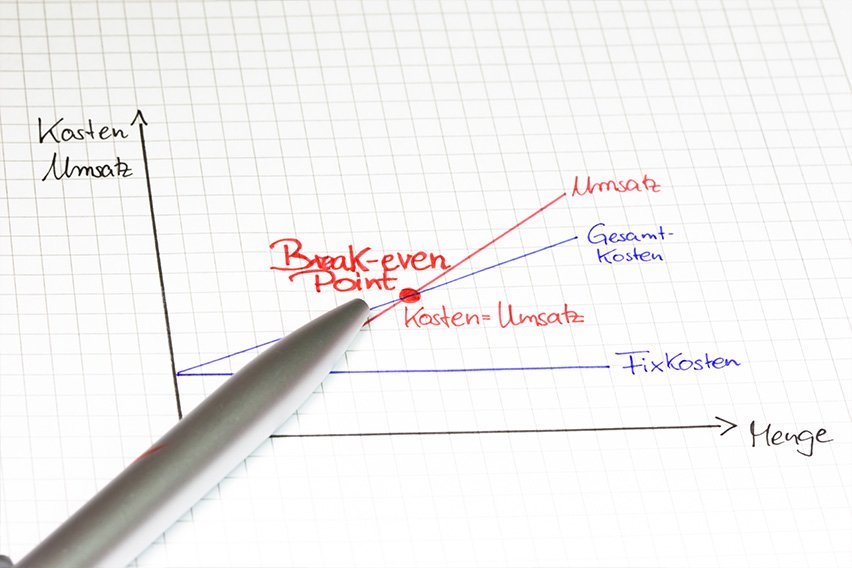

What is Managerial Accounting? How to Calculate the Break-Even Point

How to Calculate the Break-Even Point How to Calculate Retained Earnings: Formula and Example

How to Calculate Retained Earnings: Formula and Example What is Indirect Labor Cost?

What is Indirect Labor Cost? What is Journalizing Transactions?

What is Journalizing Transactions? What Does an Accountant Do?

What Does an Accountant Do?