CPA vs Accountant: What Is the Difference?

Not all accountants are CPAs (certified public accountants), but all CPAs are in the accounting profession. Typically, an accountant has achieved a bachelor’s degree in accounting. A certified public accountant earns this designation after completing specific educational and work requirements and passing a CPA exam.

These requirements are specific to each state. This means a CPA is likely to be more knowledgeable in the field of accounting than someone who has not earned the designation. A CPA is also allowed to perform certain duties that regular accountants are not permitted to do. In this article, we’ll explore more about the differences between a CPA and an accountant, their career paths, what types of education and training they need, and which is better for your business.

Key Takeaways

- Accountants are individuals who maintain and analyze an individual or company’s financial records, tracking cash flow, expenditures, and tax documents.

- CPAs are certified public accountants, licensed by the Board of Accountancy to perform the duties of an accountant, as well as act on the person or company’s behalf, with specific ethics requirements.

- You might want to hire an accountant to prepare your taxes, support and grow your business, and save time on financial paperwork.

- A CPA can help your business by remaining unbiased as they provide high levels of expertise in complex tax, business, and financial situations.

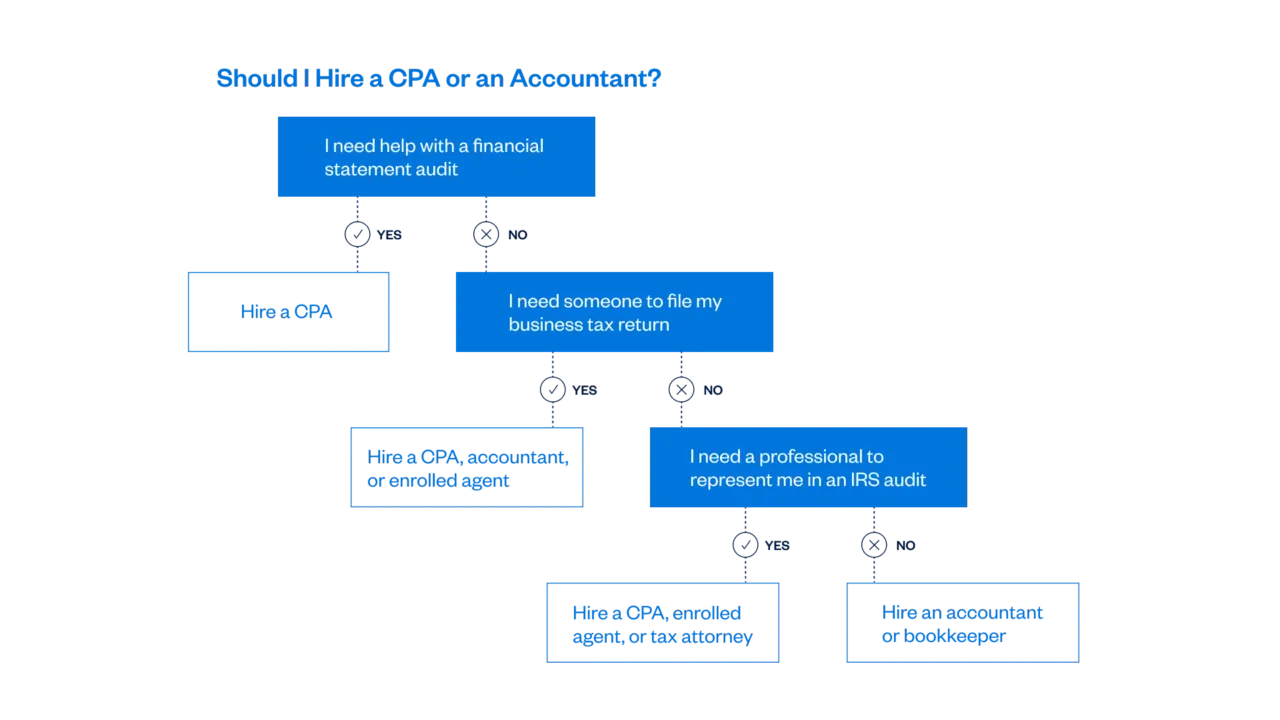

- Deciding between a CPA or an accountant will depend on your unique business needs.

Table of Contents

- What Is an Accountant?

- What Is a CPA?

- Difference Between CPA and Accountant

- Accountant vs. CPA: Which is Better?

- What Percentage of Accountants are CPAs?

- How Long Does It Take to Become a CPA?

- Final Thoughts: Deciding Between a CPA and an Accountant

What Is an Accountant?

An accountant is a person whose job it is to analyze and review financial records, keep track of a business’s cash flow and financial transactions, and assist in some tax preparation duties. In some cases, an accountant will also be involved in cost analysis, auditing, or the financial planning of a company.

What Is a CPA?

CPA is short for “certified public accountant”, an accountant who has passed a specific exam provided by the state Board of Accountancy. A licensed CPA is involved in analyzing financial data, recording financial transactions and budgets, record keeping, auditing, tax planning, and management consulting, using internal auditing, forensic accounting, and more to keep a business’ finances healthy.

A CPA must also complete continuing education regularly as defined by the state in which they are certified, which includes a mandatory ethics component.

Difference Between CPA and Accountant

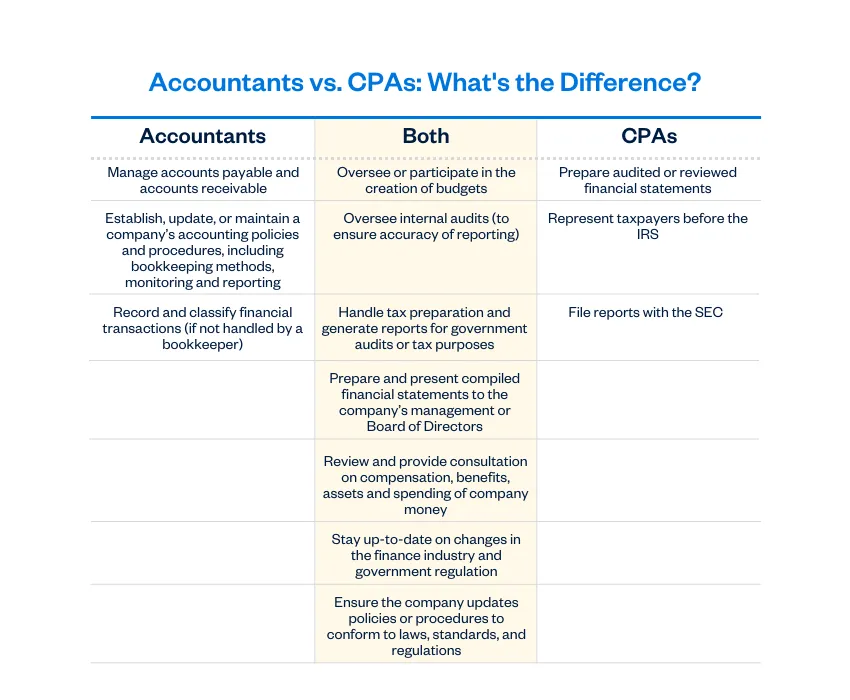

While both are accountants, when you look into the duties and tasks of someone working as a CPA vs accountant jobs, there are significant differences, which we will explore below.

Education

A person can become an accountant by earning a bachelor’s degree in accounting, finance, business management, or another related field. Most people enter the accounting field by becoming an intern while in school, then building upon their skills as a junior accountant or a company’s financial clerk, with guidance from more experienced accountants. Others may earn a master’s degree in accounting to expand their post-graduation career opportunities.

To be a CPA, you need to have earned your professional designation through work experience, education, and a licensing process. Most CPAs start with a graduate degree in accounting, tax, or business administration, meeting the criteria of accounting and business core courses required by the state. This is followed by obtaining relevant work experience and licensing to become a certified public accountant, along with passing a rigorous exam.

Responsibilities

Accountants analyze and interpret the financial data of a company and prepare financial reports. Their duties vary by client and by the industry they work in, and they may perform a wide range of finance-related tasks for their employer or their clients.

Some common responsibilities of an accountant include:

- Ensuring a small business’s financial documents are accurate and comply with relevant laws, regulations, and tax codes

- Recording and classifying financial transactions (if this work isn’t performed by a bookkeeper)

- Preparing financial statements and related schedules and disclosures

- Recommending internal controls and financial best practices

- Offering guidance to help small business owners overcome problems and reach their goals

- Overseeing business tax preparations and assisting external auditors with their annual company audits

- Improving the company’s accounting system

A CPA is responsible for more advanced accounting and business concepts, like the analysis and reporting of financial data. Their duties can be broken down as follows:

- Establishing, updating, or maintaining a company’s accounting policies and procedures, including bookkeeping methods, monitoring, and reporting

- Overseeing or participating in the creation of budgets

- Overseeing internal audits (to ensure the accuracy of reporting)

- Performing audit testing, preparing and creating audit reports for government audits or tax purposes

- Preparing and presenting financial statements to the company’s management or Board of Directors

- Filing SEC reports to the Securities and Exchange Commission to provide transparency to the public and the company investors

- Reviewing and providing consultation on compensation, benefits, assets, and spending of company money

- Managing accounts payable and accounts receivable

- Staying up to date on changes in the finance industry, tax laws, and government regulations. Ensuring the company updates policies or procedures to conform with best practices

Although the above lists several duties of a CPA, it is important to note that CPAs should not offer services where they both audit and consult for the same business. The AICPA and the SEC consider this to be a conflict of interest.

The CPA, or Certified Public Accountant, is not an international designation, it is issued solely in the United States. For instance, in Canada a “CPA” designation exists, but it stands for “Chartered Professional Accountant”.

Training And Licensing

Both accountants and CPAs must complete a minimum of a bachelor’s degree in a related field, with accounting program courses as specified by state authorities. A person can become an accountant by obtaining the appropriate level of schooling, then either working as an intern or starting a job as a lower-level accountant, with oversight from more knowledgeable senior employees.

To receive a CPA license on the other hand, a person must pass the state’s Board of Accountancy CPA exam, along with completing 150 hours of college coursework and a minimum of two years of public accounting experience working under a CPA. The exam consists of four parts, each of which is written separately. In most states, all four exams must be passed within 18 months. These are broken down as follows:

- Auditing & Attestation

- Financial Accounting & Reporting (this is generally considered to be the hardest part of the exam)

- Regulation

- Business Environment & Concepts

Additionally, a 5th part around Ethics must be completed (candidates are expected to pass the ethics exam within two years of applying for their CPA license with a score of 90 or above. This exam is a take-home, open-book test of 40 multiple-choice questions).

Applicants must score at least 75% in each CPA exam section. The CPA certification exam generally is considered difficult, and less than 20% of test-takers pass all four sections the first time they take them.

To maintain a CPA license, CPAs must complete continuing education classes every year to keep their license. All states require the equivalent of 40 hours of CPE every year, but some states have flexible requirements. For example, Alaska requires CPAs to get 80 hours of CPE every two years, at least 20 hours per year.

This vigorous licensing standard is in place to prevent unlicensed accountants from offering their services to unwitting businesses, and potentially causing serious financial, tax, or legal issues, either due to their ignorance or lack of experience. CPAs must also hold to ethical standards, acting on behalf of their client’s best interests and remaining impartial.

You can view the CPA requirements by state at ThisWayToCPA.com, which is maintained by the American Institute of Certified Public Accountants (AICPA).

Fiduciary Responsibility

The term “fiduciary responsibility” refers to the legal rights of a person or organization to act on behalf of another person, client, or company. A CPA is the only accountant with the legal rights to act as a fiduciary for their clients, and as such, have the responsibility to act in their client’s best interest, a duty not required of regular accountants.

Tax Preparation and Audits

Accountants can all file and prepare tax returns, including non-certified accountants and CPAs, though it’s important to keep in mind if they are compensated for this work they must apply for and receive a Preparer Tax Identification Number (PTIN).

Along with the usual tax proceedings, CPAs can legally represent their client when interacting with the Internal Revenue Service (IRS). This is beneficial in cases in which complicated tax issues arise, as the business owner can be confident they’re proceeding legally, per all state and federal tax laws.

Code of Ethics

General accountants don’t have any overseeing governing body, and therefore don’t have a code of ethics they’re legally bound to follow. This is not the case for CPAs, who must follow strict ethical principles. There are 5 codes of ethics a CPA must adhere to, as mandated by the American Institute of Certified Public Accountants (AICPA). These are:

- Integrity: They must only do what is right, according to the standard

- The public interest: They must ensure all actions serve the public interest

- Responsibilities: They have a responsibility to provide the best services possible

- Objectivity and independence: They must not be involved in conflicts of interest and must remain objective in all matters

- Due care: They must perform their job to the best of their ability, including upgrading their education, and seeking the guidance and evaluation of others

Average Salary

Due to their higher skill level, in most cases, CPAs earn more than general accounting professionals. Accountants may earn around $61,480 per year, while senior CPAs earn an average of $92,795 annually. For partners in a CPA firm, the average CPA salary is $166,572. This figure does not include bonuses or other benefits. These figures vary based on their skill and experience level, their education, the industry they’re working within, and their job location.

Job Opportunities

The difference between CPAs and unlicensed accountants becomes clearer after exploring the career paths for each. For example, if you’re a general accountant, you will likely work for one employer at a public or private corporation. You may work as:

- Accounting manager

- Financial or budget analyst

- Internal auditor

- Project accountant

- Risk analyst

- Management accountant

- Tax accountant

- Self-employed accountant

A CPA, on the other hand, might find work in the following fields:

- Financial forensics accountant

- IT consultant

- Personal financial advisors

- Business valuator

CPAs can work at any firm, including large multinational corporations, public accounting firms, government agencies, and public companies that must disclose their financial information to the public and shareholders.

For both types of accounting-based paths, the Bureau of Statistics states the career growth outlook to be positive, as it is expected to grow 4% from 2022 to 2032. 1

Accountant vs CPA: Which Is Better?

Both accountants and CPAs are important, each with their own skill sets. CPAs are better qualified to perform some duties and are recognized by the government as credible and an expert in the field. Individuals who have received a CPA designation are trained in generally accepted accounting principles and best practices (including online tools).

When hiring an accountant, it’s important to note that CPAs will, in most cases, charge more than non-certified accountants, but this is because only a CPA can prepare an audited financial statement or reviewed financial statement and file reports with the Securities and Exchange Committee (SEC). CPAs can also represent clients in front of the IRS state tax authorities during a tax audit, whereas a general accountant cannot. If you need someone to take care of your small business’ financial needs, you may wish to choose a general accountant. If you’re running a large corporation, with complex tax returns and SEC reporting, a CPA is better suited to your business.

What Percentage of Accountants Are CPAs?

According to the U.S. Bureau of Labor Statistics, there are roughly 1.3 million accountants in the U.S. The National Association of State Boards of Accountancy reports that there are approximately 669,000 actively licensed CPAs, meaning approximately 50% of accountants in the United States are CPAs.

How Long Does It Take to Become a CPA?

The length of time it takes to become a CPA depends on the personal situation of the candidate, their level of education, the state they live in, and the state’s qualifications. The difference between state requirements for obtaining the CPA credential can be considerable. For instance, some states only require one year of work experience while others require two.

Considering the average length of time it takes to achieve the required degree and work experience, it takes, on average, seven years to achieve the CPA certification if starting from scratch.

On the other hand, regular accountants may land jobs in small businesses or corporate accounting departments with just a bachelor’s degree and work their way up the ladder, gaining experience and general accounting skills via on-the-job training.

Final Thoughts: Deciding Between a CPA and an Accountant

Deciding between a CPA and an accountant depends on the type of company you have. For example, a public corporation, a large international company, or a business with complex tax needs will benefit from hiring somebody with training in these specific areas. If your business is smaller, local, or private, an accountant will be able to handle your needs. If you’re unsure, just ask a tax professional near you.

Whether you opt for a CPA or an accountant, FreshBooks makes your financial management easier than ever. With features like expense tracking, invoicing, and financial reporting, this powerful accounting software will support either type of professional in delivering accurate and efficient service, helping you make the most informed choice for your business needs. Try FreshBooks for free now, and see how it can simplify your business finances, fast.

Article Sources

- U.S. Bureau of Labor Statistics. Accountants and Auditors. “Accountants and Auditors”, Accessed July 8, 2024.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How Much Do Accountants Charge for a Small Business? It Depends on Your Needs

How Much Do Accountants Charge for a Small Business? It Depends on Your Needs Accounting and Finance: Why Is It Important to Your Business?

Accounting and Finance: Why Is It Important to Your Business? What Is an Unfavorable Variance and How to Avoid It?

What Is an Unfavorable Variance and How to Avoid It? Are Retained Earnings Taxed for Small Businesses?

Are Retained Earnings Taxed for Small Businesses? Bookkeeping For Freelancers: A Beginner’s Guide

Bookkeeping For Freelancers: A Beginner’s Guide