Bookkeeping Basics: A Small Business Guide

If there’s one thing all business owners should be familiar with, it’s bookkeeping. Understanding your business’s financial statements is great. However, a small-business owner should also understand the financial records of their company. This is where the bookkeeping process comes in. If you’re looking to maintain the financial health of your business, keep reading. We’re covering all of the bookkeeping basics for small businesses.

Here’s What We’ll Cover:

Bookkeeping Accounts You Should Know

Steps for Getting Acquainted with Small Business Bookkeeping

What Is Bookkeeping?

Bookkeeping is the act of record keeping for a business. All financial transactions and events need to be documented by a bookkeeper. While this seems like a simple task, there’s a bit more to it. Bookkeeping is a specific process. It has a lot of vocabulary specific to it. It also follows a set of rules. If these rules aren’t followed, then the bookkeeping isn’t considered proper leading to inaccurate financial reports.

What Does a Bookkeeper Do?

Bookkeeping and accounting are different from one another. In reality, bookkeeping is the basis of accounting (this article details the difference between bookkeeping and accounting). As such, it is a bookkeeper’s job to record transactions. All transactions documented by a bookkeeper need to be accurate records. Accountants rely on accurate records done through bookkeeping. They use this information to analyze and interpret the finances of a business.

Bookkeeping Accounts You Should Know

When reviewing the information in your books, there are 5 accounts that you should understand. Knowing how these accounts work allows you to understand the bookkeeping process more intimately.

- Asset Accounts: Anything of value to your company. These accounts are your business assets. It includes cash, accounts receivable, property, and inventory.

- Liability Accounts: Any debts your company owes. These can be anything in accounts payable and any loans payable. A business loan is one of the most common liabilities for a business.

- Revenue: The money earned by your business.

- Expense Accounts: Any costs associated with running your business. This can include payroll expenses, business expenses, and operating expenses.

- Equity Accounts: This refers to owners’ equity or shareholders’ equity. Equity is considered the overall value of your business.

When you review your accounts, you’ll need to know two terms when you review your accounts to understand them fully. Every account will have debit entries and credit entries. All accounting software options use debits and credits. Depending on the type of account, debits and credits will increase or reduce the balance.

Most businesses use the double-entry accounting method. In double-entry bookkeeping, a debit will have corresponding credit, and vice-versa. It’s highly recommended for small businesses to use the double-entry bookkeeping system.

In a manual ledger, debits are recorded on the left side, and credits are recorded on the right. It’s rare for businesses to use a ledger book, but most accounting software options resemble them.

Steps for Getting Acquainted with Small Business Bookkeeping

When you’re getting acquainted with your business’s bookkeeping, you can’t just dive in. As such, you should break the process up into steps. Take a look at the steps for getting started below.

1. Understand Your Chart of Accounts

Nearly every accounting software you’ll find has a chart of accounts. This is where all of your business’s accounts, which we discussed earlier, will appear. Many software options made for small businesses offer you a pre-made chart. This means that you don’t have to make one from scratch, which can be a frustrating process. This is especially true if you aren’t already doing your business’s accounting.

In most cases, these pre-made charts can be edited. When creating your chart of accounts, or editing it, make sure it suits your business. Your chart of accounts is your business’s bookkeeping backbone. Knowing it well makes entering transactions easier.

FreshBooks has a customizable Chart of Accounts and getting started is easy. The Chart of Accounts is preloaded with most of the accounts you need to start recording common transactions. Moving forward it’s easy to add, edit, and archive accounts in the Chart of Accounts, as well as create Journal Entries when you need to. Try it for free.

2. Entering Transactions

We cannot stress this point enough: every transaction needs to be recorded. It doesn’t matter if you use a ledger book or accounting software.

Journal entries represent any financial event of your business. When using the double-entry accounting method, every transaction will receive a debit and a credit. For example, when you set up an accounts receivable, you’ll create a journal entry that will debit the account for the amount expected. Then, when your client pays, you’ll enter another journal entry that will credit the revenue account for the amount you received.

All business transactions need to be recorded for financial transparency. If you fail to do so, you’ll never have an accurate financial picture of your business.

3. Reconciliation

One of the purposes of bookkeeping is to reconcile transactions with your bank accounts. In the past, reconciliation relied on bank statements. Thanks to technology, reconciliation can happen for nearly any period of time you choose. This is because bank statements and bank transactions are recorded online. This makes the process much easier.

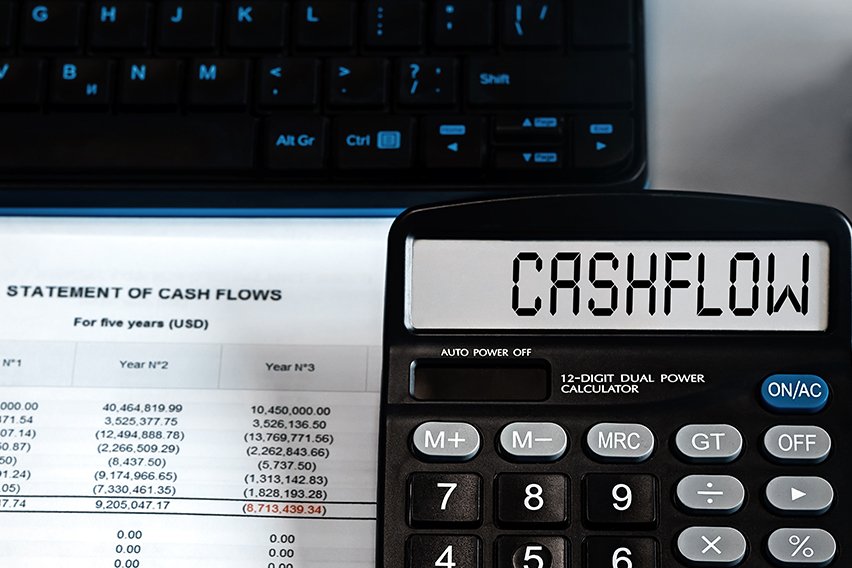

You’re checking for accuracy when reconciling your bank transactions with your ledger. It also gives small businesses a better picture of cash flow and the cash balance. Many small businesses have a limited cash flow, so knowing where your money stands at all times is crucial.

When using accounting software, many times you’ll be given the option to link your bank accounts to the program. This eliminates the need to reconcile accounts by hand. For the most part, the software needs to be double-checked, but it does all of the work for you. If you don’t link your accounts with your software, you’ll have to reconcile manually. It isn’t impossible, but it does take time.

4. Run Your Financial Statements

Bookkeeping is normally done on a monthly basis, as is accounting. After reconciliation has taken place, and any necessary adjustments have been made, it’s time to close the month. Closing the month involves grouping all accounts of the same type and understanding the totals. This is done best by accounting software. Doing it manually can be tedious and time-consuming, especially if your business has a lot of accounts.

Many applications will close the month out for your business automatically. It’s done based on a specific period of time, or the date. That means that you’ll never have to worry about preparing your financial statements. It’s done automatically for you.

Financial reports are an integral part of the bookkeeping process. They are the entire reason that bookkeeping is done. The preparation of these financial statements gives you a good look at your business. They also let your accountant view your finances in an easy-to-consume manner. When preparing financial statements, three things need to be done on a monthly basis:

- Balance Sheet: As the name implies, the balance sheet provides account balances. The accounts in question are assets, liabilities, and equity. The balance sheet can be produced by most software options on demand.

- Income Statement: A financial statement that shows net income. It provides data about the net income over a specific period of time.

- Cash Flow Statement: Shows all incoming and outgoing cash for a period of time. This is very useful for knowing how you make your money, as well as how you spend it.

Why is Bookkeeping Important?

Bookkeeping is the backbone of any business. Without it, financial statements can’t be prepared. You’re also left in the dark when it comes to your money. As such, bookkeeping is incredibly important. Here’s why:

Bookkeeping Informs Business Decisions

Because bookkeeping records all business transactions, it reveals data you may not know otherwise. You can make better business decisions when you keep track of your finances and transactions. Knowing how and when to spend your money is key. Overspending can kill any small business in a short amount of time. Don’t let it happen to your business.

Bookkeeping Attracts Investors

When you keep records of your business’s finances, you can use those records to attract investors. Financial statements that show positive growth over a long period of time are important. Without evidence like that, investors won’t be able to make an informed decision about your business. Securing a business loan from a bank often requires a presentation of your financial reports. You may miss out on investment opportunities if you don’t practice accurate bookkeeping.

Bookkeeping Allows You to Budget

Budgeting is highly important for a small business. Overspending and underperforming can create a recipe for disaster. Looking at your finances and creating a budget is much easier with insightful bookkeeping. Over time, you can create a bulletproof budget for your business.

Bookkeeping Promotes Organization

Financial organization is one of the most important aspects of a business. Without it, you’ll tend to forget things or lose track of valuable information. This should never be the case when it comes to your business’s finances and accounts. Stay organized by using good bookkeeping practices.

Bookkeeping Creates Security

When you keep a record of all of your transactions, you know exactly where all of your business’s money is. Understanding where your finances are creates a sense of security. It’s been proven that money is one of the most stressful subjects in today’s world. Effective bookkeeping will prevent you from unnecessarily stressing about your business’s finances. If there are any issues with cash flow, then bookkeeping can help you identify them, too!

Key Takeaways

To have a successful business, you must have a strong understanding of your finances. The best way to do that is through bookkeeping. When you understand the basics of bookkeeping, you can lead your business to greater heights! Need more information? Discover more helpful articles like this on our resource hub!

RELATED ARTICLES

How to Make a Cash Flow Forecast

How to Make a Cash Flow Forecast How to Calculate Revenue? Sales Revenue Formula

How to Calculate Revenue? Sales Revenue Formula What Is Rate of Return (ROR) & How to Calculate It

What Is Rate of Return (ROR) & How to Calculate It Managing Debt: 10 Tips or Advice on Dealing With Debt

Managing Debt: 10 Tips or Advice on Dealing With Debt What Is Interest Coverage Ratio? Definition & Calculation

What Is Interest Coverage Ratio? Definition & Calculation What Is Direct Debit & How Does It Work? A Guide

What Is Direct Debit & How Does It Work? A Guide