What is a Good Profit Margin?

A good profit margin is weighed against the average for other businesses in that same industry due to the fact that some industries, such as accounting and legal services, have naturally higher profit margins because they require so little overhead.

Here’s What We’ll Cover:

What Are the Types of Profit Margin?

Do You Want a High or Low Profit Margin?

Why Do You Need to Know Your Profit Margins?

What Are the Types of Profit Margin?

There are four types:

GROSS PROFIT MARGIN

Gross Profit is the income a business has left over after paying off direct expenses. Direct expenses include materials, direct labor and manufacturing costs and are referred to as “cost of goods” sold.

Interest, taxes and a company’s operating expenses are not factored into the gross profit margin equation.

Gross Profit Margin = (Total Revenue – Cost of Goods Sold)/Total Revenue x 100

The resulting number indicates a company’s profitability, but it is generally considered best practice for a company to calculate the operating profit margin too. This is because the operating profit margin allows for more expenses to be included.

OPERATING PROFIT MARGIN

Operating Profit Margin is the income left after removing cost of goods sold and operating expenses.

Operating Profit Margin = (Operating Income/Net Sales Revenue) x 100

Operating profit margin is considered to be a more important cost for a company’s financial consideration than gross profit margin. This is because operating profit margin is a direct reflection of how well a company is allocating its resources.

Operating Margin is also known as:

- Operating Income Margin

- Operating Profit Margin

- EBIT Margin

- Return on Sales (ROS)

PRE-TAX PROFIT MARGIN

The Pre-Tax Profit Margin allows one to know the profitability of a company before taxes are deducted. Comparing profit margin numbers over time indicates the direction the company is taking.

Pre-tax Profit Margin calculation:

(Earnings Before Taxes/Revenues) x 100

(Earnings Before Taxes/Revenues) x 100

NET PROFIT MARGIN

Net profit is the profit after all expenses have been paid, including interest and taxes.

Net Profit Margin = (Operating Profit – Interest Expenses – Tax Expenses)/Revenue x 100

What Is a High Profit Margin?

A high profit margin is one that outperforms the average determined for its industry. CBS News reported in 2016 that the following industries had high net profit margins:

| Industry | Net Profit Margin |

| Accounting, Tax Preparation: | 18.3% |

| Legal Services: | 17.4% |

| Lessors of Real Estate: | 17.4% |

| Outpatient Care Centers: | 15.9% |

| Offices of Real Estate Agents/Brokers: | 14.8% |

Industry Net Profit Margin

Accounting, Tax Preparation: 18.3%

Legal Services: 17.4%

Lessors of Real Estate: 17.4%

Outpatient Care Centers: 15.9%

Offices of Real Estate Agents/Brokers: 14.8%

You’ll notice that these types of industries rely heavily on qualified professionals in a service industry, and as a result are not reliant on machinery or other expensive overhead costs. For instance, Oil & Gas extraction companies have notoriously low net profit margins because the extraction process is so expensive. So do automotive dealerships because they have so much overhead (often they rely on their service and parts departments to bring in profit).

Do You Want a High or Low Profit Margin?

In all cases, high. A higher the number (compared to the company’s industry standard), the more confidence investors will have because the number is a direct reflection of how the business is being operated and expenses are being managed.

Higher profit margins also equals higher profits.

It is also important to compare a company’s profit margins with previous years, to see whether trends are developing and if decreases are becoming the norm. However, if profit margins are increasing year over year, then those figures can be used to attract investors.

It is important to stress that when calculating profit margins, operating profit margins and net profit margins are considered to be the most important numbers, as they take expenses into account. While gross profit margins will give a general idea of a company’s profitability, it should not be relied upon when making business decisions.

Why Do You Need to Know Your Profit Margins?

Profit margins need to be calculated for financial statements, which are mandatory for investors, or bankers who are considering loaning money to the business.

Profits margins also tell business owners whether their company needs to change its approach or not to doing business.

For instance, lets say a small business owner runs the numbers and sees that his operating profit margin is too low compared to his industry. He then does a deep dive on his company’s manufacturing processes and realizes that there are efficiencies he can take advantage of. These efficiencies, once realized, will save both time and money. A year later, when he runs the numbers again, he now sees that his operating profit margin is on par with his industry.

RELATED ARTICLES

How to Calculate Bad Debt Expense

How to Calculate Bad Debt Expense What is Managerial Accounting?

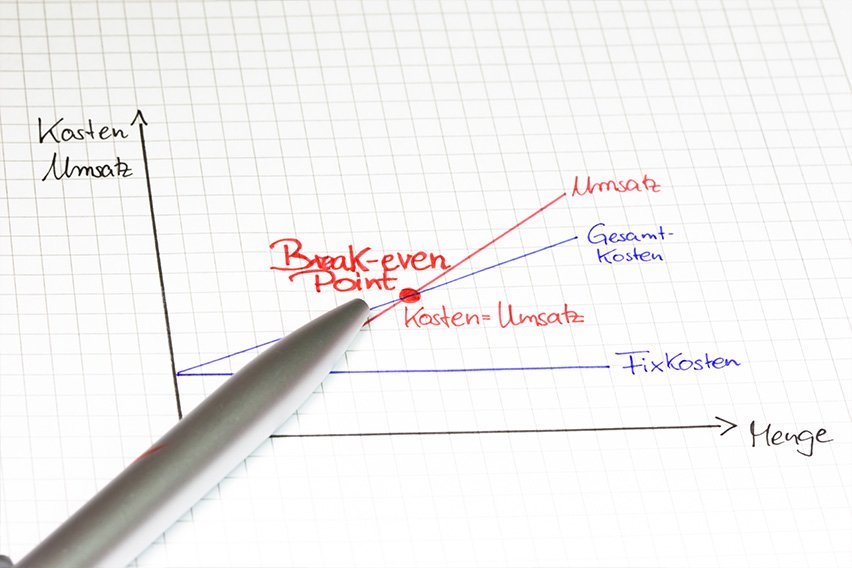

What is Managerial Accounting? How to Calculate the Break-Even Point

How to Calculate the Break-Even Point How to Calculate Retained Earnings: Formula and Example

How to Calculate Retained Earnings: Formula and Example What is Indirect Labor Cost?

What is Indirect Labor Cost? What is Journalizing Transactions?

What is Journalizing Transactions?