VAT Codes: A Complete Guide

If you have VAT goods to report on your HMRC return, this guide is for you. The codes below refer to what you should declare on your VAT return form. However, if you use FreshBooks accounting software, this is automatically done for you! Along with easy expense tracking, invoicing tools, and client collaboration tools. Our software has it all. Read more about how we can help you submit accurate VAT returns.

Key Takeaways

- VAT applies to any business with an annual taxable turnover above £85,000.

- UK VAT codes apply to any business registered for VAT.

- The codes impact your VAT form 100.

- VAT codes and rates can change over time. It’s your job to stay updated on changes that apply to you and your business.

Here’s What We’ll Cover:

What Is Value-Added Tax?

Value Added Tax is a consumption tax added to certain goods and services in the UK and Europe. To be VAT registered, you must have an annual taxable turnover higher than £85,000. VAT charges fluctuate from country to country. The applicable VAT rate also varies depending on the taxable purchases.

VAT rates for various categories and items have corresponding codes. It’s not always easy to know which tax code to use. The FreshBooks free VAT calculator tool makes it easy. It is a valuable tool for quick and error-free VAT calculations.

VAT-registered businesses in the UK:

- Must charge VAT on their goods and services at the appropriate rate. You can find out the rate on the HMRC website.

- May reclaim VAT on goods and services they purchased from other VAT-registered entities.

- Must account for import VAT on their VAT return.

What Are VAT Tax Codes?

VAT codes identify the tax rate to apply to a good or service. It’s usually a percentage followed by one or two letters. The code is different on a sales form than on a purchase form. The purchase form is the receipt or invoice you receive from your supplier. It shows your input tax, and the amount of VAT you paid for the product. Your sales form shows the output tax. It is the amount of VAT you charge your customer.

It is possible to pay more input tax than output tax. In that case, you can apply for a refund on your tax form. For example, if you purchase material used to manufacture items deemed rate reduced or zero-rated.

Make sure to distinguish between zero-rated and tax-exempt. Tax-exempt are considered non-vatable and cannot count towards your taxable income.

Each VAT code has correlating boxes on your tax return. Which VAT code you use will determine where you enter corresponding data on your tax return. In one box, you enter the tax amount and the net amount of the sale in the other.

VAT Tax Codes Guide

Below is a VAT codes list relevant to you when you’re filing your return to the HMRC. You can refer to the HMRC website for the most up-to-date information to create accurate VAT returns.

Remember that if you’re enrolled in the Flat Rate Scheme, the VAT codes could differ. It varies from industry to industry. This list consists of the most common codes. Check with the HMRC guidelines specific to your industry or tax scheme.

20.0% S – Standard Rate VAT

The standard VAT rate in the UK is 20%. All UK VAT-registered businesses must charge this rate unless they qualify for a different category. Always check with the HMRC guidelines before charging a rate other than the standard.

| VAT code | Code for sales form | Code for purchase form |

| 20.0% S | VAT at 20% to Box 1 Net Sale to Box 6 | VAT at 20% to Box 4 Net Purchase to Box 7 |

Exempt – Exempt VAT

Certain goods and services are exempt from VAT. These typically include:

- Insurance

- Medical health services

- Educational courses and training

| VAT code | Code for sales form | Code for purchase form |

| Exempt | No VAT Net Sale to Box 6 | No VAT Net Purchase to Box 7 |

5.0% R – Reduced Rate

Reduced rate VAT applies to:

- Nicotine patches and other anti-smoking aids

- Mobility aids

- Child car seats and boosters

- Insulation

| VAT code | Code for sales form | Code for purchase form |

| 5.0% R | VAT at 5% to Box 1 Net Sale to Box 6 | VAT at 5% to Box 4 Net Purchase to Box 7 |

0.00% Z – Zero Rate VAT

Zero rate VAT is very specific. It only applies to certain situations and depends on who the end customer is. For example, you can expect zero percent VAT on:

- Aids for the blind

- Babywear

- Motorbike helmets

- Brochure and leaflet printing

| VAT code | Code for sales form | Code for purchase form |

| 0.00% Z | VAT at 0% to Box 1 Net Sale to Box 6 | VAT at 0% to Box 4 Net Purchase to Box 7 |

20.0% RC SG – Default reverse charge VAT for services

Default reverse charge for goods you’ve bought in another EU country but would be classed at the standard UK rate.

| VAT code | Code for sales form | Code for purchase form |

| 20.0% RC SG | N/A | +/- VAT at 20% to Box 1 & 4 +/- Net Purchase to Box 6 & 7 |

20.0% RC MPCCs – Domestic reverse charge VAT for computers

A domestic reverse charge for UK-purchased mobile phones and computers.

| VAT code | Code for sales form | Code for purchase form |

| 20.0% RC MPCCs | N/A | +/- VAT at 20% to Box 1 & 4 Net Purchase to Box 7 |

%RC CIS – Domestic reverse charges for CIS

A domestic reverse charge for companies that operate within the Construction Industry Scheme. Under this scheme, customers account for the VAT due to HMRC rather than pay it to the supplier.

| VAT code | Code for sales form | Code for purchase form |

| 5.0% RC CIS | Net Sale to Box 6 | VAT at 5% to Box 1 and 4 Net Purchase to Box 7 |

| 20.0% RC CIS | Net Sale to Box 6 | VAT at 20% to Box 1 and 4 Net Purchase to Box 7 |

% PVAT – Postponed VAT Accounting

UK-VAT registered businesses can account for and recover VAT on imported goods rather than pay it when they arrive in the UK.

| VAT code | Code for sales form | Code for purchase form |

| 0.0% PVATA Z | N/A | Box 1 – Include the VAT due from postponed VAT accounting. Box 4 – Include the VAT reclaimed on imports from the postponed VAT accounting scheme. Box 7 – Include the total value of all imported goods, excluding VAT. |

| 20.0% PVAT | N/A | Box 1 – Include the VAT due from postponed VAT accounting. Box 4 – Include the VAT reclaimed on imports from the postponed VAT accounting scheme. Box 7 – Include the total value of all imported goods, excluding VAT. |

EC – EC VAT codes and rates

EC codes and rates apply to VAT-registered businesses that buy and sell goods from another VAT-registered company in an EC member state. The supplier receives a VAT registration number from the customer. You make the VAT nil as the supplier using the reverse charge method.

The purchaser/customer acts as the supplier and recipient, paying any VAT using the reverse charge mechanism.

20.0% ECG – Intra EU B2B purchase of goods

| VAT Code | Code for sales form | Code for purchase form |

| 20.0% ECG | N/A | +/- VAT at 20% to Box 2 and 4 +/- Net Purchase to Box 7 and 9 |

20.0% ECS – Intra EU B2B purchase of services

| VAT Code | Code for sales form | Code for purchase form |

| 20.0% ECS | N/A | +/- VAT at 20% to Box 1 and 4 +/- Net Purchase to Box 6 and 7 |

0.0% ECS – Intra EU B2B supply of services

You must note the location of the supply. In B2B, the location of supply is the location of the purchaser instead of business-to-consumer transactions, in which case the location is where your business is based.

| VAT Code | Code for sales form | Code for purchase form |

| 0.0% ECS | Net sale to Box 6 | +/- VAT at 20% to Box 1 and 4 +/- Net Purchase to Box 6 and 7 |

0.0% ECG – Intra EU B2B supply of goods

| VAT Code | Code for sales form | Code for purchase form |

| 0.0% ECG | Net sales to Box 6 and 8 | +/- VAT at 0% to Box 2 and 4 +/- Purchase to Box 7 and 9 |

0.0% RC – Intra EU B2B reverse charge

Use this reverse charge code for B2B sale and purchase transactions of computer chips and mobile phones within the EU.

| VAT Code | Code for sales form | Code for purchase form |

| 0.0% RC | Net sale to Box 6 | N/A |

No VAT – Out of Scope of VAT

You don’t need to report out-of-scope VAT items on your VAT return.

No VAT applies in any of the following situations:

- Goods sold when you’re not registered for VAT/you don’t need to register for VAT

- Goods and services bought or sold outside the EU

- Goods and services purchased and sold for personal use

- Goods sold or otherwise supplied but not as part of your business

- Welfare services by charities

- Charity Donations

- Statutory services, e.g., MOT testing

- Transportation tolls

Conclusion

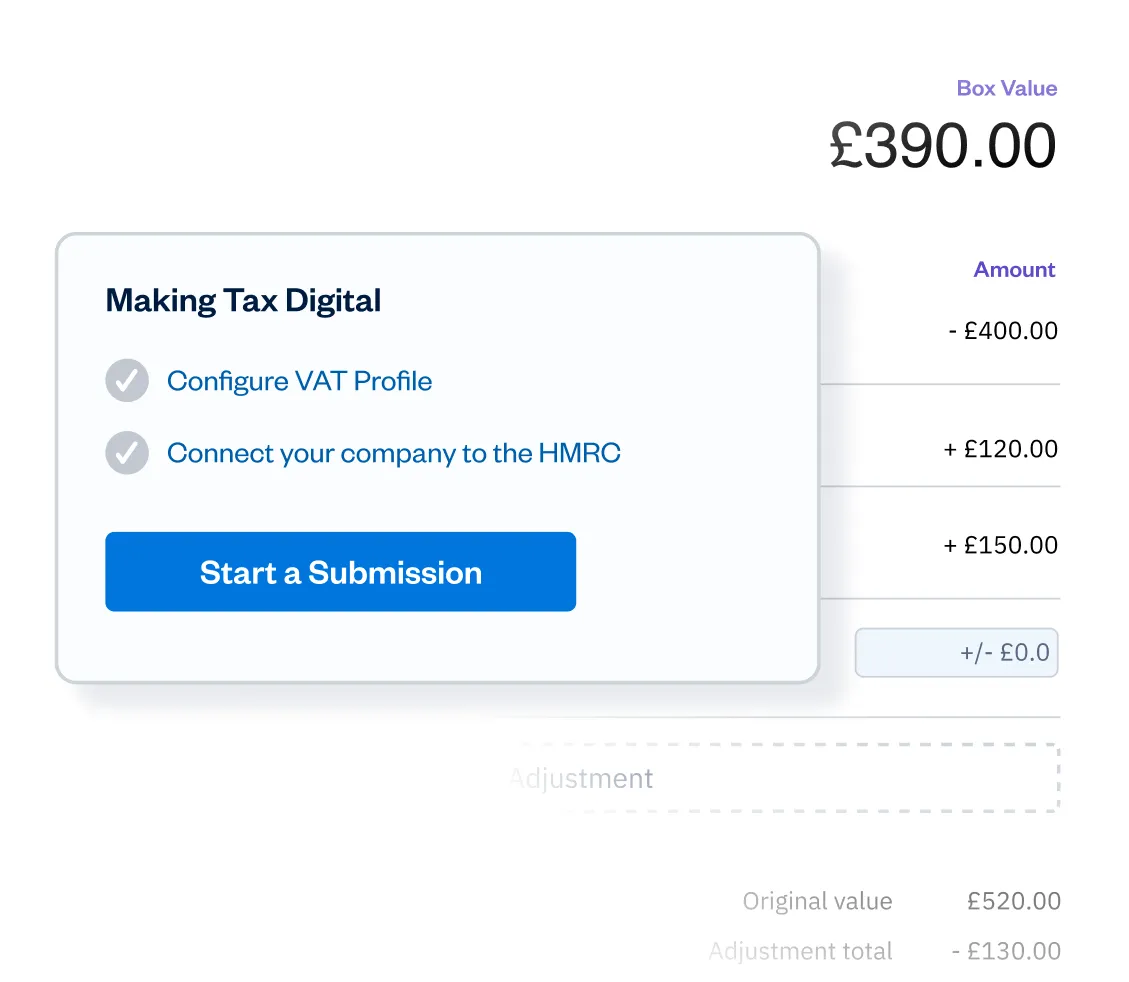

For many, meeting the requirements for VAT registration can mean their business is growing. It also means more tax information to learn. Now that you understand tax codes better and how to use them, you can feel more confident come tax time. Use FreshBooks MTD VAT Software to remove any lingering doubt that you did it correctly. The software calculates your codes, generates your invoices, puts data in the correct box on your Form 100, and simplifies filing VAT tax returns.

For more tax guides like this one, check out our resource hub!

FAQs on VAT Codes

How many VAT codes are there in the UK?

There are currently 11 codes that apply to VAT-registered businesses in the UK. There are an additional 5 codes for companies dealing with businesses from EC member countries. While they apply to international business transactions, they are still VAT codes for UK tax purposes.

Can VAT codes change over time or with changes in tax regulations?

VAT tax and codes can change over time and with changes in tax regulation. During the recent COVID pandemic, VAT codes and tax for restaurant and hospitality services were decreased to 5%, then up to 12.5% before returning to the standard tax rate.

Can I use multiple VAT codes on the same invoice or transaction?

If you have multiple categories of items in a single transaction, you’ll likely have multiple VAT codes. For example, if you sell a child’s car seat and a candy bar, you will have a reduced car seat tax rate and a standard candy bar.

What is the VAT code for services provided to overseas customers?

If you provide service to a non-member of the EC and not in the UK, you do not have to charge EC VAT. There won’t be a code, but you need to input the net sale in box 6 of your return.

Can I reclaim VAT on business entertainment expenses?

Generally speaking, a business cannot claim back entertainment expenses. This includes client gifts and dinners. A business can claim back VAT on entertainment expenses for staff, such as staff parties and social events.

About the author

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Progressive Tax: Definition, Examples & How It Works

Progressive Tax: Definition, Examples & How It Works How to Reduce Corporation Tax: 8 Ways

How to Reduce Corporation Tax: 8 Ways What Is a P32 Employer Payment Record?

What Is a P32 Employer Payment Record? What Is Input Tax (Input VAT)? A Tax Guidance

What Is Input Tax (Input VAT)? A Tax Guidance Claiming VAT on Mileage Expenses

Claiming VAT on Mileage Expenses What Is the Marginal Tax Rate? How Much Tax Do You Pay

What Is the Marginal Tax Rate? How Much Tax Do You Pay