PayPal Instant Transfer: Fees, Limits, and How It Works

Standard PayPal payments take 1 to 3 days to transfer to your bank account, which can be slow and inconvenient for many users. PayPal’s instant money transfer feature gives you the option for same-day transfers for a small fee. You can transfer money between your PayPal wallet and your bank account or your debit card in just 30 minutes or less.

PayPal instant transfer is quick and convenient, making it a great fit for individuals and small business owners. We’ll explore how PayPal instant transfers work, fees and limits, and steps for sending and receiving money through instant transfer.

Key Takeaways

- PayPal instant transfers take 30 minutes or less and cost a small fee.

- Standard PayPal transfers are free and take 1 to 3 days.

- PayPal charges a fixed fee of 1.75% of the transaction amount on instant transfers.

- Instant transfers have limits on the amount you can send per transaction.

- PayPal instant transfers are quick, convenient, and secure.

Table of Contents

- How Long Does PayPal Instant Transfer Take?

- PayPal Instant Transfer Fee

- PayPal Instant Transfer Limit

- How to Link Your Bank Account or Card to PayPal for Instant Transfers

- How to Transfer Money From Paypal To Bank Account Instantly?

- Pros and Cons of PayPal Instant Transfer

- Recognize Instant Transfer Scams

- How To Make the Most of Instant Transfers on PayPal

- Conclusion

- Frequently Asked Questions

How Long Does PayPal Instant Transfer Take?

PayPal instant transfers can take up to 30 minutes, but will often transfer in just a few minutes. This makes them a great alternative to slower standard PayPal transfers.

Standard PayPal transactions typically take 1 to 3 days to process. Although standard transfers are free, this time delay can be inconvenient for many PayPal users.

PayPal instant transfers offer a quicker solution for individual and merchant users looking for a faster way to transfer money to their bank accounts. For a small fee, instant transfers enable PayPal users to send same-day transactions in just 30 minutes or less.

PayPal Instant Transfer Fee

PayPal charges a small fee for the convenience of using an instant money transfer. In most cases, you’re charged 1.75% of the transfer amount on instant transfers. This fee applies to domestic transactions to bank accounts and credit cards.

There are also minimum and maximum fee amounts for instant transfers. If your transfer is conducted in US currency, you’ll pay a minimum of 25 cents up to a maximum of $25.

The following table provides more details on fees for PayPal instant transfers:

| Withdrawal Type | PayPal Fee and Transfer Time |

| PayPal instant transfer to bank account | 1.75% of transfer amount with a minimum of 25 cents and a maximum of $25, transfers in 30 minutes or less |

| PayPal standard transfer to bank account | No fees*, transfers in 1 to 3 days |

| PayPal instant transfer to credit card | 1.75% of transfer amount, transfers in 30 minutes or less |

| PayPal standard transfer to credit card | No fees*, transfers in 1 to 3 days |

*There are no fees for standard transactions, however, fees may apply if you are also doing a currency conversion.

PayPal Instant Transfer Limit

Instant transfers have limits on the amount of money that you can send at one time. If you’re transferring from your PayPal balance to your bank account you can send a maximum of $25,000 per transaction.

Instant credit card transfers have a limit of $5,000 per day, up to a maximum of $15,000 per month.

The following table details PayPal’s instant transfer limits for bank accounts and credit cards:

| Instant Transfer Type | PayPal Instant Transfer Limit |

| Transfer to bank account | Up to $25,000 per transaction |

| Transfer to credit card | Up to $5,000 per transaction, $5,000 per day, or $5,000 per week, with a maximum of $15,000 per month |

How to Link Your Bank Account or Card to PayPal for Instant Transfers

If you’re new to PayPal, you’ll need a linked bank account or credit card before you can use PayPal instant transfers. We’ll take you through the steps to link your account or card so you can get started sending and receiving money.

Linking Your Bank Account

- From PayPal’s web browser, create an account or log in to your existing account

- Click the Wallet button (or Menu, then Wallet if you’re accessing from a mobile device)

- Click Link Bank Account

- Add your bank account information, including account name and number and routing number. You can find this information on your checks or your online bank account, or you can contact your bank.

- Follow the on-screen prompts, then confirm

Linking Your Credit Card

- From PayPal’s web browser, create an account or log in to your existing account

- Click the Wallet button (or Menu, then Wallet if you’re accessing from a mobile device)

- Click Link Credit or Debit Card

- Add your card details. You can find these on your credit card or your online bank account, or you can contact your card provider.

- Follow the on-screen prompts, then click Link to complete the process

Once you’ve linked a valid bank account, credit card, or debit card, you’ll be able to send and receive PayPal instant transfers.

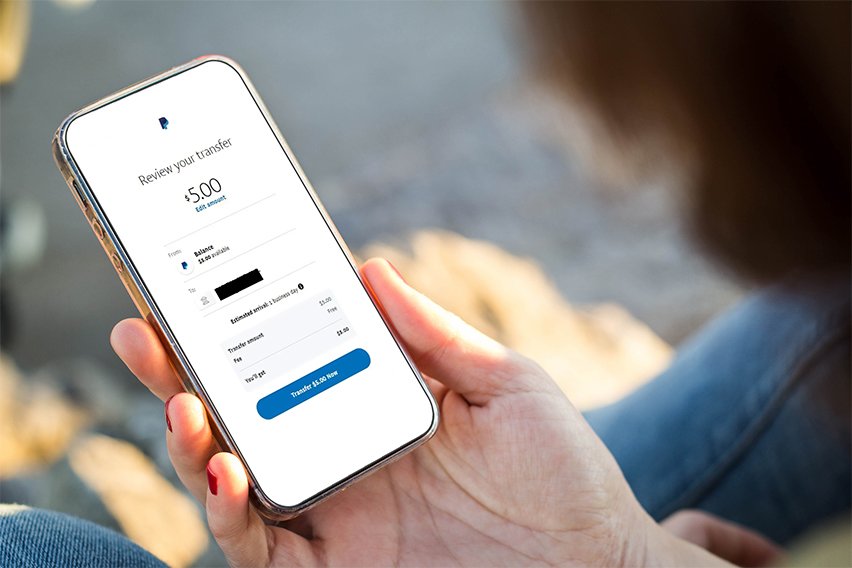

How to Transfer Money From Paypal To Bank Account Instantly?

PayPal offers 2 ways to transfer money from PayPal account to bank or credit card. Standard transactions are typically free and take between 1 to 3 days. Instant transfers charge a small fee and processed in 30 minutes or less.

We’ll take you through the steps to use PayPal instant transfer:

- Log into your PayPal account and click the Wallet button

- Select Transfer Money

- Select Transfer to Your Bank

- Select In Minutes

- If you have multiple bank accounts or cards linked, select where you’d like to transfer the money

- Choose the amount you want to send, check that you’re aware of the instant transfer fee (1.75% of the transfer amount), and follow the on-screen prompts to confirm your transfer

You can make instant transfers through the PayPal web browser or with the PayPal mobile app.

Pros and Cons of PayPal Instant Transfer

Explore the pros and cons of PayPal instant transfers to decide whether this transfer type is right for you.

Pros

Speed:

Instant transfers enable you to send same-day financial transactions. You can send and receive money in 30 minutes or less, and often in just a few minutes.

Convenience:

You can send and receive PayPal instant transfers from your laptop, desktop, or mobile device, making it easier than ever to quickly send funds.

Flexibility:

Same-day transfers make it easier to conduct time-sensitive financial transactions, giving you greater flexibility for buying and selling.

Cons

Transfer Fees:

PayPal charges a small fee for instant transfers. You’ll pay 1.75% of your transaction amount when you use instant transfer to withdraw money to your bank account or credit card.

Transaction Limits:

PayPal instant transfers come with transaction limits. You can send a maximum of $25,000 per transaction to your bank account, or $5,000 per transaction to your credit card.

Cancellation Time:

Although you can cancel PayPal instant transfers after they’re sent, you cannot cancel them once they’re authorized. Instant transfers authorize more quickly, giving you less time to cancel.

Recognize Instant Transfer Scams

In 2022, payment scams and bank transfer fraud resulted in roughly $1.9 billion in losses in the U.S. alone. PayPal is considered secure, but it’s important to remember that all online payments come with some degree of risk. Learning to recognize common scam tactics and online fraud can help you reduce your risk when using online money-sending tools. Some scams to watch out for include:

- Fake invoice fraud, where scammers pose as legitimate business vendors to pressure individuals into paying a false invoice.

- Authorized Push Payment (APP) fraud, where scammers pose as personal connections like friends or family to request money.

- Account Takeover (ATO) fraud, where hackers may use phishing schemes to gain access to individual accounts.

Recognizing these schemes and using security tools like multi-factor authentication can help ensure your online payment account stays secure.

How to Make the Most of Instant Transfers on PayPal

Instant access to funds is great, but the fees – not so much. Here is how to use the instant transfer feature to your best advantage.

Avoid Transfers to Your Debit Card

Transfers from PayPal to your debit card are capped at $5,000 per week or $15,000 per month. However, when you transfer to your bank account you can send up to $25,000 per transaction. Sending you your bank account rather than your debit card enables you to make the most of the maximum transfer fee of $25 per transaction.

Transfer as Little as Possible

By little, we mean frequency! The trick to reducing the fees you pay to PayPal is to reduce the number of transfers you request. Since you pay a minimum transfer fee for every transaction, sending many small transactions adds up quickly. It’s more effective to send a few large transactions since the fee is capped at $25.

Transfer as Much as Possible

By “much”, we mean amount. Transfer as much as possible in one go to capitalize on that $25 cap.

Conclusion

PayPal instant transfer offers a secure, convenient way to quickly send and receive money. PayPal charges a small fee for these transactions, and each instant transfer comes with an amount limit.

Online payment systems like PayPal are essential to many small businesses, so it’s important to make the most of these tools. FreshBooks invoicing software and FreshBooks payments enable you to create and send professional invoices and receive payment through popular systems like PayPal and Stripe. Try FreshBooks free to boost your efficiency, get paid faster, and grow your business today.

FAQs on PayPal Instant Transfer

Learn more about eligible cards, transfer times, and transfer holds with frequently asked questions about PayPal instant transfer.

What cards work with PayPal instant transfer?

PayPal allows you to connect debit cards as well as a variety of credit cards, including Visa, Mastercard, Discover, and American Express. You can use these for both instant and standard PayPal transfers.

Why can’t I instantly transfer on PayPal?

If you haven’t linked an eligible bank account or credit card to your PayPal account, you won’t be able to use instant transfer. Instant transfer also includes a small fee as well as transaction amount limits, so if you have insufficient funds for the fee, or if you have exceeded the limit, instant transfer won’t work.

Is PayPal to PayPal transfer instant?

PayPal to PayPal transfers are not instant. Standard free transactions take 1 to 3 days, while instant transfers take 30 minutes or less. Users can choose which transfer type to use, but if they select instant transfer it comes with a small fee and a transaction limit.

Why is PayPal holding my instant transfer?

In some cases, PayPal will apply a temporary hold on transfers for security reasons. This may occur if you’re sending money to a new recipient or if you’re sending money for the first time after your account has been inactive for a while.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

What Is an eCheck? An Extensive Guide on Electronic Checks

What Is an eCheck? An Extensive Guide on Electronic Checks How To Transfer Money From PayPal to Bank: A Step-by-Step Guide

How To Transfer Money From PayPal to Bank: A Step-by-Step Guide How To Receive Money From Cash App

How To Receive Money From Cash App How to Receive Money on PayPal? Small Business Guide

How to Receive Money on PayPal? Small Business Guide Does PayPal Charge a Fee? Know-How to Reduce Fees on PayPal

Does PayPal Charge a Fee? Know-How to Reduce Fees on PayPal What is Payment Gateway?

What is Payment Gateway?