How To Fill Out A W9: Everything You Need to Know for 2025

Tax season can become a large endeavor for small businesses and sole proprietorships—particularly if you don’t have a dedicated accountant on staff. There are many responsibilities, such as reporting your net earnings for federal income taxes, properly reporting all tax deductions, and ensuring you provide accurate information throughout.

In addition to several other forms small business owners must prepare when filing their income tax return, a completed W-9 form is essential. In this article, we’ll take a look at the purpose and function of form W-9, along with how to fill it out to ensure accurate, correct information under tax law. Let’s get into it.

Key Takeaways

- A W-9 form is an IRS tax form that a freelancer or contractor fills out.

- W-9 forms are required for all self-employed workers, like independent contractors, vendors, freelancers, and consultants.

- W-9 forms show that the taxpayer is not subject to backup withholding and is responsible for paying their own taxes.

- W-9 forms need to include specific information before you submit them to the IRS.

- Single-member LLCs and corporations will file W-9 forms differently.

What this article covers:

Who Is Required to Fill out a W-9?

How To Fill Out A W-9 For An LLC

What’s the Difference between a W-9 and a W-4?

Navigate Tax Time Effortlessly with Freshbooks

Who Is Required to Fill Out a W-9?

The W-9 form must be filled out by self-employed workers of all kinds, such as independent contractors, vendors, freelancers, and consultants. This tax form allows businesses to keep track of their external workforce and helps the IRS ensure that freelancers are paying into social services. As a contractor or freelancer, you may have completed jobs for multiple businesses. This means that you may have to fill out multiple W-9 forms in the year.

Apart from freelancers, professional consultants, trade workers, and independent contractors, the W-9 tax form must be completed for any income earned on mortgage interest paid by individuals, specific real estate transactions, and dividends paid to shareholders. Individuals receiving compensation for various financial transactions, including the collection of student loan interest, may also need to fill out a W-9 form.

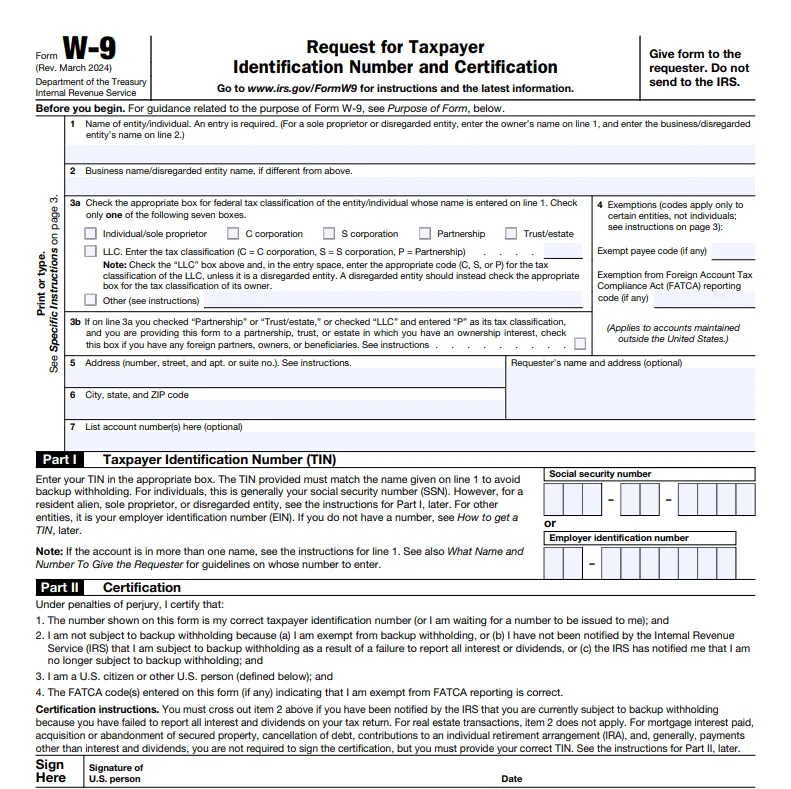

How to Fill out a W-9

Now that you understand how form W-9 works and functions within the greater tax system, let’s take a look at how to fill out your form W-9 for federal tax purposes.

Line 1 – Name

Firstly, print your full legal name at the top of the form, in the space next to where it says ‘name.’ The name you print here must match the name shown on your federal income tax return.

Line 2 – Business Name

On line 2, print your business name, trade name, DBA name, or disregarded entity name. If you do not own a business, you can leave this line blank.

Line 3 – Federal Tax Classification

Next, it’s time to indicate the classification under which you (as an independent contractor) are considered for tax purposes. Check the first box if you file your W-9 as an individual or sole proprietorship.

Taxes for sole proprietorships and single-member LLCs are both classified under the owner’s Social Security number since they haven’t been classified as another type of business in the eyes of the IRS.

If the first box doesn’t apply to you, you will check off one of the following boxes according to the nature of your business: C corporation, S corporation, Partnership, or Trust/estate business.

Lastly, there’s the LLC box, which is reserved for LLCs or partnerships with multiple members. Check this box if this applies to you, and use the blank space adjacent to the box to indicate other details regarding your LLC: mark “P” if your LLC is treated as a partnership or a “C” or “S” (depending on the type of corporation in question) if your LLC is taxed as a corporation. If you leave this space blank, your LLC will be taxed as a partnership, so it’s vital to pay attention, ensure you provide the correct information, and that you fill in the appropriate box.

Line 4 – Exemptions

You don’t need to fill out this line if you are filing as an individual. But certain businesses and entities will need to if they are reporting any exemptions, along with the relevant code indicating the reason.

If your business or entity is exempt from backup withholding, fill in the first line under line 4 with your relevant code. If your business is not exempt from backup withholding, however, the company that hired you for your services will be required to withhold taxes from your net pay at a flat rate of 24%, which will be sent to the IRS directly. This process is known as backup withholding.

If you’re not sure about exemptions and which apply to your entity, page 3 of the IRS form W-9 will outline the information you need.

Lines 5 and 6 – Address

Lines 5 and 6 are simple. Just enter the address (including street name, number, and unit number if applicable) where your employer should send all information returns on line 5. Line 6 leaves space to enter the relevant city, state, and ZIP code of your address.

Line 7 – Account Information

Line 7 is optional and is there to provide the account number(s) of any accounts your employer might need. Most individuals won’t need to fill this line out.

Part I – Taxpayer Identification Number (TIN) and Employer Identification Number (EIN)

In this section, you have the option of filling in your Social Security number (SSN) or your employee identification number (EIN). If you’re filing your W-9 as an individual or a single-member LLC, it’s recommended to fill in your Social Security number. If you file as a multi-member LLC classified as a partnership or corporation, it’s recommended to use your EIN instead.

Furthermore, if you are a resident alien (as a resident alien, you are ineligible for an SSN), you should enter your correct taxpayer identification number (ITIN) into this section.

Making a mistake, such as entering the incorrect TIN, can lead to major problems later on, so it’s once again important to verify that you’re entering the correct information, especially the correct taxpayer identification number.

Part II – Certification

Lastly, it’s time to certify that everything you’ve entered on the form is correct and factual to the best of your knowledge. Read the instructions carefully to ensure you sign, date, and certify the W-9 correctly. This will prevent any unnecessary delays from occurring later on.

When you’re finished, securely provide the form to the company or individual who issued it to you. Do not send the form to the IRS.

How To Fill Out A W9 For An LLC

A single-member Limited Liability Company is considered a disregarded entity by the Internal Revenue Service for federal income tax purposes. In this case, the sole member of an LLC must file taxes in the same way that sole proprietors do.

1. Enter your name and the legal name of your limited liability company (LLC) on the first two lines of the W-9. On the first line, write the name you file your tax returns under, and on the second line, enter the legal name of the LLC.

2. Enter the business address, city, state, and ZIP code.

3. Check the “LLC” box and in the right space, enter the appropriate code (C = C corporation, S = S corporation, P = Partnership) for the tax classification.

4. Enter your Social Security number. You must ideally use your SSN. However, the IRS allows you to enter an employee identification number (EIN) that you’ve obtained in your capacity as a sole proprietor.

5. Sign the certification and submit the W-9 form to the requester.

Corporation or Partnership

If the LLC is a corporation or partnership, follow the steps below:

1. Enter the name of the LLC as recorded in the tax documents. If the LLC has a secondary business name, enter it on the second line, “Business Name.”

2. Check the “Limited Liability Company” box.

3. On the tax classification line, write a “P” for partnership, “S” for S Corporation, or “C” for the corporation.

4. Enter the business address, city, state, and ZIP code

5. Enter the employer ID number of the LLC

6. Sign and date the W-9 and submit it to the requester

Freelancers and contractors must fill out the W-9 form for every client they’ve worked for. To stay on the safe side, save a copy of the W-9 form for your own records. You can use it to contact a client if you are missing the 1099-MISC come tax time.

Also Read: What is My LLC Tax Classification

What’s the Difference Between a W-9 and a W-4 tax forms?

Unlike a W-4, which is filled out when an employee begins a new job with an employer, a W-9 is provided to independent contractors and freelancers. Although the W-9 and W-4 forms request similar information (such as your name, address, and SSN), their purposes are different.

Because employers pay taxes out of their employee’s gross earnings, the W-4 is used to determine how much is withheld from your paychecks. Since companies do not withhold money from independent contractors for federal tax purposes, the W-9 form is used instead as an agreement, confirming that the contractor or freelancer agrees that they are responsible for paying their own taxes out of the gross earnings paid by another individual or entity.

Navigate Tax Time Effortlessly with Freshbooks

Taxes can seem like an intimidating process, particularly for independent contractors and freelancers. However, it doesn’t have to be a complex situation at all. With a bit of time spent understanding the details of the IRS form W-9, you’ll be able to confidently fill them out and ensure tax season goes smoothly.

If you’re looking for help keeping payments, tax forms, and other financial details organized throughout the year, FreshBooks is here to help. As your all-inclusive, cloud-based accounting software solution, FreshBooks accounting software can help in managing and organizing tax time reporting, including W-9 forms. With its user-friendly interface, FreshBooks makes it easy to keep track of vendor information, generate reports, and stay on top of tax compliance. Additionally, FreshBooks can help with issuing 1099 forms and processing payments.

FreshBooks is here to help contractors, sole proprietors, and small businesses approach taxes with ease and confidence. Learn more about our accounting and tax support services, and click here to start your free trial with FreshBooks today.

FAQs

Do you have any questions about filling out your W-9 or anything else to do with paying taxes as a contractor? Here are some commonly asked questions.

How much taxes will I pay on a W-9?

The exact amount you’ll pay in federal income taxes completely depends on your gross earnings for that year as an independent contractor. However, if you are subject to backup withholding, your payer will withhold 24% of your total earnings and send those funds directly to the IRS.

Is a W-9 the same as a 1099?

No, A W-9 (or multiple) is an essential step in filling out a 1099, however. Independent contractors fill out a W-9 form to confirm their tax obligations for each of their employers, who will, in turn, use these tax forms to fill out their 1099. The 1099 form details the worker’s income for federal tax purposes and goes hand-in-hand with the W-9 form. To learn more about the 1099 form and the filing process, follow our guide titled How to File a 1099

Can you fill out a W-9 as an independent contractor without a business?

Yes. If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC. Simply fill under your name and SSN to file form W-9 without a business.

What happens if you don’t fill out W-9?

Failing to fill out W-9 can lead to ramifications from the IRS. If you fail or refuse to provide a filled-out W-9 form, you will be fined $50 for each failure. Furthermore, a payee who refuses to fill out a W-9 (or provides false information) will be subject to backup withholding, requiring the payer to withhold taxes at a rate of 24% on all future earnings.

How much does it cost to fill out a form w9?

Filling out a W-9 form itself does not typically cost anything, as the form is provided by the Internal Revenue Service (IRS) and can be downloaded for free from their website. However, if you need assistance filling out the form, you may need to hire a tax professional or accountant, which could result in fees or charges.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

Tax Preparation Checklist: Information You Need Before Filing Taxes

Tax Preparation Checklist: Information You Need Before Filing Taxes Requirements for Tax Exemption: Tax-Exempt Organizations

Requirements for Tax Exemption: Tax-Exempt Organizations What Is FICA Tax? Understanding Payroll Tax Requirements

What Is FICA Tax? Understanding Payroll Tax Requirements Tax Depreciation: The Impact of Depreciation on Taxes

Tax Depreciation: The Impact of Depreciation on Taxes Tax Classifications for LLC: Everything You Need to Know

Tax Classifications for LLC: Everything You Need to Know How to Calculate Withholding Tax (4 Easy Steps)

How to Calculate Withholding Tax (4 Easy Steps)