Degree of Operating Leverage: Definition, Formula & Calculation

In order to determine how effectively a company uses its fixed expenses to generate profits, operating leverage, a financial efficiency ratio, is used to assess the proportion of total costs that are composed of variable costs and fixed costs.

A corporation will have a maximum operating leverage ratio and make more money from each additional sale if fixed costs are higher relative to variable costs. On the other side, a higher proportion of variable costs will lead to a low operating leverage ratio and a lower profit from each additional sale for the company. In other words, greater fixed expenses result in a higher leverage ratio, which, when sales rise, results in higher profits.

Read on as we take a closer look at the degree of operating leverage. We’ll go over exactly what it is, the formula used to calculate it, and how it compares to the combined leverage.

Table of Contents

KEY TAKEAWAYS

- The degree of operating leverage (DOL) is a ratio that measures the percentage change in earnings before interest and taxes (EBIT) to the percentage change in sales.

- Investors use the degree of operating leverage to determine how much risk is associated with a company’s operations.

- Companies that have a high degree of operating leverage have more risk than a company with a low degree of operating leverage. A small change in sales can have a large impact on earnings.

What Is DOL (Degree of Operating Leverage)?

Degree of operating leverage, or DOL, is a ratio designed to measure a company’s sensitivity of EBIT to changes in revenue.

This ratio helps managers and investors alike to identify how a company’s cost structure will affect earnings. i.e, the mix of variable and fixed costs.

As such, the DOL ratio can be a useful tool in forecasting a company’s financial performance. Degree of operating leverage closely relates to the concept of financial leverage, which is a key driver of shareholder value.

As a business owner or manager, it is important to be aware of the company’s cost structure and how changes in revenue will impact earnings. Additionally, investors should also keep an eye on this ratio when considering an investment in a company.

Degree of Operating Leverage Formula

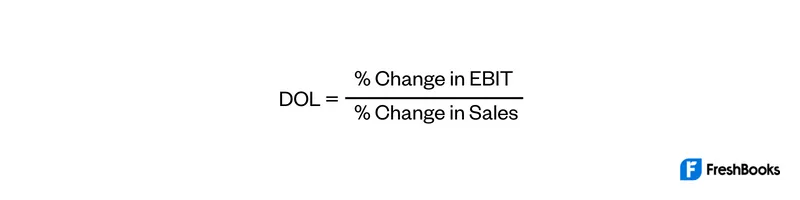

Operating leverage can be measured using the degree of operating leverage (DOL) formula, which is:

The higher the DOL, the greater the operating leverage and the more risk to the company. This is because small changes in sales can have a large impact on operating income.

A company with a high DOL is said to have high financial leverage. This means that it has borrowed money to finance its fixed costs. Financial leverage is a measure of how much a company has borrowed in relation to its equity.

A company with high financial leverage is riskier because it can struggle to make interest payments if sales fall. This can lead to bankruptcy.

How to Calculate the Degree of Operating Leverage?

To calculate the degree of operating leverage, you will need to know the company’s sales, variable costs, and operating income.

Variable costs vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance.

Operating income is equal to sales minus variable costs and fixed costs.

Degree of Operating Leverage Example

To illustrate, let’s assume that a company has the following financial information for two years:

Year 1

Sales = $1,000

EBIT = $100

Operating expenses = $900

Income from operations = $100

Year 2

Sales = $1,200

EBIT = $120

Operating expenses = $1,080

Income from operations = $120

The company’s degree of operating leverage would be calculated as follows:

Year 1

% Change in EBIT = ($100 – $0) ÷ $0 = 100%

% Change in Sales = ($1,000 – $0) ÷ $0 = 100%

DOL = 100% ÷ 100% = 1.0x

Year 2

% Change in EBIT = ($120 – $100) ÷ $100 = 20%

% Change in Sales = ($1,200 – $1,000) ÷ $1,000 = 20%

DOL = 20% ÷ 20% = 1.0x

As can be seen from the example, the company’s degree of operating leverage is 1.0x for both years. This means that its operating income is sensitive to sales changes. A small change in sales can have a large impact on operating income.

If the company’s sales increase by 10%, from $1,000 to $1,100, then its operating income will increase by 10%, from $100 to $110. However, if sales fall by 10%, from $1,000 to $900, then operating income will also fall by 10%, from $100 to $90.

Degree of Operating Leverage vs Degree of Combined Leverage

The degree of operating leverage (DOL) measures a company’s sensitivity to sales changes. The higher the DOL, the more sensitive operating income is to sales changes.

The degree of combined leverage (DCL) measures a company’s sensitivity to sales changes and financial leverage. The formula for calculating DCL is:

DCL = DOL x Financial Leverage Ratio

The financial leverage ratio divides the % change in sales by the % change in earnings per share (EPS). You then take DOL and multiply it by DFL (degree of financial leverage).

In contrast, degree of operating leverage only considers the sales side. It does not take into account financial leverage.

DCL is a more comprehensive measure of a company’s risk because it takes into account both sales and financial leverage.

A company with a high DCL is more risky because small changes in sales can have a large impact on EPS. This too can cause a company to file for bankruptcy. It is therefore important to consider both DOL and financial leverage when assessing a company’s risk.

Summary

DOL is an important ratio to consider when making investment decisions. It measures a company’s sensitivity to sales changes of operating income. A higher degree of operating leverage equals greater risk to a company’s earnings.

But you should consider both metrics when making investment decisions. Degree of combined leverage measures a company’s sensitivity of net income to sales changes.

FAQs About Degree of Operating Leverage

A high DOL means that a company’s operating income is more sensitive to sales changes.

A low DOL means that a company’s operating income is less sensitive to sales changes.

It depends. A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase. However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income.

No. Degree of operating leverage can never be negative because it is a ratio of two positive numbers (sales and operating income).

It does this by measuring how sensitive a company is to operating income sales changes. Higher measures of leverage mean that a company’s operating income is more sensitive to sales changes.

This can be good or bad. But it depends on whether a company is expecting an increase or decrease in sales.

If a company expects an increase in sales, a high degree of operating leverage will lead to a corresponding operating income increase. But if a company is expecting a sales decrease, a high degree of operating leverage will lead to an operating income decrease.

Share: