What Is Making Tax Digital: An Extensive Guide

The Making Tax Digital (MTD) initiative aims to transform the UK tax system so it’s easier to navigate and less prone to human error. Essentially, the system requires taxpayers to submit tax data digitally. All businesses will get a digital tax account to file quarterly returns.

This concept seems simple enough. However, it comes with several compliance standards to maintain the integrity of tax data. For instance, data transfer must occur through an MTD-compliant digital link.

Since 2023, MTD only applies to VAT-registered businesses and sole proprietors. In 2026, it will also apply to property, income, and corporation tax.

Key Takeaways

- Making Tax Digital (MTD) is a modern tax system that requires digital submissions

- MTD’s goal is to simplify taxpaying and increase accuracy.

- VAT-registered companies within the current VAT threshold must store VAT records electronically and file VAT returns digitally.

- MTD will apply to income tax, UK property tax, and corporation tax starting in 2026.

- In 2026, MTD will only apply to those making over £50,000. This amount will decrease to £30,000 in 2027.

- Not all software tools are MTD-compatible, be mindful about which one you choose.

- You can register for MTD on the Gov.uk website.

- Non-VAT businesses have time to prepare for MTD’s expansion.

This article serves as a comprehensive guide to MTD. It will examine the following:

How Will MTD Change the Way Things Are Done?

Benefits of Making Tax Digital

Challenges of Making Tax Digital

Which Digital Records Do I Need to Keep?

Which Accounting Software Should I Use?

How do I Prepare for Making Tax Digital?

What is Making Tax Digital?

Making Tax Digital (MTD) is a UK government initiative encouraging businesses to keep digital tax records. The idea behind this initiative is to make the process simpler and more transparent with a digital audit trail. Digital records are also less error-prone than manual ones.

Does It Apply to My Business?

Since 2023, MTD only applies to VAT-registered businesses with a taxable turnover above the current VAT threshold. Going forward, there will be MTD for income tax, property, and corporate taxes.

These standards apply to corporations and self-employed sole traders. Small businesses are not exempt from MTD based on their size. On FreshBooks you can check if your business is MTD compliant.

MTD for ITSA (Income Tax Self Assessment) will only apply to those with an annual income above £50,000 in 2026 and £30,000 in 2027.

For a seamless transition to Making Tax Digital, consider using FreshBooks MTD VAT Software, which is compatible with HMRC’s requirements and offers user-friendly digital record-keeping features.

How Will MTD Change The Way Things Are Done?

Other than moving away from paper records, the biggest change that is coming with MTD is when businesses file their taxes. Instead of filing an annual tax return, businesses will submit their taxes to the HMRC every quarter.

If you currently only have paper records, you may move them to your digital system. Once you have, you must only use software going forward. Follow FreshBooks’ Making Tax Digital checklist to simplify your process and ensure you don’t miss anything.

Benefits of Making Tax Digital

Accuracy

The HMRC estimates a £32 billion difference between expected taxes and taxes paid for the 2020-2021 tax year. While malicious actors manipulating tax information play a part, they lost most of this money to unintentional misreporting.

Keeping digital records decreases the chances of human error. MTD also highlights which digital transfer methods can and cannot be used so they can preserve a digital audit trail. Both of these standards should decrease the gap between taxes owed and taxes paid.

Simplicity

Those who already use accounting software know that it makes bookkeeping much easier. Most tools save you time by performing calculations and providing instant access to your financial records.

Moreover, financial software offers added value. Many come with added features such as data analytics, time tracking, and invoice templates. These digital tools also streamline tax filings, as you only need to submit your records digitally instead of mailing them or scheduling a meeting.

Time Savings

Switching from an annual to a quarterly schedule may make it seem like you’ll need to spend more time filing tax returns. In reality, the opposite is true. The new quarterly cadence means businesses have shorter tax periods throughout the year instead of one large, time-consuming one at year-end.

A well-managed digital record will require fewer “double checks” than anything on paper. Additionally, checking tools can ensure the accuracy of your business finances without requiring you to spend time reading over every record.

Real-Time Data

Digital tax accounts let you track your financial information all year round. You don’t have to wait until after you submit your tax return. This data helps you make informed business decisions and prepare for deadlines well in advance.

Less Paperwork

There’s no reason to sift through paper receipts and filing cabinets to find information when you keep digital records. Everything you need to know and submit is stored in your online system. This saves your time and decreases the likelihood of forgetting to submit something.

Challenges of Making Tax Digital

Awkward Transition Period

It can be difficult to transition from an old system to a new one. This is why the HMRC is rolling out MTD in phases instead of abruptly forcing change. A business may need help with employee upskilling, software adoption, or getting used to digital record keeping.

Cost of New Software

High-quality, MTD-compatible software can be pricey, especially for small businesses. There is also the added cost of the required IT infrastructure to properly keep digital records.

The HMRC will not provide free MTD-compatible software to low-income taxpayers as they did for self-assessment. This is because MTD tools are third-party software applications. The decision to offer free or low-cost MTD-compatible software is up to the companies.

Limited Internet Access in Some Regions

Internet access isn’t reliable in all parts of the UK. For this reason, business owners and sole traders may apply for an exemption to MTD based on their internet access. VAT-registered businesses may contact the VAT helpline if internet access affects their ability to submit digital VAT returns.

What Digital Records Do I Need To Keep?

Digital records are any recorded information you can view on an electronic device such as a computer, tablet, or smartphone. The MTD rules state that all required tax information must be stored digitally and transferred via MTD digital links.

A VAT-registered business must store the following information digitally.

- Business name

- Contact details

- VAT registration number

- All used VAT accounting schemes

- The date and value of each VAT supply

- The amount of VAT charged on each purchase (retail businesses are exempt)

- The dates, values, and amount of your input VAT

- Output tax due on sales and EU acquisitions

What Accounting Software Should I Use?

Not all software tools are MTD-compatible. The HMRC has an online list of accounting software tools that fulfil their MTD for VAT requirements. Your accounting system must be compatible with API (Application Program Interface) because that’s what the HMRC uses to collect tax data.

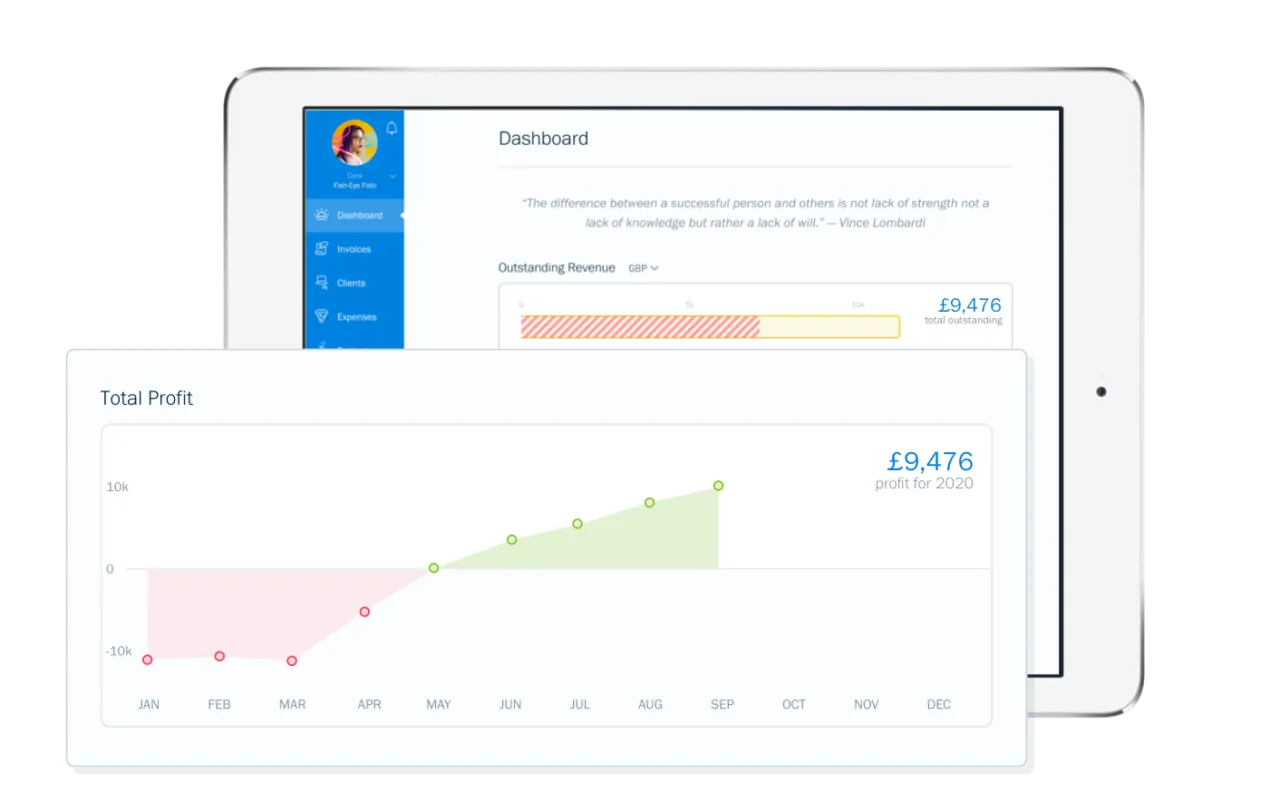

FreshBooks is a cloud-based accounting software tool that made HMRC’s list. We have user-friendly digital record-keeping features and a simple way to submit your VAT returns online. You can also view previously submitted VAT returns and check what you owe. Click here to start your trial today.

How Do I Register For MTD?

Until 2026, only VAT-registered businesses need to register for MTD. Registering for MTD on the UK government’s website is quite easy. You may also ask your accountant to register on your behalf.

You will need to provide the following information for registration:

- Business name

- Business email address

- VAT registration number

- Your business’s Government Gateway ID

- Your Unique Taxpayer Reference (UTR) (limited companies only)

- Your most recent VAT return

- Your National Insurance Number if you’re a sole proprietor

Do not sign up less than 7 days before your VAT return is due or less than 5 days after it’s due. The HMRC typically takes 72 hours to process your registration.

How Do I Prepare For Making Tax Digital?

If you still need to register under MTD for VAT, you have time to prepare. MTD for ITSA soft landed in December 2022 and will be mandated in April 2026.

In the meantime, you can prepare by:

- Find out if you’re one of the MTD-affected businesses or when you will be

- Register for MTD, this is not required yet, but you can register for the soft trial period

- Learn all you can about digital record keeping and start storing your records digitally

- Research the best MTD-compatible software for your business

- Research the MTD rules thoroughly so there are no surprises when the time comes

- Get ready for quarterly tax submissions. Mark these dates in your calendar, so you don’t forget

Conclusion

At the moment, MTD may seem inconvenient, but it will benefit accountants and taxpayers in the long run. Many accounting software tools are very user-friendly and the programs will help you keep everything accurate.

This is also why it’s crucial to choose an MTD-compatible tool. Not only is it the law, but it will also make your tax paying process much more manageable.

FAQs On Making Tax Digital

What are the penalties for non-compliance with MTD rules?

The penalty for non-compliance depends on the offence.

- You may be fined £400 for each improperly submitted VAT file.

- You may be fined £5 to £15 per day for each day you do not implement digital links.

- If you submit VAT records with errors, you will have to pay up to 100% of the VAT owed.

- If you underestimate the amount of VAT owed, you will have to pay 30% of your assessment if you do not inform the HMRC within 30 days.

What is the future of Making Tax Digital and how might it evolve over time?

The next step for MTD is expanding to non-VAT businesses and ITSA. In the future, it may apply to more taxpayers as technology evolves and the internet becomes more accessible.

Can businesses still use spreadsheets to keep their records for MTD?

Businesses can still use spreadsheets. Linked cells and Excel formulas are valid MTD digital links.

How does Making Tax Digital affect businesses that are not registered for VAT?

MTD does not yet affect businesses not registered for VAT. This will change in April 2026.

How can businesses ensure they properly prepare for Making Tax Digital?

Business owners must be aware of when MTD will apply to their company. Once they know this date, they can prepare by learning more about electronic records, shopping for MTD-compatible software, or registering for the trial period if they still need to be registered under MTD for VAT.

About the author

Balil Warraich is an ACCA and CPA with over ten years of experience in the financial space. He specializes in accounting, assurance, and taxation services. Balil currently resides in British Columbia, Canada, where you’ll find him at https://www.notioncpa.com/

RELATED ARTICLES

Sign Up for Making Tax Digital for VAT: A Complete Guide

Sign Up for Making Tax Digital for VAT: A Complete Guide MTD for Income Tax: How Will It Affect You?

MTD for Income Tax: How Will It Affect You? Making Tax Digital Timeline: Key Dates You Should Know

Making Tax Digital Timeline: Key Dates You Should Know 10 Best Making Tax Digital (MTD) Software for VAT

10 Best Making Tax Digital (MTD) Software for VAT Does Making Tax Digital Apply to Sole Traders?

Does Making Tax Digital Apply to Sole Traders? When Does Making Tax Digital Start?

When Does Making Tax Digital Start?