Profit and Loss Statement: Definition, Types, And Examples

A profit and loss (P&L) statement is a financial report that summarizes a business’s total income and expenses for a specific period. The profit and loss statement is also known as an income statement or a statement of operations.

The goal of a P&L statement is to measure a company’s profits by subtracting expenses from income. This type of report helps provide an overview of the business’s overall financial health.

In this guide, we’ll go over the details of how to create a profit and loss statement, explain the two different accounting methods to create one, go over their components, and break down the best practices for your profit and loss statement’s format.

Key Takeaways

- Profit and loss statements summarize your revenue and expenses, helping to gauge the profitability of your business.

- There are two methods to create P&L statements: cash method and accrual method.

- P&L statements include revenue, cost of goods sold, gross profit, operating expenses, operating income or loss, other income/expenses, and overall profit.

Table of Contents

- What Is a Profit and Loss Statement?

- Types of Profit and Loss Statement

- Key Components of a Profit and Loss Statement

- Profit and Loss Statement Example

- Download the Profit and Loss Statement

- How to Analyze a Profit and Loss Statement (P&L)

- How to Create a Profit and Loss Statement?

- What Can I Learn From My Profit and Loss Statement?

- Conclusion

- Frequently Asked Questions

What Is a Profit and Loss Statement?

A profit and loss statement is a type of financial statement that contains summarized information about your business’s revenue and expenses.

The statement is generated on a weekly, monthly, quarterly, or annual basis, depending on the standard operating procedure of a business. P&L statements are regularly generated alongside balance sheets and cash flow statements. The combined insights of these 3 reports help guide decision-making and drive profitability.

The basic formula of a profit & loss statement is:

Types of Profit and Loss Statement

There are 2 ways to prepare a profit and loss statement. You can prepare it by using the cash or the accrual method. Here are the differences between them:

Cash Method

The cash method is also called the cash bais accounting method. It is the simpler of the 2 methods for creating P&L statements. It records income and expenses when the business receives or pays cash. When the business receives cash, it’s noted as revenue. When the business pays cash (for bills or anything else), it’s noted as an expense. This is a simple way to calculate profit and loss and is commonly used by small businesses or for personal finance.

Accrual Method

The accrual basis accounting method is a slightly more complex type of income statement generation than the cash method, but it offers greater insight as a result. In the accrual method, revenues are accounted for as they’re earned. For example, you would record sales of products or services to customers on an accrual P&L statement on the date you send out the invoice, even if you haven’t received the payment yet.

The same goes for expenses, which are accounted for in the period they are used in instead of when you paid for them. For example, if you pay for your business insurance covering September through August once a year, you would only expense four months of insurance in the first year. This allows you to take a more forward-thinking approach to your business finances.

Key Components of a Profit and Loss Statement

Profit and loss statements will look a bit different from business to business, depending on the business type and complexity. For example, if you sell products versus services, have multiple types of income, or have lots of expenses, your P&L statements might have different components and accounts. Below are some typical income statement components.

1. Revenue

Revenue represents the net sales or cash receipts during the accounting period. It includes the money earned or received from the primary business activity of the entity. Revenue often equals your sales.

2. Cost of Goods Sold (COGS)

Cost of goods sold, or COGS, are the direct expenses incurred to produce products or deliver services to customers, including direct labor and materials.

3. Gross Profit

Also known as gross income, gross profit is net revenue minus the cost of goods sold.

4. Operating Expenses

Operating expenses are administrative, general, and selling expenses related to running the business for a specific period of time. This includes rental expenses, payroll, utilities, office supplies, inventory write off and any indirect costs required to operate the business. Also included are non-cash expenses such as depreciation.

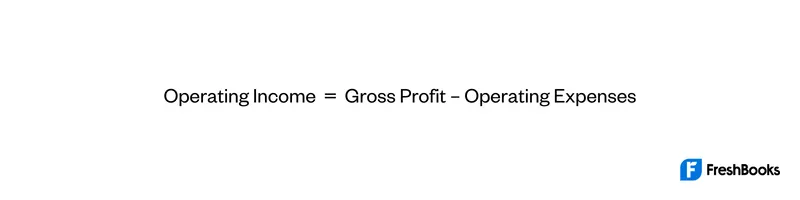

5. Operating Income

Operating income refers to earnings before taxes, depreciation, interest, and amortization. Deduct all expenses from your gross profit to calculate operating income. You will have an operating income if your expenses are smaller than your revenue. Otherwise, you will have an operating loss.

6. Other Income and Expenses

While not required, many businesses separate certain revenues and expenses into an additional section on the P&L statement. This section usually includes income and expenses that aren’t related to normal operations, such as gains or losses from the sale of the company’s assets, interest and dividend income from investments, and other income or expenses that are either unusual or infrequent.

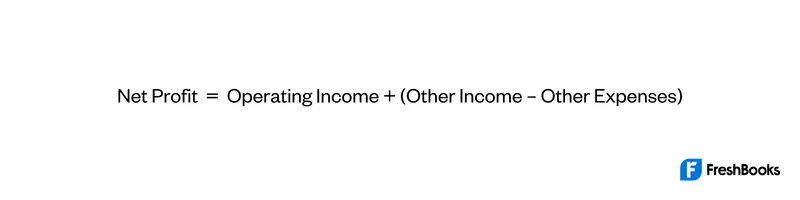

7. Net Profit

Net profit is the remaining revenue amount after deducting all expenses. To calculate this figure, subtract the total expenses from your gross profit.

Profit and Loss Statement Example

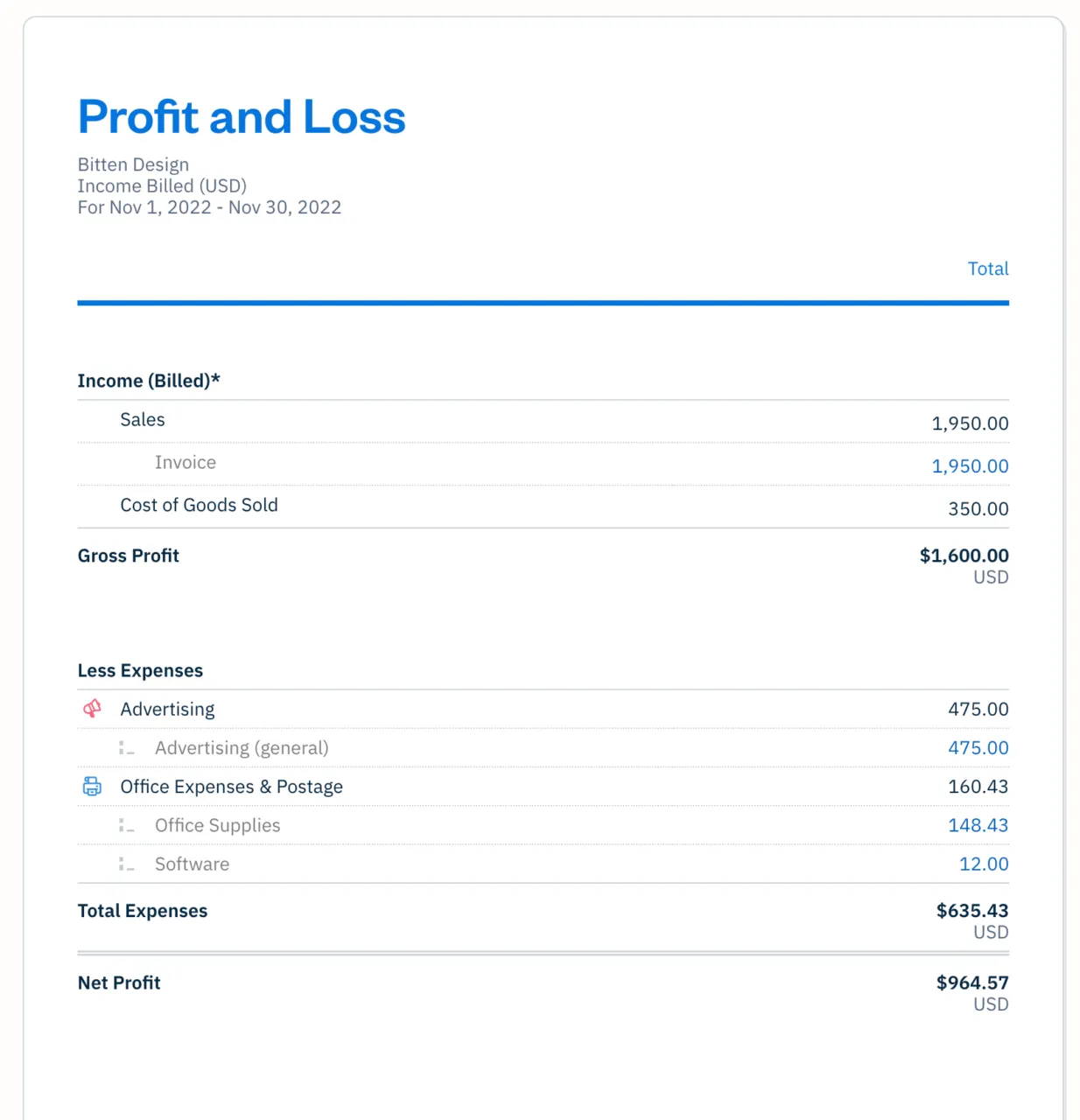

A P&L statement starts with a header containing the name of your business and the accounting period.

This is followed by:

- Income

- Expenses

- Net Profit

Here is a sample profit and loss statement in FreshBooks.

Download the Profit and Loss Statement

A profit and loss statement is an essential financial statement for businesses of all types and sizes. If you’re ready to benefit from the insights of this kind of report but aren’t interested in spending time creating one from scratch, FreshBooks has you covered. Our free Profit and Loss Statement Template is a customizable, versatile resource to help you better manage your financial reporting.

How To Analyze a Profit and Loss Statement

Profit and loss statements are a vital type of a financial report, but they can only serve your business if you understand how to read and analyze them. Once you understand what all the numbers mean, you can let the insights guide your future decisions to help your business grow and become more profitable. There are a number of ways to analyze data from a P&L statement—the method you choose will depend on your goals.

You might be using the statement to propose changes to improve the business’ financial health, to determine the attractiveness of the business to investors, or to help you decide whether or not to acquire a business. Here are a few examples of P&L statement analysis:

- Comparing data year-over-year (also known as horizontal analysis) or for industry benchmarking (comparing the financial position of similar businesses)

- Analyzing financial trends (i.e., determining whether metrics are improving or getting worse over time)

- Analyzing margins (e.g., gross profit margins, earnings before interest, taxes, depreciation, amortization, EBITDA margin, operating margins, net profit margins

- Calculating and analyzing valuation metrics, such as your EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation, and amortization) ratio, P/E (price/earnings) ratio, or your PB (price to book) ratio

- Calculating rates of return on assets (ROA) and equity (ROE)

How To Create a Profit and Loss Statement?

There are two basic methods of creating a profit and loss statement manually, single step and multi step. Lets explore them in detail:

Single-Step Method

Primarily used by service-based industries and small businesses, the single-step method determines net income by subtracting expenses and losses from revenues and gains.

It uses a single subtotal for all revenue line items and a single subtotal for all expense items. The net gain or loss appears at the bottom of the report and is what’s known as the “bottom line” in accounting.

The formula to calculate profit with the single-step method is:

A single-step statement does not provide a breakdown of expenses by department or gross margin calculations.

Multiple-Step Method

An alternative to the single-step method, the multi-step profit and loss statement separates the operating revenue and expenses from other revenue and expenses. This is done to calculate net operating income.

This method is better suited for larger businesses that want to understand the profitability of their core operations.

The three steps of the multi-step method are:

Step 1: Calculate Gross Profit

Step 2: Calculate Operating Income

Step 3: Calculate Net Income

Note that income taxes paid may be listed with expenses or subtracted at the end of your statement, just above the bottom line.

Instead of manually creating a P&L statement, you can use accounting software to streamline the process. The detailed breakdown of profits and losses in the financial reports will give you the full picture when it comes to the health of your business.

What Can I Learn From My Profit and Loss Statement?

Many small businesses prepare financial statements because they are required by a bank or are necessary for filing tax returns. However, the profit and loss statement can also be a useful tool for monitoring your company’s financial health.

Here are 3 key insights you can gather from the information in your profit and loss statement.

Where Your Profits Are Coming From

If you sell multiple products or services, you can break them down across multiple product or service lines on your P&L. This can tell you whether certain products or services are more profitable than others and if some are growing while others are shrinking.

Whether You’re Managing Costs Efficiently

Looking at a comparative profit and loss statement that compares your current numbers to those of a prior period can show you whether certain expenses are growing faster than expected. For example, if revenues increase by 20% from the prior year, but office supplies expenses are up 75%, you want to figure out why.

Whether Your Business Operations Are Profitable

Your business may have plenty of cash in the bank from loans and investors, but are you turning a profit? The bottom line of your profit and loss statement will tell you whether your company’s financial performance is positive or negative.

While a P&L statement is useful on its own, analyzing it, along with other financial statements like your balance sheet and cash flow statement, can provide more insight into your company’s financial position.

Conclusion

Insights and good data are crucial for running a business and a good P&L statement is one of the best ways to collect and analyze this information. With an understanding of a P&L statement’s key components and the process for analyzing them, as well as how to use P&L statements alongside other financial statements, you can make better-informed decisions for the future of your business.

If you’re looking for a simple way to handle profit and loss reporting that saves you time and helps your business thrive, FreshBooks is here to help with our cloud-based accounting software. Try FreshBooks free today.

FAQs About Profit and Loss Statement

Still curious about the ins and outs of profit and loss statements? Here are answers to some common questions people also ask:

Are companies required to prepare P&L statements?

Publicly traded companies are required to prepare and file a P&L statement with the SEC, alongside your other financial statements. This allows investors, regulators, and financial analysts to analyze the health of your business. Private companies, however, aren’t required to prepare and report profits and losses.

What’s the difference between a balance sheet and a P&L statement?

A balance sheet provides insight into a company’s overall assets and liabilities on a given day (usually the last day of the fiscal year), whereas P&L statements define net income, expenses, and overall profitability and financial health over a period of time.

What’s the difference between a P&L statement and a cash flow statement?

A cash flow statement reflects changes in cash, mostly based on assets and liabilities. It looks at different cash sources, like operations, investing, and financing, and reports the changes in those accounts. A profit & loss statement shows the cash inflow and outflow and non-cash transactions such as depreciation. Both financial statements are useful, but they serve different purposes.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Understanding Bank Reconciliation and How It Works

Understanding Bank Reconciliation and How It Works Sales Tax Summary Report: All You Need to Know

Sales Tax Summary Report: All You Need to Know What Is Accounts Aging and How Does It Help Your Small Business?

What Is Accounts Aging and How Does It Help Your Small Business? Balance Sheet vs Income Statement: Differences With Examples

Balance Sheet vs Income Statement: Differences With Examples How to Prepare Financial Statements for Small Businesses

How to Prepare Financial Statements for Small Businesses