Making Tax Digital for Landlords: Everything You Need to Know

Making Tax Digital (MTD) for landlords has been pushed back. The new date for rollout is April 6, 2026. It is compulsory for everyone who meets the criteria.

MTD rollout may seem far off in the future, but FreshBooks is ready now because we know timely preparation of business income decreases stress. Also, this change to the tax system may impact how you do business today.

All the rules for MTD for landlords are under HMRC’s ‘Making Tax Digital for Income Tax’ heading.

Key Takeaways

- While there are some exemptions, any person who meets the criteria must enrol in Making Tax Digital.

- With MTD, it is essential to keep digital records up to date. Your digital records include clear scans of hard copies and digital links to original cloud locations.

- FreshBooks meets the software requirements for MTD for Landlords.

- Rather than a yearly tax submission, with MTD, landlords make quarterly submissions and one final submission at the end of the tax year.

- Failure to meet deadlines will result in a £200 penalty. Failure to use proper software can result in a £400 penalty.

- Benefits to transitioning to the MTD system include time savings, a real-time snapshot of your business, and the removal of guesswork on how much tax you’ll owe at the end of the year.

- The government can demonstrate MTD has the potential to improve the productivity of the UK economy.

Here’s What We’ll Cover:

What are the Making Tax Digital For Income Tax Criteria?

What are the Actual Making Tax Digital Changes?

You’re Going to Need New Software…

What are the MTD Deadlines and Penalties

Are There any Making Tax Digital Benefits for Me?

Why is the Government Introducing ‘Making Tax Digital’?

What are the Making Tax Digital For Income Tax Criteria?

Making Tax Digital for landlords will be a compulsory part of your ITSA tax process if you meet the criteria. There is a two-stage process to the roll-out.

The first stage of MTD for landlords will commence on 6 April 2026. At that time, you meet the qualifications if all of the following apply:

- You are an individual;

- Your qualifying income exceeds £50,000;

- You registered for income tax self-assessment; and

- You were self-employed or collecting income from property before 6 April 2025.

The second stage will commence on 6 April 2027. You meet the qualifications for MTD if all of the following apply:

- You are an individual;

- Your qualifying income exceeds £30,000;

- You registered for self-assessment; and

- You were self-employed or collecting property income before 6 April 2026.

Are there any exemptions to the Making Tax Digital changes?

There are exemptions to MTD for landlords if:

- You make less than £50,000 per year;

- You rent to lodgers as part of the Rent a Room’ scheme;

- You rent out holiday lets;

- You’re already complying with Making Tax Digital for VAT because you earn over the £85,000 VAT threshold, or you’ve voluntarily registered for VAT; or

- Rental income or self-employed earnings aren’t your only source of income.

HMRC’s rules for Making Tax Digital for landlords include exemptions on the grounds of disability, religion, and other very specific circumstances. But these are very few and far between.

What are the Actual Making Tax Digital Changes?

You’ll need to adapt to 2 main Making Tax Digital changes; keeping records digitally and new paperwork that must be sent to HMRC online.

At the moment, you’re reporting to HMRC through the self-assessment system. Filling in everyone’s favourite form—the self-assessment tax return. (Yes, we’re joking!)

From 6 April 2026, if you’re in MTD for income tax, the yearly self-assessment of your income tax return becomes:

- Quarterly reports of expenses and income to HMRC;

- An End of Period Statement (EOPS) sent to HMRC at the end of each accounting period, including any tax relief; and

- Submit 1 legally binding ‘Final Declaration’ at the end of the tax year. This is your official sign-off on HMRC’s income tax calculations and your commitment to providing all necessary, truthful information.

No more self-assessment tax returns!

You’re Going to Need New Software…

To keep digital records and meet new direct submission deadlines as per the UK tax system, you must have accounting software or property management software that is fully compatible with HMRC.

You can get bridging software if you prefer to keep your current software system. Bridging software translates your information from your current accounting system into the correct format and links to HMRC’s portal.

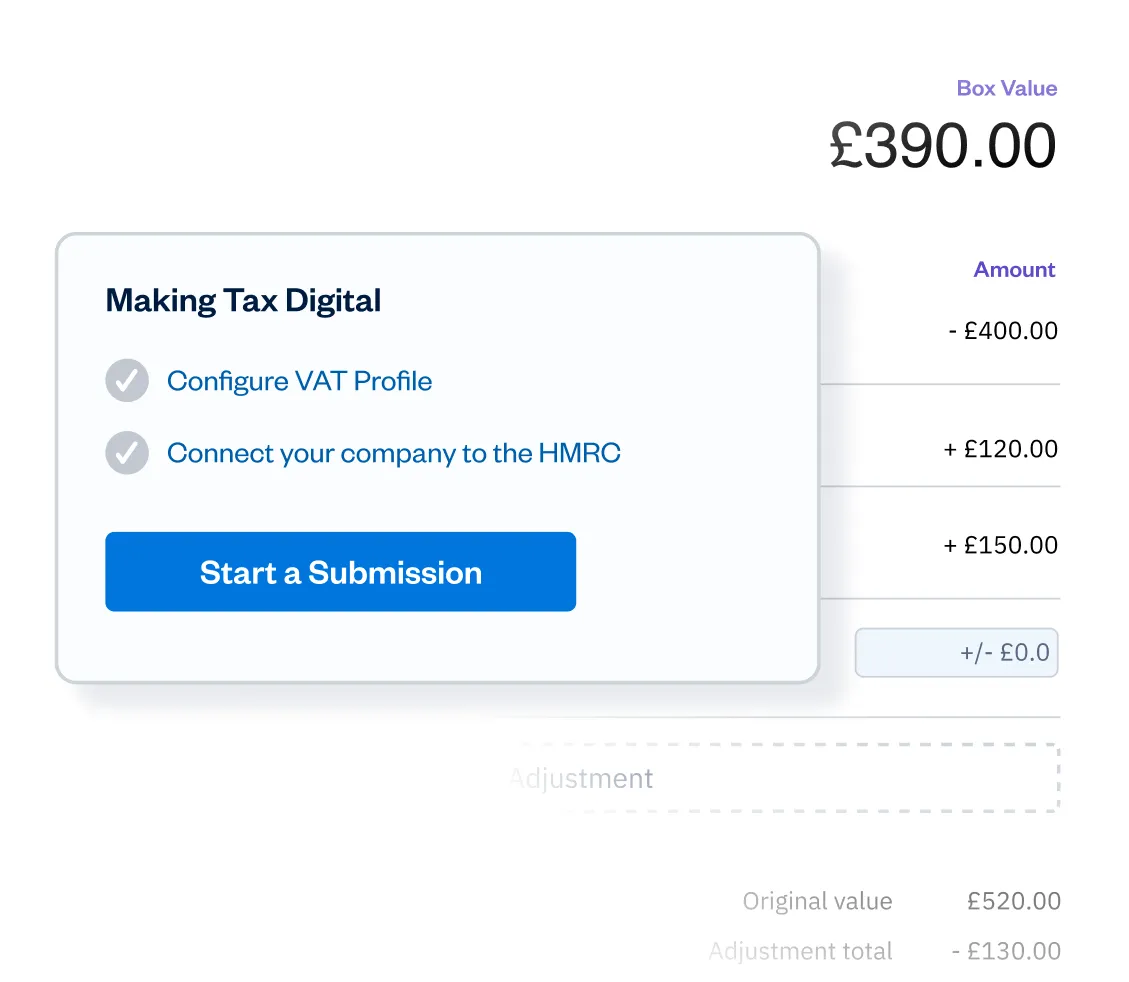

Or you can get Making Tax Digital software like FreshBooks. With FreshBooks, your business records are already digital, and we’re fully in line with HMRC requirements. FreshBooks organises all your digital records, generates required reports in a few clicks, and links directly to HMRC.

At the start of their Making Tax Digital programme, HMRC suggested providing taxpayers with free software they’d produced. But this didn’t happen. Instead, they published a list of ‘recognised’ software. Some options are free. And you can opt for downloadable or cloud-based software. The list of Making Tax Digital for Income Tax software is short compared with the Making Tax Digital for VAT range. The list will increase as the deadline gets closer. FreshBooks is a MTD compliant software, try it for free today.

What are the MTD Deadlines and Penalties

Deadlines for Making Tax Digital will utilise a point system like speeding tickets. You will get a point against you when you are late filing. When you have a certain number of points, you pay a £200 fine.

Quarterly deadlines will follow a three-month period, due the following month. The first quarter is from 6 April to 5 July. The report is due 5 August.

Failing to use MTD-compatible software can result in a £400 penalty for every return you file.

Making Tax Digital for income tax and landlords requires digital records. Failure to maintain digital records can result in a £5 – £15 fine for every day you do not meet the requirement.

You must use digital links to transfer data between software programs. More than copying and pasting images and data is required. Failure to comply can result in a £5 – £15 fine for every day you do not meet the requirement.

Use the checking software. The software you use for MTD should have a ‘Check’ option you can select before you submit. If you do not check before you submit, you will have to pay back the VAT you owe, and you can be charged up to 100% of the VAT you owe.

Are There any Making Tax Digital Benefits for Me?

As a landlord, this may seem like an unnecessary upheaval. If you’ve always filed your tax return and paid your tax bill on time, this may seem like HMRC is solving a non-existent problem. And it’s going to cost you time and money to get ready.

But once you’re used to your new software and settled into the system, as a landlord, you should see some benefits, like:

- Time savings on record-keeping because you collect everything digitally as you go.

- Continuously updated accounts mean a constantly accurate picture of your cash flow.

- A real-time snapshot of your property business can make developing and growing your business easier.

- No more worrying about having enough set aside for your taxes because you already know what to expect.

You do not need to provide any new information. You only need to collect and present it in a new, digital format.

And, even more importantly, you won’t pay any more tax, and the deadline to pay your tax bill remains the same.

Why is the Government Introducing ‘Making Tax Digital’?

Most taxpayers want to get their tax right. But, despite their best efforts, the Treasury loses out every year just from genuine administrative errors. For example, government figures show that errors cost £8.5 billion in the 2018-19 tax year. Changes to the tax system are their way of reducing this loss.

As the financial secretary to the Treasury, Jesse Norman, said: “Making Tax Digital will make it easier for businesses to keep on top of their tax affairs. But it also has huge potential to improve the productivity of our economy and its resilience in times of crisis.”

Conclusion

Making Tax Digital supports HMRC’s plans to digitise the tax system. While it may seem like a hassle at first glance, it can help simplify tax returns and ensure everyone has the same opportunity to get their tax right. Through MTD tax software like FreshBooks, you can integrate tax management with a range of business processes.

MTD can also contribute to wider productivity gains for businesses. You don’t have to wait for the 2026 roll-out. If you qualify, you can take advantage of the HMRC’s pilot scheme by signing up today!

FAQs on MTD for Landlords

Do I need to comply with MTD for Landlords if I only have one property?

Yes. If your combined income from property and other sources is more than £50,000, you need to comply with MTD for landlords by 6 April 2026.

Can I appoint someone to submit my MTD for Landlords returns on my behalf?

Yes, you can authorise someone else to deal with HM Revenue and Customs. This person can be an accountant, friend, or relative, for example.

Do I need to keep physical copies of my records for MTD?

Yes, if you receive and provide physical copies in your business, you must keep copies for VAT. Information from those records must be entered into your MTD for Landlords compatible software. You must retain the original because the data isn’t a copy of the invoice.

Do I need to provide tenant information under MTD?

With the rollout of MTD for landlords, there is no change to the kind of information you need to provide to the HMRC.

How can I ensure accuracy in my MTD records?

Prompt data input, clear scans, and properly labelled digital documents can help ensure accuracy in your MTD records.

About the author

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Sole Trader Tax Guide

Sole Trader Tax Guide Tax Return Deadline in the UK (2024-25)

Tax Return Deadline in the UK (2024-25) How to Start a Limited Company in the UK

How to Start a Limited Company in the UK What is a Sole Trader: Meaning, Role, and Pros & Cons

What is a Sole Trader: Meaning, Role, and Pros & Cons How to Register a Business Name in the UK

How to Register a Business Name in the UK Everything You Need to Know About Making Tax Digital Software

Everything You Need to Know About Making Tax Digital Software