Return on Sales (ROS): Definition, Formula & Calculation

Return on Sales (ROS) is a performance metric that measures how effectively the company uses its sales resources to generate revenue.

This metric identifies the amount of profit that comes from a specific dollar amount of sales spending. If you want to know more about Return on Sales (ROS), this article will explain its meaning.

It also looks at why it’s important and how you can implement it within your own organization. Keep reading to find out more.

Table of Contents

KEY TAKEAWAYS

- ROS is a ratio used to measure a company’s profitability.

- It is calculated by dividing net income by total sales.

- ROS is a useful ratio for comparing companies in the same industry.

- A higher ROS indicates a more profitable company.

What Is Return on Sales (ROS)?

The return on sales ratio identifies the amount of profit that comes from a specific dollar of sales spending. The return on sales metric is often used to evaluate the effectiveness of sales and marketing efforts and quality of goods, services, and customer relationships.

This metric is particularly important in product-based businesses. Return on sales is a measure of the effectiveness of your sales strategy and sales team.

It shows how much profit a company makes from its sales efforts. This metric examines how much of the total sales revenue is left over after subtracting all of the expenses related to those sales.

ROS is a useful efficiency ratio for comparing companies in the same industry because it shows how much profit a company generates from its sales.

A higher ROS indicates more potential dividends. However, it is important to compare ROS between companies of different sizes because a large company will usually have a higher ROS than a small company.

Why Is Return on Sales Important?

This metric identifies the amount of profit that comes from a specific dollar amount of sales spending. The return on sales ratio is particularly important in product-based businesses. It can be used to evaluate the effectiveness of sales and marketing efforts and quality of goods, services, and customer relationships.

This metric helps a company manage its sales and marketing activities by measuring how effective they are at generating revenue. It also helps a company determine how much money should be spent on sales activities, based on the amount of profit generated by those sales activities.

Both help improve your company performance. And if you can increase your company revenues, you can improve your production costs.

This makes you have valuable reinvestment potential for investors. It’s vital that you keep your operating expenses balanced with your business operations.

But you have to turn sales into profits at the same time. This can prove to be a challenging balancing act.

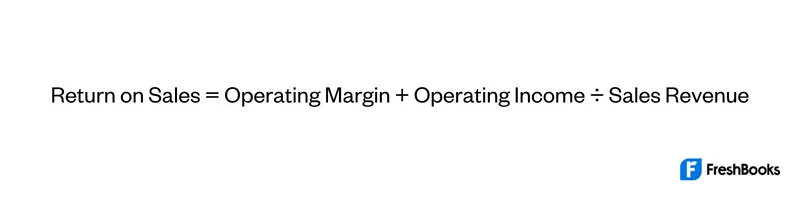

Return on Sales (ROS) Formula

Remember that the formula above is used to calculate the overall return on sales ratio for your company as a whole. You can also calculate the return on sales ratio for each sales channel, such as your website, call center, etc.

With the right margins, you can ensure that your core products earn you money. You may need to adjust your product price. Look at your balance sheet and review your annual sales figures.

See which type of sale performs best on any given business day. You want this return on all of your other sales, possibly even better.

By comparing the difference between sales, you can make better decisions as a business owner.

How to Calculate Return on Sales

To calculate return on sales, you must first calculate operating margin, operating income, and sales revenue. Operating margin is equal to sales revenue minus all sales-related costs.

Sales revenue is the amount of money brought in from customers, while sales-related costs are the expenses related to bringing in those sales, such as marketing costs, salaries for sales employees, etc.

Then, simply divide operating margin and operating income by sales revenue to get the return on sales ratio. You can find the return on sales formula in the following section. It shows how to calculate return on sales.

How to Use Return on Sales

There are several ways to use the return on sales ratio to improve your sales activities. First, you can use it to evaluate the effectiveness of your sales and marketing efforts. If you want to increase sales, you first need to understand how much profit you’re currently generating from those sales.

Second, you can use the return on sales ratio to determine how much money should be spent on sales activities. This metric identifies how much of your sales revenue comes from each sales channel.

You can then use that information to determine how much money should be spent to increase sales in each sales channel. That way, your company can allocate sales and marketing resources more efficiently.

Limitations of Return on Sales

The return on sales ratio is useful for identifying sales and marketing inefficiencies. However, it doesn’t provide insight into the root causes of those inefficiencies.

It’s important to dig deeper and identify specific problems, such as a lack of product demand, ineffective sales figures or marketing tactics, or poor sales rep relationships with customers. Once you identify a problem, you can create a plan to solve it.

Another limitation of this financial ratio is that it only reflects sales activities that happen within the company. It doesn’t include sales made by third-party distributors or sales made through online marketplaces.

Example of How to Use Return on Sales

Let’s look at examples of sales returns. First, let’s say your company’s profit margin is 10% and its sales revenue is $100,000. In this example, your return on sales ratio is 10%. That means your company made $10,000 in profit from $100,000 in sales revenue.

If you want to improve this ratio, you can focus on increasing sales revenue or decreasing sales-related expenses. You could also do both!

If you’re struggling to grow sales, you could increase advertising, hire new sales reps, or offer discounts to existing customers. This would improve your operating profit margin.

At the same time, you could negotiate with your suppliers to get lower prices or renegotiate your lease agreement to reduce your overhead costs. By focusing on these two areas, you could improve your return on sales ratio.

Summary

One important thing to remember is that returns on sales figures are not an absolute number. It can vary widely depending on the company and industry, as well as the amount of sales effort that went into acquiring those sales.

That’s why it’s important to calculate return on sales regularly to track your sales progress. To do that, you need to know what your sales costs are, including any marketing costs.

Then, you can track how those numbers change over time. That way, you’ll be able to see whether your sales efforts are producing positive results and how you can improve them.

FAQs About Return on Sales

A ROS of between 5% and 10% is excellent for the majority of businesses. This figure would be negative if your company’s finances were in difficulty. You are making money if your ROS is higher than 0%.

There are a number of ways to improve your return on sales. Some methods include:

- Increasing prices

- Decreasing costs

- Improving efficiency

- Generating more sales

- Investing in marketing or advertising to generate more awareness of your product or service.

Gross margin is the percentage of revenue that a company keeps after accounting for the cost of goods sold. Return on sales (ROS) is a ratio used to measure a company’s profitability.

Share: