When Does Making Tax Digital Start?

Making Tax Digital has already started for individual taxpayers and Value Added Tax(VAT)-registered businesses. HM Revenue and Customs (HMRC) has a long-term MTD plan. It’s designed to streamline the entire tax system by taking the majority of processes online. A firm, final goodbye to paper records.

It will eventually encompass the tax affairs of individuals, self-employed businesses, landlords, Small and Medium-Sized Enterprises (SMEs), and large corporations. Minimising the tax lost through administrative errors. Maximising tax efficiency for taxpayers and the Treasury.

It’s up to you to make sure that you’re Making Tax Digital ready. But that doesn’t mean that you’re going it alone. FreshBooks is always a step ahead, keeping pace with HMRC developments so that we’re ready for the next stage before you need it. Check what phase you’re in. Then have a look at the guides we’ve got ready for you.

Key Takeaways

- If you’re wondering when Making Tax Digital starts for VAT, you should know that it’s already begun, and it’s up to you to make sure you are ready to file digitally.

- The rollout of MTD is being introduced in phases, beginning with taxpayers with an annual income of over £50,000, starting in April of 2026.

- MTD will be enforced for those earning between £30,000 and £50,000 per year starting in April of 2027.

- Those who earn under £30,000 as self-employed individuals can continue doing Self Assessments as usual and don’t need to switch to MTD now.

- Penalty fees will be levied based on a points system if payments are late or missed.

- FreshBooks offers helpful guides to help you stay on track and HMRC Recognised.

Here’s What We’ll Cover:

Phase 1: Making Tax Digital (MTD) for VAT

Phase 2: Making Tax Digital for Income Tax

Phase 3: Making Tax Digital for Corporation Tax

What About Penalties For Missing Deadlines?

How To Prepare For Making Tax Digital

Phase 1: Making Tax Digital (MTD) for VAT

So, when does Making Tax Digital start for VAT? The first official phase of MTD has already started.

From April 2019, VAT-registered businesses that met the VAT threshold were required to switch to Making Tax Digital for VAT rules. The VAT threshold is still £85,000 annual turnover. This means they needed to keep digital VAT records and submit VAT returns online to HMRC—from the end of their first accounting period after 1st April 2019.

In April 2022, all voluntarily VAT-registered businesses began using MTD for VAT, whether they had taxable turnover above the VAT threshold or not. From the first accounting period after April 2022, you must follow the Making Tax Digital for VAT regulations.

As of January 2023, the new digital MTD penalty points system has been implemented, so those who miss deadlines will begin to see financial penalties. Quarterly updates will be required, with a final year-end declaration in April.

What does this mean for VAT-registered businesses?

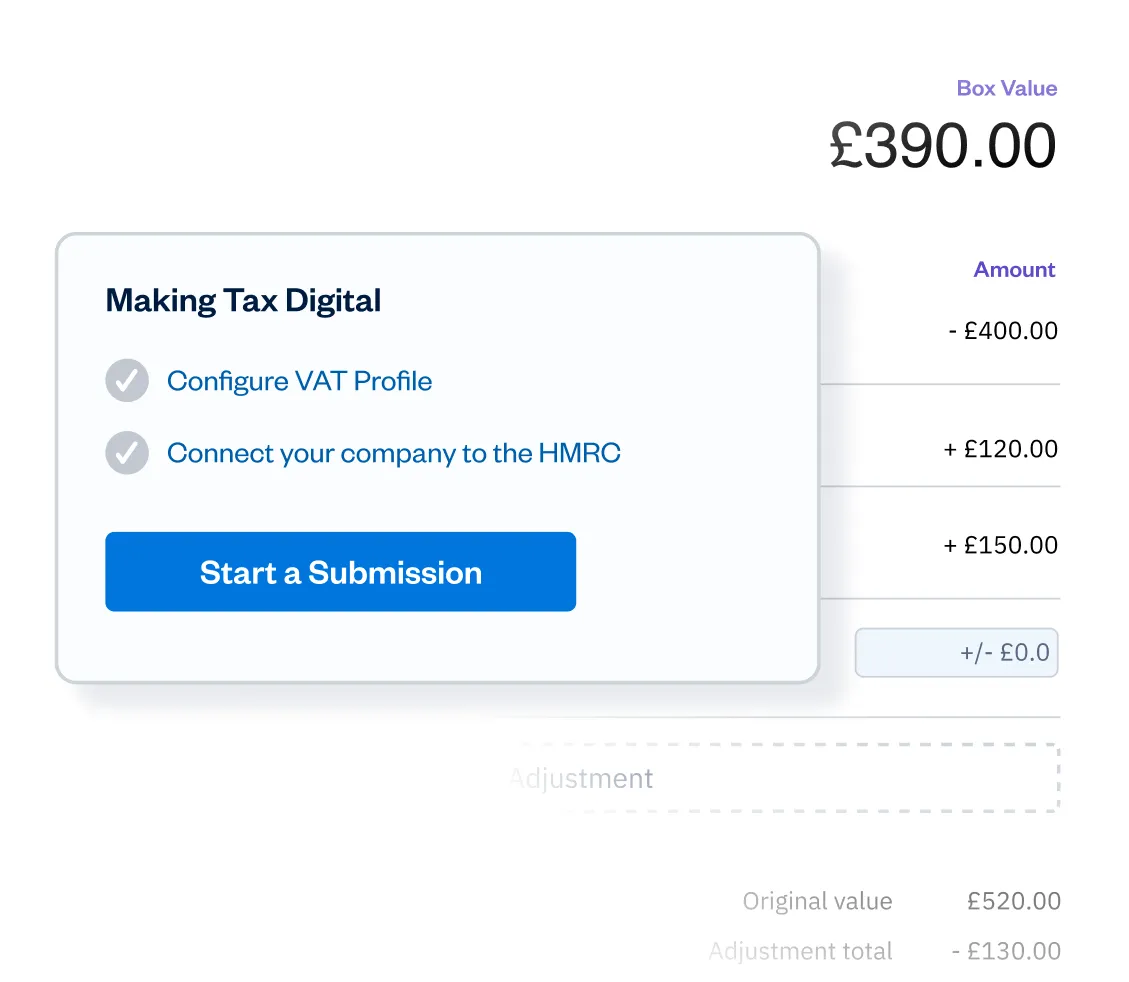

Practically speaking, VAT-registered businesses need Making Tax Digital accounting software. You’ve got 2 options. You can either keep your VAT records as they are and get bridging software that links to HMRC systems, or you can use accounting software that keeps digital records and sends your tax information straight to HMRC. FreshBooks customers don’t need to worry about it—your account is compatible with MTD for VAT.

If You’re a Newly VAT-Registered Business…

Know that there’s no free HMRC-generated software, but there is a list of recognised software to choose from. It’s a sizable list, but there are 6 features you can use to narrow your search.

It’s important to note that HMRC does not endorse or recommend any one product or software provider. Be wary of any companies claiming HMRC endorsement—especially if they don’t feature on the list. There are several free options available, and you’ll find FreshBooks’ ’10 Best Making Tax Digital for VAT Software’ guide useful when you’re making your decision.

As a VAT-registered business, you need to keep digital records of all your VAT and other business transactions. You must be able to send your quarterly VAT returns online, straight to HMRC’s platform. FreshBooks accounting software offers easy VAT Return filing, connecting directly to HMRC and making it easy to keep your records accurate and compliant.

To avoid unnecessary stress, it’s important to remember that this isn’t new information. It’s just presenting your tax affairs in a new, digital format. Yes, there’s an adjustment period, but it’s not an entire overhaul of tax legislation—and you can give your accountant access or have them set up as your tax agent.

Phase 2: Making Tax Digital for Income Tax

Making Tax Digital for Income Tax —when does it start? MTD for Income Tax is being introduced in phases. At first, it’ll only apply to UK landlords and self-employed businesses with annual income over £50,000, starting in April of 2026.

After April 2027, MTD for income tax will also include people earning between £30,000 and £50,000 per year. This includes foreign property income. If you are a self-employed individual making less than £30,000 and don’t have a VAT number, you don’t have to use MTD and can continue filing for Self Assessment as normal.

If you are making above the £30,000 threshold, it’s wise to figure out what you need to do now.

For you, Making Tax Digital for Income Tax means making 2 main changes:

- Keep digital records of your self-employed business or landlord income

- Submit quarterly and annual information to HMRC

What Do I Need to Be Ready for Making Tax Digital for Income Tax?

Every business that meets the £10,000 registration threshold for Making Tax Digital for Income Tax needs compatible accounting software. If you’ve got FreshBooks, you’re one step ahead because you’re already keeping digital records, and you’ll be able to submit the necessary documents straight to HMRC through FreshBooks.

You need to decide if you want MTD software programs that keep digital records and link directly to HMRC’s portal. Or if you prefer bridging software that connects what you’re currently using, like spreadsheets, to the correct HMRC platform.

You can use either downloadable or cloud accounting software. HMRC doesn’t give businesses free compatible software, but it does curate a list of recognised software. At the moment, this is a much shorter list than the Making Tax Digital for VAT one, and the search descriptors are much less detailed.

Do I Still Submit a Self-Assessment Tax Return?

No, Making Tax Digital for Income Tax removes Self Assessment tax returns and brings in new tax administration for small businesses. As well as keeping digital tax records, you’ll need to send a quarterly income and expenses update to HMRC.

When each accounting period ends, you’ll need to complete an End of Period Statement (EOPS) for each business or property income. This includes your tax allowances, and reliefs claim. As an individual, you also submit a Final Declaration at this point. This is a legal acknowledgement that you agree with HMRC’s income tax calculations based on your information. And the declaration that you haven’t left anything out of your submission.

As you can see, you’ve already got all the information you need in your FreshBooks app. It’s the same details you need for a Self Assessment tax return. It’s just a question of taking a bit of time to get your head around a new way of presenting it to HMRC. And we’re here to help with that bit, too.

Phase 3: Making Tax Digital for Corporation Tax

Making Tax Digital for Corporation Tax will apply to limited companies, and currently, the government says it will start in 2026, with pilots beginning in 2024.

At the moment, Making Tax Digital for Corporation Tax is in the consultation stage of development. HMRC ran an open call for input from companies, other organisations that fall within Corporation Tax, software developers, tax agents, accountants, and relevant professional bodies. This consultation period was from 12 November 2020 to 5 March 2021. HMRC also held 9 virtual consultation events during January and February 2021. Then online consultation form contains 22 questions that cover a lot of details about the implementation of Making Tax Digital for Corporation Tax and who should be part of it. Once the results are analysed, you can read the conclusions here.

What About Penalties For Missing Deadlines?

Starting in 2026, penalties for missing deadlines or failing to file your MTD for your VAT return will be enforced on a points system.

Within the first year of these new rules being implemented, if a self-employed individual or business has made reasonable efforts to comply, no fines will be levied unless it can be proven that the non-compliance is deliberate.

After this grace period, taxpayers will start to accrue “points” that, when added up, will result in a £200 fine. Points accrue separately for income tax and VAT. If you submit annually, the fine will be applied after 2 points. If you submit quarterly, the fine will be applied after 4 points, and if you submit monthly, the fine will be applied after 5 points. If submission deadlines continue to be missed, the taxpayer will face steeper fines.

If you make an error and earn a point by mistake but get back on track by paying all due returns, your points will expire after 24 months for annual submitters, 12 months for quarterly submitters, and 6 months for monthly submitters. There is also a right to appeal against points and penalties if you believe you have a reasonable excuse for not meeting the deadline.

There is also a late payment penalty system, where those who pay their VAT late may be fined up to 4% of the amount due daily, and a document error penalty that is currently in effect, making it imperative to stay organised.

Using FreshBooks can help you manage your books, keep track of transactions, and ensure your tax compliance so you are ready when you need to create quarterly reports. Stop concerning yourself with fines for missing deadlines because FreshBooks is MTD-compliant software and keeps all your tax records ready for filing in a couple of clicks. The trick is to be prepared.

How To Prepare For Making Tax Digital

There are a few steps you can take that will make the process easier as you prepare for the new Making Tax Digital process.

First, you must register for Making Tax Digital VAT online. You are not automatically signed up, so you must start the process yourself. This quick step moves your current VAT account from the old HMRC system into the new MTD system. You will need to provide your business email address, Government Gateway ID and password, VAT registration number, and latest VAT return, so make sure you have all of this information handy before you begin.

Next, you’ll want to sign up for a digital record-keeping program compatible with MTD, like FreshBooks. You have to find your own compatible software to file with the HMRC. Choosing a user-friendly, 100% compatible solution like FreshBooks will ensure easy cloud accounting, making it easy to submit VAT returns and link your software digitally. You can even view previous returns.

Review your record-keeping system, and revise it as necessary to comply with the new MTD rules. Digitise old files, get rid of paper-based records, and replace manual processes with digital ones. You may even find that you save time and money as you do so.

Finally, you can submit your MTD VAT or ITSA return on your desired monthly, quarterly, or annual schedule to remain tax compliant.

Conclusion

Remaining compliant with the new MTD VAT rules is not difficult, especially once you get used to the new digital record-keeping and filing systems. The government is giving businesses, landlords, and self-employed individuals a full year’s grace period as new financial systems are implemented, and has provided a list of software programs that will work with the MTD site.

Accounting software can help you keep your business organised, and VAT-compliant. Stay on track and ready for the switch to MTD with FreshBooks.

FAQs on When Does Making Tax Digital Start

Can I claim expenses and deductions under Making Tax Digital?

Yes, in your quarterly updates and annual end-of-period statement, you can make adjustments that include claiming expenses, allowances, reliefs, and other deductions before making your final declaration.

Can I still use a tax agent or accountant for Making Tax Digital?

Yes, you or your accountant can input your returns to HMRC. The main difference between how it is now and how it will be with MTD is that you must keep all your VAT, sales, and costs in a digital software program rather than writing down totals manually.

Will Making Tax Digital affect how I report income from rental properties?

Yes, if you make over £30,000 a year, you will need to record all sources of income digitally, likely using accounting software. Otherwise, it should be similar to before, as you will be providing the same information as you were on your Self Assessment tax return.

Can I view my tax account online under Making Tax Digital?

Yes, once you are signed up for your personal tax account, you can log in on the gov.uk tax account site to make claims, view tax information, check and manage tax credits, see how much tax you’ve paid in the past 5 years, make account changes, and more.

How can I ensure the security and privacy of my digital tax records?

To avoid online fraud and data breaches, make sure you use a strong password combination, verify that your accounting software is from a legitimate company like FreshBooks, do not ignore software updates, and never work on your tax return using public Wi-Fi.

About the author

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Making Tax Digital for Landlords: Everything You Need to Know

Making Tax Digital for Landlords: Everything You Need to Know Sole Trader Tax Guide

Sole Trader Tax Guide Tax Return Deadline in the UK (2024-25)

Tax Return Deadline in the UK (2024-25) How to Start a Limited Company in the UK

How to Start a Limited Company in the UK Everything You Need to Know About Making Tax Digital Software

Everything You Need to Know About Making Tax Digital Software